Disclaimer of Inheritance Rights for Stepchildren

Description

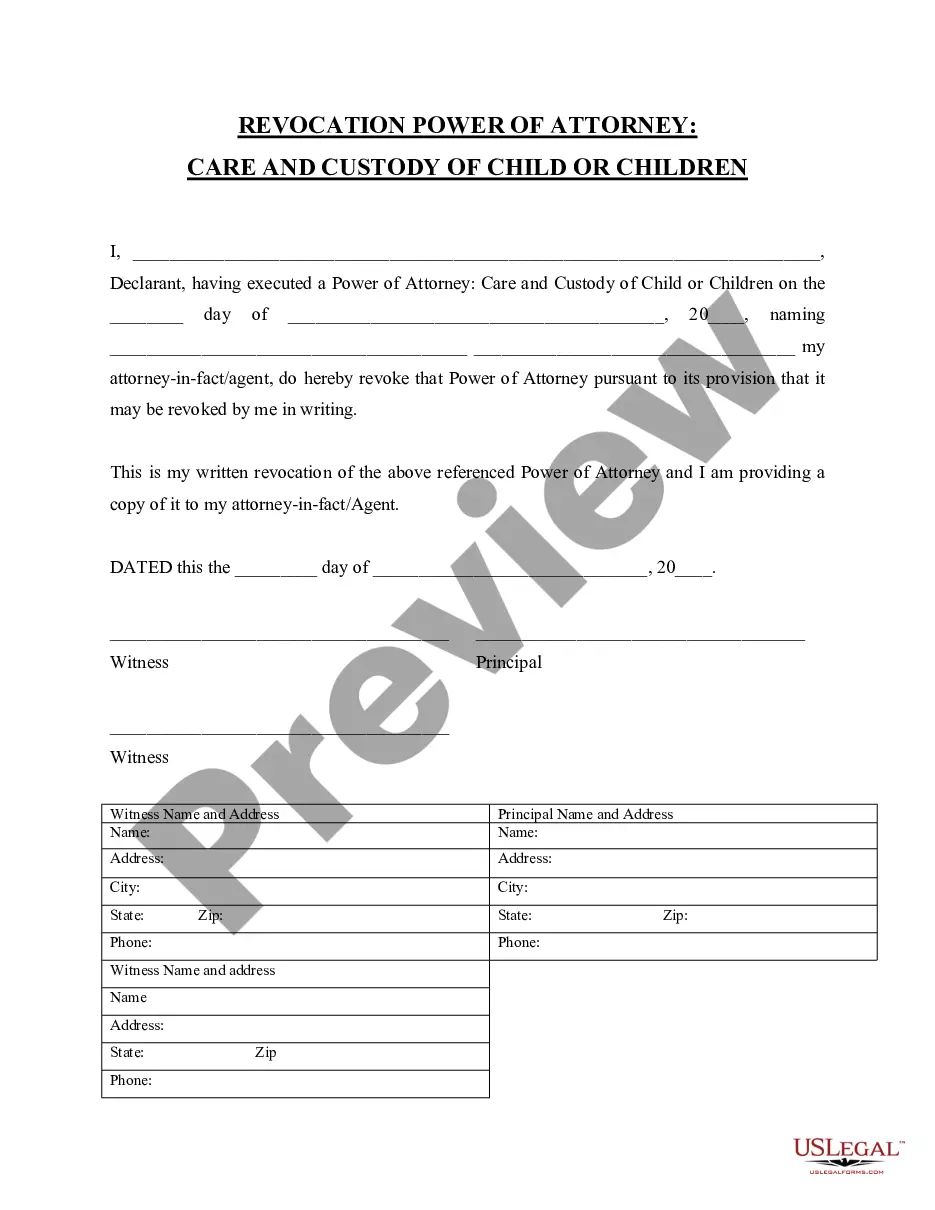

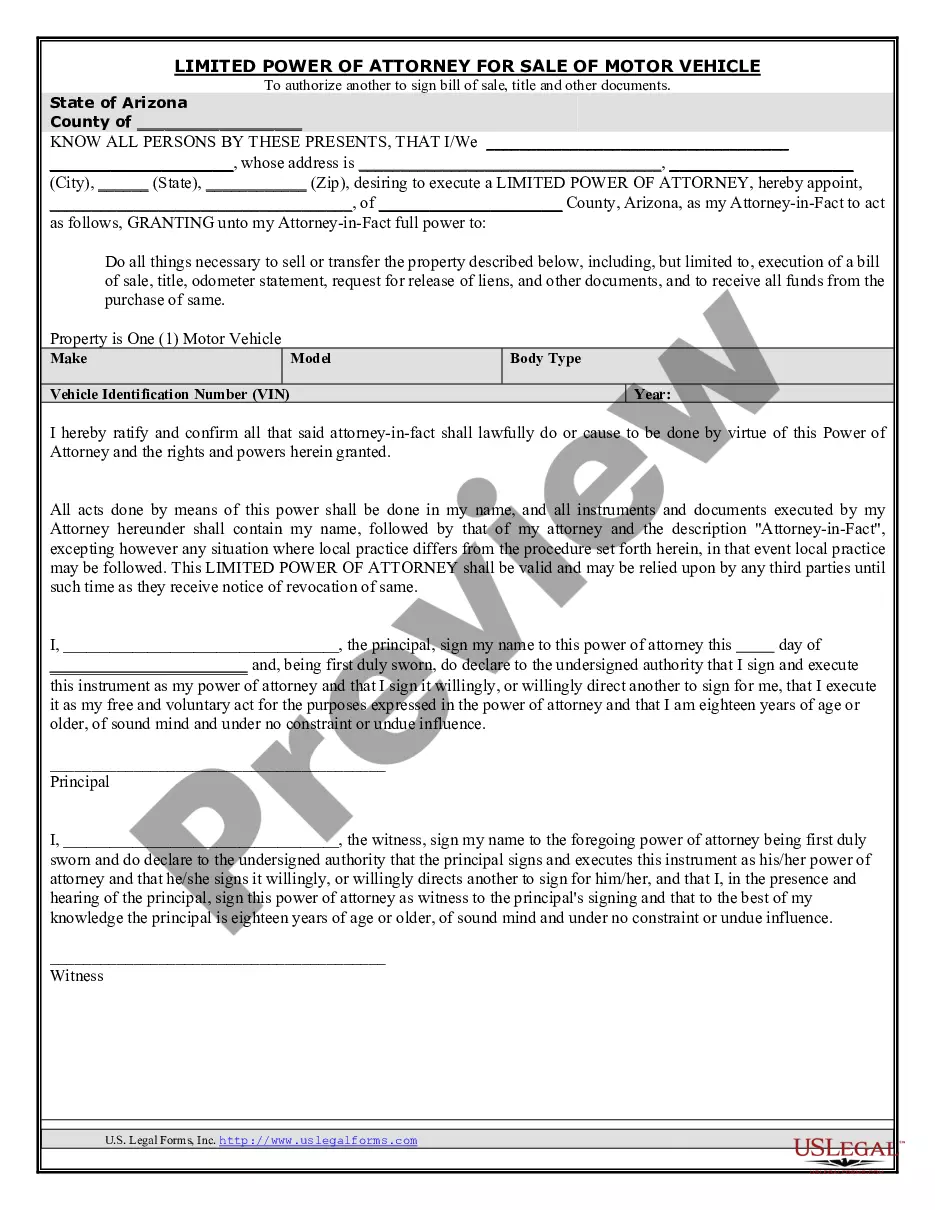

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

Use US Legal Forms to get a printable Disclaimer of Inheritance Rights for Stepchildren. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue on the internet and provides affordable and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and some of them can be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Disclaimer of Inheritance Rights for Stepchildren:

- Check to make sure you get the correct template in relation to the state it is needed in.

- Review the document by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Disclaimer of Inheritance Rights for Stepchildren. More than three million users already have utilized our platform successfully. Select your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

A stepchild cannot inherit from a stepparent, unless the stepparent made stepchild a legatee in his will.

Yes there still exist the relationship of step-father and step-child. The relation would still qualify under the Federal family leave act, but you will not inherit from your step-father's estate nor he through your's unless you or he is named in the will.

In fact, California law states that stepchildren do not inherit until all of the relatives directly related to the stepparent or relatives descended from the stepparent's grandparents receive property. This can even apply if your stepparent inherited your biological parent's assets upon their passing.

Even if biological dad and stepmother makes their wills at the same time and the wills are identical in that both wills leave the estate to the surviving spouse, and upon the second to die leave the estate in equal shares to the biological and stepchildren, after the death of the first spouse, the surviving spouse can

Yes there still exist the relationship of step-father and step-child. The relation would still qualify under the Federal family leave act, but you will not inherit from your step-father's estate nor he through your's unless you or he is named in the will.

If your partner dies, you don't automatically get parental responsibility for your stepchild. Parental responsibility passes to your stepchild's surviving biological parent. Even after biological parents separate, they still have shared parental responsibility.

Unfortunately, stepchildren are not included under the definition of children in these laws.In fact, California law states that stepchildren do not inherit until all of the relatives directly related to the stepparent or relatives descended from the stepparent's grandparents receive property.

Generally, step children are not the next of kin as they are not blood related to the step father. If the mother had a will or died with out a will and her estate never went through the probate process, the children may be able to come back and get half the house.