Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice

Description

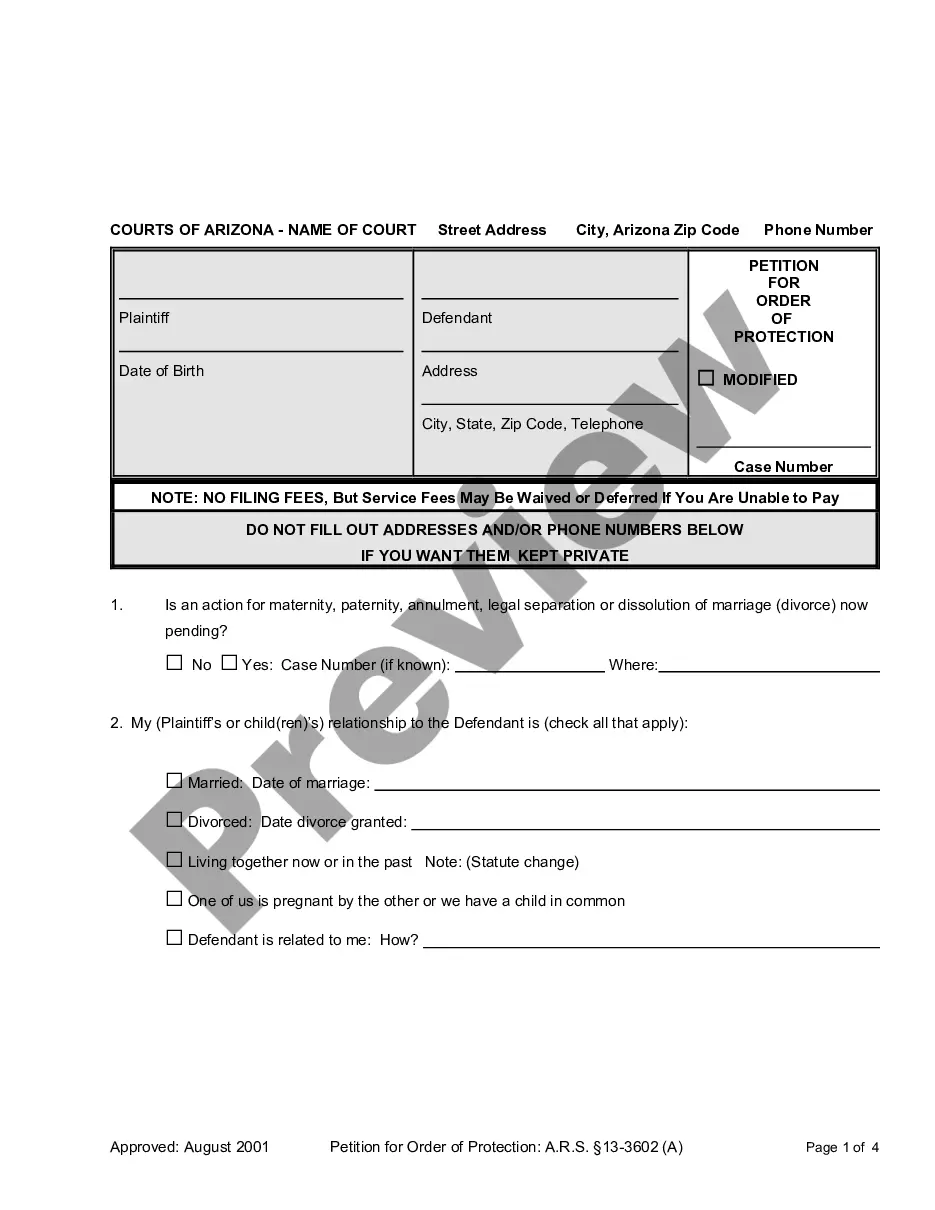

How to fill out Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

Aren't you tired of choosing from numerous templates each time you want to create a Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice? US Legal Forms eliminates the lost time an incredible number of Americans spend searching the internet for ideal tax and legal forms. Our skilled team of attorneys is constantly changing the state-specific Samples collection, so it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription need to complete simple actions before being able to download their Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice:

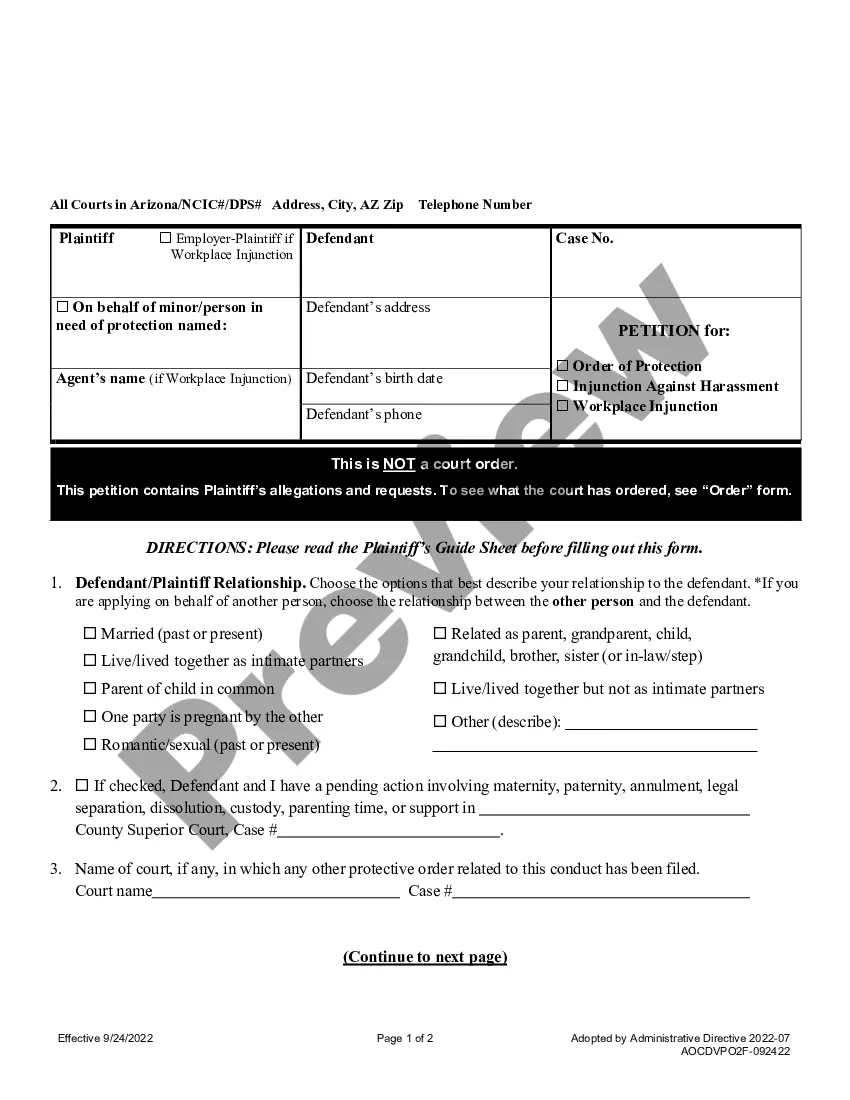

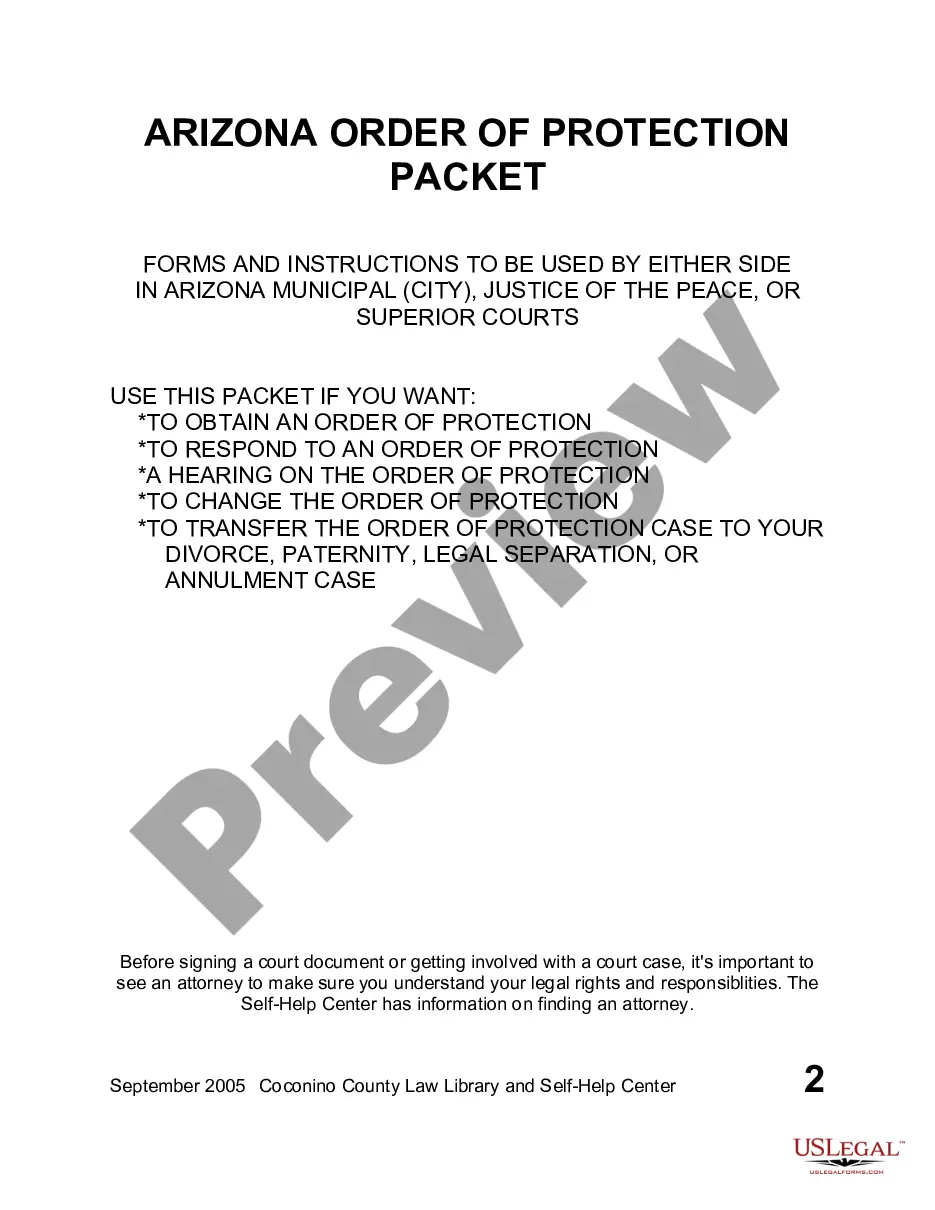

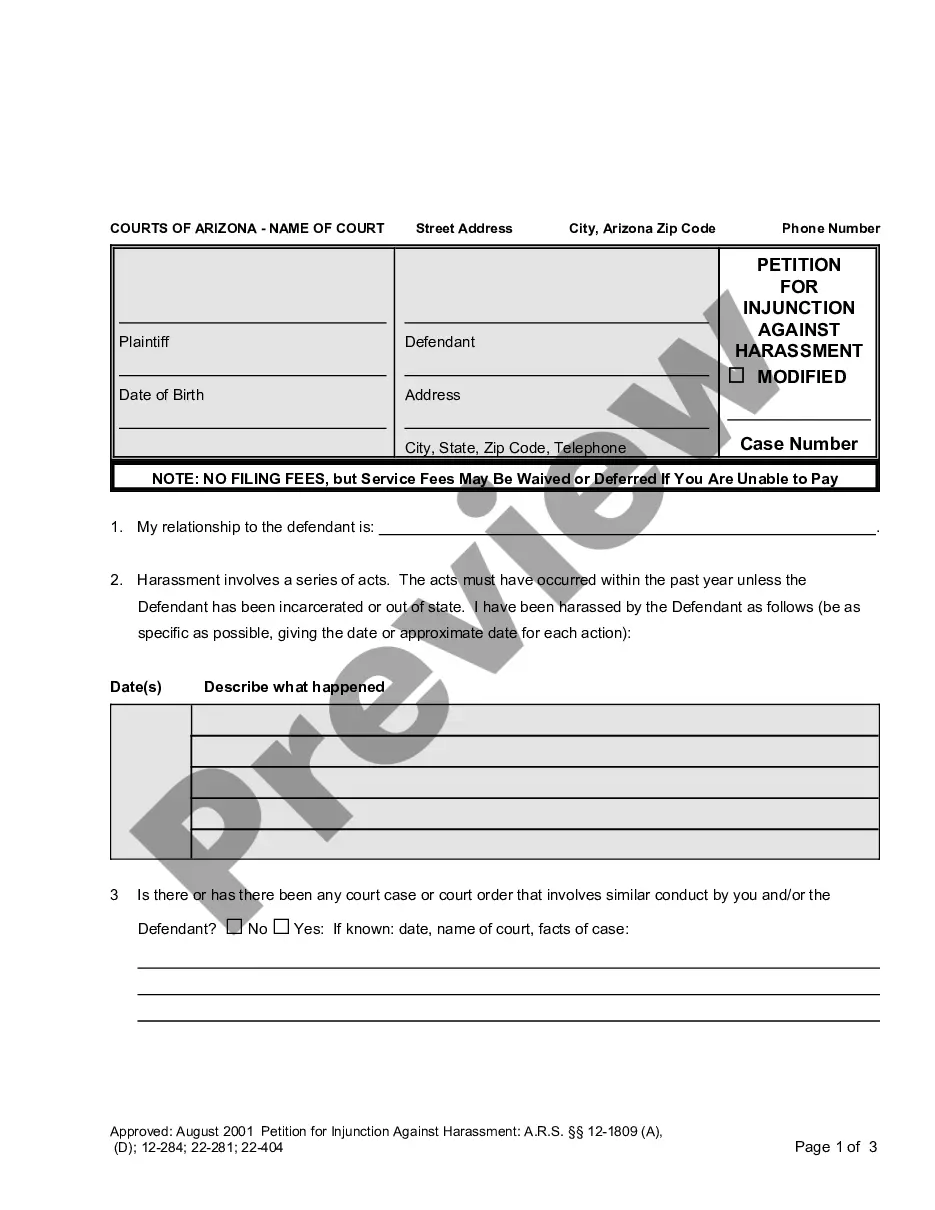

- Use the Preview function and read the form description (if available) to make certain that it is the best document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate example for your state and situation.

- Utilize the Search field on top of the site if you have to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your document in a convenient format to complete, print, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you will need for whatever state you require it in. With US Legal Forms, completing Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice templates or any other official documents is not hard. Get started now, and don't forget to double-check your samples with certified lawyers!

Form popularity

FAQ

In the letter, reference the date of the initial contact and the method, for example, "a phone call received from your agency on April 25, 2019." You also need to provide a statement that you're requesting validation of the debt. Do not admit to owing the debt or make any reference to payment.

Fair Debt Collection Practices Act (FDCPA) Validation Letter The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies.

It's a violation of the collection practices act for a debt collector to refuse to send a validation notice or fail to respond to your verification letter. If you encounter such behavior, you can file a complaint with the Consumer Financial Protection Bureau.

According to the CFPB, the collector would have to confirm it has in addition to the usual info account number associated with the debt, date of default, amount owed at default, and the date and amount of any payment or credit applied after default.

The debt validation letter includes:A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

A debt collector must tell you the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt. Any debt collector who contacts you claiming you owe on a debt is required by law to tell you certain information about the debt.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.