Notice of Default under Security Agreement in Purchase of Mobile Home

Description Agreement Home Notice

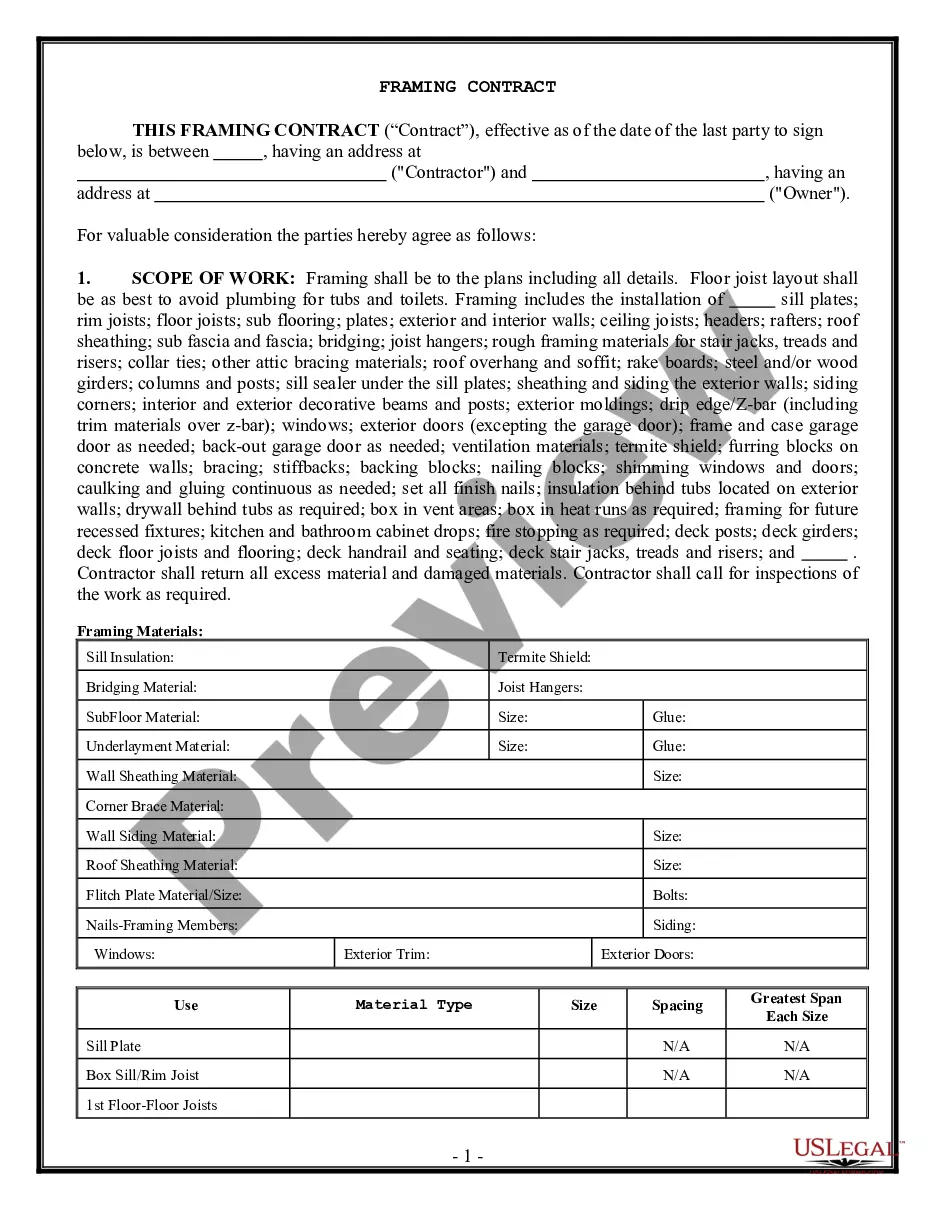

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

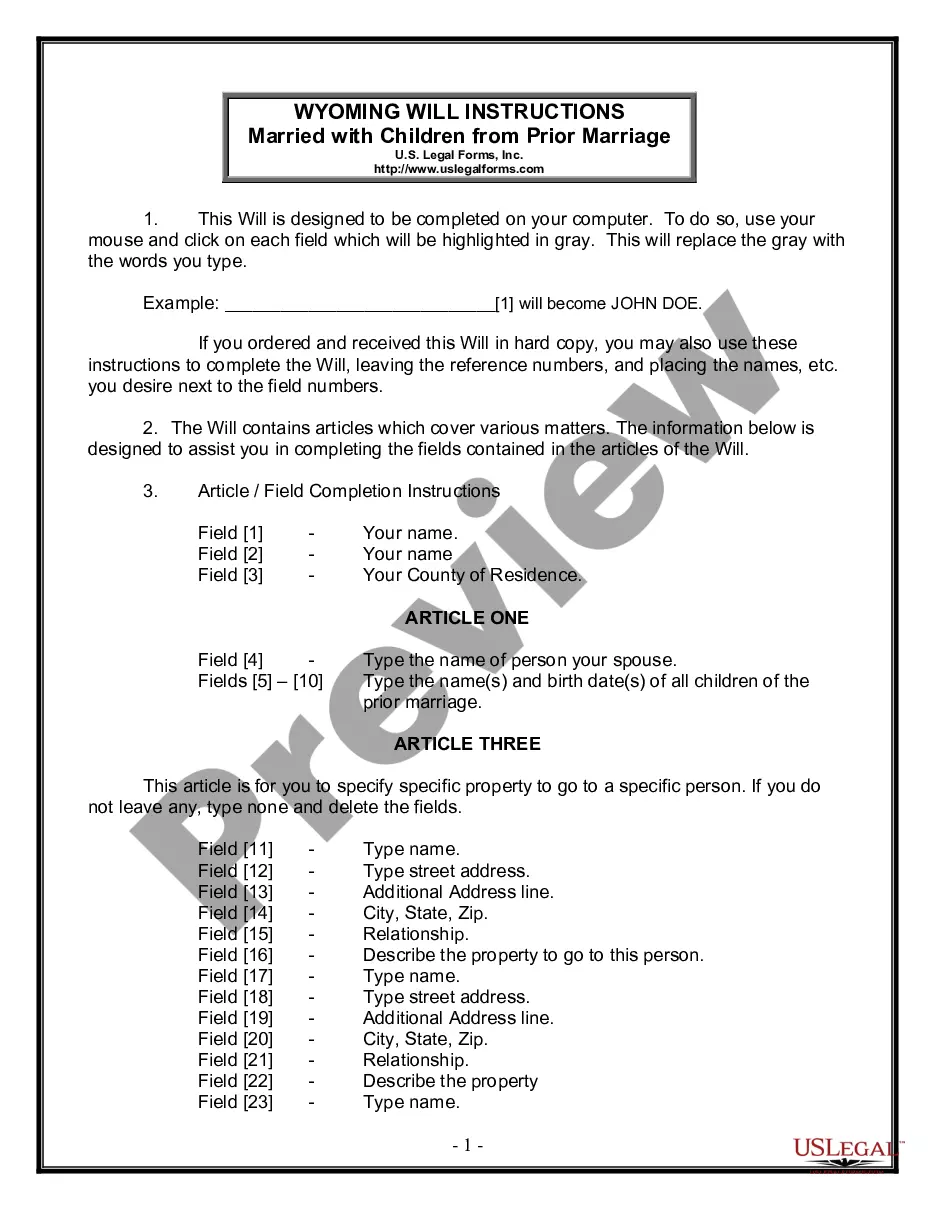

How to fill out Default Home Creditor?

Aren't you tired of choosing from numerous samples each time you require to create a Notice of Default under Security Agreement in Purchase of Mobile Home? US Legal Forms eliminates the wasted time an incredible number of American people spend surfing around the internet for suitable tax and legal forms. Our skilled team of lawyers is constantly modernizing the state-specific Templates catalogue, so that it always provides the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete a few simple actions before having the ability to get access to their Notice of Default under Security Agreement in Purchase of Mobile Home:

- Use the Preview function and look at the form description (if available) to make sure that it’s the appropriate document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template for your state and situation.

- Make use of the Search field on top of the webpage if you have to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a needed format to complete, print, and sign the document.

When you’ve followed the step-by-step instructions above, you'll always have the capacity to log in and download whatever file you want for whatever state you need it in. With US Legal Forms, finishing Notice of Default under Security Agreement in Purchase of Mobile Home samples or other official paperwork is easy. Get started now, and don't forget to examine your examples with certified lawyers!

Notice Default Agreement Form popularity

Notice Default Purchase Agreement Other Form Names

Notice Default Mobile FAQ

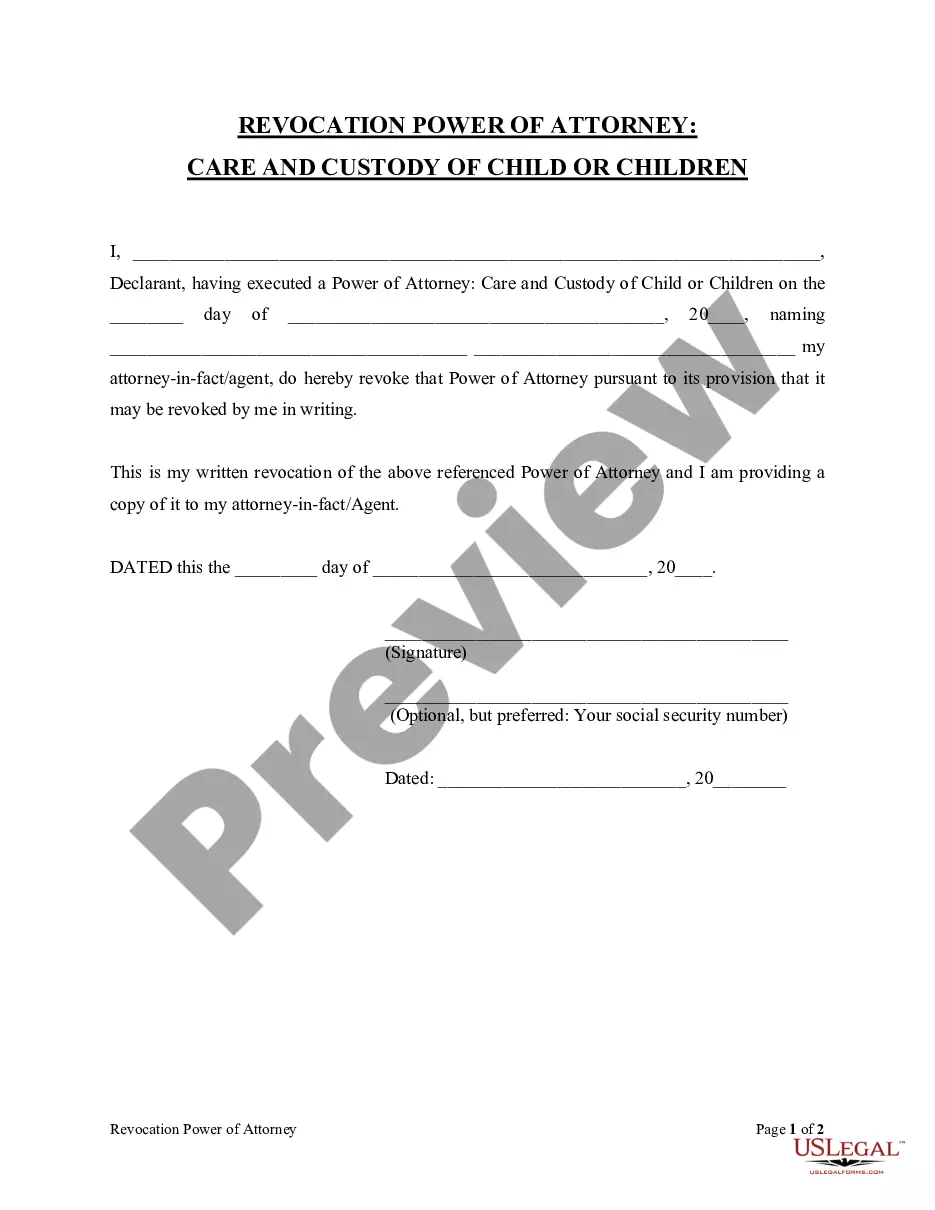

Voluntary repossession. In a voluntary repossession, the homeowner voluntarily surrenders the home to the lender. If a manufactured home is wrapped up with the land as collateral for the loan, the lender will likely forecloseeven if the manufactured home is still classified as personal property.

You can pay off the difference of the mortgage right away if you have the cash on hand. You could also take out a loan for less money with a lower interest rate than the mortgage. Another option you have is to short sale your mobile home.

After a repossession order, you have no house, but you may still have the debt. This depends on how much of your mortgage is unpaid. If the mortgage amount due is low, the bank or lender will return you your money after paying all the fees and recovering its debt once the sale is made.

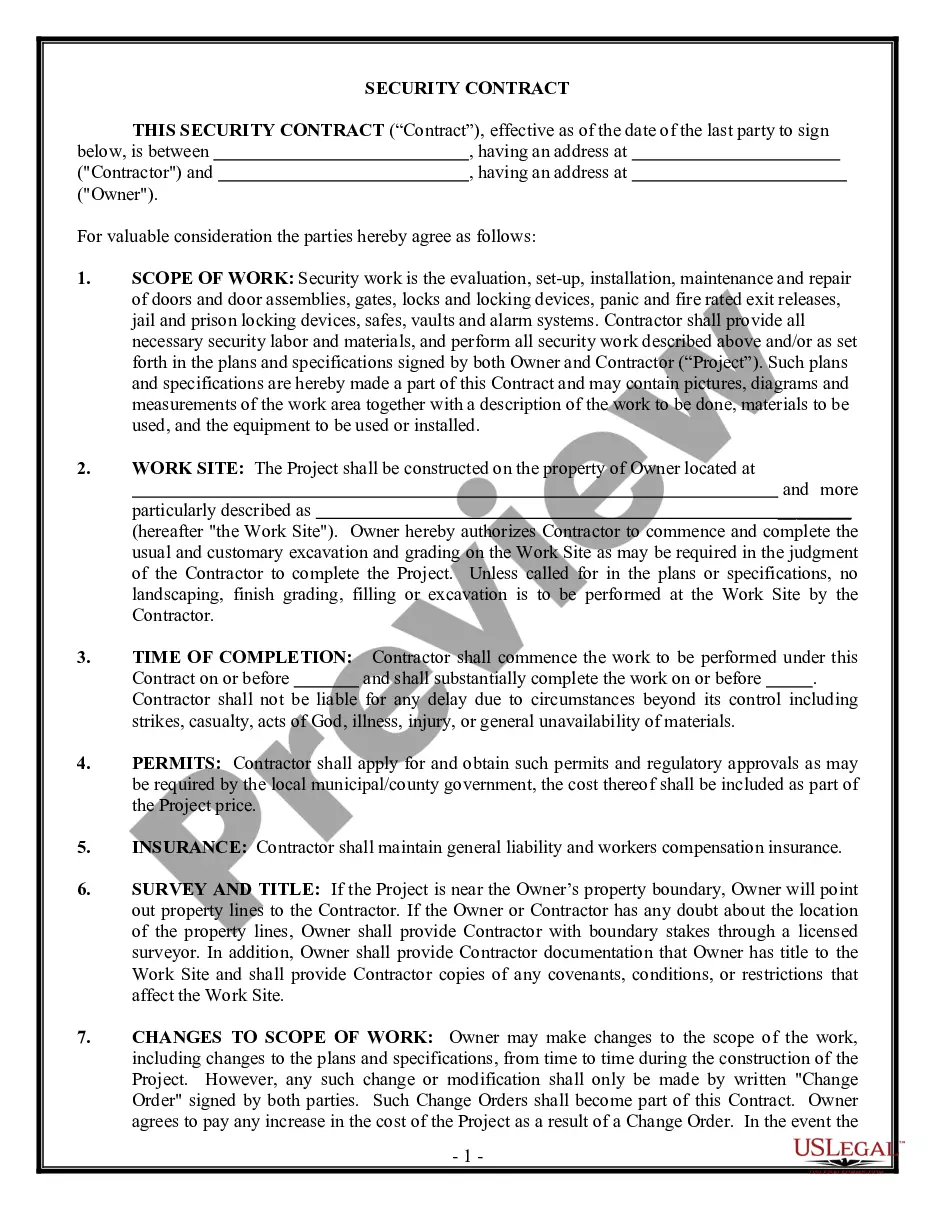

The term purchase money security interest (PMSI) refers to a legal claim that allows a lender to either repossess property financed with its loan or to demand repayment in cash if the borrower defaults. It gives the lender priority over claims made by other creditors.

What Happens if the Manufactured Homeowner Defaults on the Loan? If the borrower defaults on loan payments for a manufactured home, the creditor can repossess or foreclose the home.Generally, if the home is personal property, the creditor repossesses the home.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A repossession takes seven years to come off your credit report. That seven-year countdown starts from the date of the first missed payment that led to the repossession. When you finance a vehicle, the lender owns it until it is completely paid off.