Cash Receipts Journal

Description

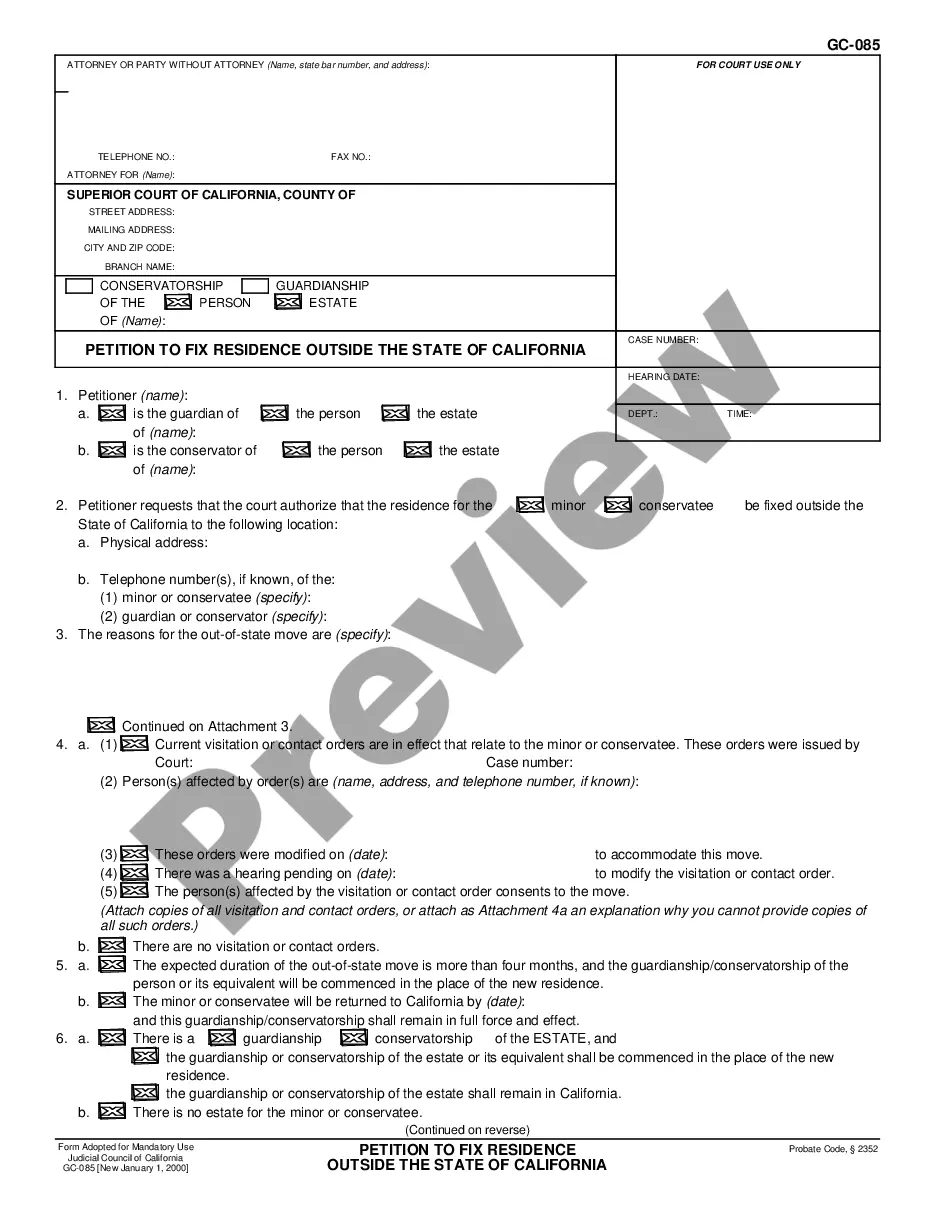

How to fill out Cash Receipts Journal?

Aren't you tired of choosing from numerous samples each time you want to create a Cash Receipts Journal? US Legal Forms eliminates the wasted time countless American citizens spend surfing around the internet for perfect tax and legal forms. Our skilled group of lawyers is constantly updating the state-specific Samples library, to ensure that it always offers the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription need to complete quick and easy actions before being able to get access to their Cash Receipts Journal:

- Utilize the Preview function and look at the form description (if available) to be sure that it is the proper document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right sample to your state and situation.

- Make use of the Search field at the top of the site if you need to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your file in a convenient format to complete, create a hard copy, and sign the document.

Once you have followed the step-by-step instructions above, you'll always be capable of sign in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Cash Receipts Journal samples or other legal documents is simple. Get started now, and don't forget to look at the examples with accredited lawyers!

Form popularity

FAQ

The cash payments journal is used to record the cash disbursements made by check, including payments on account, payments for cash merchandise purchase, payments for various expenses, and other loan payments.In the journal shown in the below example, the other credit column is for Other Accounts.

Create the sales entry Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit. Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit).

The date of the transaction. A unique number that identifies the document. The name of the payer. The amount of cash received. The payment method (such as by cash or check) The signature of the receiving person.

All receipts must include, but are not limited to, the following information: the date received, the dollar amount, a receipt number, name of the person paying for the transaction, description of the service or product, name of the department or area collecting the funds, and signature of the cash handler.

It should be written on company letterhead, state the customer's name and payment amount. Write that it is paid. On the printed or hand-written receipt, write the words Paid in Full in large letters that cover a good portion of the receipt. Sign your name on the receipt as well to make the receipt a binding receipt.

The four main special journals are the sales journal, purchases journal, cash disbursements journal, and cash receipts journal.

The date when you received the payments. The name of the customer who gave the payment. The payment amount. The purpose of the payment. The name of the person who received the payment.

Specify the amount that was received. Specify the date of payment. If necessary, indicate the method of payment: cash, check, wire transfer, etc. Specify the reason for the payment. Mention related invoice number and date (optional)

The cash receipts journal is used to record all transactions involving the receipt of cash, including such transactions as cash sales, the receipt of a bank loan, the receipt of a payment on account, and the sale of other assets such as marketable securities.