Checklist for Business Loans Secured by Real Estate

Description

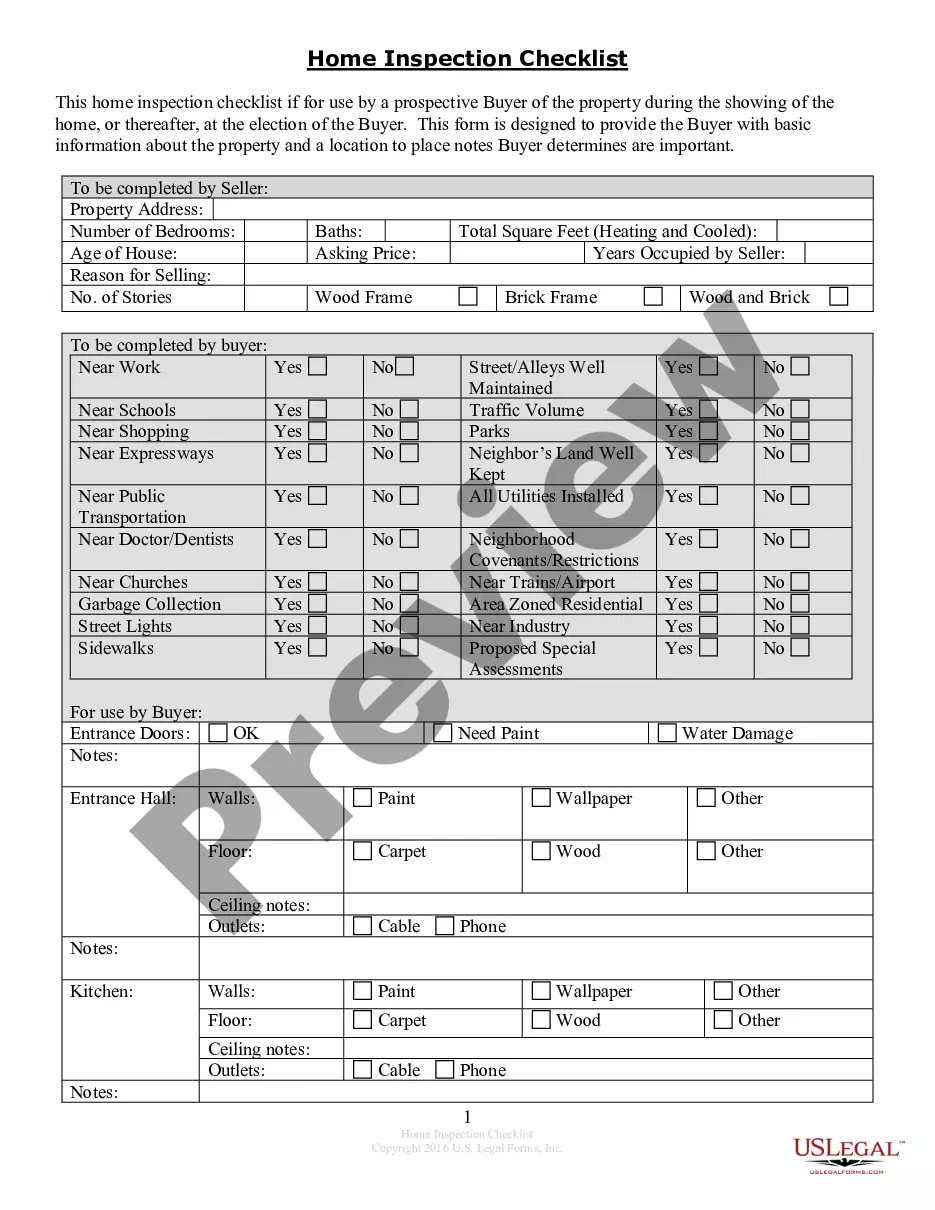

How to fill out Checklist For Business Loans Secured By Real Estate?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Checklist for Business Loans Secured by Real Estate templates. Our service offers thousands of legal documents drafted by licensed attorneys and categorized by state.

To obtain a sample from US Legal Forms, users just need to sign up for an account first. If you are already registered on our service, log in and choose the template you are looking for and purchase it. Right after purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your needs.

- If the form features a Preview function, utilize it to review the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with the debit/visa or mastercard.

- Choose a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill in the Form name. Join a large number of happy subscribers who’re already using US Legal Forms!

Form popularity

FAQ

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

Truth-in-Lending Act (TILA) Generally, no. TILA does not apply to business-purpose loans (including loans to acquire, improve or maintain non-owner occupied rental property) or loans made to entities. Real Estate Settlement Procedures Act (RESPA) Generally, no.

How much collateral do I need for a business loan? Most lenders want collateral that's worth at least as much as the loan you hope to secure. So if you're looking to borrow $50,000 for your business, the assets to secure it must have a cash value of at least $50,000.

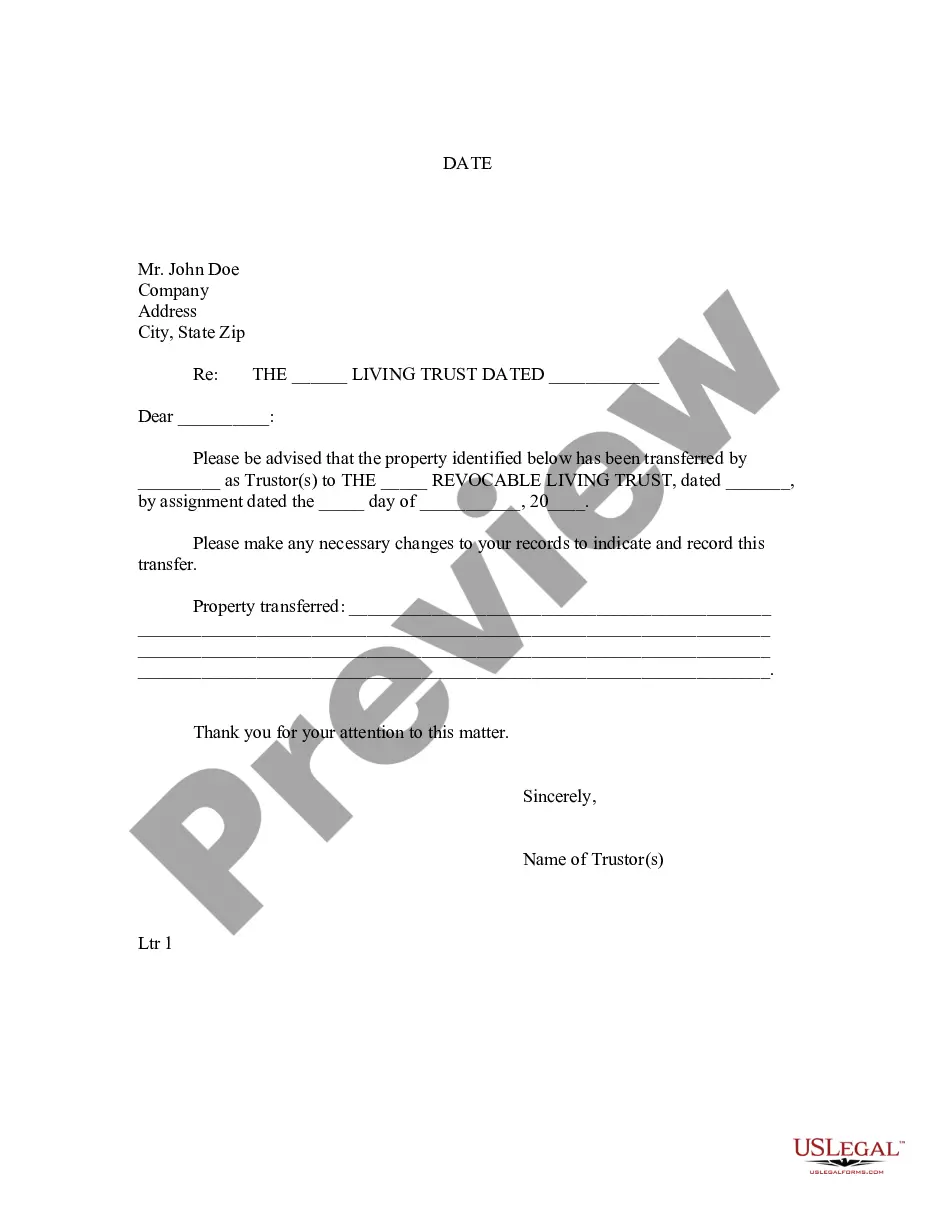

Documents Needed for the Business Loan Application SBA Form 413, Personal Financial Statement. SBA Form 1919, Borrower Information. SBA Form 912, Statement of Personal History. 3 years of federal personal tax returns.

For a business loan, business assets such as equipment, vehicles, buildings, and inventory can be used as collateral. Accounts receivables can also be used as collateral. Any business asset that has value and can be sold by the lender to pay off the loan if necessary can be considered collateral.

Understanding Regulation U It applies to entities other than broker-dealers such as commercial banks, savings and loan associations, federal savings banks, credit unions, production credit associations, insurance companies and companies that have employee stock option plans.

Figure out how much money you need. Decide what type of loan best fits your needs. Check your credit scores. Put together the required documents. Assess the value of your collateral. Shop around for the best business loan terms. Apply for a business loan.

While you may be able to get a small business loan without having to offer collateral, that doesn't mean the lender won't ask for other conditions. Specifically, you may be asked to sign a personal guarantee or agree to a Uniform Commercial Code (UCC) lien.