Mobile Home Purchase Agreement

What is this form?

The Mobile Home Purchase Agreement is a legal document used by buyers and sellers to outline the terms of a mobile home sale. This form serves as an essential contract that protects the interests of both parties, detailing the purchase price, delivery details, and conditions of sale. Unlike generic sales agreements, this form is specifically tailored for mobile home transactions, ensuring compliance with relevant regulations and providing clarity on ownership and responsibilities.

Form components explained

- Description of the mobile home, including model, year, and serial number.

- Terms of delivery, including responsible party and timeline.

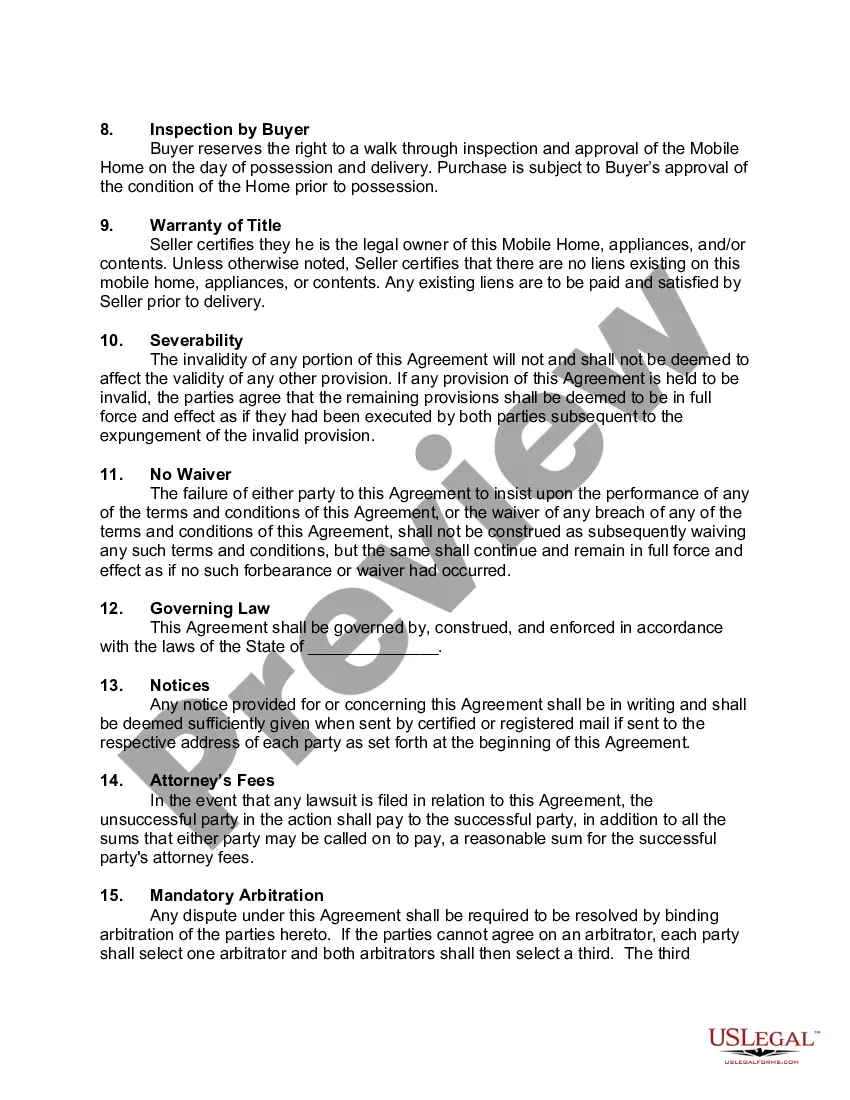

- Warranty of title, confirming the seller's ownership and absence of liens.

- Buyer's right to inspect the mobile home prior to possession.

- Governing law that applies to the agreement.

- Details regarding mandatory arbitration in case of disputes.

When this form is needed

This form should be used when an individual intends to purchase a mobile home from another party. It is necessary when both parties agree on the sale and want to document the specifics of the transaction, including the property's details, financial arrangements, and conditions prior to possession. This agreement can be particularly useful when buying or selling a mobile home located in a mobile home park or on private property.

Who can use this document

- Buyers looking to purchase a mobile home.

- Sellers who want to formalize the sale of their mobile home.

- Real estate agents involved in mobile home transactions.

- Individuals seeking to clarify terms and conditions of a mobile home sale.

Instructions for completing this form

- Identify the parties involved: clearly state the names of the buyer and seller.

- Specify the mobile home: fill in the model, year, serial number, and other details.

- Enter the purchase price: denote the agreed-upon amount for the mobile home.

- Set delivery details: include the date and location for the delivery of the mobile home.

- Include signatures: ensure both parties sign and date the agreement to confirm their consent.

Notarization guidance

This form does not typically require notarization unless specified by local law. However, having the agreement notarized can add an extra layer of authenticity and may be beneficial in certain jurisdictions.

Common mistakes

- Not accurately describing the mobile home, leading to disputes over what was sold.

- Failing to include a clear delivery date and responsible party.

- Neglecting to sign the agreement, which can render it unenforceable.

- Overlooking the need for an inspection clause before purchase.

Benefits of completing this form online

- Convenience: easily download and fill out the form from your device.

- Editability: adjust terms as needed to suit your specific situation.

- Reliability: ensure the agreement is based on templates created by licensed attorneys.

What to keep in mind

- The Mobile Home Purchase Agreement is essential for formalizing the sale of a mobile home.

- It is crucial for both buyers and sellers to clearly understand and agree upon the terms.

- Review local regulations to ensure compliance before using the form.

- Always inspect the mobile home before finalizing the purchase to avoid future disputes.

Form popularity

FAQ

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

Step 1: Apply For A Mortgage. Step 2: Research The Neighborhood. Step 3: Find A Property. Step 4: Ask For A Seller's Disclosure. Step 5: Make An Offer. Step 6: Hire A Lawyer And Home Inspector. Step 7: Negotiate. Step 8: Finalize Home Financing And Closing.

Buyer and seller information. Property details. Pricing and financing. Fixtures and appliances included/excluded in the sale. Closing and possession dates. Earnest money deposit amount. Closing costs and who is responsible for paying.

Who Prepares The Real Estate Purchase Agreement? Typically, the buyer's agent writes up the purchase agreement. However, unless they are legally licensed to practice law, real estate agents generally can't create their own legal contracts.