Cash Receipts Control Log

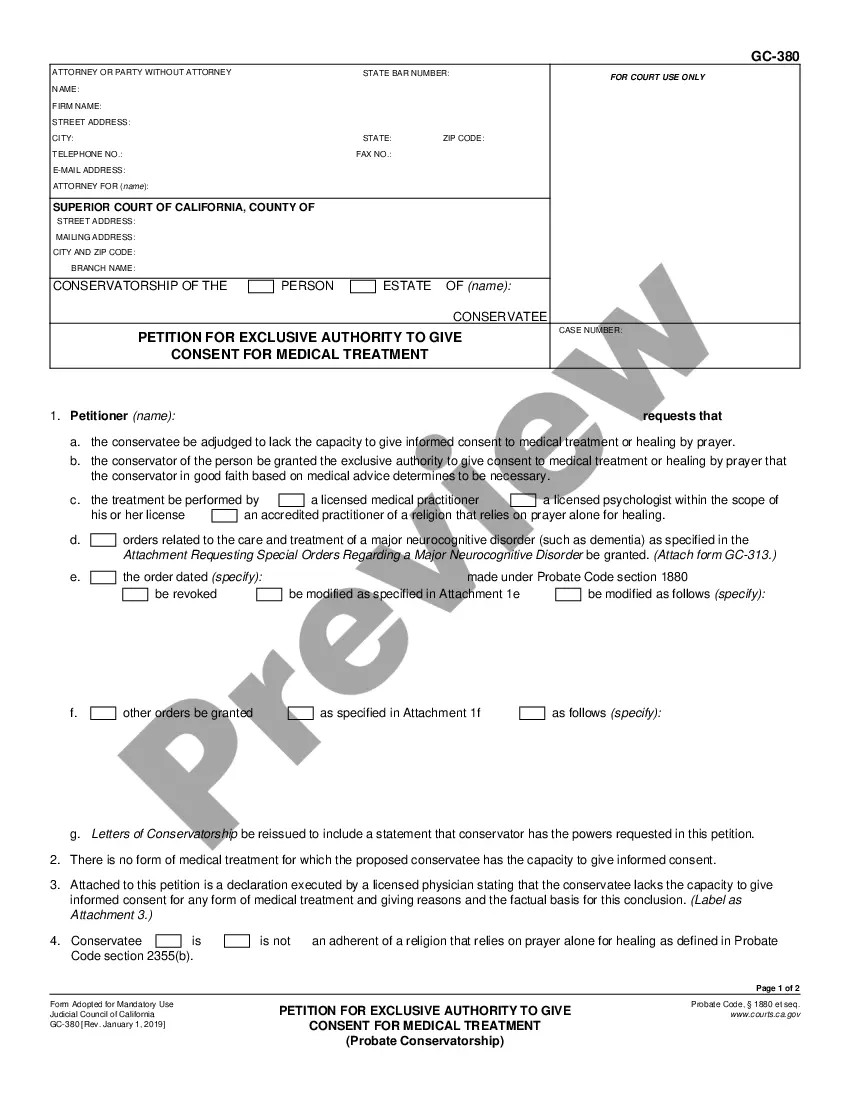

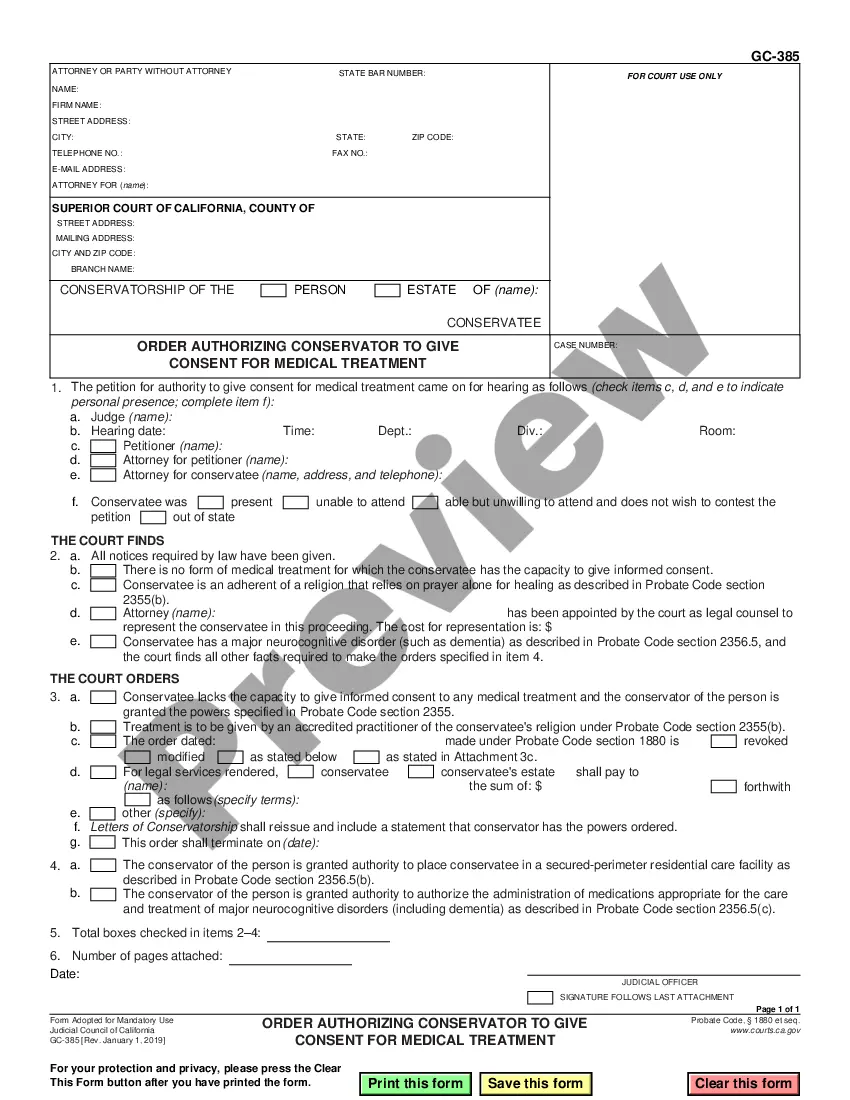

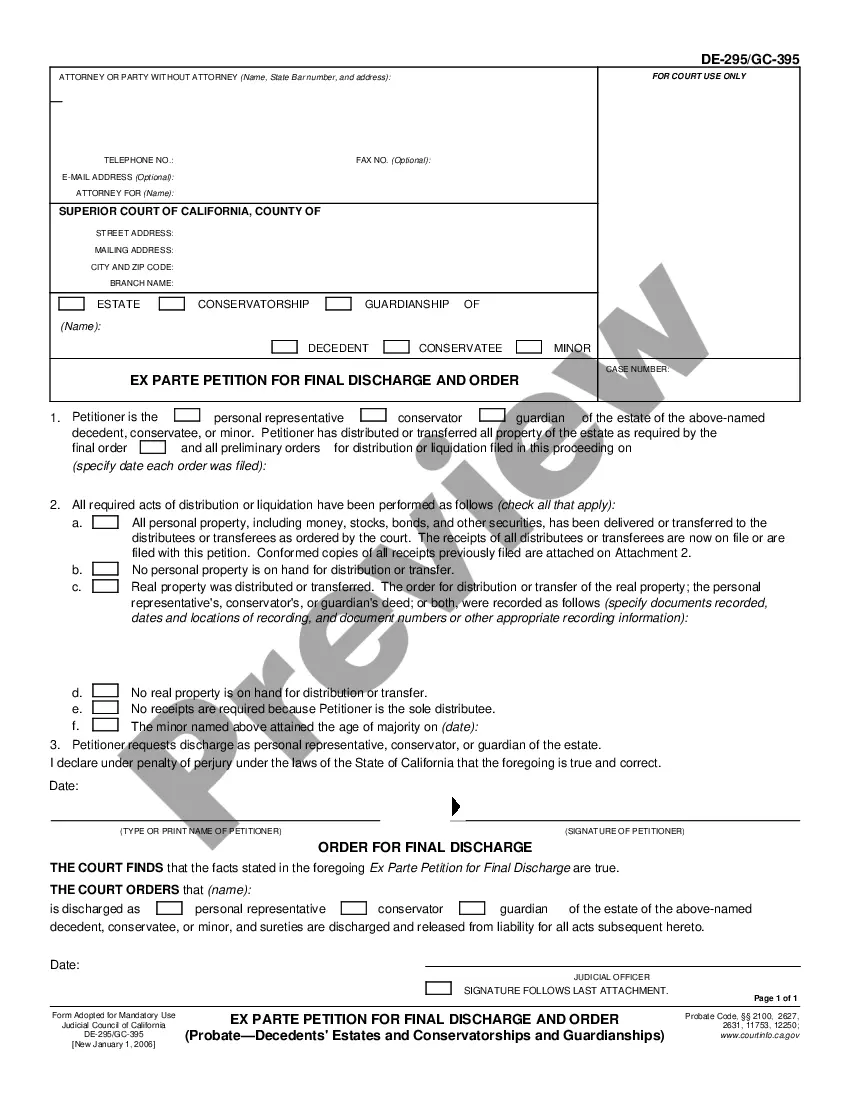

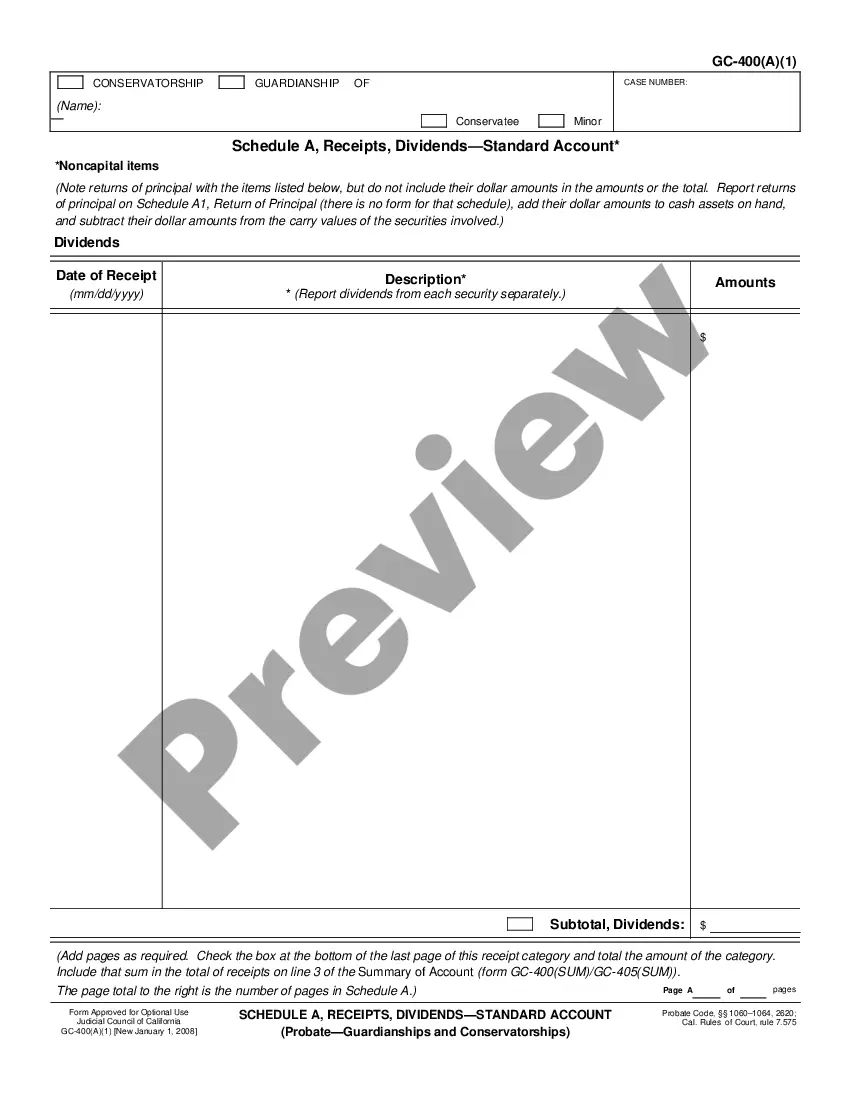

Description

How to fill out Cash Receipts Control Log?

Aren't you tired of choosing from countless samples every time you want to create a Cash Receipts Control Log? US Legal Forms eliminates the lost time countless American citizens spend browsing the internet for suitable tax and legal forms. Our skilled team of lawyers is constantly updating the state-specific Samples collection, so that it always has the proper documents for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple actions before having the ability to get access to their Cash Receipts Control Log:

- Make use of the Preview function and look at the form description (if available) to make certain that it is the right document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper sample for the state and situation.

- Make use of the Search field on top of the page if you want to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your file in a required format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step recommendations above, you'll always be able to sign in and download whatever file you want for whatever state you want it in. With US Legal Forms, completing Cash Receipts Control Log samples or any other legal paperwork is not difficult. Get started now, and don't forget to look at the samples with accredited attorneys!

Form popularity

FAQ

Multiply the percentage of sales you collect in the quarter in which you make the sales by the forecasted sales for the current quarter to calculate the amount of the current quarter's sales you will collect in the current quarter. In this example, multiply 60 percent, or 0.6, by $1,200 to get $720.

A cash receipts journal is used to record all cash receipts of the business. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received.

All receipts must include, but are not limited to, the following information: the date received, the dollar amount, a receipt number, name of the person paying for the transaction, description of the service or product, name of the department or area collecting the funds, and signature of the cash handler.

Pre-listing cash receipt: It is a list that records the transaction that does not include sales, cash, and accounts receivable. This list helps the company in the verification of cash deposits in the bank with the accounting records of the company.

Record checks and cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list. Forward payments. Apply cash to invoices. Record other cash (optional). Deposit cash. Match to bank receipt.

Cash receipts received during the current period might need to be subtracted. If a sale began in a previous period and you received cash in the current period, you need to reverse the sale in the current period and record it as a receivable in the last period (when the sale occurred).

Record cash receipts when received. Keep funds secured. Document transfers. Give receipts to each customer. Don't share passwords. Give each cashier a separate cash drawer. Supervisors verify cash deposits. Supervisors approve all voided refunded transactions.

Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.

1Record checks and cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.2Forward payments.3Apply cash to invoices.4Record other cash (optional).5Deposit cash.6Match to bank receipt.