Angel Investor Agreement

About this form

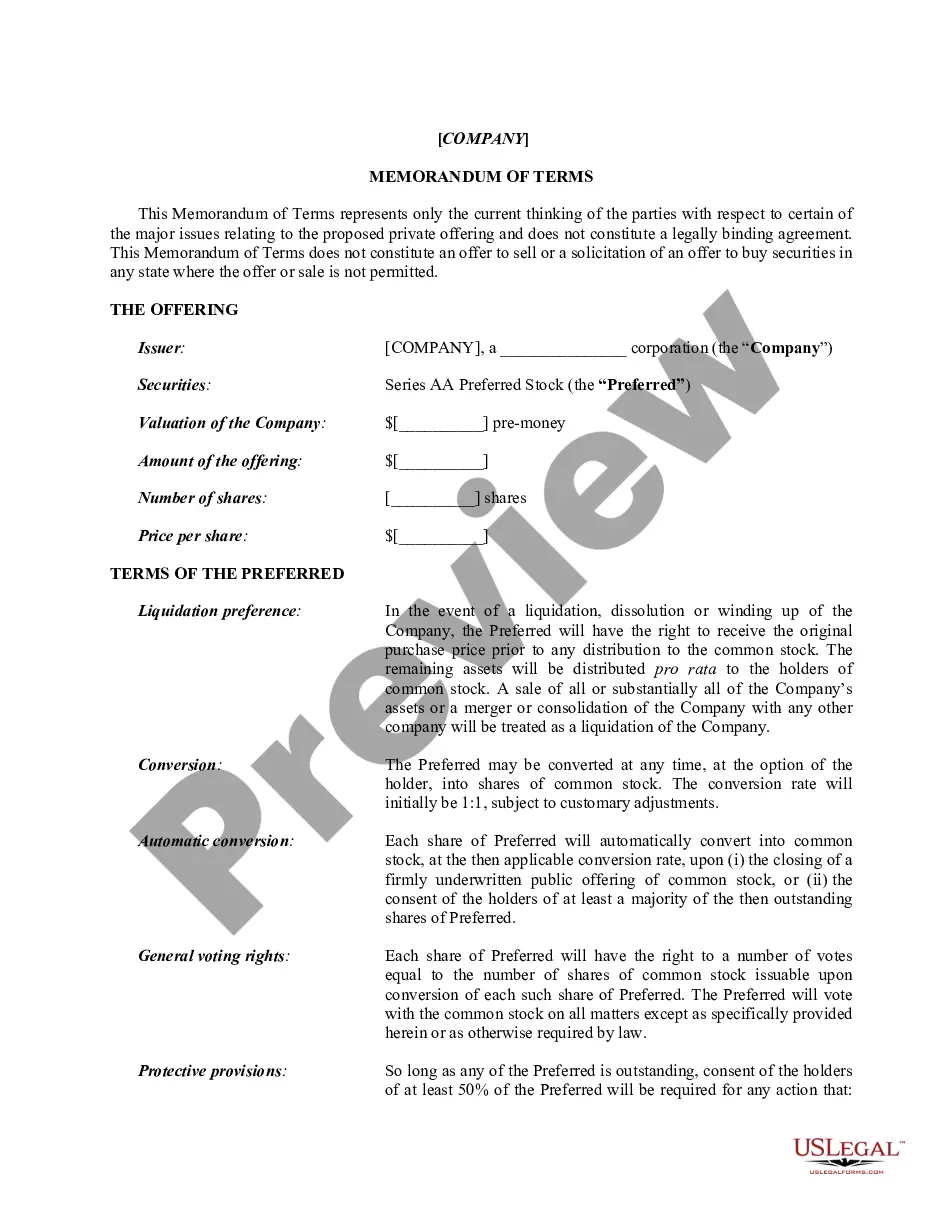

The Angel Investor Agreement is a legal document that outlines the relationship between angel investors and a network that facilitates investments in startups. This agreement is crucial for protecting investors while providing them with the necessary framework to participate in high-risk ventures. Unlike standard investment agreements, this form specifically addresses the unique aspects of investments made by angel investors, ensuring compliance with securities regulations and defining confidentiality commitments.

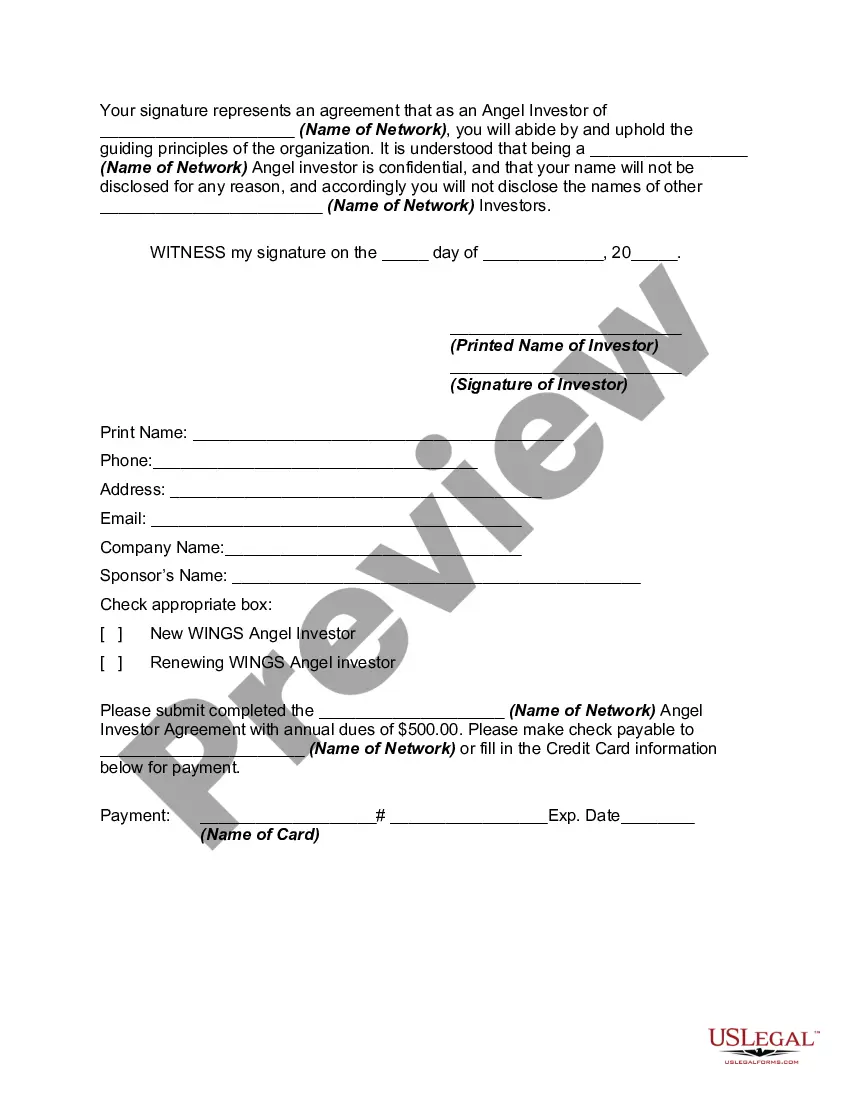

Form components explained

- Name and address of the Angel Network.

- Definitions of accredited and sophisticated investors.

- Clarification that the network does not act as a venture fund or investment advisor.

- Confidentiality agreement regarding investor identities.

- Signature and contact information fields for the investor.

- Payment information for annual dues.

Common use cases

This form should be used when an individual intends to join an angel investor network to provide capital to startups. It is particularly relevant when an investor seeks to formalize their relationship with the network and comply with investor eligibility requirements outlined by securities law. Use this agreement to ensure clarity on confidentiality and expectations surrounding investment activities.

Who needs this form

- Able investors looking to engage with startup companies through an angel network.

- Individuals qualifying as accredited or sophisticated investors according to securities regulations.

- New members or renewing members of an angel investor network.

How to complete this form

- Fill out the name and address of the Angel Network.

- Choose and indicate your investor status as either accredited or sophisticated.

- Provide your contact information, including phone number and email address.

- Sign and date the form to confirm your agreement to the terms outlined.

- Submit the completed agreement along with the annual dues payment.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete contact information.

- Neglecting to read and understand the definitions of investor types.

- Not signing the agreement before submission.

- Ignoring the requirement for confidentiality regarding other investors.

Advantages of online completion

- Easy access to a professionally drafted agreement, ensuring compliance with legal requirements.

- Editable PDF format allows for convenient customization before printing.

- Instant download simplifies the process, avoiding lengthy wait times.

Looking for another form?

Form popularity

FAQ

After calculating winners and losers over time, angels who invest through angel groups will typically see a portfolio return in the 23-37% range, or about 2.5X. Getting 4.8X your money back sounds good, until you think about what you could have done with that money if you could have reinvested it after five years.

They can be repaid on a straight schedule (for investors who are providing loans instead of buying equity in your company), they can be paid back based upon their percentage of ownership, or they can be paid back at a preferred rate of return.

Founders: 20 to 30 percent. Angel investors: 20 to 30 percent. Option pool: 20 percent. Venture capitalists: 30 to 40 percent.

In terms of how much money angel investors can bring to the table, it's not unusual for a typical investment to range from $25,000 to $100,000. In some instances, angel investors may be willing to part with even larger sums to assist a startup. Pros: Angel funding is not a loan.

Angel investors typically want from 20 to 25 percent return on the money they invest in your company. Venture capitalists may take even more; if the product is still in development, for example, an investor may want 40 percent of the business to compensate for the high risk it is taking.

The typical angel investment is about $10,000. The average angel investment is $77,000. The average amount of money received by each company receiving angel investment is close to $372,000.The amount of money received by companies from accredited angel groups tends to be a bit higher, but not that much larger.

The typical angel investment is $25,000 to $100,000 a company, but can go higher.