The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description Bad Debt Write Off

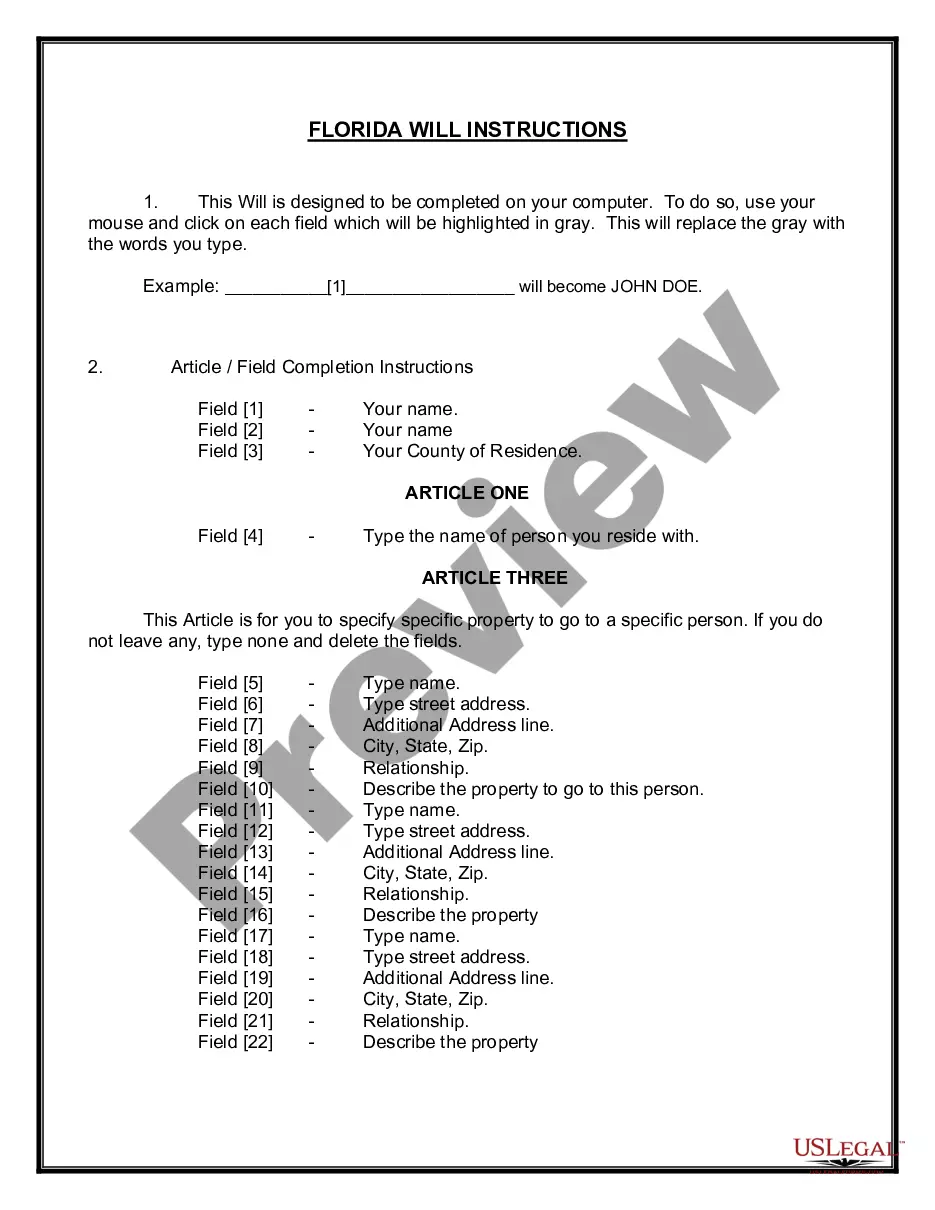

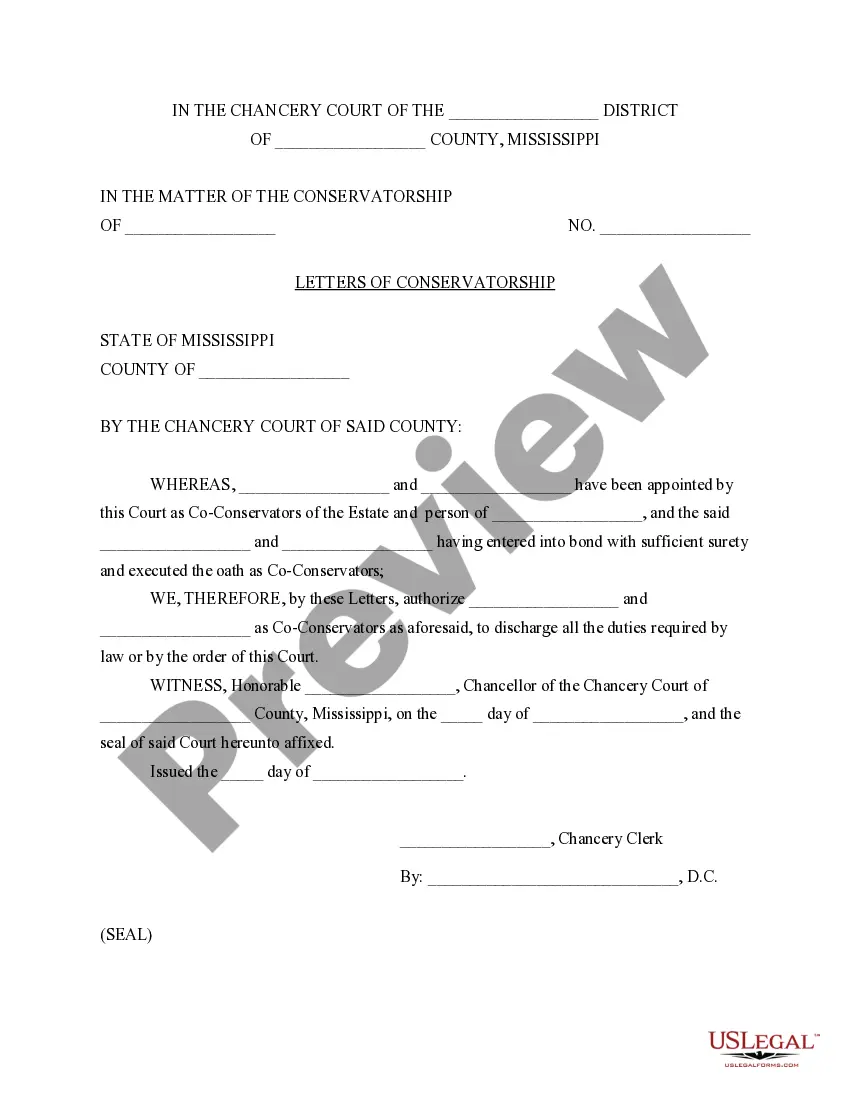

How to fill out How To Write An Affidavit Letter?

Aren't you tired of choosing from numerous templates every time you require to create a Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities? US Legal Forms eliminates the wasted time millions of Americans spend browsing the internet for appropriate tax and legal forms. Our expert crew of attorneys is constantly updating the state-specific Forms catalogue, so that it always provides the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription should complete simple actions before having the ability to get access to their Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities:

- Use the Preview function and look at the form description (if available) to make sure that it is the right document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right template for the state and situation.

- Make use of the Search field on top of the site if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your template in a convenient format to finish, create a hard copy, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always be able to log in and download whatever document you require for whatever state you want it in. With US Legal Forms, finishing Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities templates or other legal files is not hard. Get going now, and don't forget to look at your examples with certified lawyers!

Affidavit Financial Form Form popularity

Discharging Dissolved Stocks Other Form Names

Credits Debtor Satisfy FAQ

In concept, a financial affidavit is a simple document. It is a sworn statement of your income, expenses, assets and liabilities. The form for the affidavit is prescribed by the Florida Supreme Court. Both parties must file and serve a financial affidavit in a divorce case.Expenses are the problem.

What Is a Financial Affidavit? A financial affidavit, which has different names in each state, is a statement showing your income, expenses, debts and assets. It allows a court to figure out how much spousal support and child support it should award.

The main purpose of a financial affidavit is to provide the court with an explanation of a party's financial circumstances. Without this information, the court would be unable to make financial orders or orders concerning property distribution.

The basic format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

In all contested (and some uncontested) divorces, the Courts require each spouse to file what's called a Financial Affidavit, a formal document that details the typical financial factors that play a role in every marriage: how much you earn (income), how much you spend (expenses), how much you own (assets), how much

If you lie on this document, you are lying to the court.Depending on how serious your untruth, lying on a financial affidavit could mean that your spouse is awarded a larger portion of the marital assets, something that could negatively impact your financial situation for many years to come.

Statement of Cash Flows. A cash flow statement is one of the most important planning tools you have available. Income Statement. Like a cash flow statement, an income statement is one of the most important and valuable financial statements at your disposal. Balance Sheet. Statement of Changes in Equity.

Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.