Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

- Key Concepts & Definitions

- Agreement for Sale of Business Sole: A legal document that outlines the terms and conditions for the sale and purchase of a sole proprietorship business.

- Purchase Price: The amount of money agreed upon by the seller and buyer for acquiring the business assets.

- Business Assets: All tangible and intangible assets that are owned by the business and are transferred in the sale.

- Closing Date: The finalized date when the ownership of the business is transferred from the seller to the buyer and final payments are made.

- Step-by-Step Guide to Creating an Agreement for Sale of Business

- Identify the business assets that will be included in the sale.

- Determine the purchase price for these assets.

- Negotiate other relevant terms such as payment schedules, liabilities, and warranties.

- Use a sale agreement template to draft the agreement.

- Ensure both seller and buyer review and understand the details of the agreement.

- Sign the agreement on or before the closing date to legally validate the transfer.

- Risk Analysis

- Undervaluation: Risk of assets being sold for less than their worth.

- Legal Disputes: Potential for legal challenges if the agreement is not comprehensive or is improperly executed.

- Financial Instability: Buyer's inability to meet financial terms can lead to transaction failure.

- Opportunity Costs: Risks associated with the seller potentially missing better offers due to an exclusive negotiation agreement with one buyer.

- Pros & Cons of Using an Agreement for Sale of Business

- Pros: Legally binding agreement ensures clear understanding and terms, thereby protecting both parties interests.

- Cons: Requires meticulous detail and can be costly to draft if professional legal help is sought.

- Best Practices

- Use a professional template or seek legal counsel to draft the agreement to ensure it covers all necessary legal bases.

- Conduct due diligence on all business aspects, such as financials, legal obligations, and asset conditions before finalizing the agreement.

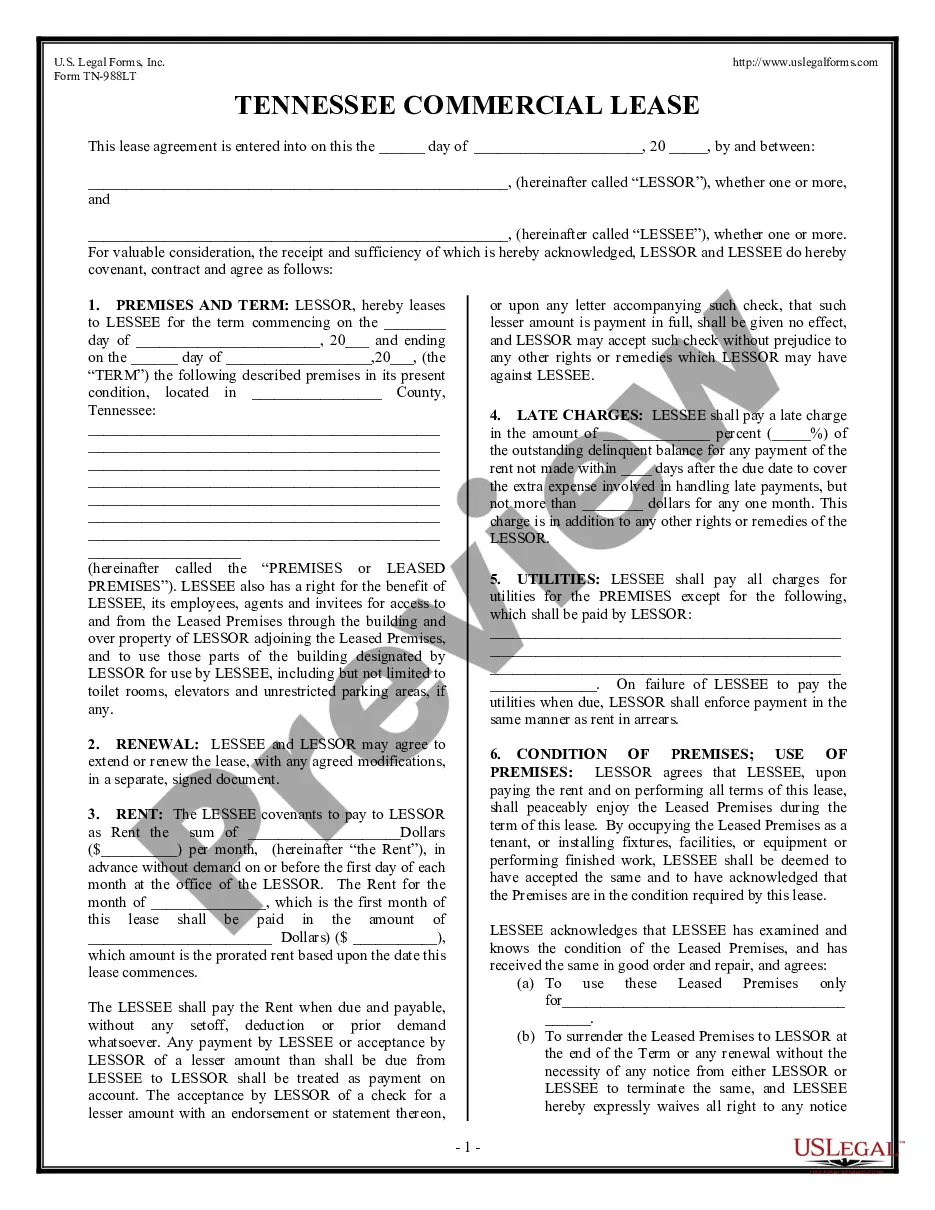

- Clearly outline all terms of the sale including any contingencies that must be met before the deal is finalized.

- Common Mistakes & How to Avoid Them

- Lack of Clarity: Avoid vague language by clearly defining all terms and aspects of the sale within the agreement.

- Skipping Due Diligence: Always conduct thorough assessments of all business areas before signing the sale agreement.

- Ignoring Legal Requirements: Ensure all local and state business sale regulations are adhered to.

How to fill out Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

Aren't you tired of choosing from hundreds of samples each time you want to create a Agreement for Sale of Business - Sole Proprietorship - Asset Purchase? US Legal Forms eliminates the wasted time countless Americans spend browsing the internet for ideal tax and legal forms. Our skilled team of lawyers is constantly modernizing the state-specific Templates library, so that it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple steps before having the ability to download their Agreement for Sale of Business - Sole Proprietorship - Asset Purchase:

- Make use of the Preview function and read the form description (if available) to make sure that it’s the best document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template to your state and situation.

- Make use of the Search field at the top of the web page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your document in a needed format to finish, print, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be capable of log in and download whatever file you need for whatever state you need it in. With US Legal Forms, completing Agreement for Sale of Business - Sole Proprietorship - Asset Purchase templates or other legal paperwork is easy. Begin now, and don't forget to double-check your examples with accredited lawyers!

Form popularity

FAQ

Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties. Description of Goods and/or Services. A sales contract should also address what is being bought or sold. Payment. Delivery. Miscellaneous Provisions. Samples.

A Business Bill of Sale is a legal document that recognizes the sale and change of ownership of a business and all its assets. The Business Bill of Sale sets the terms for the sale, details key information of the buyer and seller, and acts as a key record of the final transaction.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

A Sale of Business Agreement is entered into where one party (the seller) wants to sell its business to another party (the buyer). In the event that the sale and purchase of the business includes the buyer purchasing real estate or taking over a lease then we recommend that legal advice be sought.

List of all assets included in the sale including fixtures, furnishings, equipment, machinery, inventories, accounts receivable, business name, customer lists, goodwill, and other items; also includes assets to be excluded from the sale, such as cash and cash accounts, real estate, automobiles, etc.

A Purchase Sale Agreement is the legal document that specifies all of the terms and conditions associated with the purchase and sale of a company or the assets. The document outlines the price, the payment method (For example, cash or debt), the representations and warranties, and any conditions.

Buyer and seller information. Property details. Pricing and financing. Fixtures and appliances included/excluded in the sale. Closing and possession dates. Earnest money deposit amount. Closing costs and who is responsible for paying.

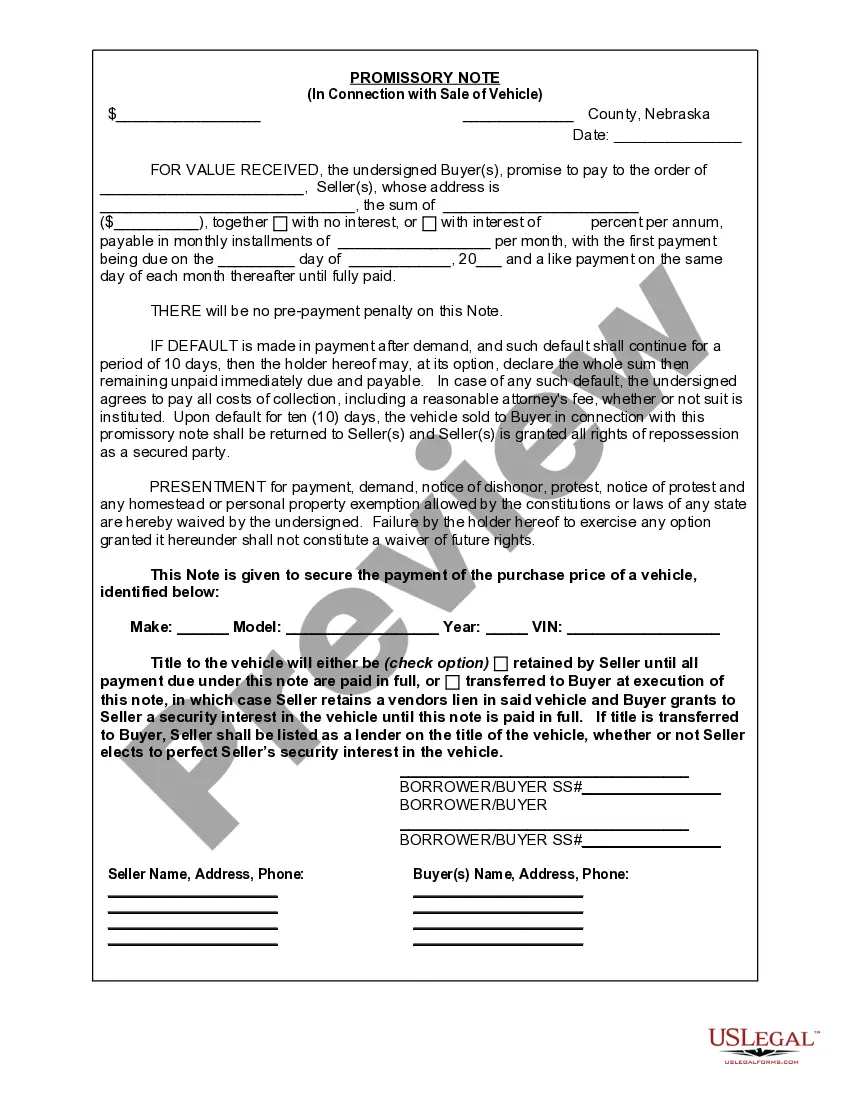

The more common form of structuring payments in a business purchase is for you to make a down payment of perhaps 20% or 25% and then sign a promissory note agreeing to pay the balance to the seller over a number of years, in regular installments.

1Identity of the Parties/Date of Agreement. The first topic a sales contract should address is the identity of the parties.2Description of Goods and/or Services. A sales contract should also address what is being bought or sold.3Payment.4Delivery.5Miscellaneous Provisions.6Samples.