Judgment Foreclosing Mortgage and Ordering Sale

Description Mortgage Ordering

How to fill out Foreclosing Form?

Aren't you sick and tired of choosing from numerous samples every time you require to create a Judgment Foreclosing Mortgage and Ordering Sale ? US Legal Forms eliminates the wasted time millions of American citizens spend browsing the internet for ideal tax and legal forms. Our expert team of lawyers is constantly modernizing the state-specific Templates collection, so it always has the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription should complete easy actions before having the ability to get access to their Judgment Foreclosing Mortgage and Ordering Sale :

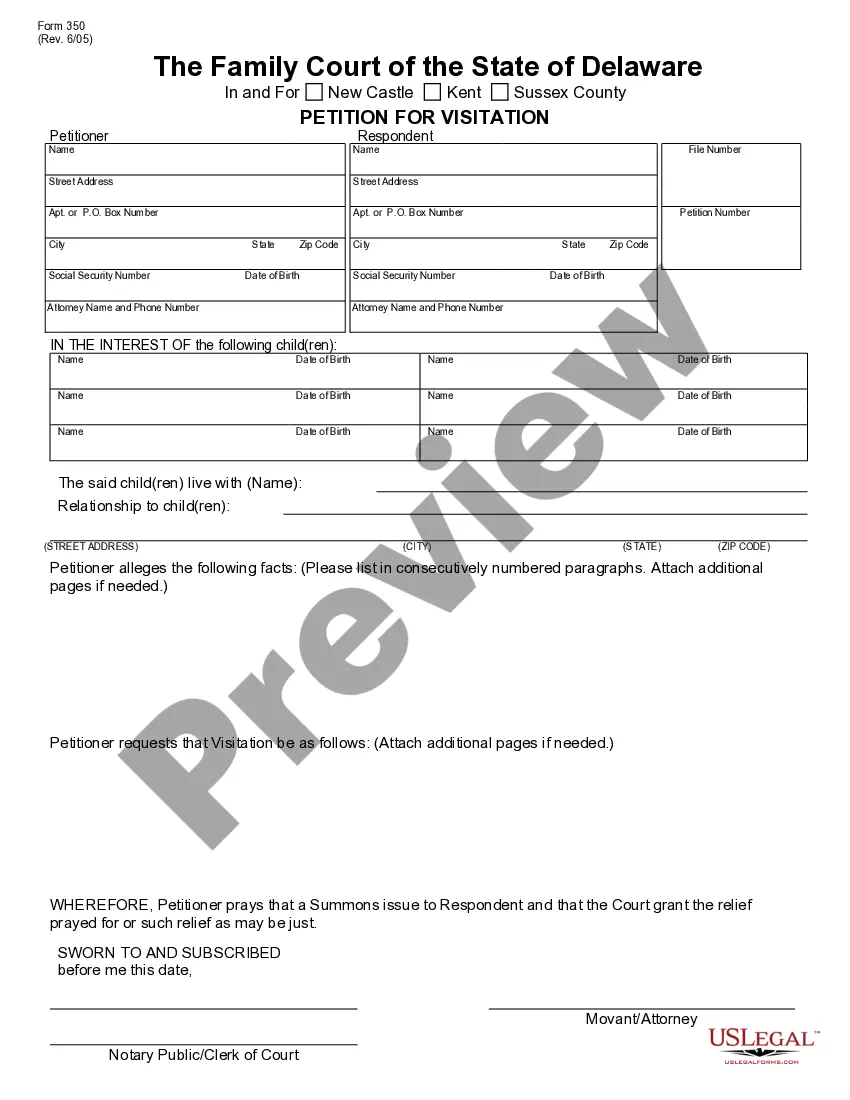

- Use the Preview function and read the form description (if available) to be sure that it is the proper document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper sample for the state and situation.

- Use the Search field on top of the web page if you have to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your file in a needed format to finish, print, and sign the document.

As soon as you’ve followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you need for whatever state you require it in. With US Legal Forms, finishing Judgment Foreclosing Mortgage and Ordering Sale templates or any other official documents is easy. Get going now, and don't forget to look at your examples with certified attorneys!

Judgment Foreclosing Form popularity

Judgment Mortgage Other Form Names

Judgment Sale Online FAQ

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

When a junior mortgage holder has been sold-out in a first-mortgage foreclosure, that junior mortgage holder usually can, depending on state law, sue you personally on the promissory note to recover the money it loaned you.

When a junior lienholder forecloses, a senior lienholder recovers nothing from the sale proceeds. But the senior lien remains intact and the foreclosure buyer takes title to the property subject to the senior lien.

Yes, a second mortgage holder can foreclose, even if you are current on your first mortgage.After taking care of expenses, the mortgages will be paid off in order of priority; until the first mortgage is fully paid off, the second mortgage holder will not receive any funds.

If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

You get behind in your mortgage payments. The bank sends a letter notifying you of its intent to begin foreclosure. The bank files a lawsuit. The bank gives you notice of the lawsuit. You have a chance to respond.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.

Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title. But the second-mortgage debt and creditor's judgment remain, even though they're no longer attached to the foreclosed property.