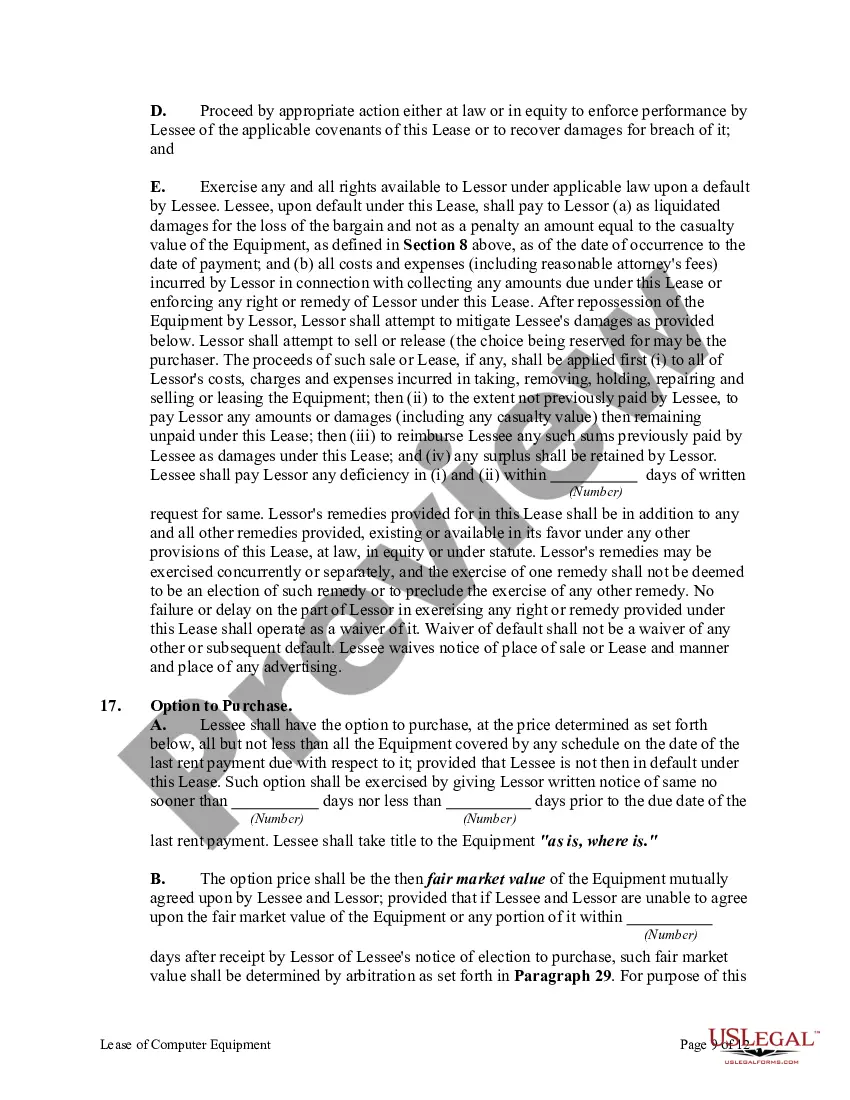

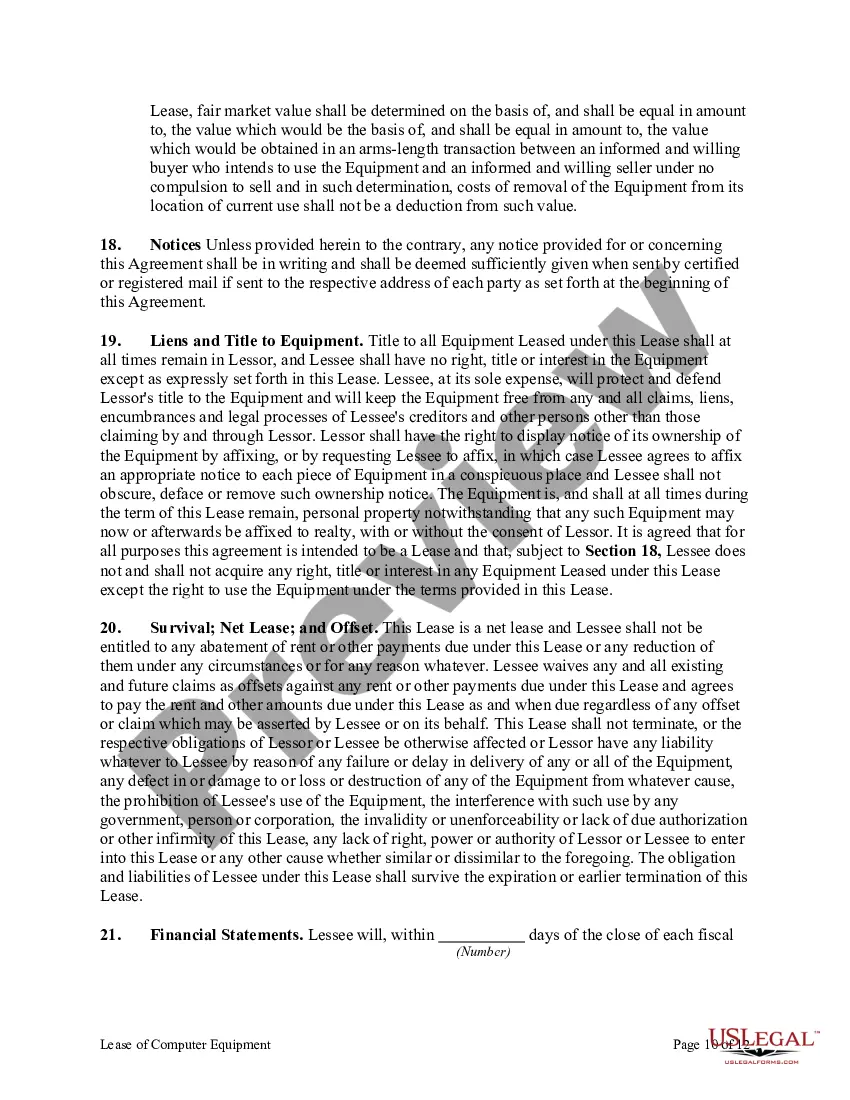

Lease of Computer Equipment with Equipment Schedule and Option to Purchase

Description Unfitness Discoverable Matured

How to fill out Lease Option Purchase?

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a Lease of Computer Equipment with Equipment Schedule and Option to Purchase? US Legal Forms eliminates the lost time numerous American citizens spend exploring the internet for perfect tax and legal forms. Our expert crew of lawyers is constantly upgrading the state-specific Samples library, so it always has the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

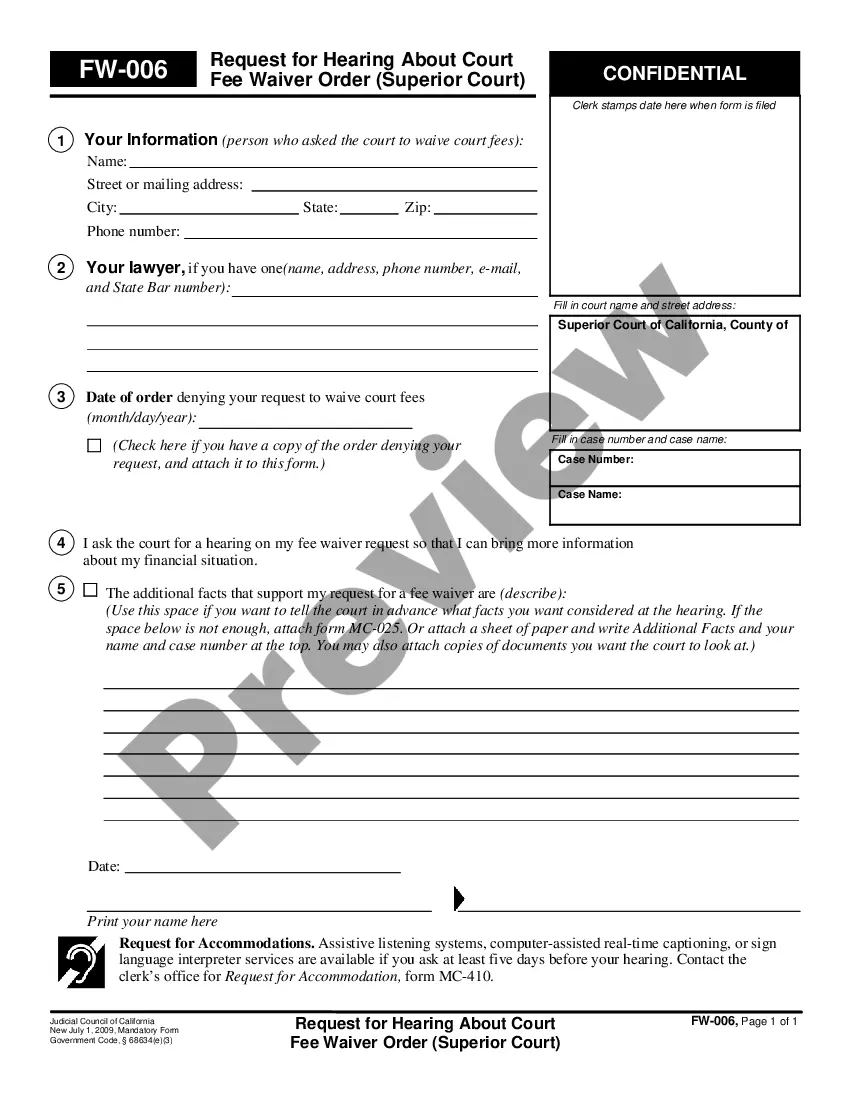

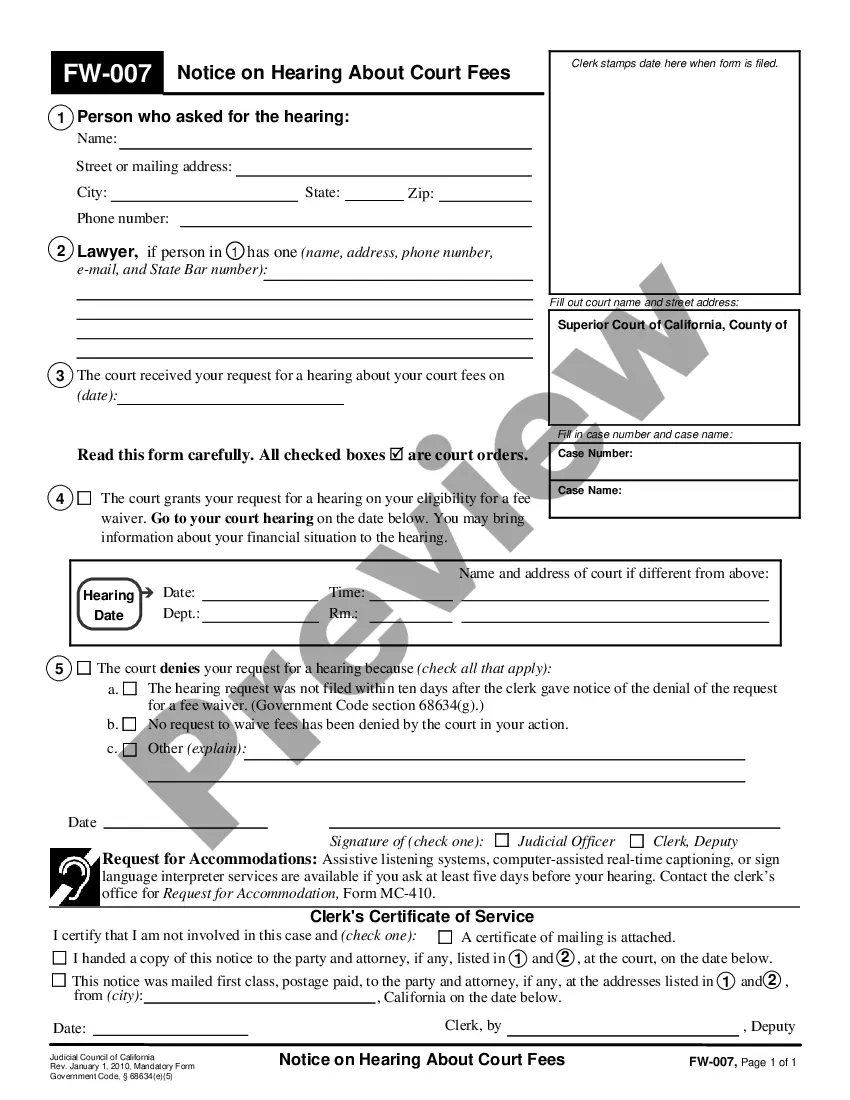

Users who don't have an active subscription should complete easy actions before having the ability to download their Lease of Computer Equipment with Equipment Schedule and Option to Purchase:

- Utilize the Preview function and look at the form description (if available) to be sure that it’s the appropriate document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right sample for the state and situation.

- Use the Search field at the top of the site if you want to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your sample in a required format to finish, create a hard copy, and sign the document.

After you’ve followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever document you want for whatever state you require it in. With US Legal Forms, completing Lease of Computer Equipment with Equipment Schedule and Option to Purchase templates or any other official paperwork is not difficult. Get going now, and don't forget to look at the samples with certified attorneys!

Lease Equipment Form Agreement Form popularity

Crated Unfitness Suspends Other Form Names

Infirmity Discoverable Suspends FAQ

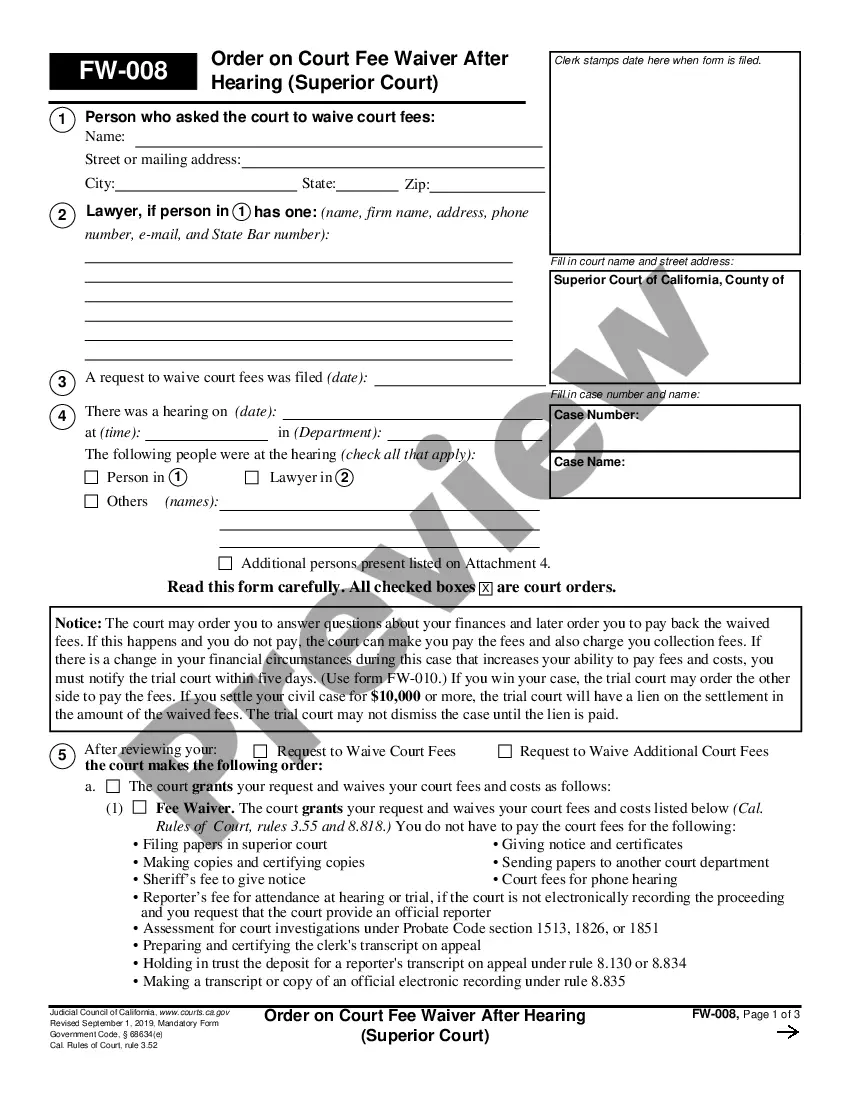

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

Officially record the lease agreement and purchase option. The easiest way to do this is have the paperwork notarized and then recorded in your local public real estate records. Escrow the deed. Record a mortgage.

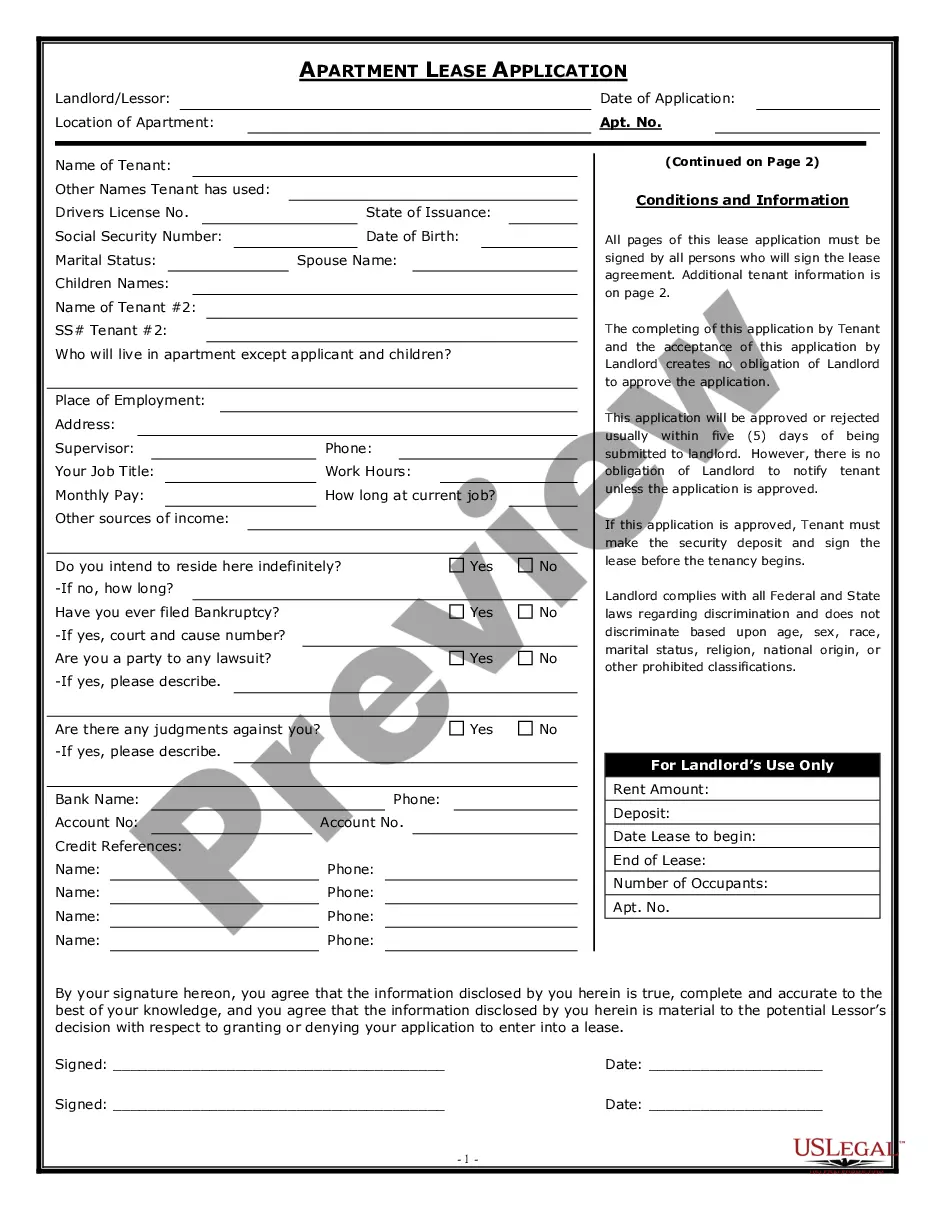

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

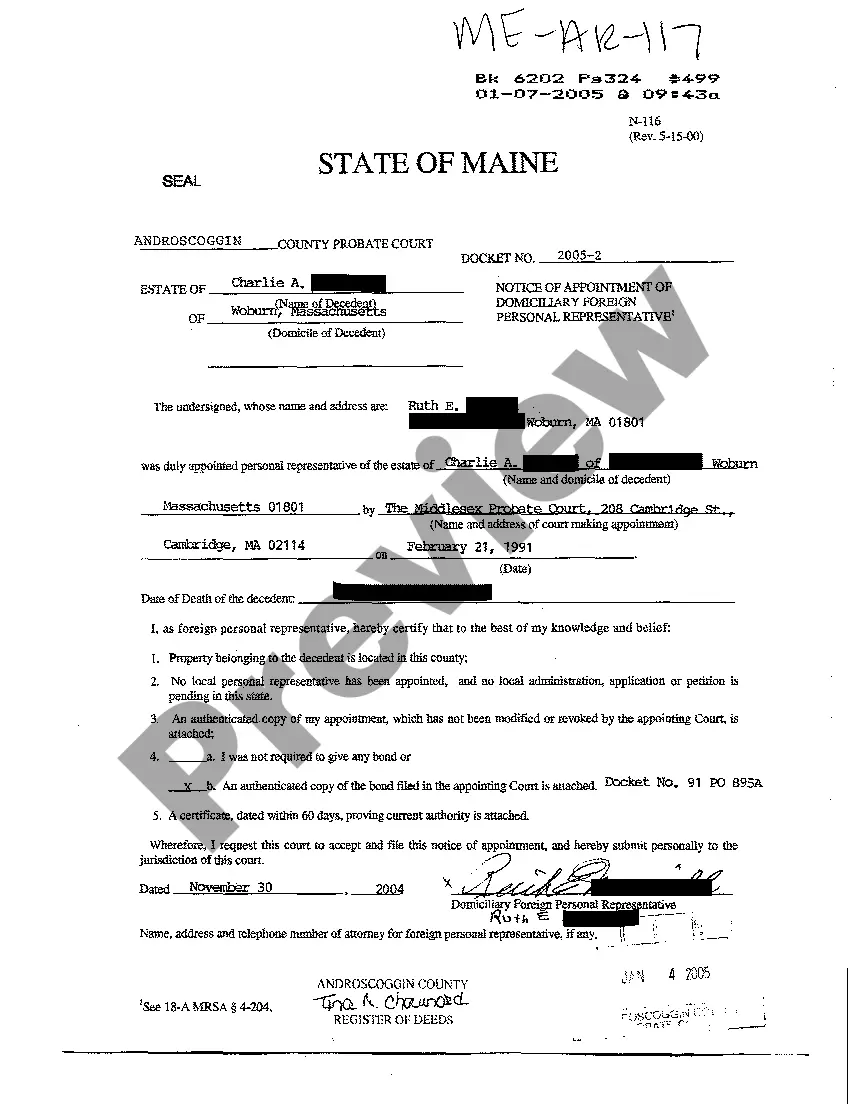

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

Lease-option contracts give you the right to buy the home when the lease expires, while lease-purchase contracts require you to buy it. You pay rent throughout the lease, and in some cases, a percentage of the payment is applied to the purchase price.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if:The lease runs for 75% or more of the asset's useful life.