An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Marital Deduction Trust - Trust A and Bypass Trust B

Description Marital Trust A

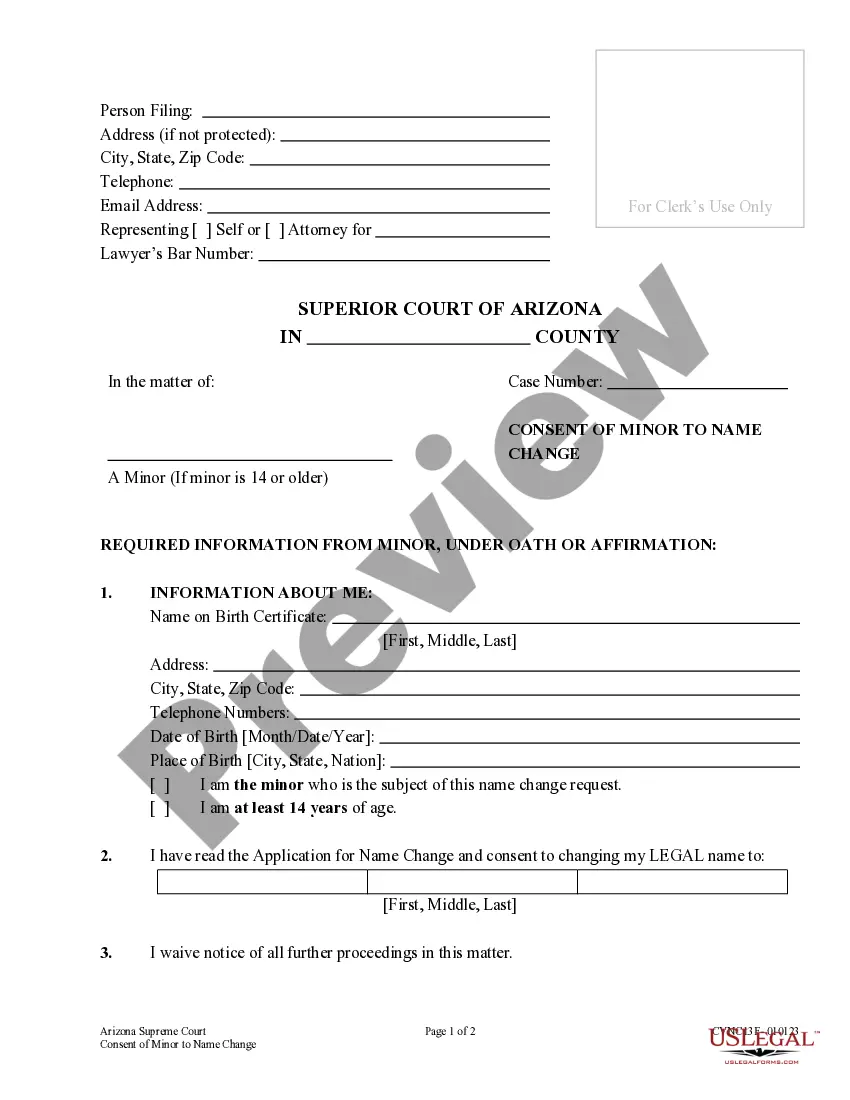

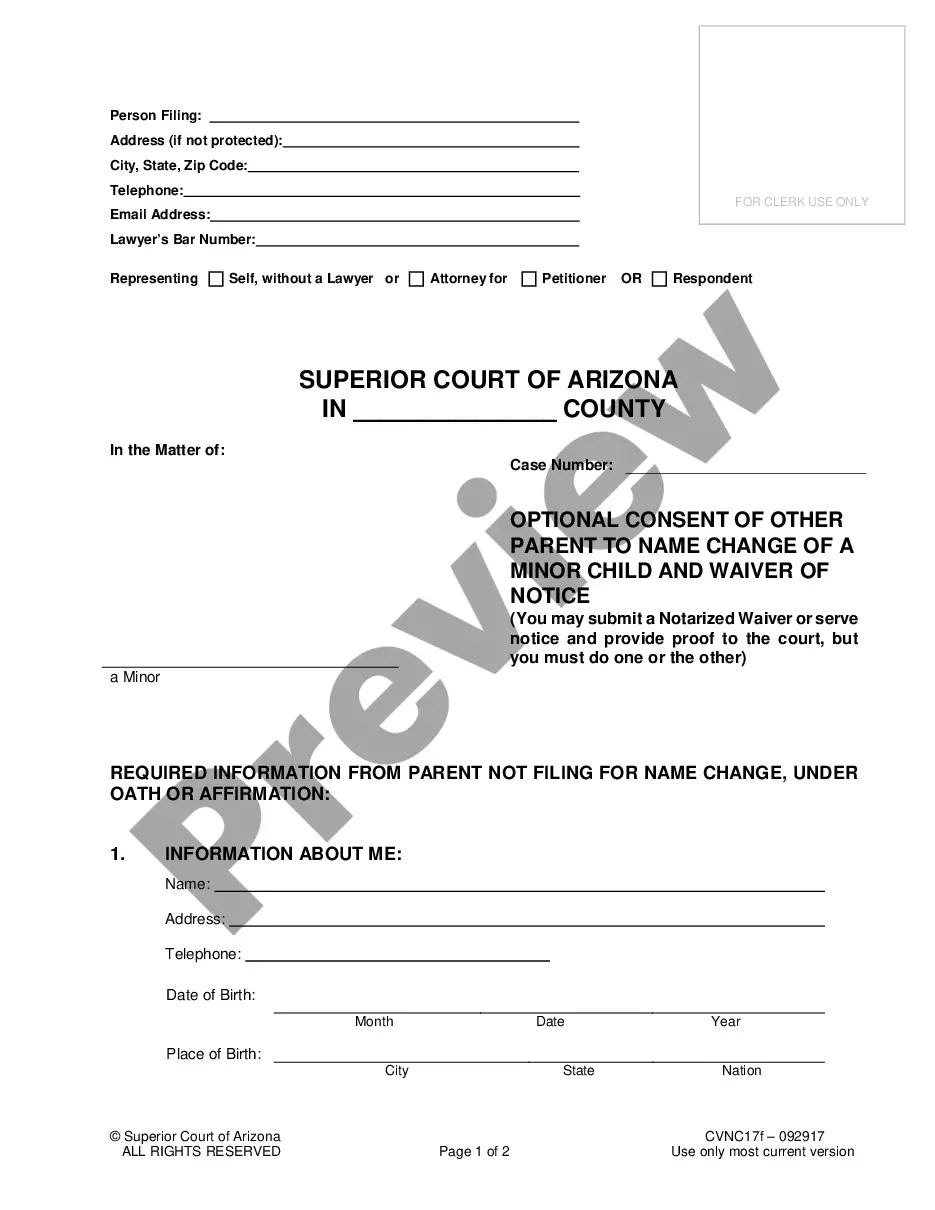

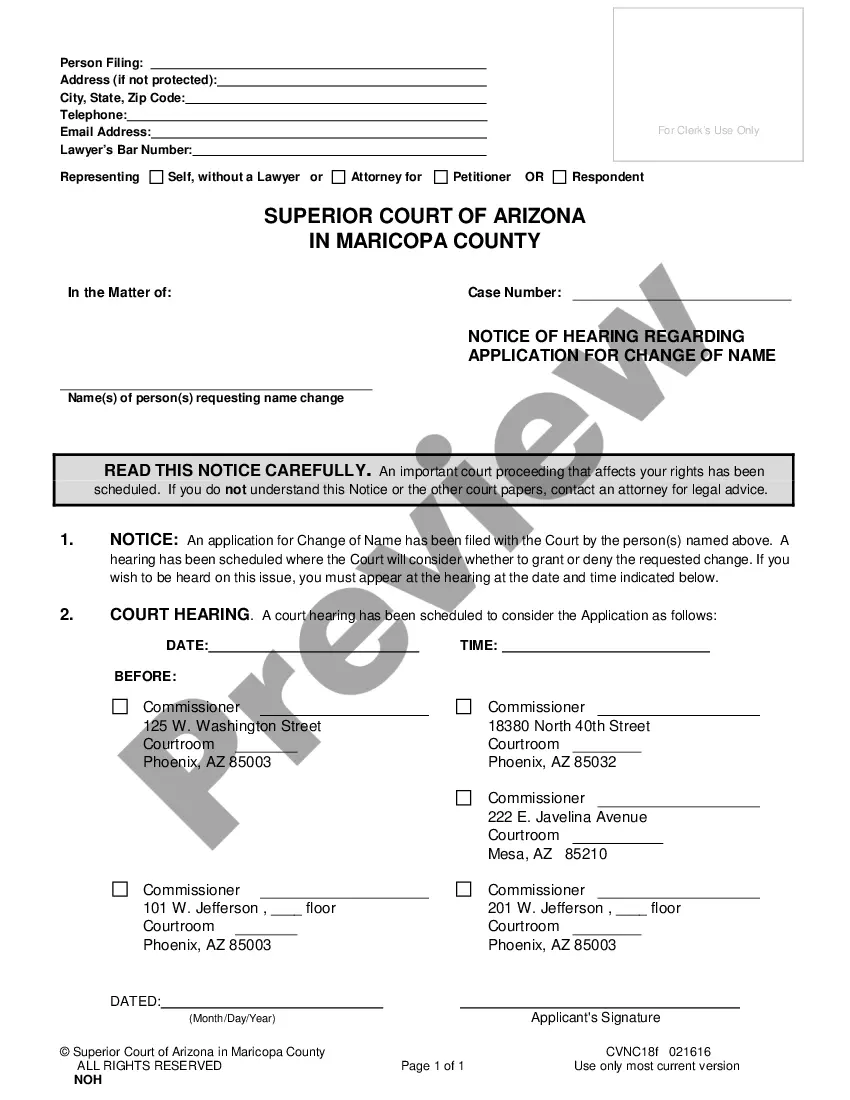

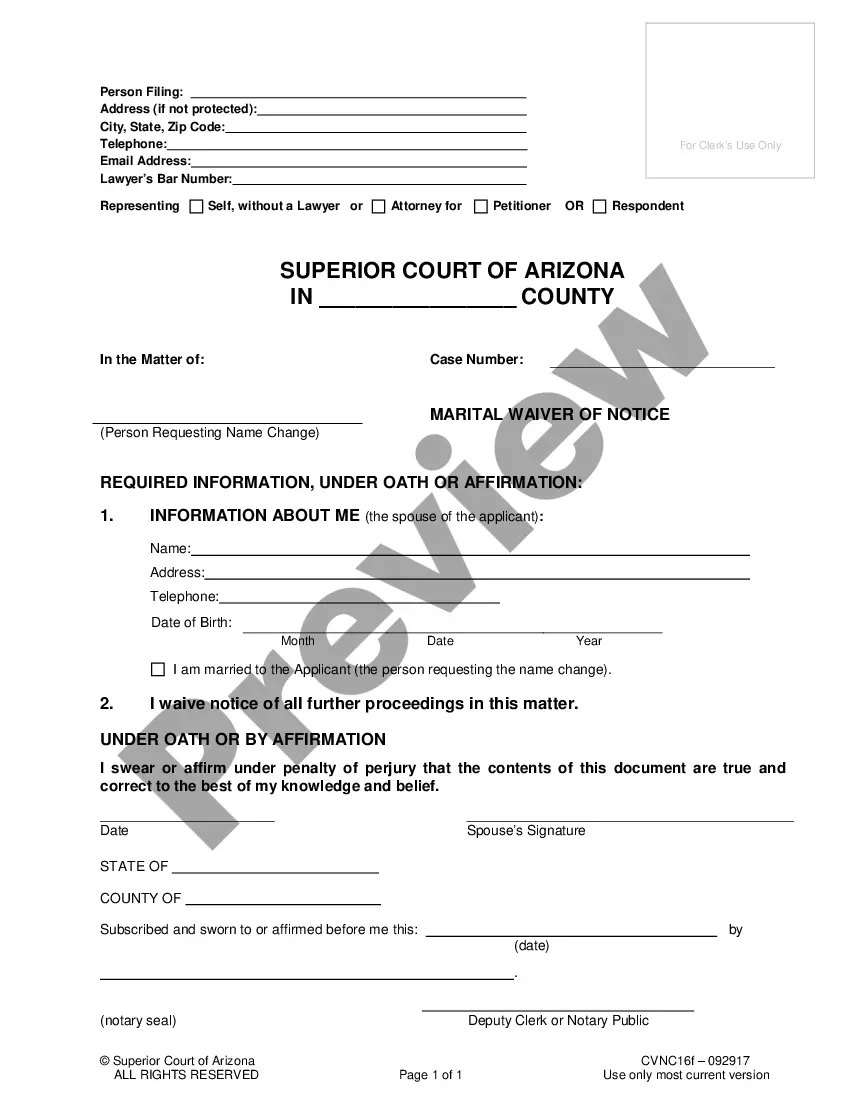

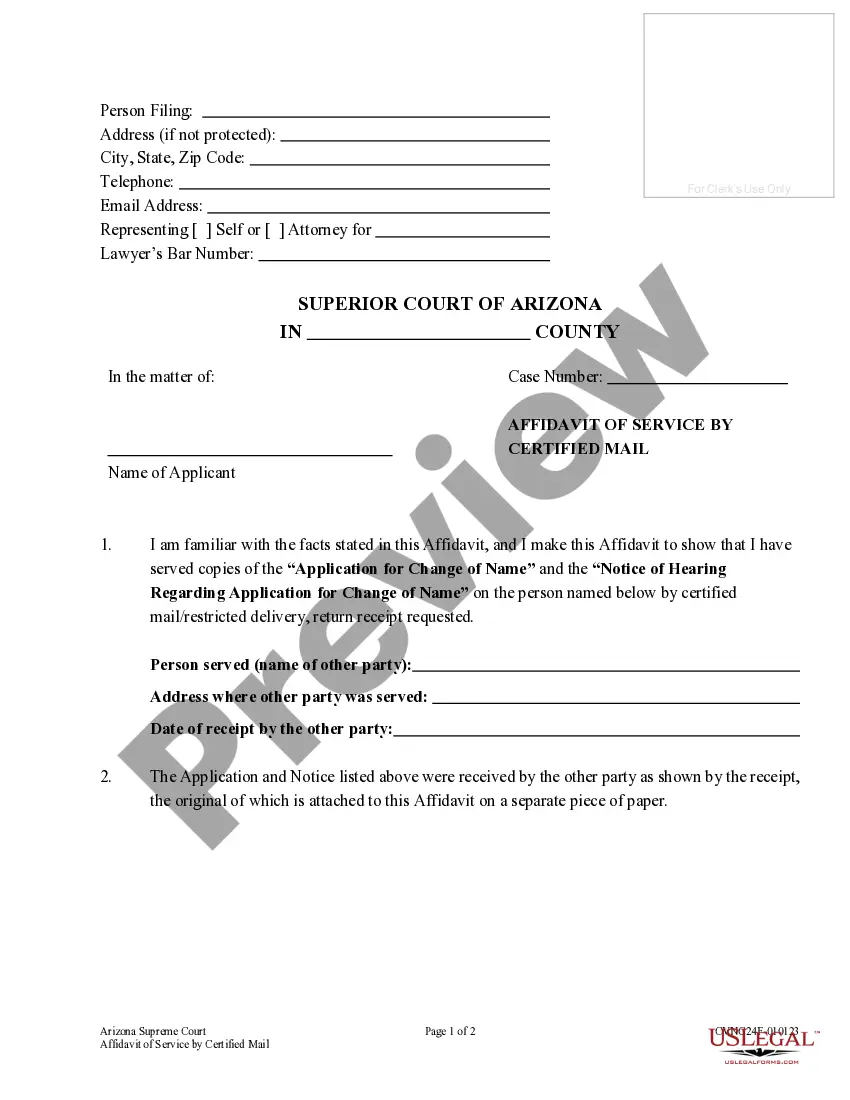

How to fill out Marital Deduction Revocable?

Aren't you sick and tired of choosing from countless templates every time you require to create a Marital Deduction Trust - Trust A and Bypass Trust B? US Legal Forms eliminates the wasted time numerous Americans spend surfing around the internet for perfect tax and legal forms. Our professional team of lawyers is constantly changing the state-specific Templates catalogue, so it always offers the right documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

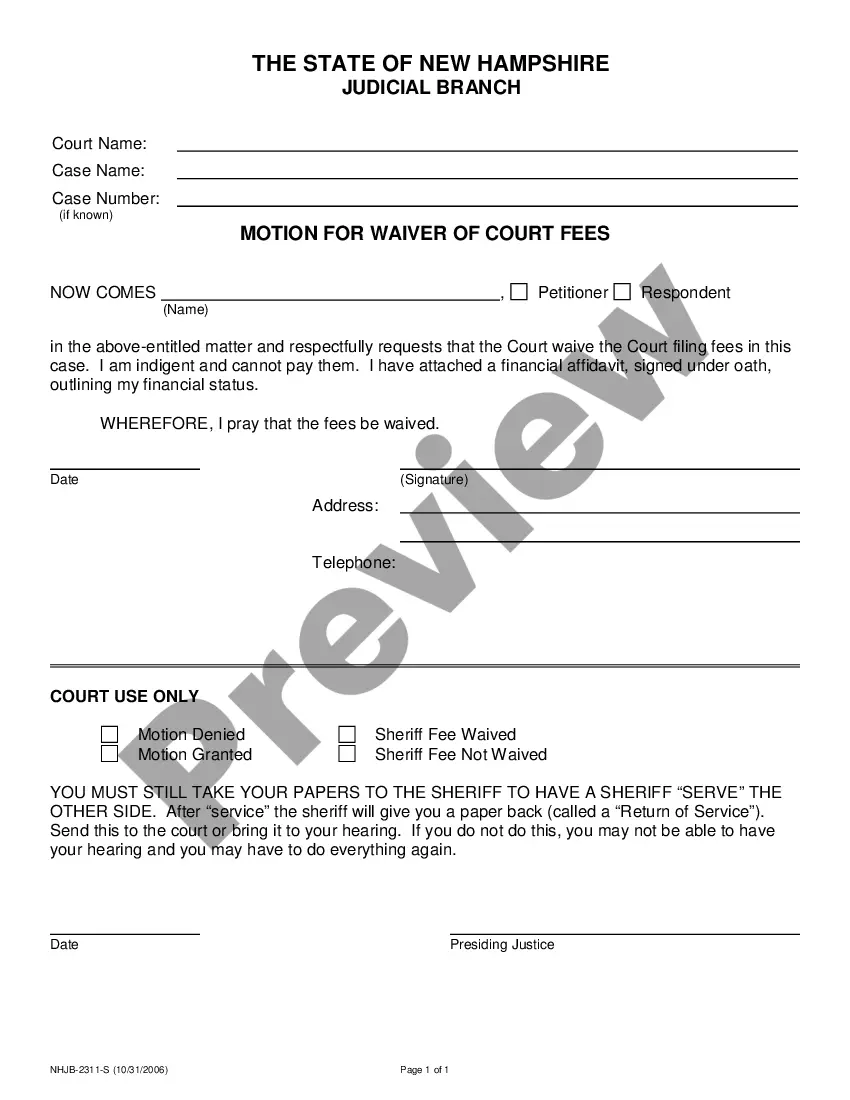

Users who don't have an active subscription need to complete simple steps before having the ability to get access to their Marital Deduction Trust - Trust A and Bypass Trust B:

- Use the Preview function and look at the form description (if available) to make sure that it’s the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right template for the state and situation.

- Make use of the Search field at the top of the page if you want to look for another document.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your document in a convenient format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step guidelines above, you'll always be capable of sign in and download whatever file you want for whatever state you need it in. With US Legal Forms, finishing Marital Deduction Trust - Trust A and Bypass Trust B templates or any other legal files is simple. Get started now, and don't forget to recheck your examples with certified attorneys!

Bypass Trust Diagram Form popularity

Trust A Revocable Living Other Form Names

What Is Marital Deduction FAQ

A bypass trust can still be useful in some circumstances. If your estate is greater than the current estate tax exemption, a bypass trust is still a good way to protect your assets from the estate tax.

The trust qualifies for the marital deduction. In a QTIP trust, the surviving spouse must receive all income generated by the trust property for life, paid at least annually.After the surviving spouse's death, the property passes to the remainder beneficiaries of the trust, who usually are the children of the couple.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away.The first part is the marital trust, or A trust. The second is a bypass, family or B trust. The marital trust is a revocable trust that belongs to the surviving spouse.

The effect of the marital deduction trust is that it shields both spouse's assets and estates from federal estate taxes because when the first spouse dies, the assets indicated by the settlor (the spouse who created the trust) pass to the marital trust free and clear of any and all federal estate taxes.

In the case of a marital trust, the IRS subjects the remaining trust assets to federal estate taxes when the surviving spouse passes. However, a couple can take advantage of the federal gift and estate tax exemption. This is the amount that you can pass on to heirs before you'd ever owe an actual estate tax.

An estate trust is a type of marital deduction trust requiring that when the surviving spouse dies, all remaining trust principal must go into his/her estate. This means the surviving spouse gets to choose the final beneficiaries, by will or within a living trust.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

A marital deduction trust is a trust in which transfers of property between married partners are free of federal transfer tax.

A marital trust is a legal entity established to pass assets to a surviving spouse or children/grandchildren. When a spouse dies, their assets are moved into the trust. A general power of appointment, an estate trust, and a QTIP trust are three types of marital trusts.