General Journal

Description Sample General Journal

How to fill out General Journal?

Aren't you sick and tired of choosing from hundreds of samples every time you require to create a General Journal? US Legal Forms eliminates the lost time countless American people spend searching the internet for suitable tax and legal forms. Our skilled crew of attorneys is constantly modernizing the state-specific Samples library, to ensure that it always has the appropriate documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have a subscription should complete quick and easy actions before having the capability to download their General Journal:

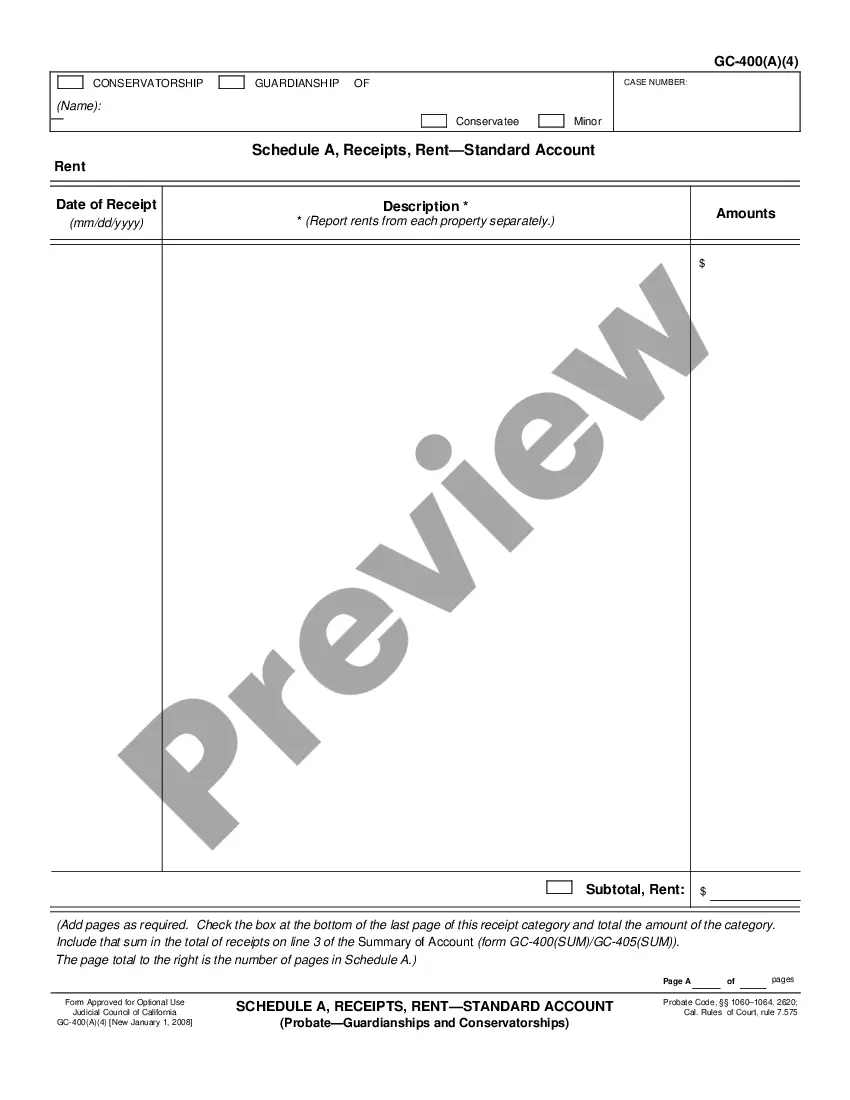

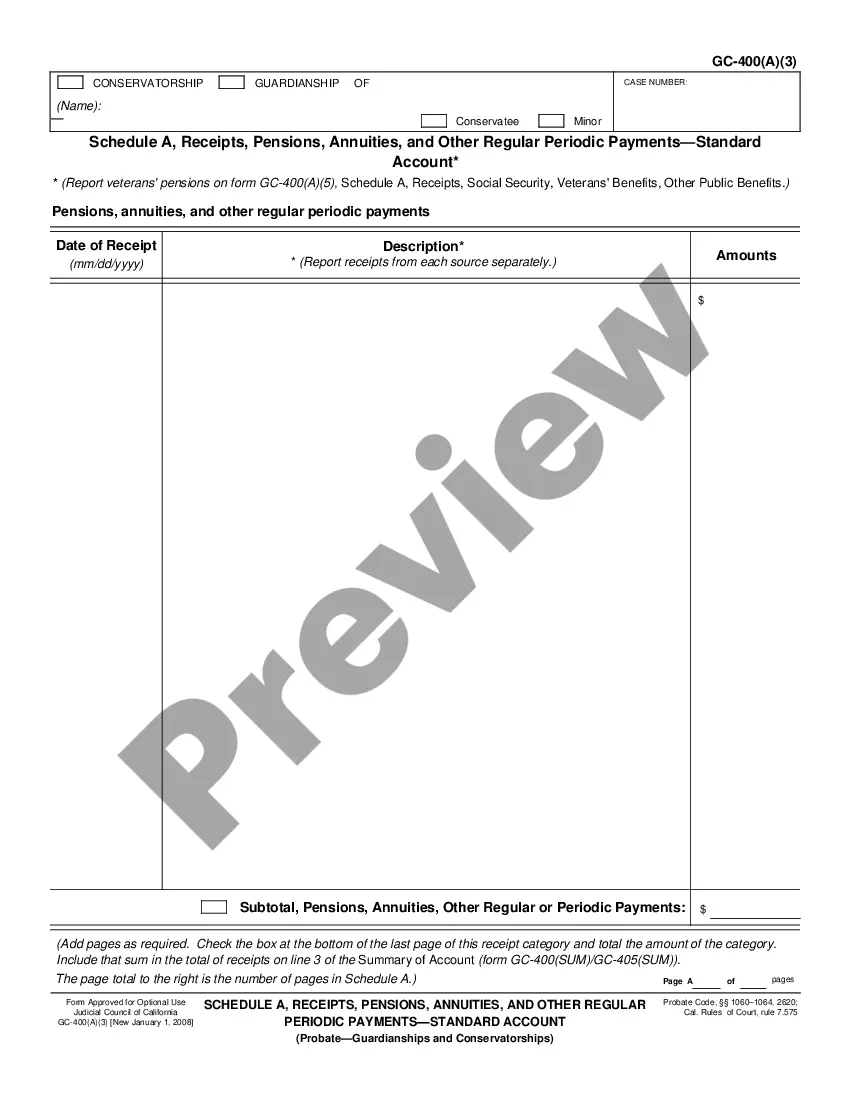

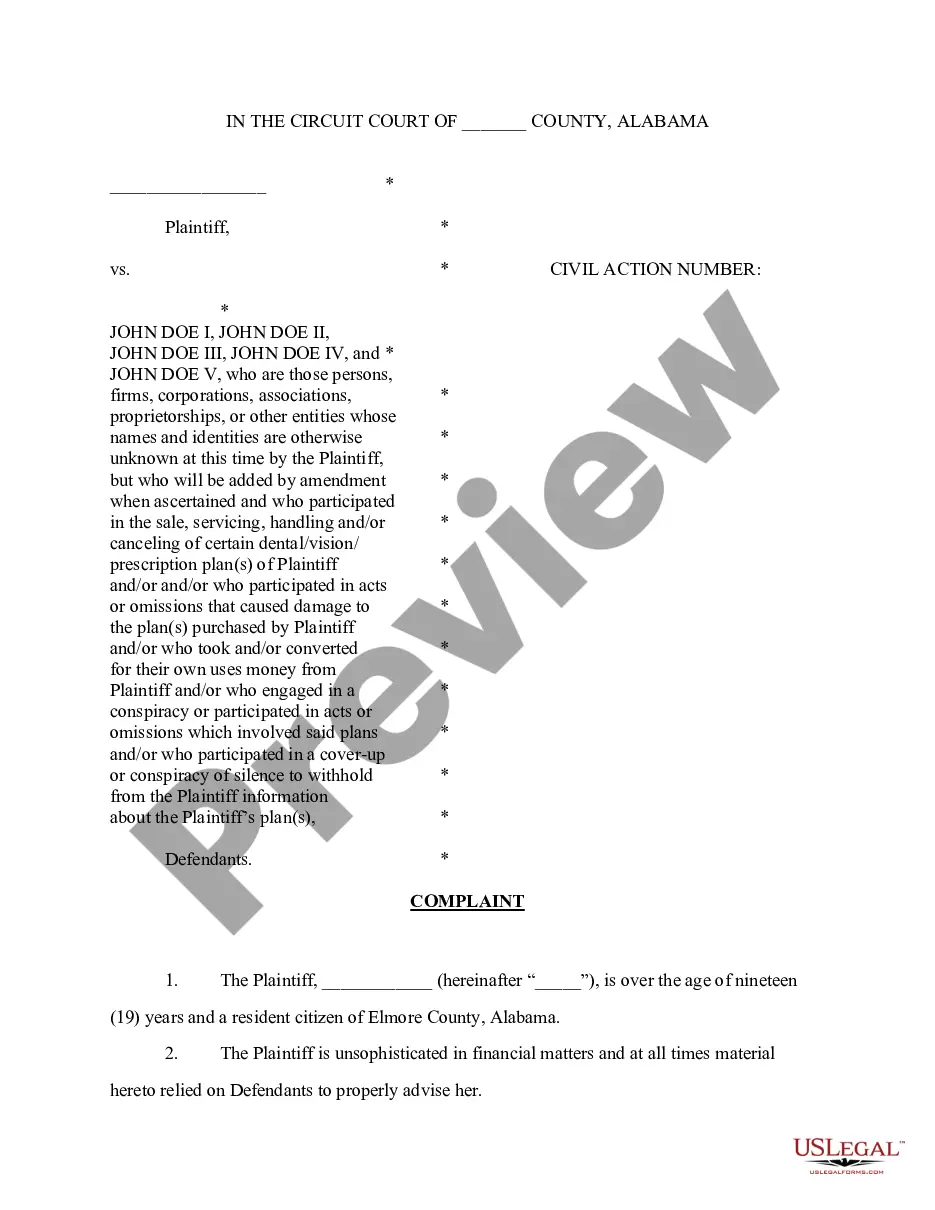

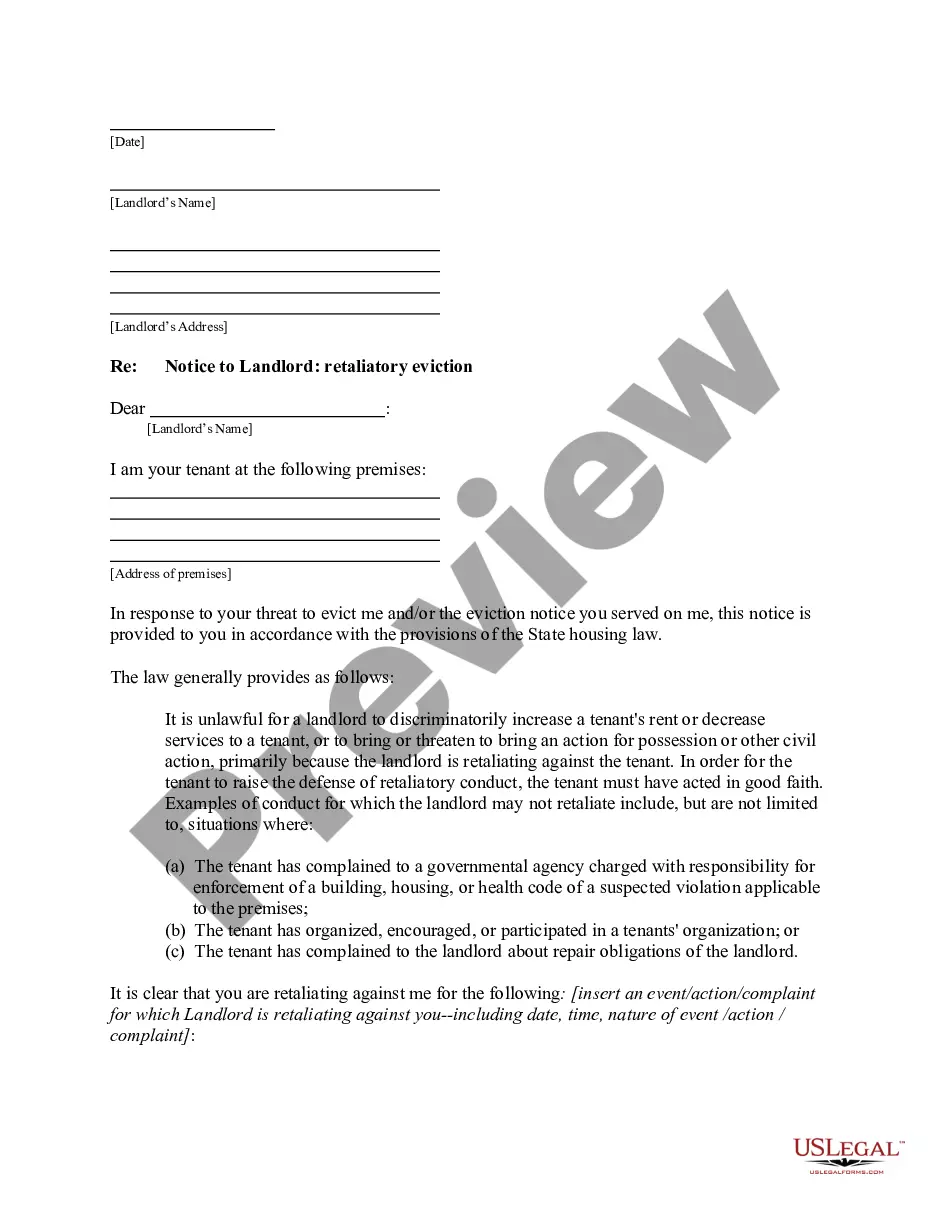

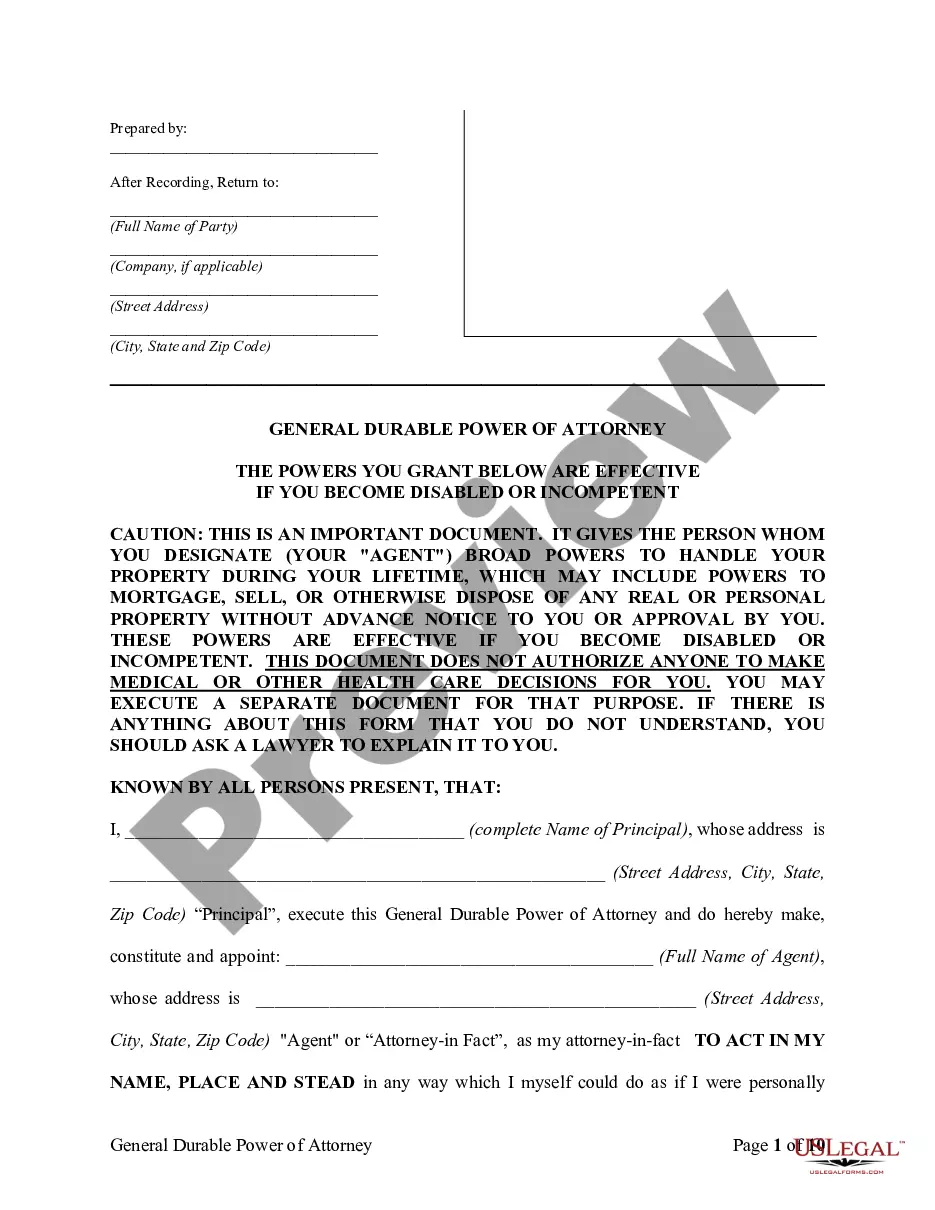

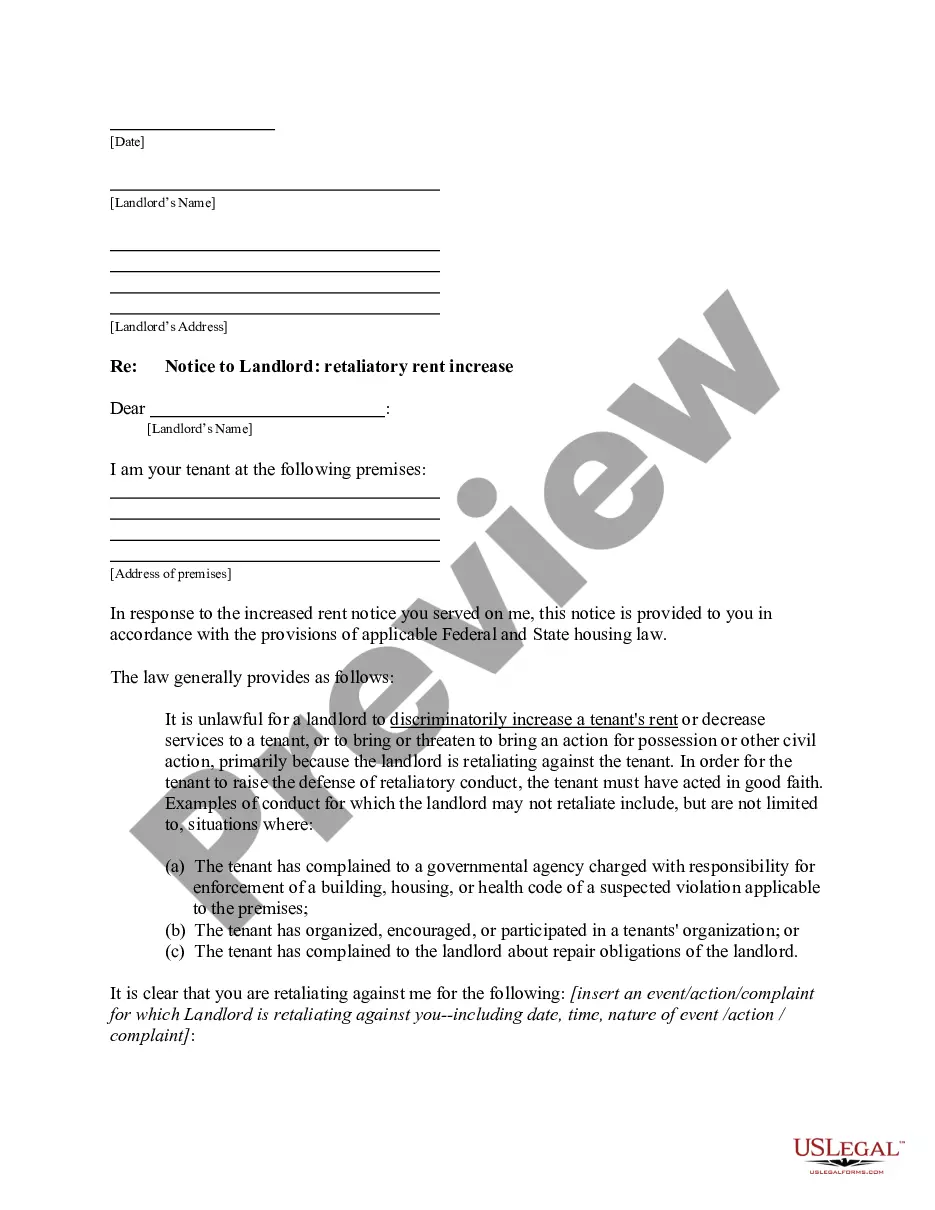

- Utilize the Preview function and read the form description (if available) to be sure that it’s the correct document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Make use of the Search field on top of the site if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your document in a needed format to complete, create a hard copy, and sign the document.

Once you’ve followed the step-by-step instructions above, you'll always have the ability to sign in and download whatever file you want for whatever state you require it in. With US Legal Forms, finishing General Journal templates or any other legal documents is easy. Get going now, and don't forget to recheck your examples with accredited lawyers!

Journal Date Amount Form popularity

Form Small Accounting Other Form Names

FAQ

Another way to visualize business transactions is to write a general journal entry. Each general journal entry lists the date, the account title(s) to be debited and the corresponding amount(s) followed by the account title(s) to be credited and the corresponding amount(s).

Describe the purpose and structure of a journal entry. Identify the purpose of a journal. Define trial balance and indicate the source of its monetary balances. Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise.

It is easy to begin sentences with, I feel, or I think, or I wonder. Don't feel pressured to stick to any particular form or topic. The beginning of your journal writing can just be an introduction to your thoughts at the time. This is your personal space, so you should feel comfortable writing.

The accounts into which the debits and credits are to be recorded. The date of the entry. The accounting period in which the journal entry should be recorded. The name of the person recording the entry. Any managerial authorization(s)

Each journal entry includes the date, the amount of the debit and credit, the titles of the accounts being debited and credited (with the title of the credited account being indented), and also a short narration of why the journal entry is being recorded.

Journal entries are how transactions get recorded in your company's books on a daily basis. Every transaction that gets entered into your general ledger starts with a journal entry that includes the date of the transaction, amount, affected accounts, and description.

A journal is a record of transactions listed as they occur that shows the specific accounts affected by the transaction. Used in a double-entry accounting system, journal entries require both a debit and a credit to complete each entry.

The General Journal Entry includes a brief description of the entry, the Account name, amounts, and whether those amounts are recorded in the debit or credit side of accounts. All General Journal Entries must be balanced - that is the total debits must equal the total credits.