Agreement to Purchase Note and Mortgage

Description

How to fill out Agreement To Purchase Note And Mortgage?

Aren't you tired of choosing from hundreds of templates each time you require to create a Agreement to Purchase Note and Mortgage? US Legal Forms eliminates the wasted time an incredible number of American people spend surfing around the internet for suitable tax and legal forms. Our expert crew of attorneys is constantly upgrading the state-specific Forms catalogue, to ensure that it always has the proper files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete a few simple steps before being able to get access to their Agreement to Purchase Note and Mortgage:

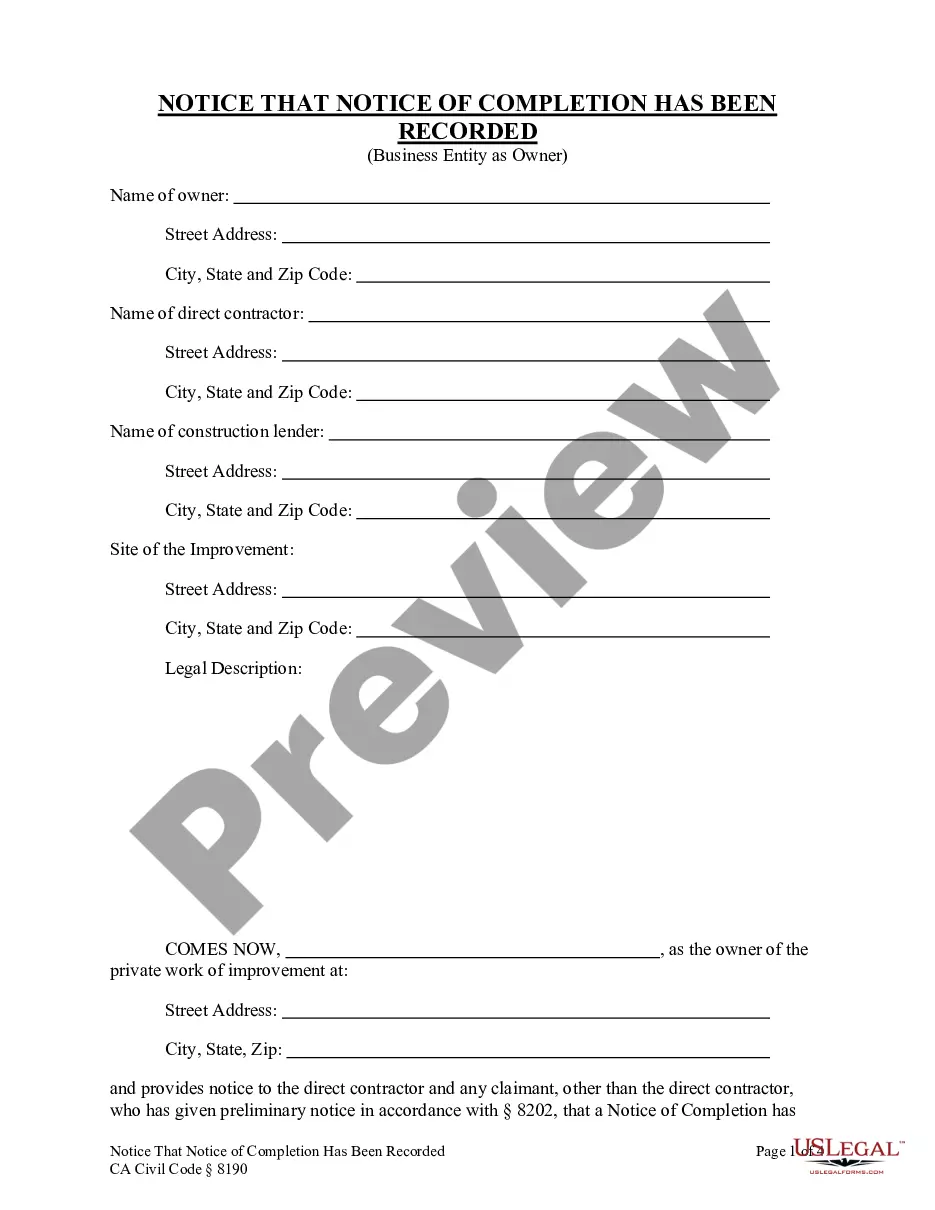

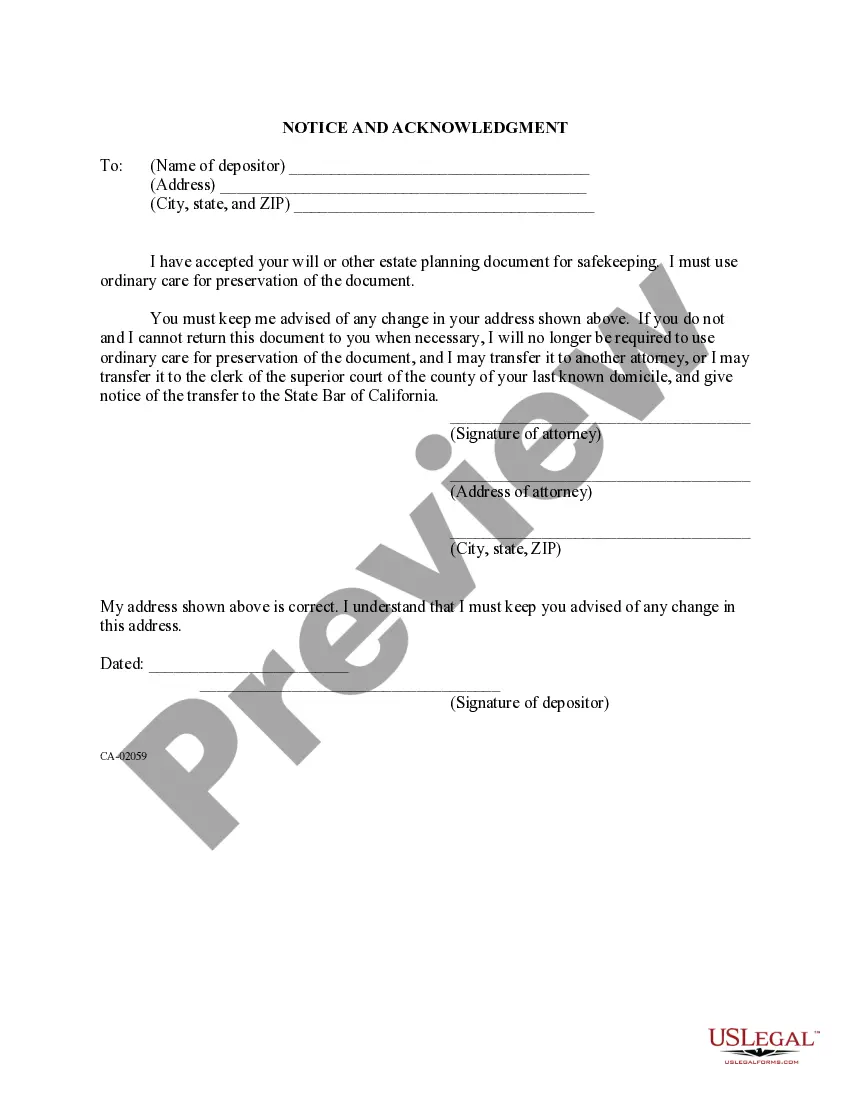

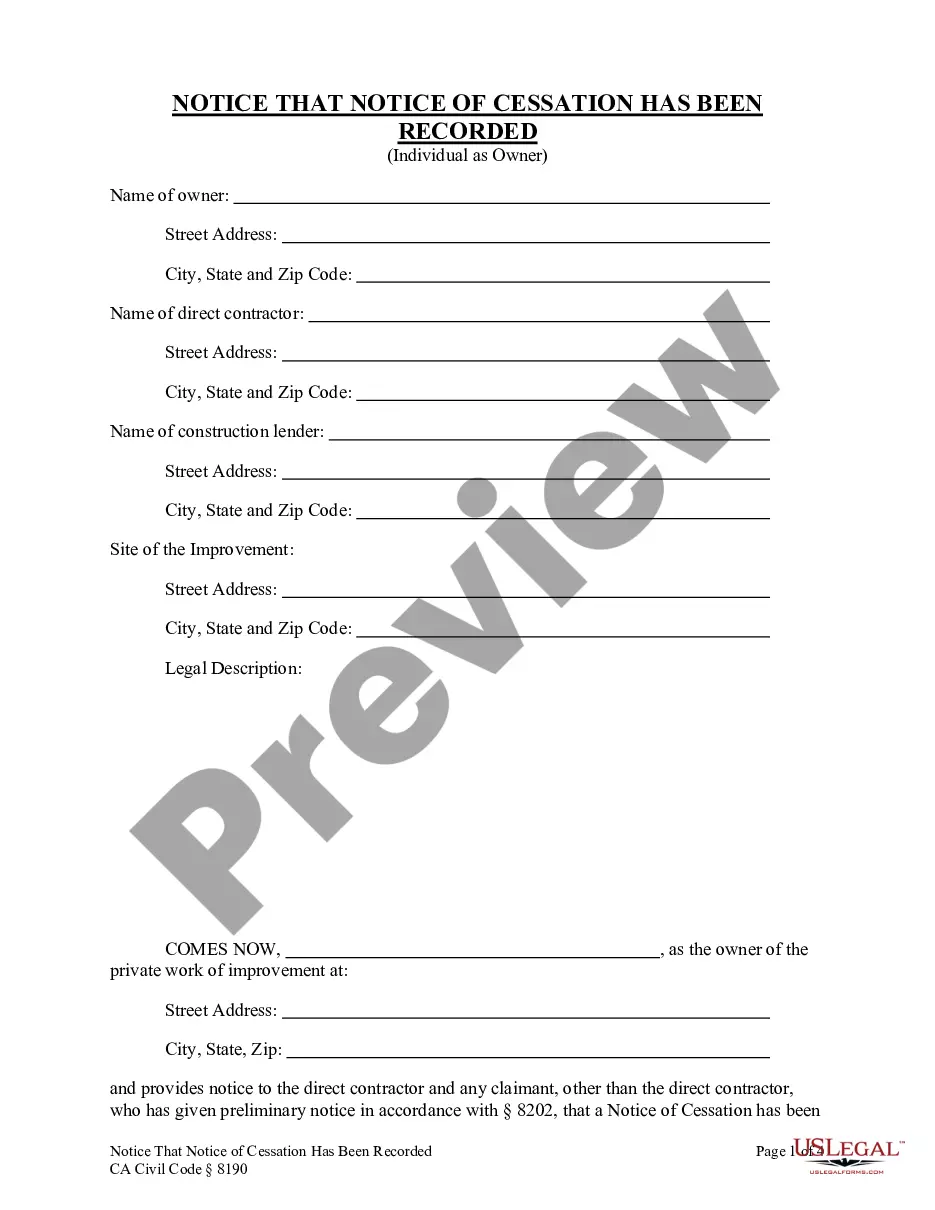

- Use the Preview function and look at the form description (if available) to be sure that it is the proper document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the proper template for the state and situation.

- Make use of the Search field on top of the page if you need to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your file in a required format to finish, print, and sign the document.

Once you have followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you will need for whatever state you require it in. With US Legal Forms, finishing Agreement to Purchase Note and Mortgage templates or other official files is simple. Begin now, and don't forget to recheck your samples with accredited attorneys!

Form popularity

FAQ

Write the title. Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

Buyer and seller information. Property details. Pricing and financing. Fixtures and appliances included/excluded in the sale. Closing and possession dates. Earnest money deposit amount. Closing costs and who is responsible for paying.

If you own a computer and have a sheet of paper, you can create your own mortgage to finance the purchase of real estate. No one checks your credit, and you don't need a cash down payment.There is a huge market of investors who buy privately created mortgages and trust deeds (often referred to as paper).

Write the title. Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

A Mortgage Agreement is a pledge by a borrower that they will relinquish their claim to the property if they cannot pay their loan. Contrary to common belief, a Mortgage Agreement isn't the loan itself; it's a lien on the property.A Mortgage Agreement is the remedy in case the loan isn't repaid.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.