Invoice Template for Sole Trader

Description Invoice For Sole Trader

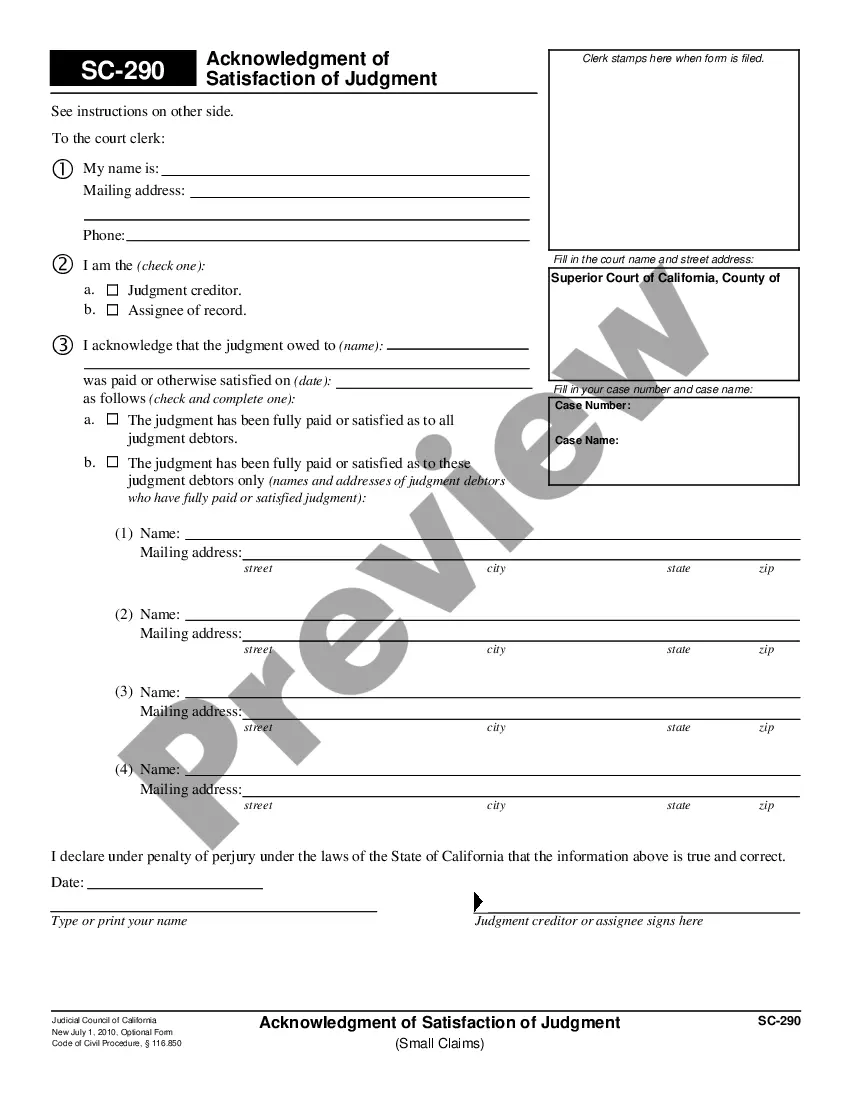

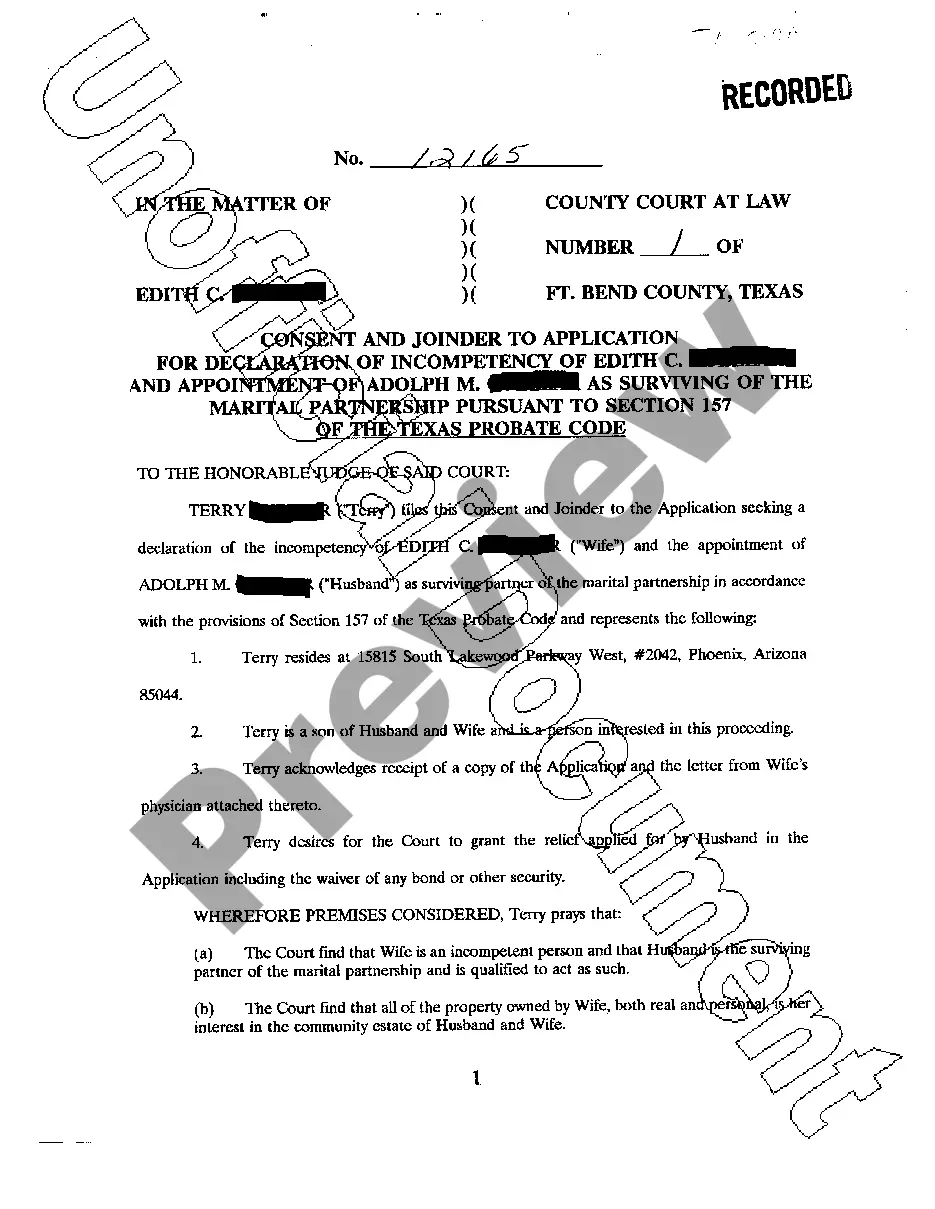

How to fill out Invoice Template For Sole Trader?

Use US Legal Forms to get a printable Invoice Template for Sole Trader. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue on the internet and provides cost-effective and accurate templates for customers and attorneys, and SMBs. The templates are grouped into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Invoice Template for Sole Trader:

- Check to make sure you get the proper template in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Invoice Template for Sole Trader. Over three million users already have used our service successfully. Select your subscription plan and get high-quality documents in a few clicks.

How To Invoice As A Sole Trader Form popularity

Invoice Template For Sole Trader Other Form Names

Sole Proprietor Invoice Template FAQ

Your business name (at the top) The Australian Business Number (ABN) or Australian Company Number (CAN) near the business name. The word 'Invoice' stated prominently at the top. An invoice number alongside the word 'Invoice'

Create an Invoice Header with Your Business Information. Include Your Client's Contact Details. Provide Invoice Information. Specify Your Payment Terms. Include an Itemized List of Services. List Applicable Taxes. Consider Adding Notes.

Identify the Document as an Invoice. Include Your Business Information. Add the Client's Contact Details. Assign a Unique Invoice Number. Add the Invoice Date. Provide Details of Your Services. Include Your Payment Terms. List the Total Amount Due.

Sole traders must also keep detailed financial records That includes details of all your sales. You must also keep proof of any expenses (eg receipts, invoices, utility bills, etc for any stock and supplies or other outgoings you might have).

Your company/trading name, VAT number (if applicable), address and contact info. Your customer's company/trading name, address and contact info. A unique invoice number. The date of the invoice. A description of what you are charging for.

A unique identification number. your company name, address and contact information. the company name and address of the customer you're invoicing. a clear description of what you're charging for. the date the goods or service were provided (supply date) the date of the invoice.

The words Tax Invoice must be on the document. ABN your invoice must show your ABN (Australian Business Number) Your identity Your business name or trading name. The date the issue date of the invoice. Items sold include a description, price and quantity.

Your business name (at the top) The Australian Business Number (ABN) or Australian Company Number (CAN) near the business name. The term 'Tax invoice' at the top (not just 'Invoice') An invoice number alongside the word 'Tax invoice' The date you're issuing the invoice at the right-hand side.

In general it is thought that you cannot invoice yourself for your own time.