Community Property Agreement

Description

How to fill out Community Property Agreement?

Aren't you tired of choosing from numerous samples each time you require to create a Community Property Agreement? US Legal Forms eliminates the wasted time millions of Americans spend searching the internet for suitable tax and legal forms. Our skilled team of lawyers is constantly modernizing the state-specific Templates library, so it always has the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

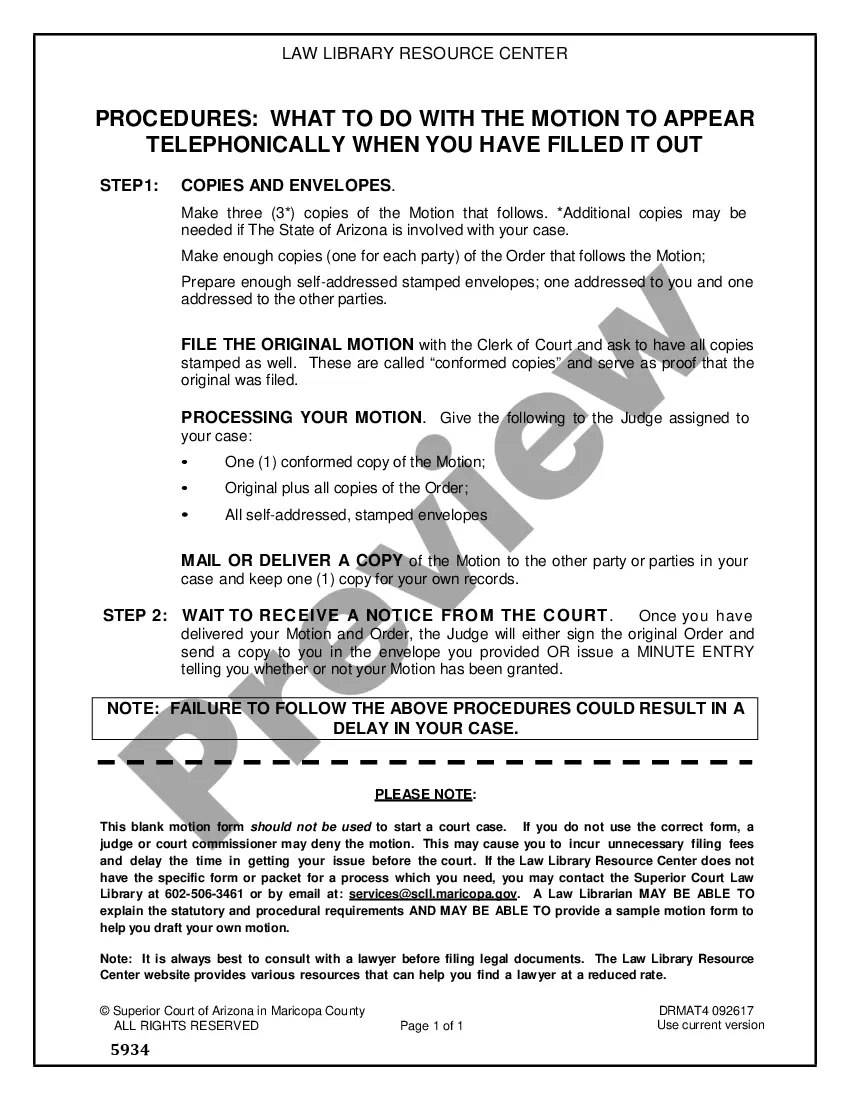

Visitors who don't have an active subscription should complete simple steps before having the ability to download their Community Property Agreement:

- Make use of the Preview function and look at the form description (if available) to make certain that it’s the right document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the correct template for your state and situation.

- Utilize the Search field on top of the page if you have to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a convenient format to finish, create a hard copy, and sign the document.

When you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever document you want for whatever state you want it in. With US Legal Forms, completing Community Property Agreement templates or any other official documents is not difficult. Get started now, and don't forget to look at the examples with certified lawyers!

Form popularity

FAQ

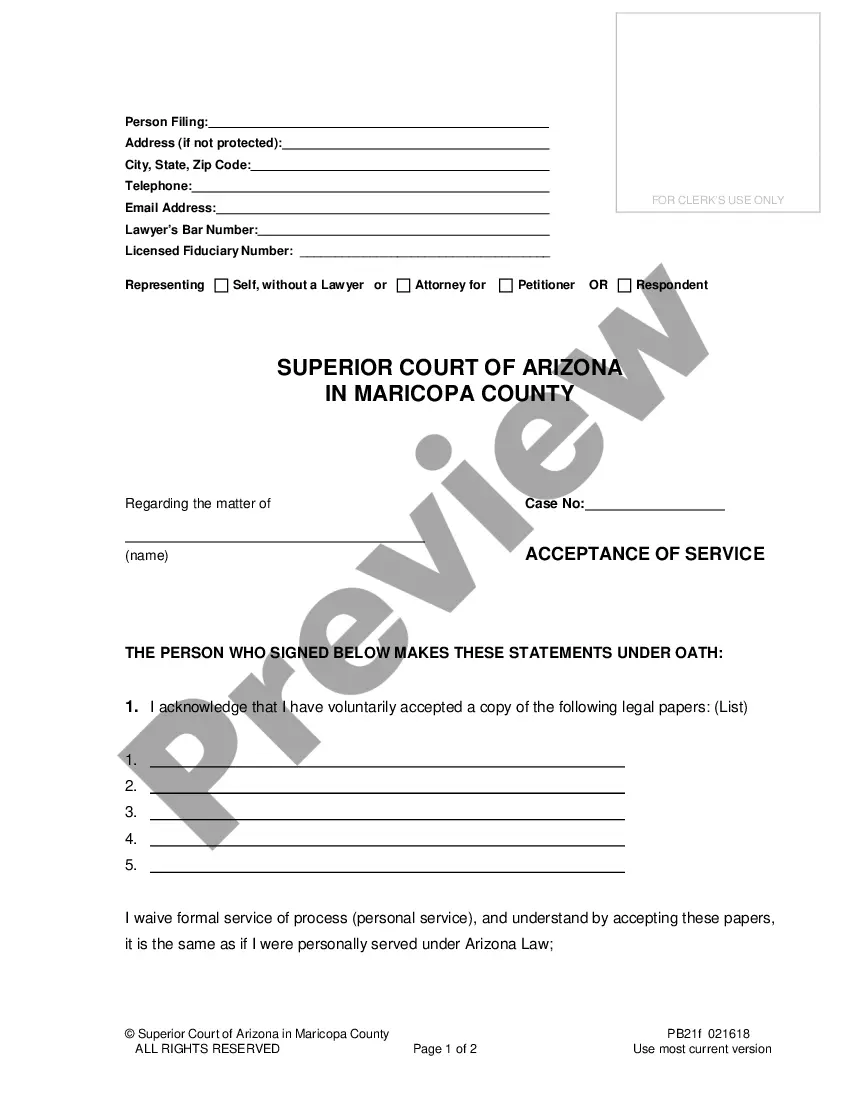

Community property in American English noun. U.S. Law (in some states) property acquired by marriage partners, either individually or together, that is considered by law to be jointly owned and equally shared.

Community property is everything a husband and wife own together. This typically includes all money earned, debts incurred, and property acquired during the marriage.Any real or personal property acquired with income earned during the marriage. This includes vehicles, homes, furniture, appliances and luxury items.

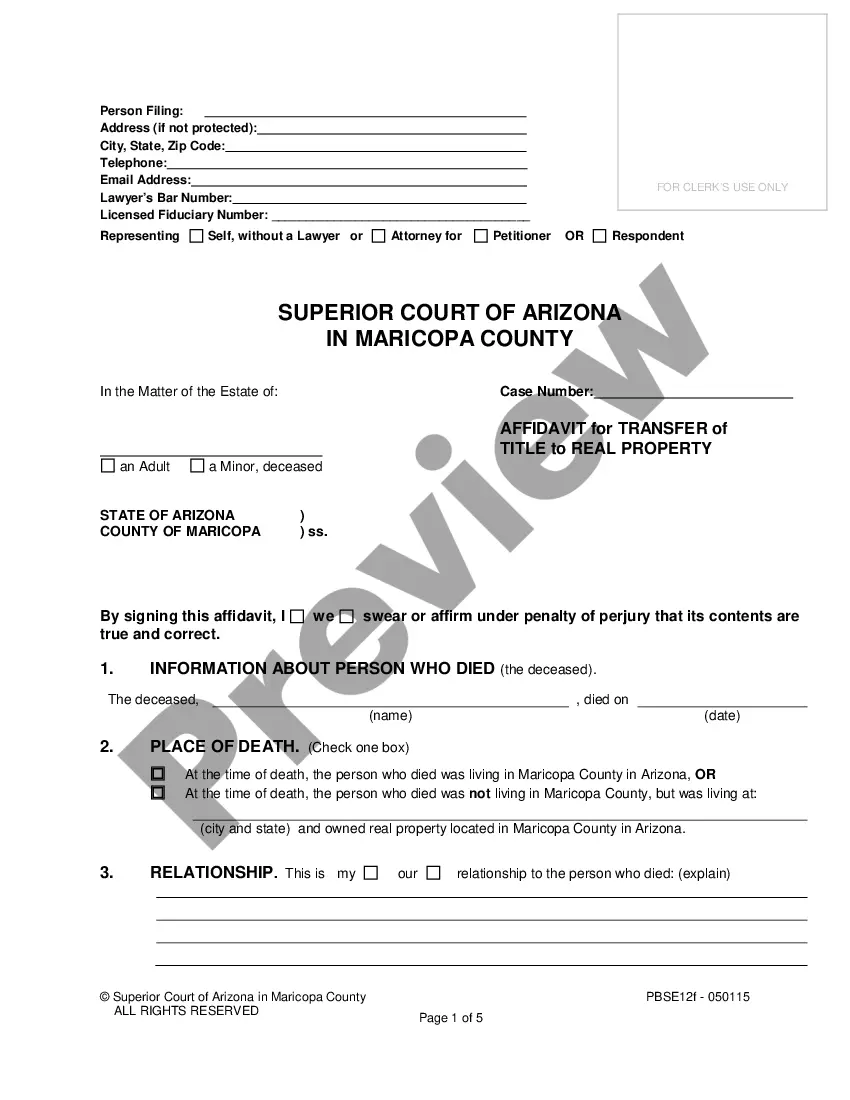

At divorce, community property is generally divided equally between the spouses, while each spouse keeps his or her separate property. Equitable distribution. In all other states, assets and earnings accumulated during marriage are divided equitably (fairly), but not necessarily equally.

Holding title as community property with right of survivorship gives married couples the hybrid benefits of joint tenancy and community property: you avoid probate, your spouse cannot will away his or her ownership to another individual, and the surviving spouse receives a double step-up in basis.

Community Property in Washington A judge will divide all community property items equally during a divorce. Community assets include income, stocks, royalties, rents, cars, the marital home, bank accounts, 401k accounts, credit card charges, and any other assets or debts accumulated during the couple's marriage.

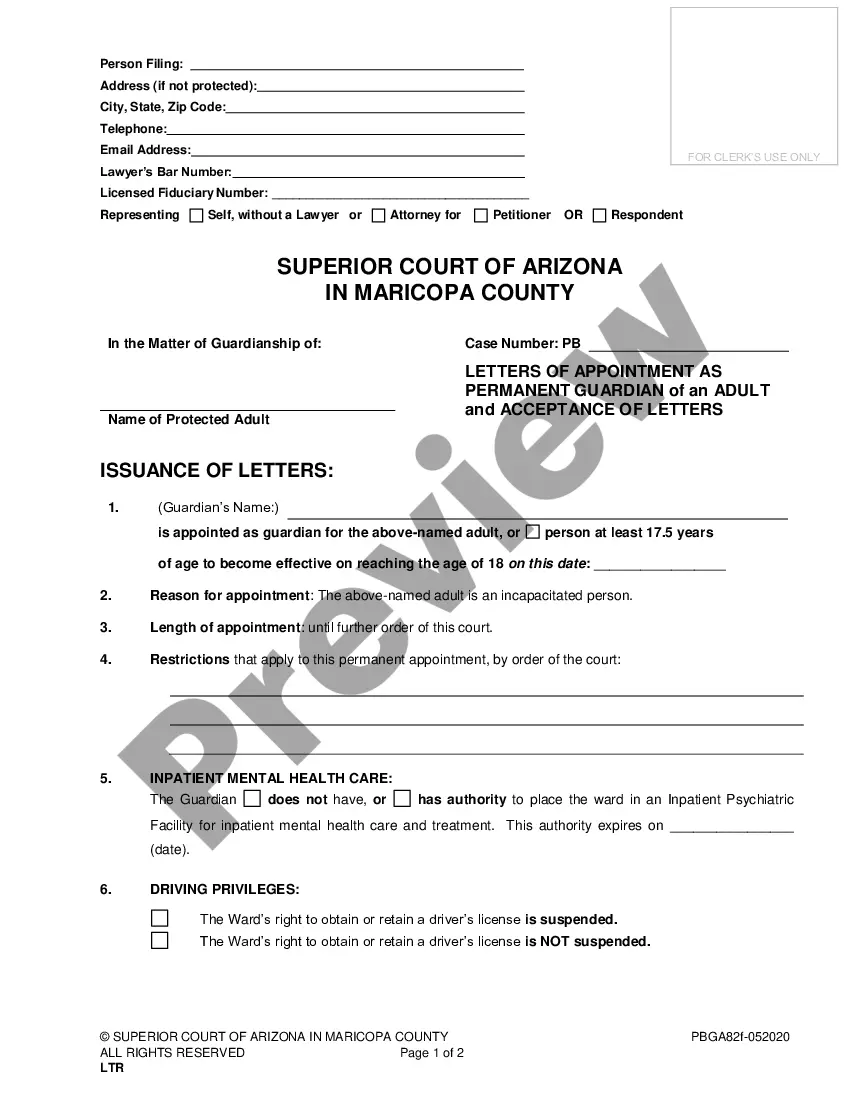

A community property agreement states that when the first spouse or partner dies 1) all property both people own converts to community property and 2) all of the deceased person's property immediately goes to the surviving spouse.

Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage.

A Community Property Agreement is a contract that a married couple in a community property state sign as a couple that specifies how they want their property to be classified.In a community property state, a married person owns only one-half of the community property and all of his or her individual property.