Disputed Accounted Settlement

Description

How to fill out Disputed Accounted Settlement?

Aren't you sick and tired of choosing from countless samples every time you want to create a Disputed Accounted Settlement? US Legal Forms eliminates the lost time numerous American people spend browsing the internet for suitable tax and legal forms. Our expert team of attorneys is constantly upgrading the state-specific Samples catalogue, so that it always offers the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete quick and easy steps before having the ability to download their Disputed Accounted Settlement:

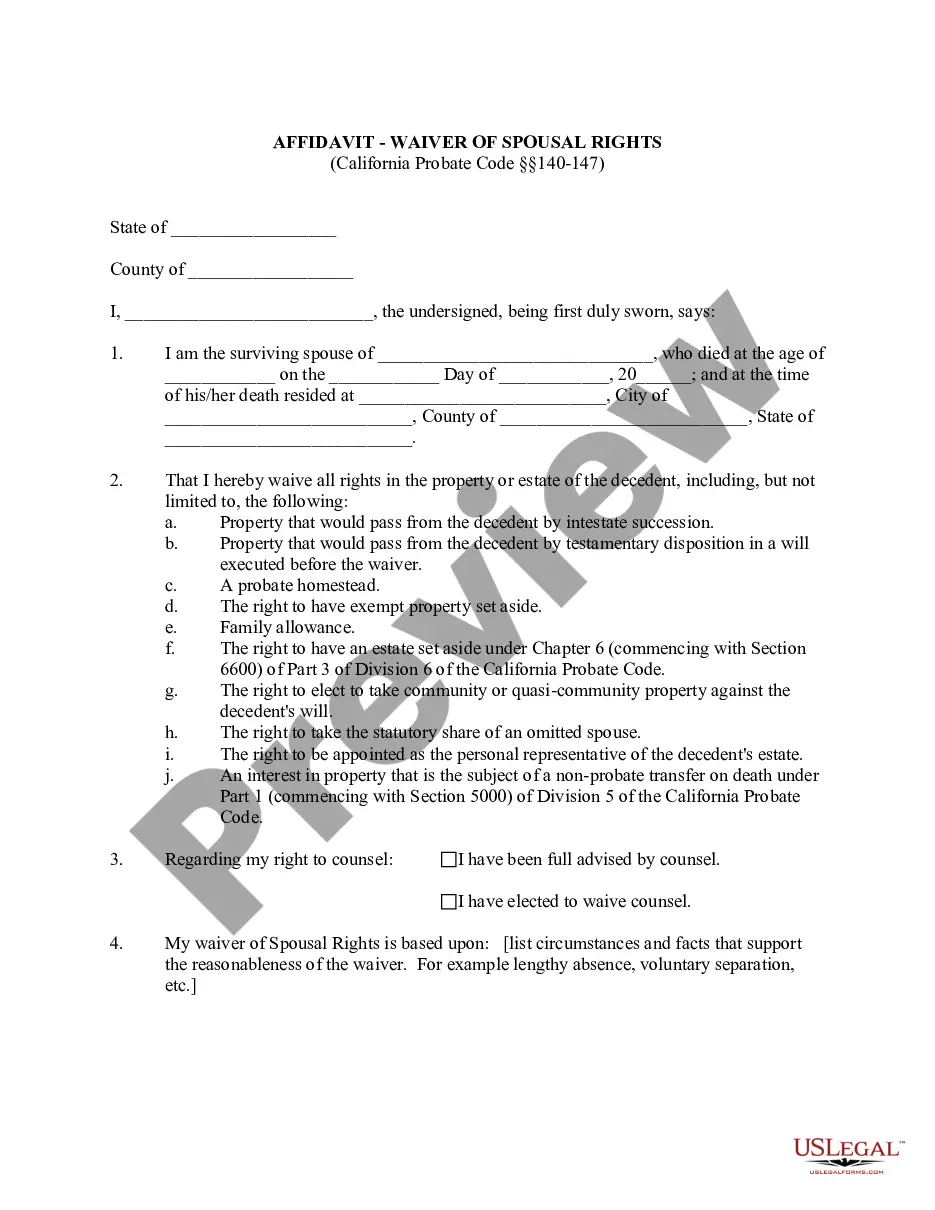

- Make use of the Preview function and look at the form description (if available) to ensure that it’s the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right example for your state and situation.

- Make use of the Search field at the top of the page if you need to look for another file.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your template in a required format to finish, create a hard copy, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the ability to log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, finishing Disputed Accounted Settlement samples or any other official documents is not difficult. Get started now, and don't forget to examine your samples with certified attorneys!

Form popularity

FAQ

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request that the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

1) Write the name and account number of the creditor in question under the Item in Dispute section. 2) Write in the reason for your dispute in the Reason for Dispute section. 3) Sign and mail to the appropriate credit bureau. Mail/call the appropriate credit bureau.

Credit scores can be affected by outstanding debt, even if it no longer exists. Navigating debt negotiations can be tricky, especially if you settled with a company for less than you owe. But a company can and will remove a settled debt from your credit history, if you know how to ask.

Dispute the error with the credit bureau. Report the collections account and ask to have it removed from your credit report. 2feff Provide copies of any evidence you have proving the debt doesn't belong to you. Even if the debt belongs to you, that doesn't mean the collector is legally able to collect from you.

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

Payments reported late that were actually on time. Accounts that aren't yours. Inaccurate credit limit/loan amount or account balance. Inaccurate creditor. Inaccurate account status, for example, an account status reported as past due when the account is actually current.

The Federal Trade Commission advises that you be as specific as possible in the letter about the reason why you think you do not owe this debt (or owe all of it, if you're disputing the amount), but you should give as little personal information as possible in the letter.

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

Your letter should identify each item you dispute, state the facts and explain why you dispute the information, and ask that the information provider take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.