Agreement to Compromise Debt

Description Agreement Debt Contract

How to fill out Agreement To Compromise Debt?

Aren't you sick and tired of choosing from numerous templates every time you want to create a Agreement to Compromise Debt? US Legal Forms eliminates the wasted time an incredible number of Americans spend browsing the internet for ideal tax and legal forms. Our skilled crew of attorneys is constantly changing the state-specific Templates library, so that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

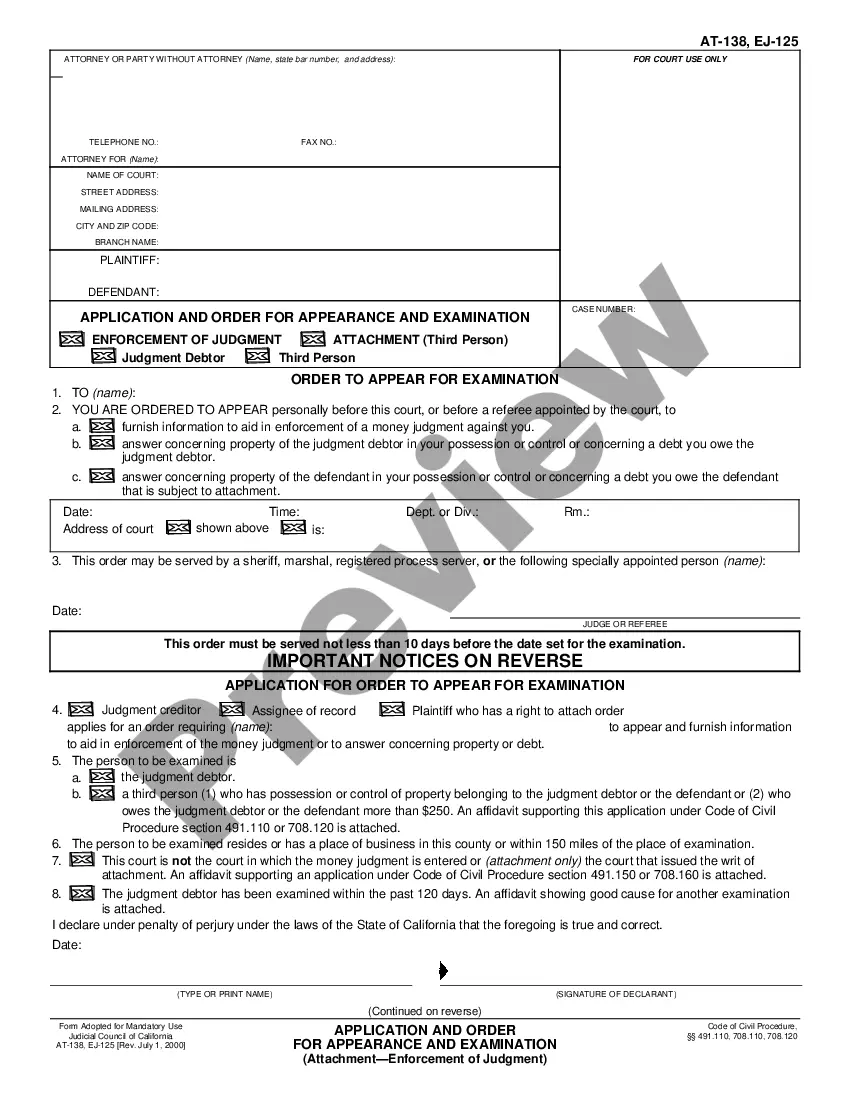

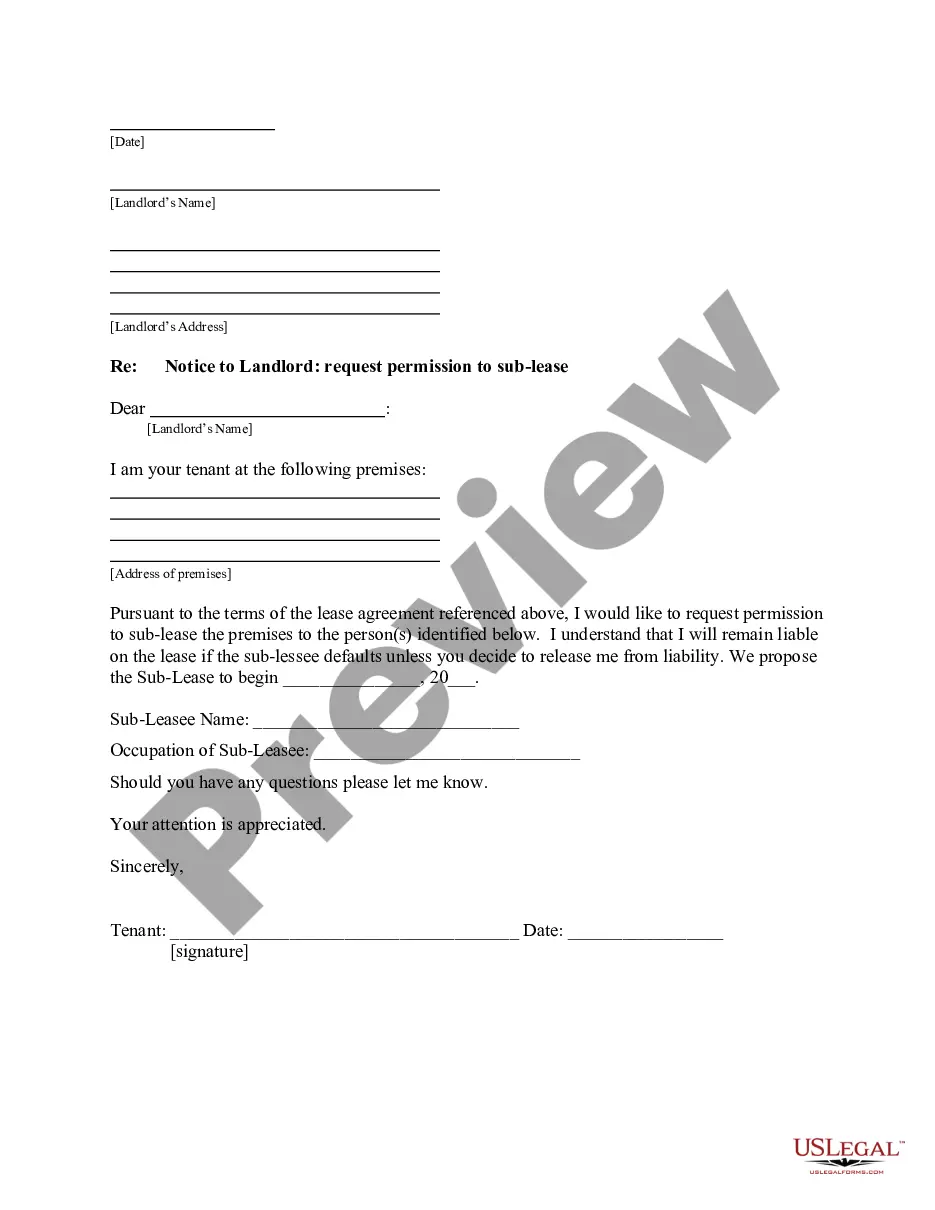

Users who don't have a subscription need to complete quick and easy actions before having the capability to download their Agreement to Compromise Debt:

- Make use of the Preview function and look at the form description (if available) to be sure that it is the correct document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the proper example to your state and situation.

- Make use of the Search field on top of the page if you need to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a needed format to complete, print, and sign the document.

After you’ve followed the step-by-step guidelines above, you'll always be capable of log in and download whatever document you require for whatever state you require it in. With US Legal Forms, finishing Agreement to Compromise Debt templates or any other legal files is not hard. Begin now, and don't forget to look at your examples with certified attorneys!

Agreement Compromise Form Form popularity

FAQ

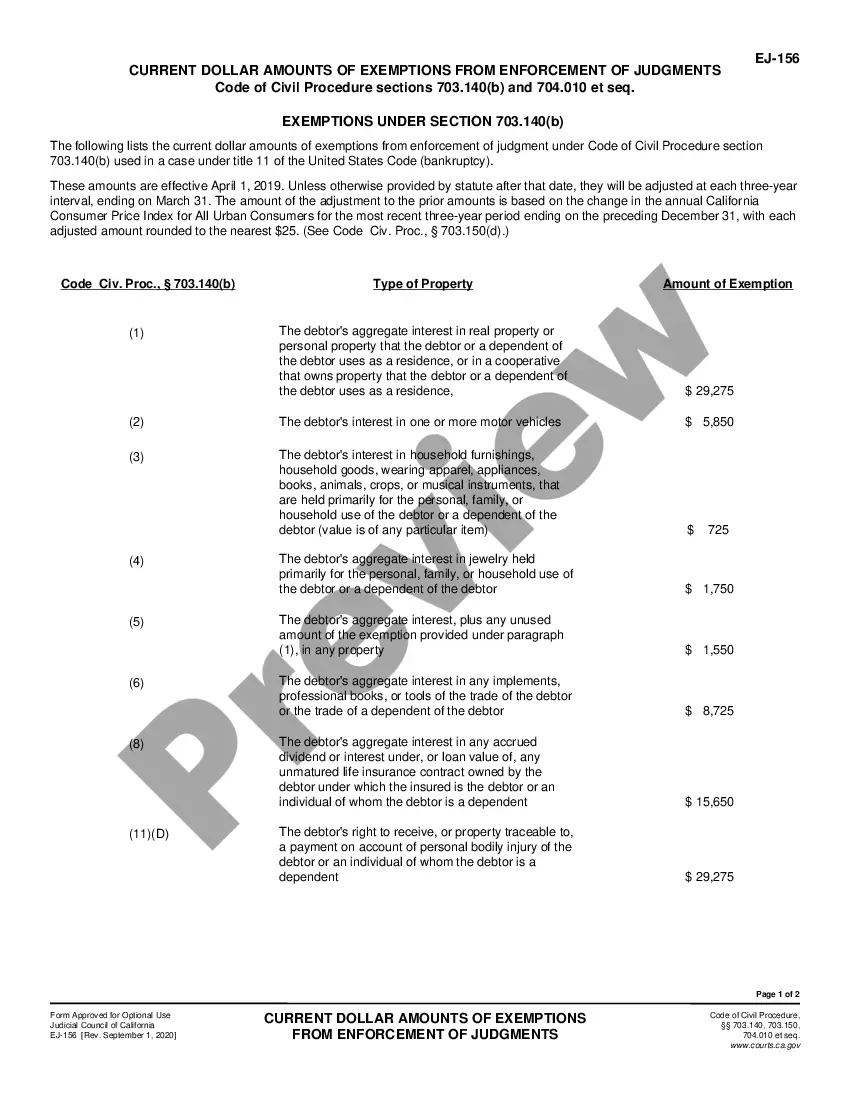

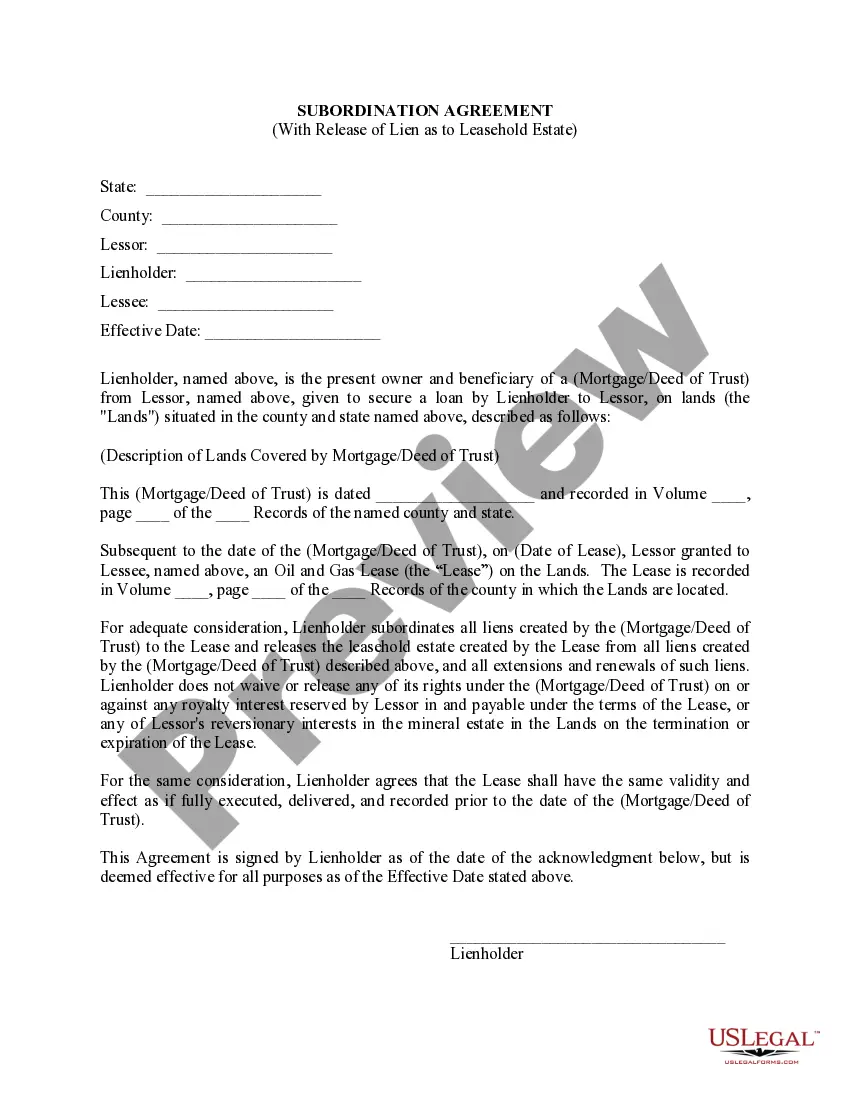

The document (contract) which evidences the agreement between parties and which binds the parties following a negotiation to adhere to the terms agreed upon as a result of the negotiation.

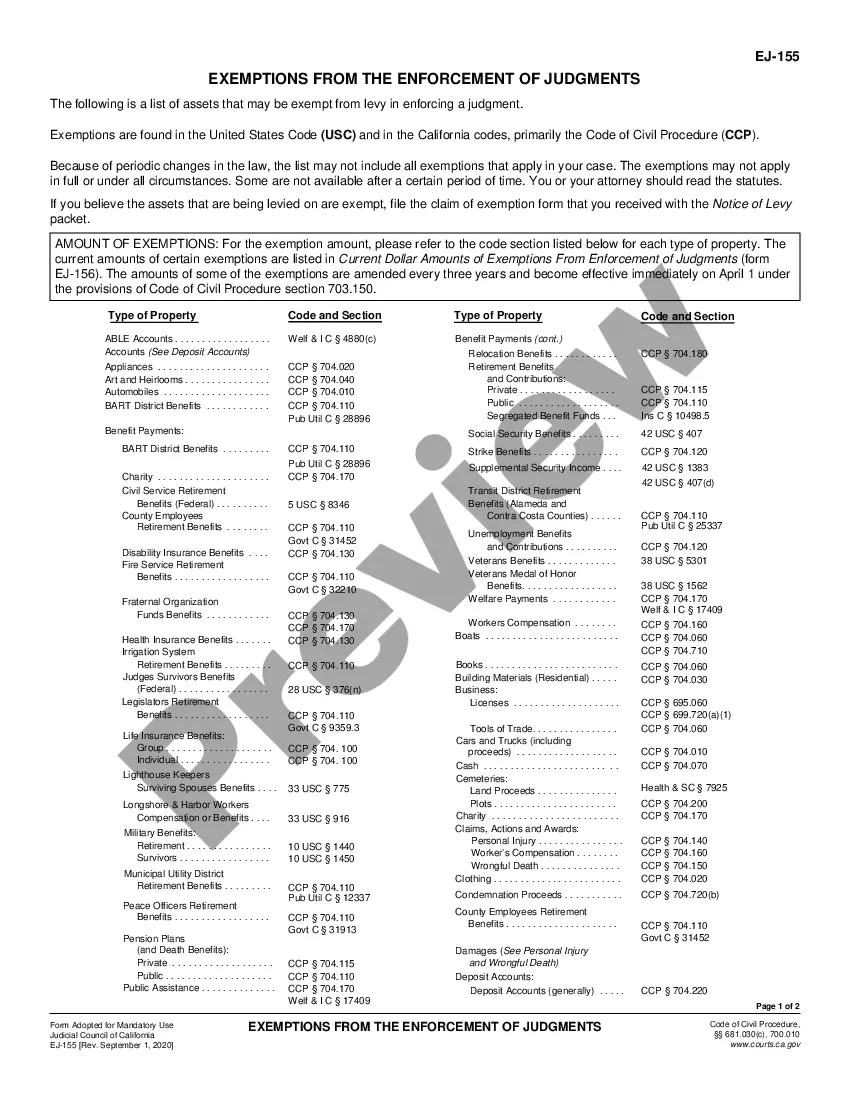

The agreement should list the rights, claims, obligations, or interests that will be released in the settlement as well as any claims or obligations that are not part of the settlement.

A Settlement Agreement (formerly known as a Compromise Agreement) is a legally binding agreement between you and your employer. This usually provides for a severance payment by the employer in return for your agreement not to pursue any claims in a Tribunal or a Court.

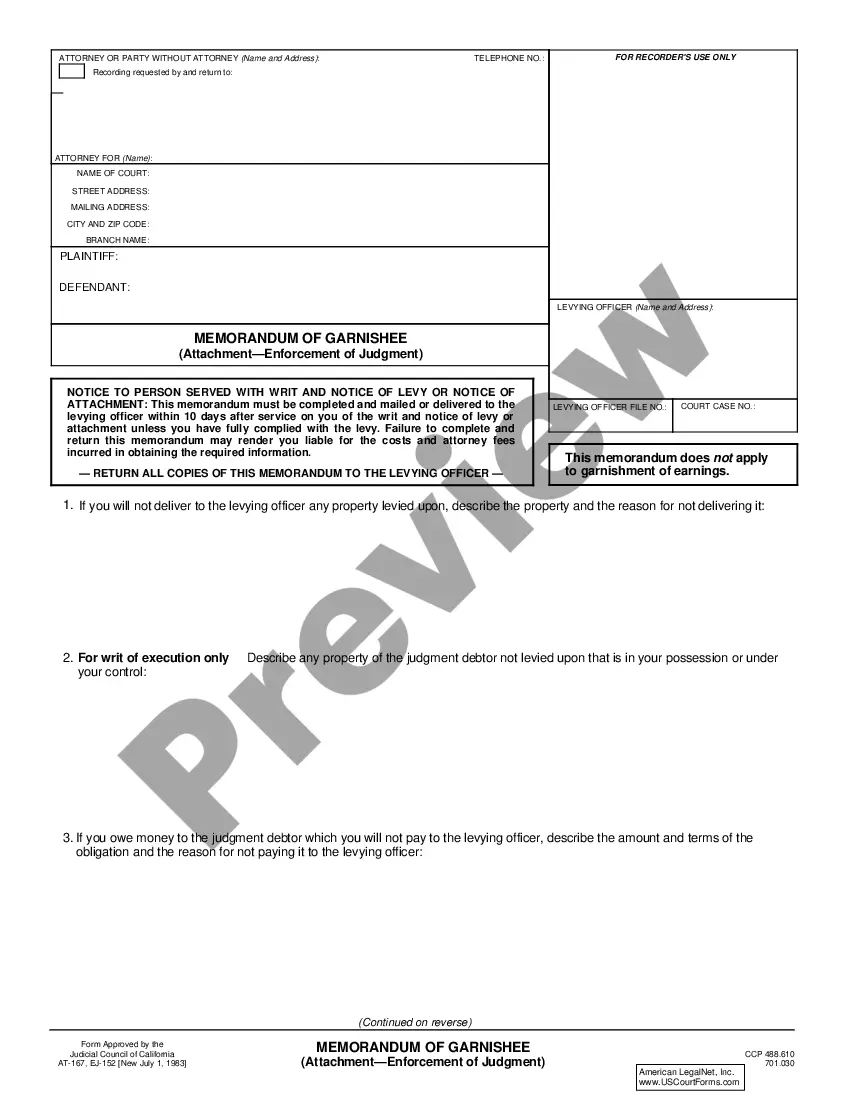

Key Obligations. Also called the terms of settlement, these include who will pay or do what, and what will happen after the payment is made or the actions completed. They should include details like a payment deadline. Release. Parties agree to release each other from all future claims, demands and actions.

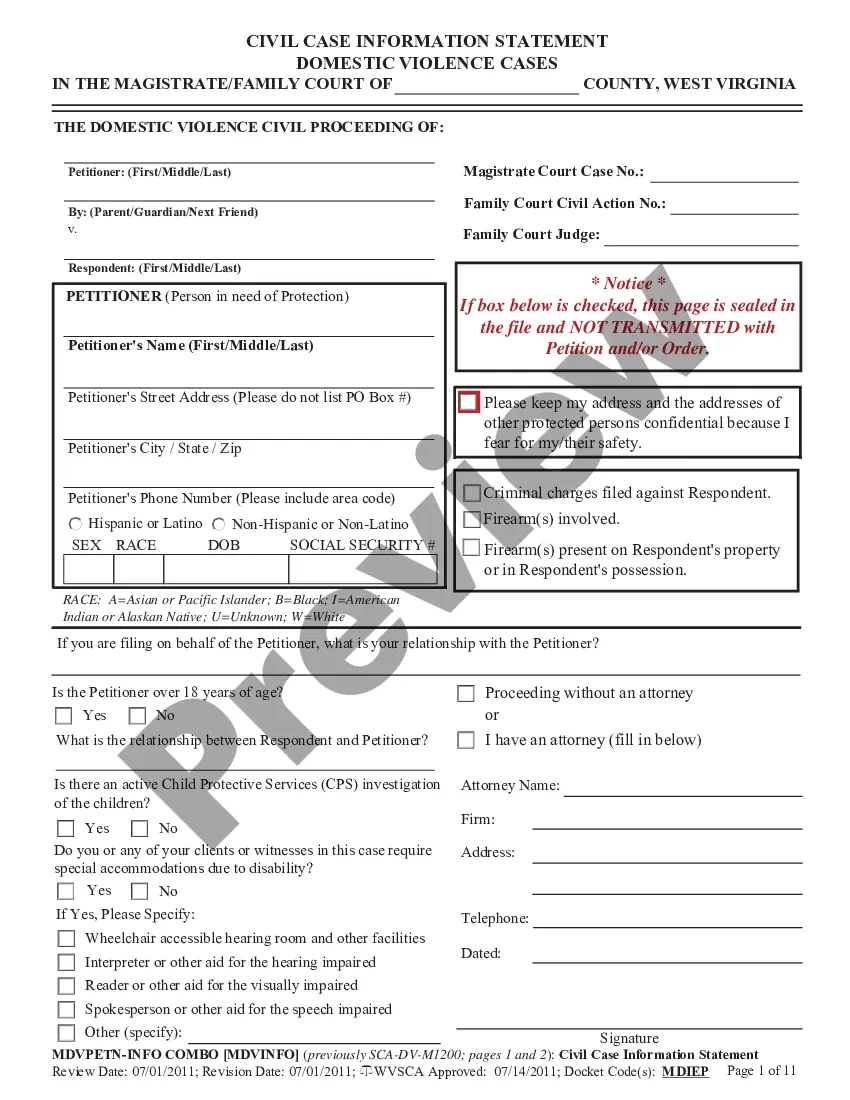

2714 Retain relevant documents. 2714 Decide whether (and when) to make offer. 2714 Evaluate the reasons for settling. 2714 Assess motivating factors to settle. 2714 Confirm client's ability to settle. 2714 List all covered parties. 2714 List all legal issues to be settled.

Unless you have already have another job to go to, it is not easy to ascertain how long you will be out of work, but as a general rule of thumb, a payment equivalent to six month's salary is considered to be a good settlement.

1Original creditor and collection agent's company name.2Date the letter was written.3Your name.4Your account number.5Outstanding balance owed on the account (optional)6Amount agreed to as settlement.How to Write a Successful Debt Settlement Agreement - Bills\nwww.bills.com > Paying Off Debt > Debt Settlement