A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him.

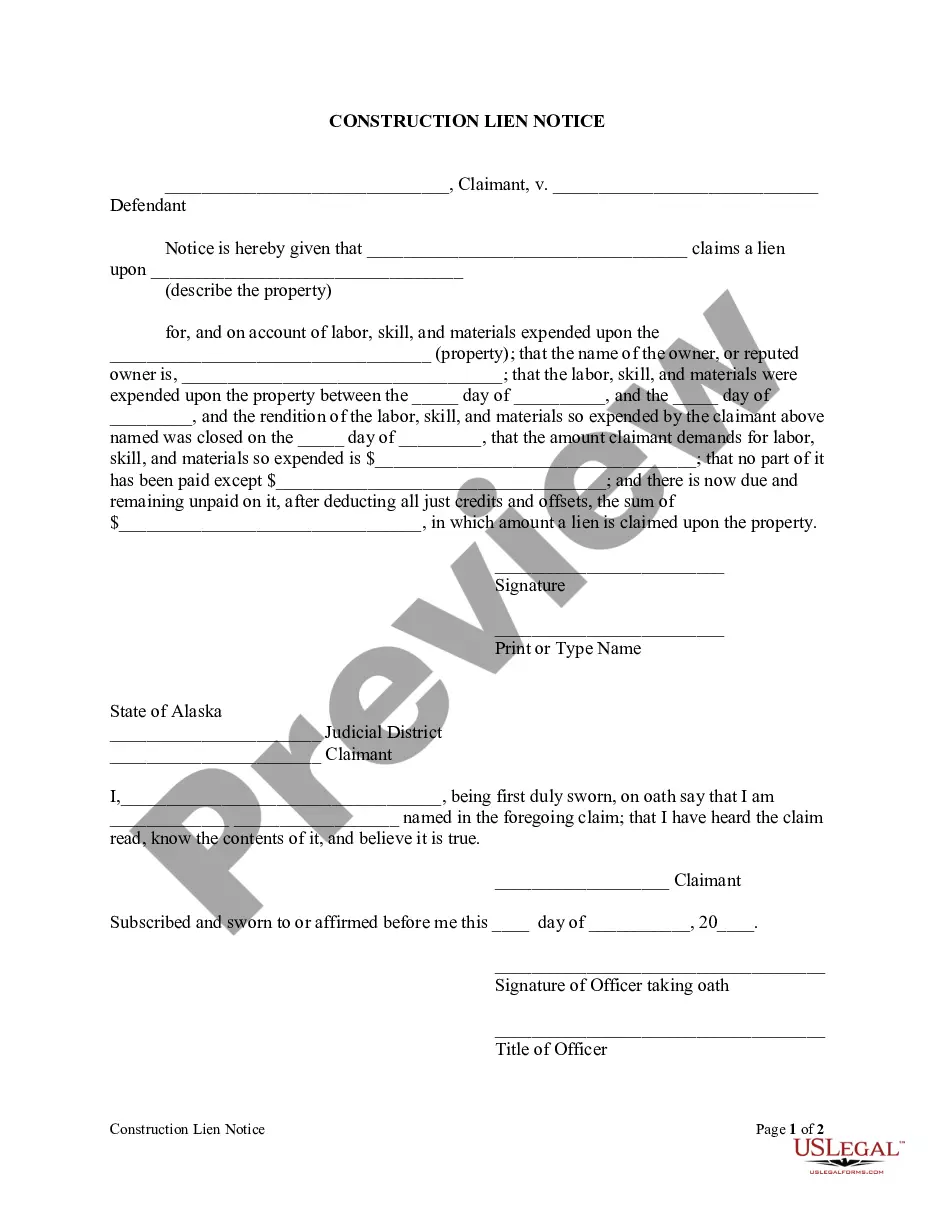

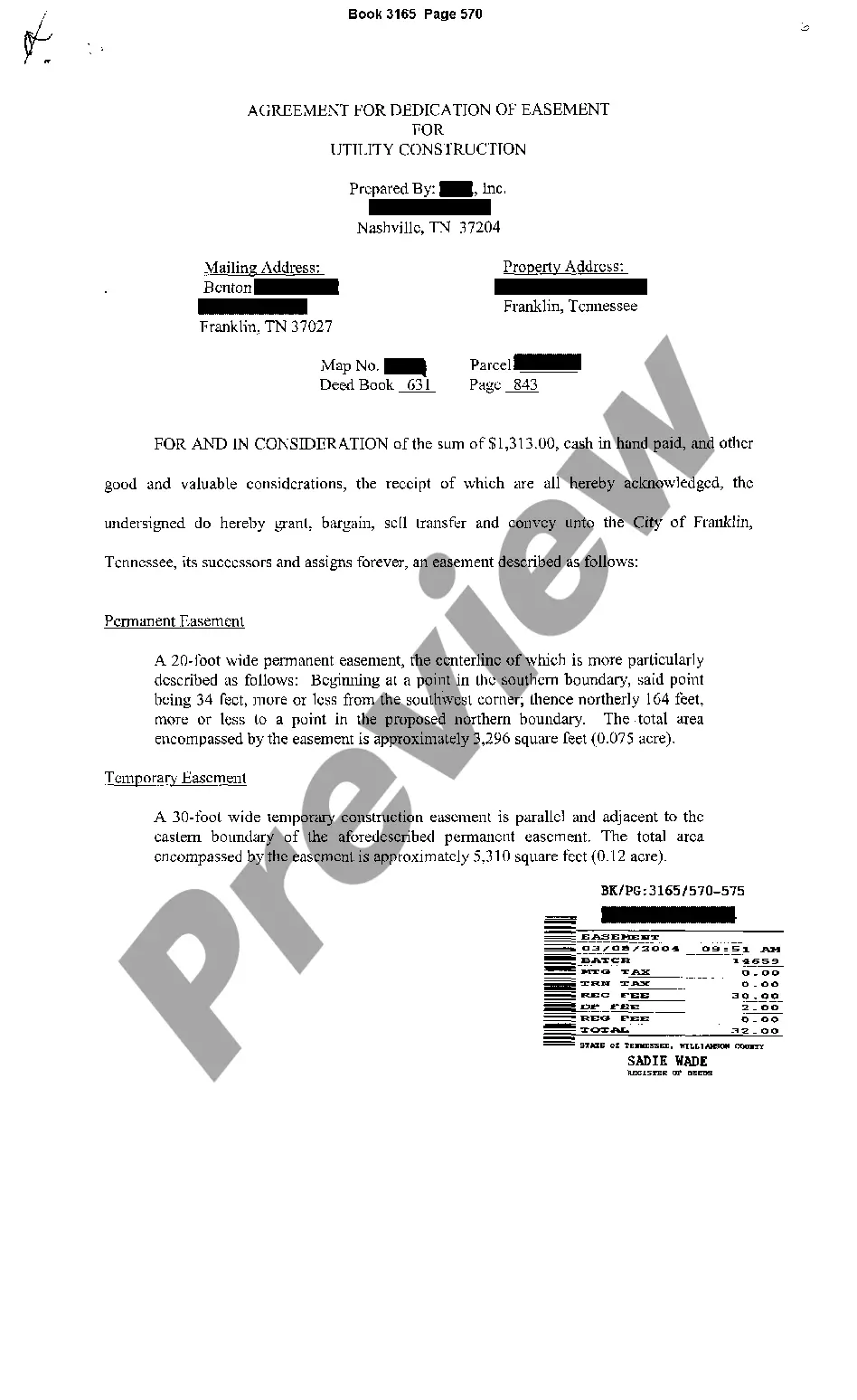

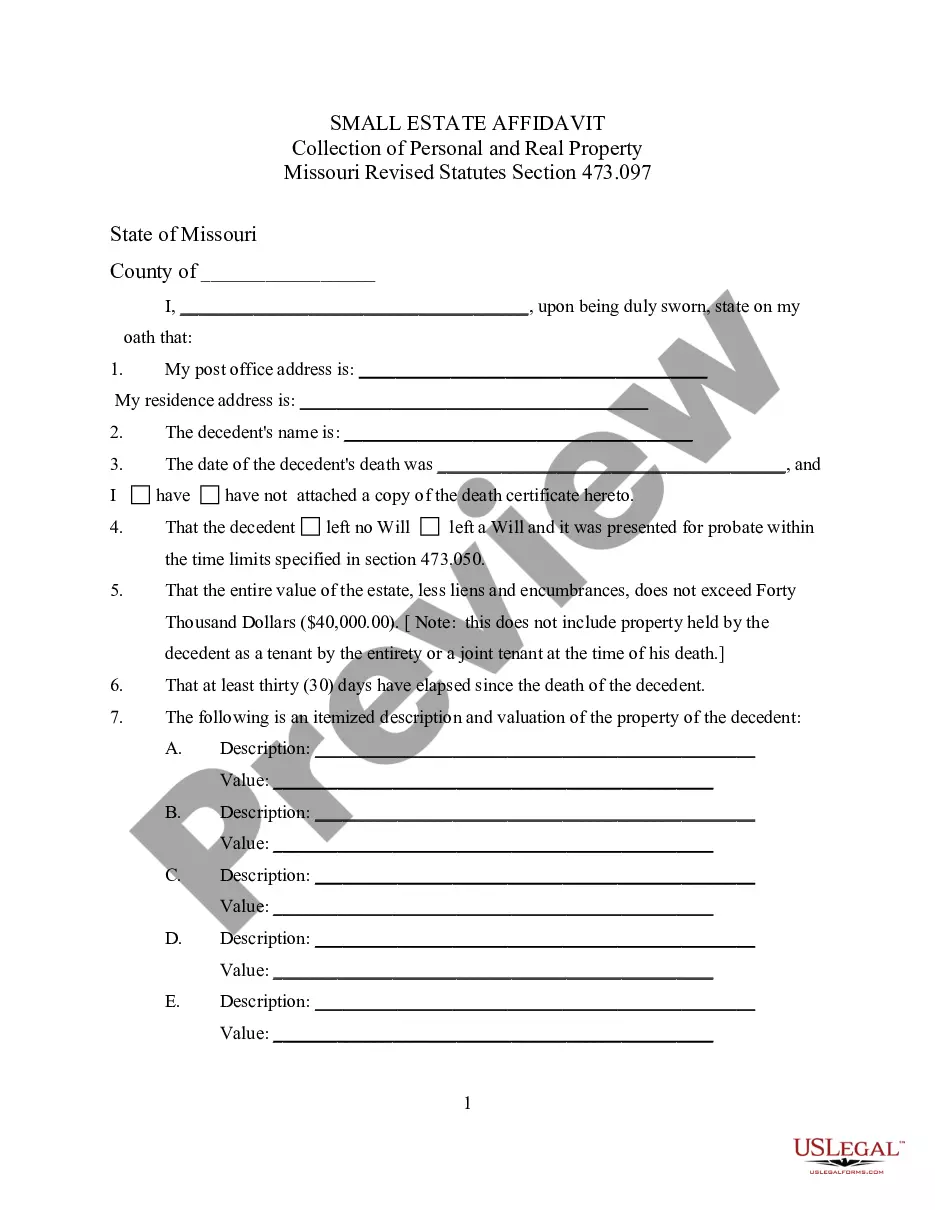

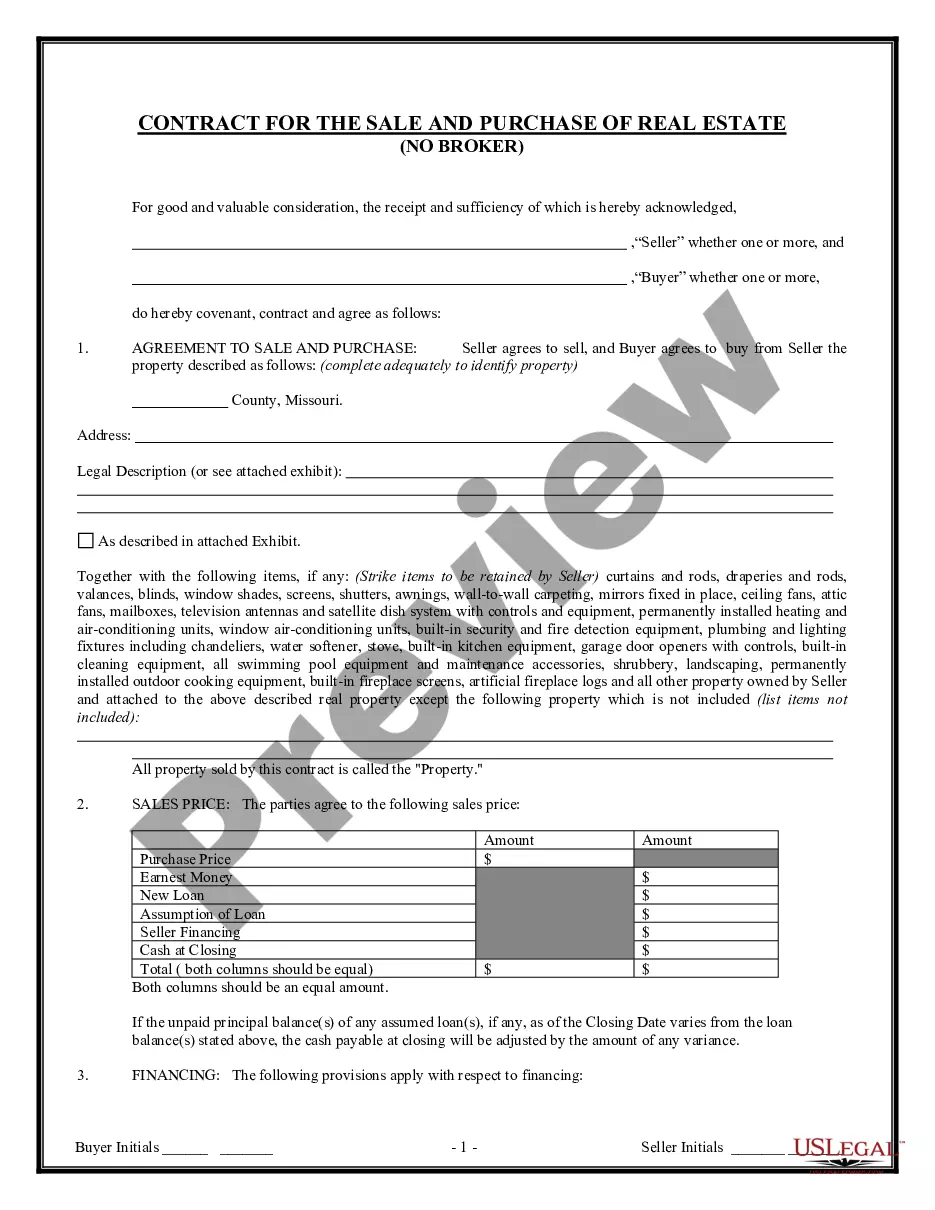

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.