Sworn Statement regarding Proof of Loss for Automobile Claim

Description Sworn Statement In Proof Of Loss

How to fill out What Is A Sworn Affidavit?

Aren't you tired of choosing from countless templates each time you need to create a Sworn Statement regarding Proof of Loss for Automobile Claim? US Legal Forms eliminates the lost time millions of American citizens spend searching the internet for appropriate tax and legal forms. Our skilled group of attorneys is constantly modernizing the state-specific Templates library, so it always has the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete easy actions before being able to get access to their Sworn Statement regarding Proof of Loss for Automobile Claim:

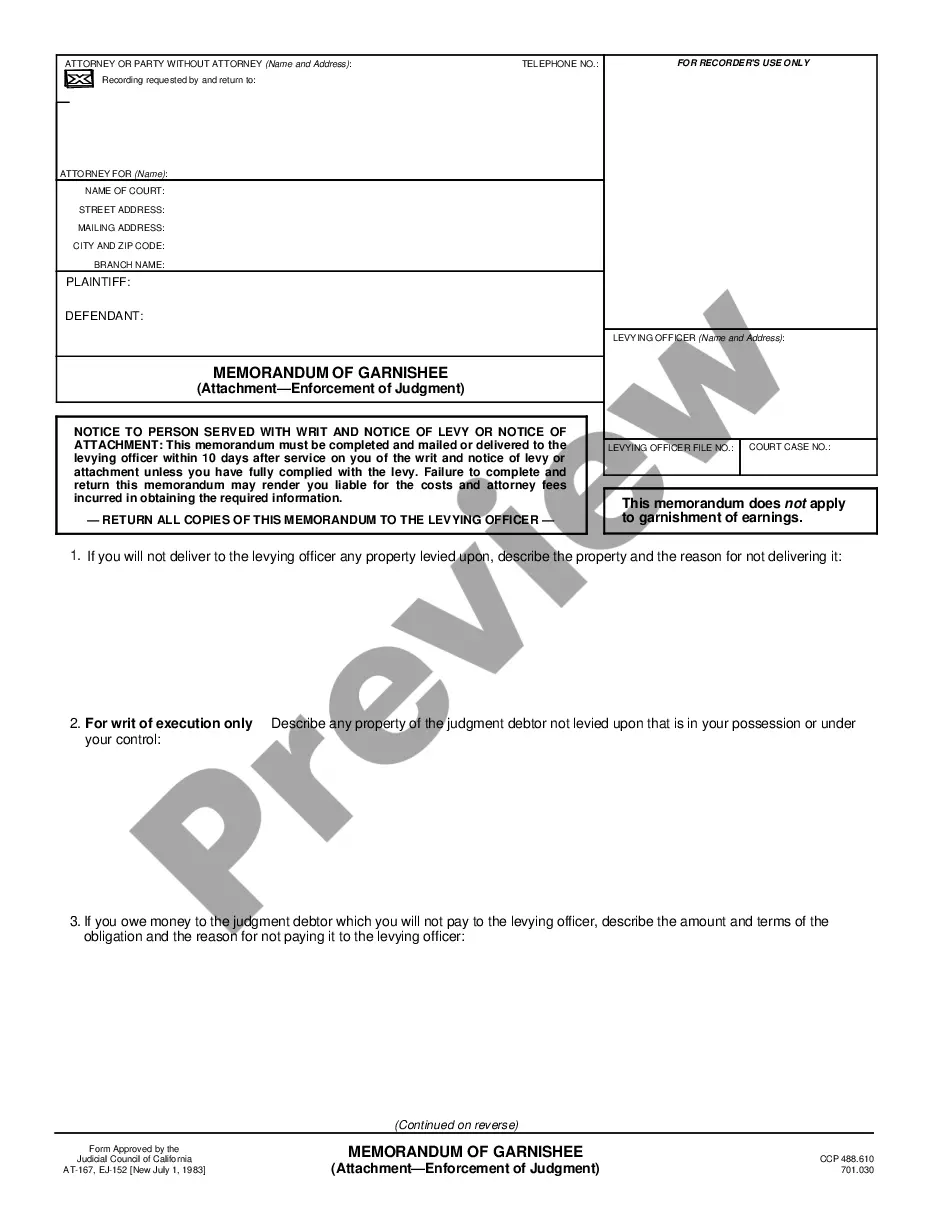

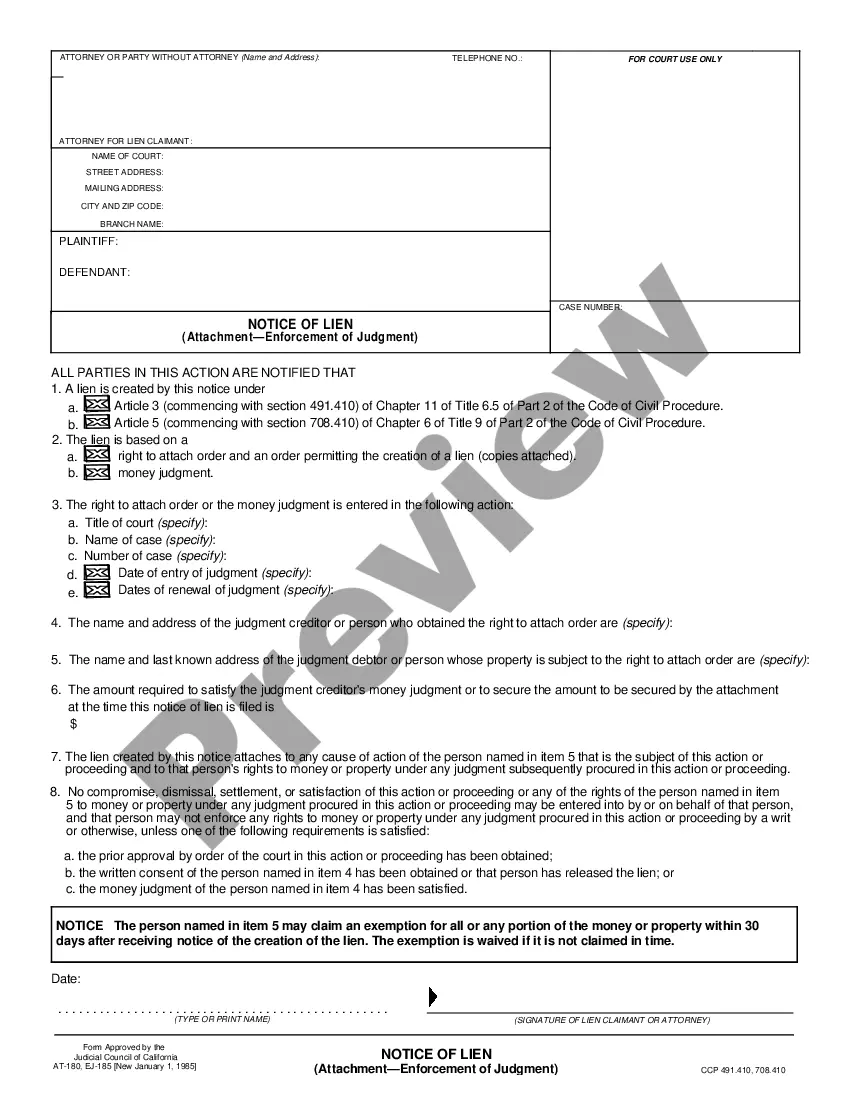

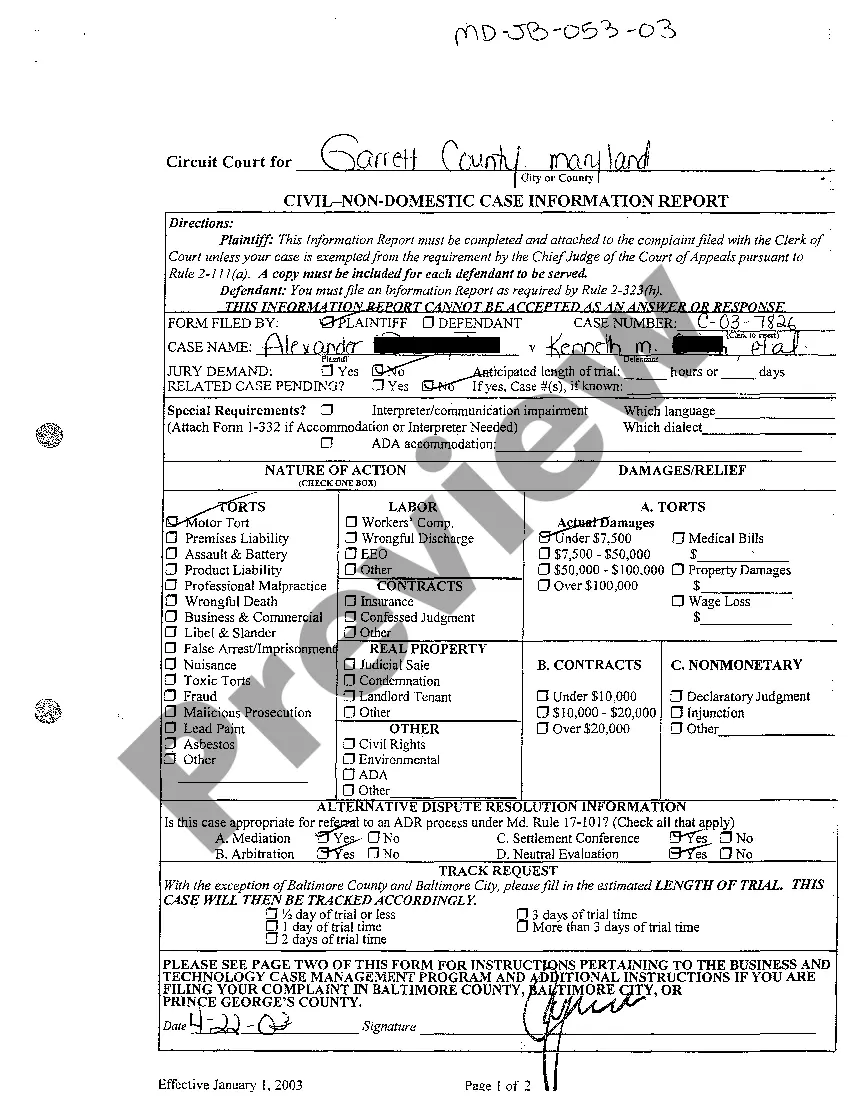

- Make use of the Preview function and look at the form description (if available) to make sure that it’s the right document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for the state and situation.

- Utilize the Search field at the top of the webpage if you want to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your sample in a needed format to finish, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever file you will need for whatever state you need it in. With US Legal Forms, completing Sworn Statement regarding Proof of Loss for Automobile Claim samples or any other legal files is easy. Get going now, and don't forget to look at your samples with certified attorneys!

Statement Of Loss Form Form popularity

Automobile Proof Of Loss Form Example Other Form Names

Sworn Statement Example FAQ

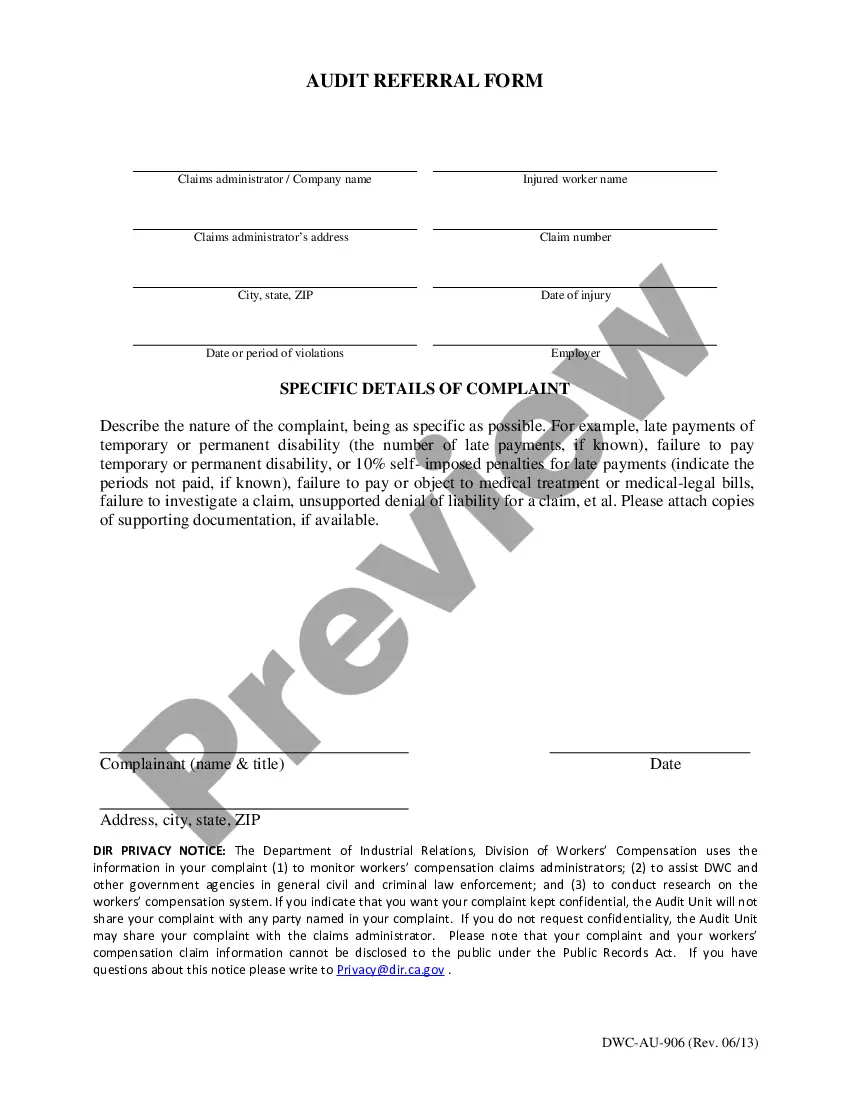

200bEach insurance company provides a form that is used to document damaged or destroyed items. Your insurer will request specific information from you in the event of a loss. Keeping receipts and a current home inventory can assist the claims process.

The proof of loss provision means that the insured must supply the insurer with some evidence that the loss actually occurred and to what extent. The claimant has 90 days to supply the proof, if reasonably possible.

A Sworn Statement in Proof of Loss is a document the policyholder may be requested to submit following a property loss claim. The purpose of the Proof of Loss is to obtain a formal statement from the policyholder regarding the true circumstances and scope of the property loss.

A Proof of Loss is a formal, legal document that states the amount of money the policyholder is requesting from the insurance carrier. It provides the insurance company with detailed information regarding the formal claim of damages.

In the property insurance industry, a statement of loss is synonymous with a proof of loss. Whether your insurer calls it by one name or the other, the document is prepared by your insurer's claim adjuster to itemize your damaged goods that need replacement or repair after a disaster involving your business or home.

200bEach insurance company provides a form that is used to document damaged or destroyed items. Your insurer will request specific information from you in the event of a loss.

Coverage amounts at the time of the loss; Date and cause of the loss; Documents that support the value of the property and the amount of loss claimed (i.e. estimates, inventories, receipts, etc.); Parties claiming the loss under the policy;

The date and cause of the loss. Coverage amounts at the time the loss occurred. Documents that support the value of your property and the amount of loss you claim such as estimates, inventories, receipts, etc. Policy number. Parties that have an interest in the property.