The Uniform Probate Code was drafted by the National Conference of Commissioners on Uniform State Laws. However, not all state legislatures have adopted it. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Sworn Statement of Beneficiary of Estate and Consent to Close Estate - Uniform Probate Code

Description Estate Close Probate

How to fill out Sworn Statement Form Sample?

Aren't you tired of choosing from hundreds of samples every time you need to create a Sworn Statement of Beneficiary of Estate and Consent to Close Estate - Uniform Probate Code? US Legal Forms eliminates the lost time an incredible number of American citizens spend browsing the internet for suitable tax and legal forms. Our skilled team of attorneys is constantly changing the state-specific Samples library, so that it always has the proper files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete simple actions before having the ability to download their Sworn Statement of Beneficiary of Estate and Consent to Close Estate - Uniform Probate Code:

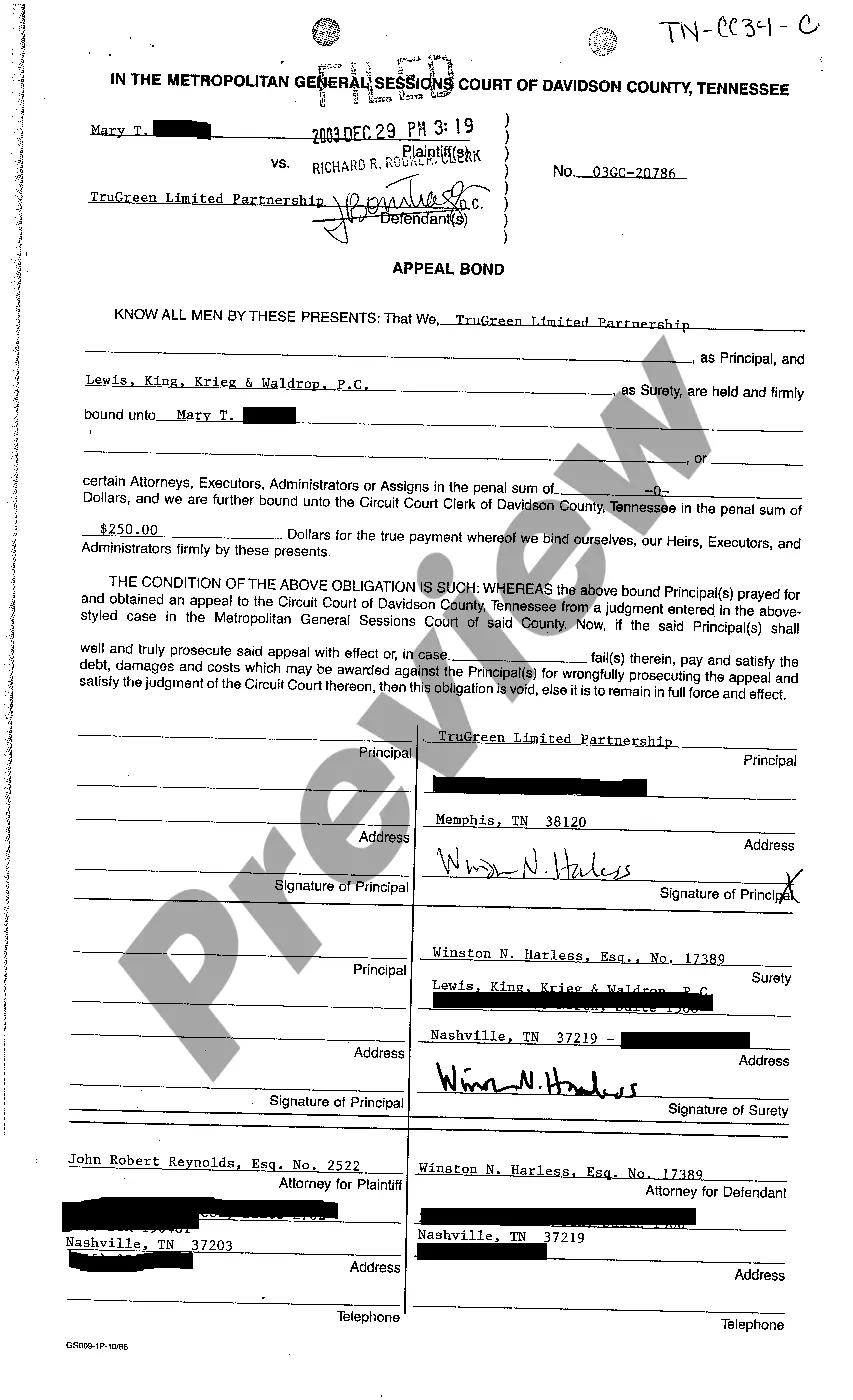

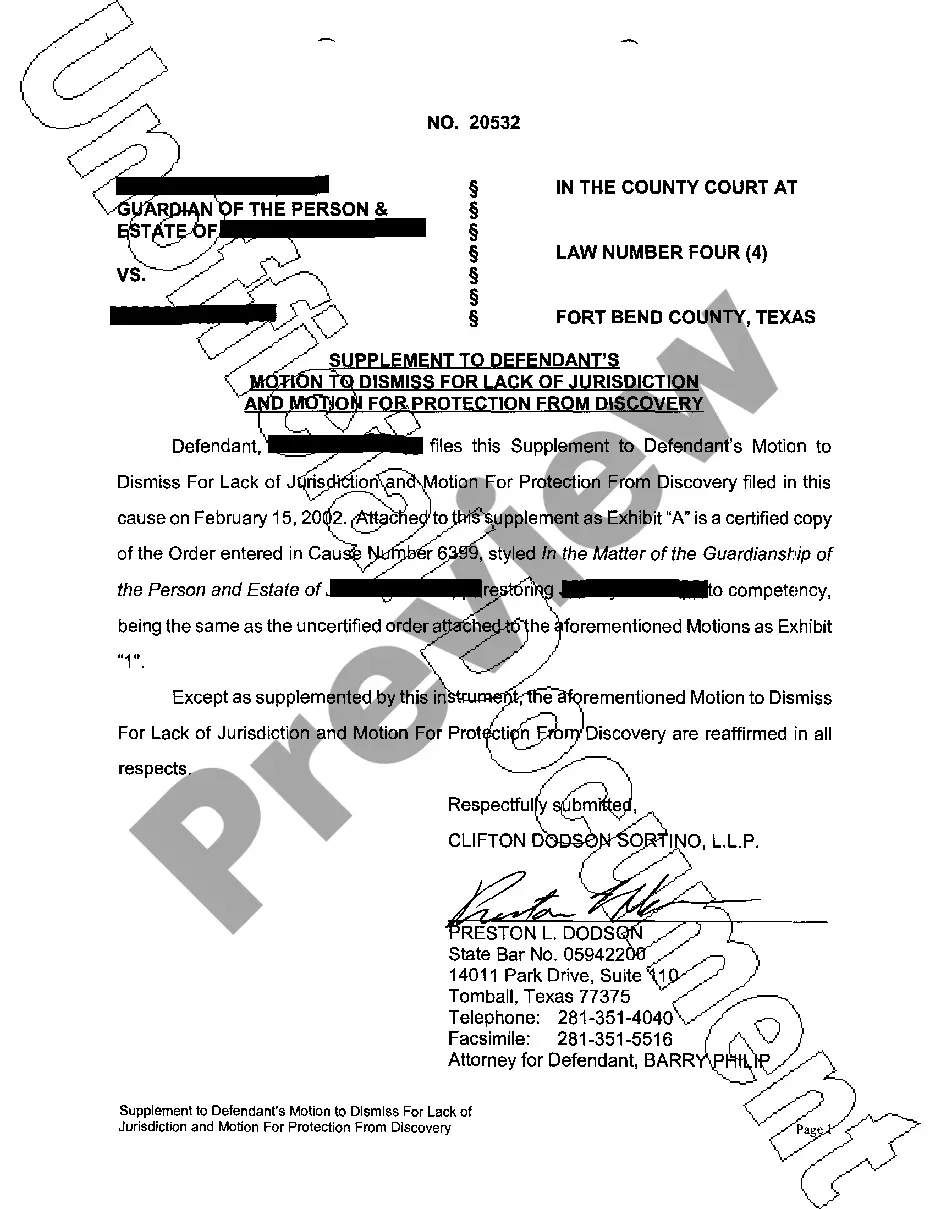

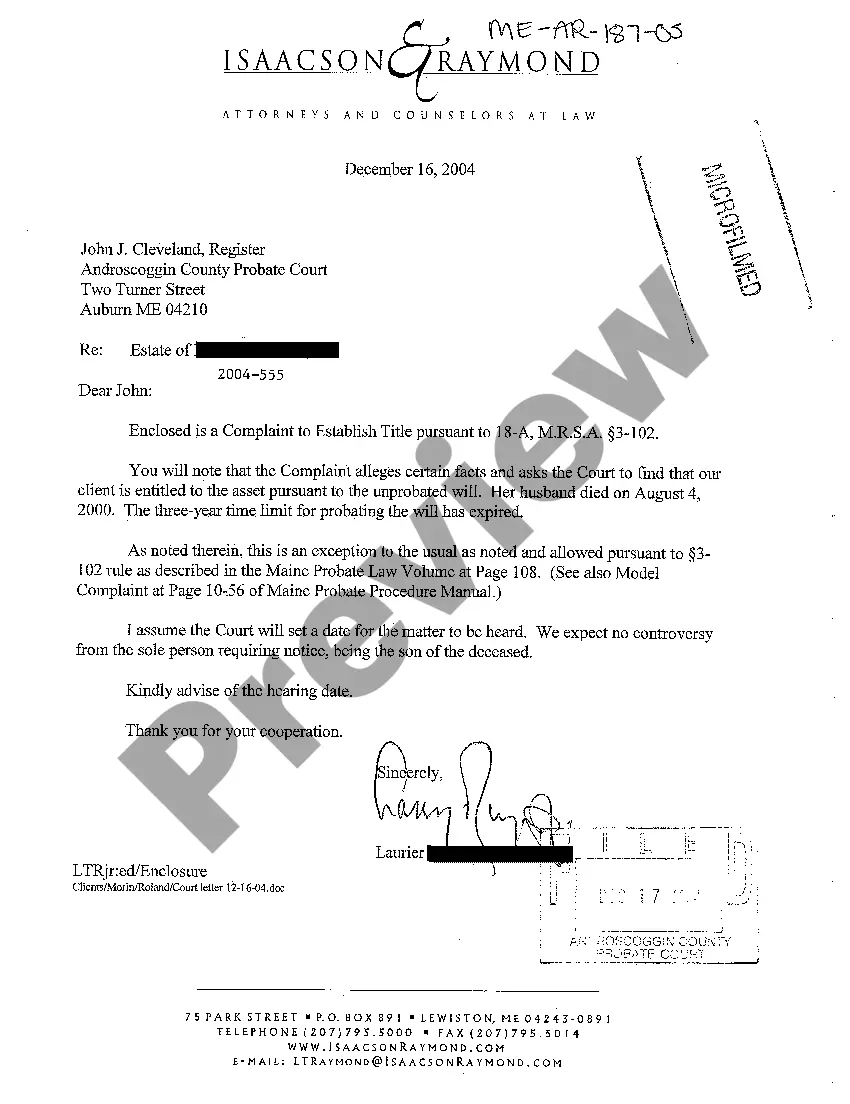

- Utilize the Preview function and read the form description (if available) to make certain that it is the appropriate document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for the state and situation.

- Use the Search field at the top of the webpage if you need to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a needed format to complete, create a hard copy, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever file you will need for whatever state you require it in. With US Legal Forms, completing Sworn Statement of Beneficiary of Estate and Consent to Close Estate - Uniform Probate Code samples or any other official documents is simple. Begin now, and don't forget to double-check your examples with certified lawyers!

Uniform Probate Form popularity

Uniform Probate Code Other Form Names

Estate Executor Spreadsheet FAQ

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

By Stephanie Kurose, J.D. Closing a person's estate after they die can often be a long, detailed process. This includes paying off debts, filing final tax returns, and, finally, distributing the estate's assets according to the wishes of the deceased.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Under the Administration and Probate Act there is a period of 6 months once Probate (or Letters of Administration, if there was no Will) is granted in which claims can be made on an Estate.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

1Complete a final Inventory of Assets.2Using the Inventory of Assets in the final accounting, complete the final accounting.Closing an Estate in a Formal Probate Process\nwww.thecommonexecutor.com > closing-an-estate-in-a-formal-probate-pro...