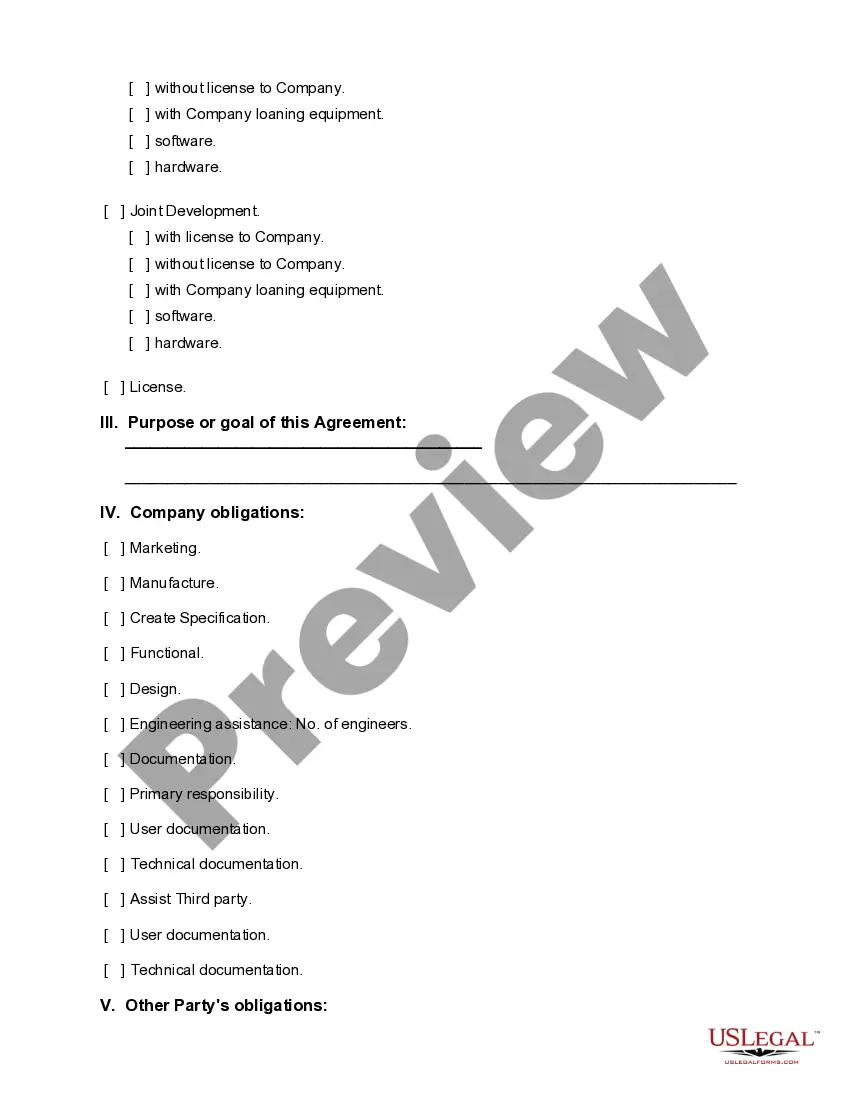

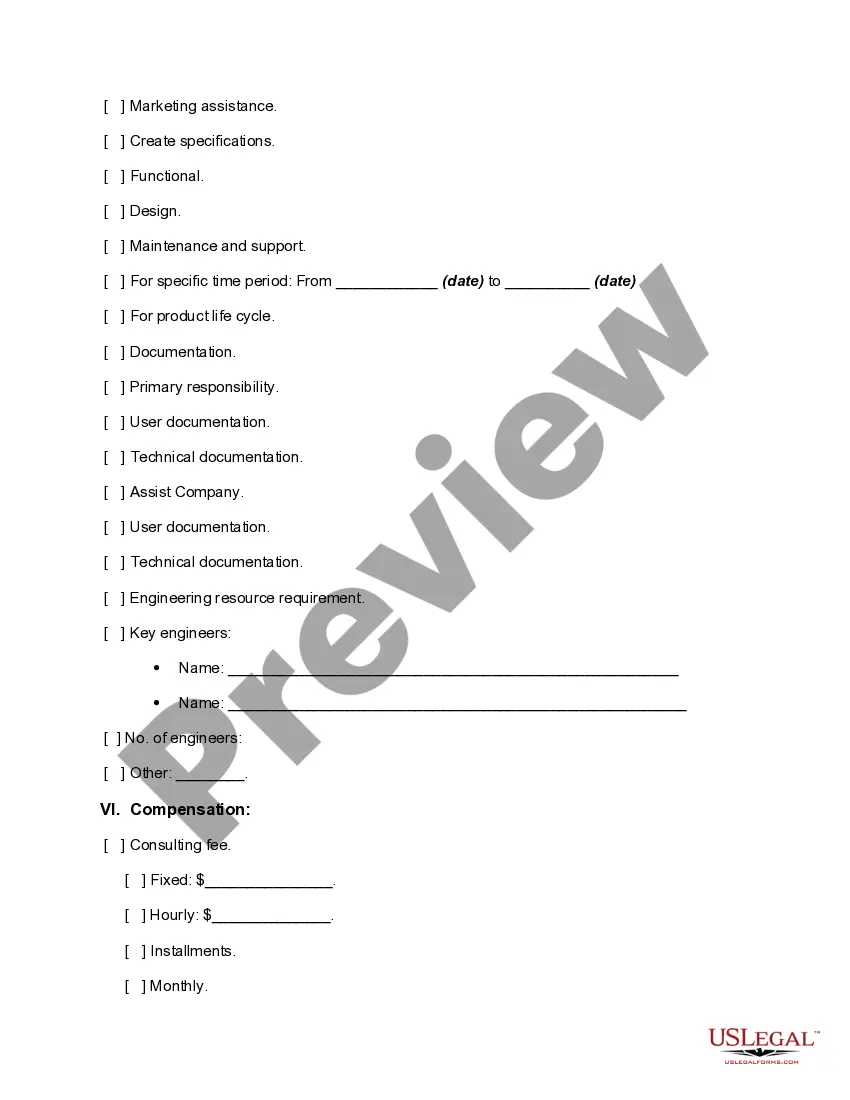

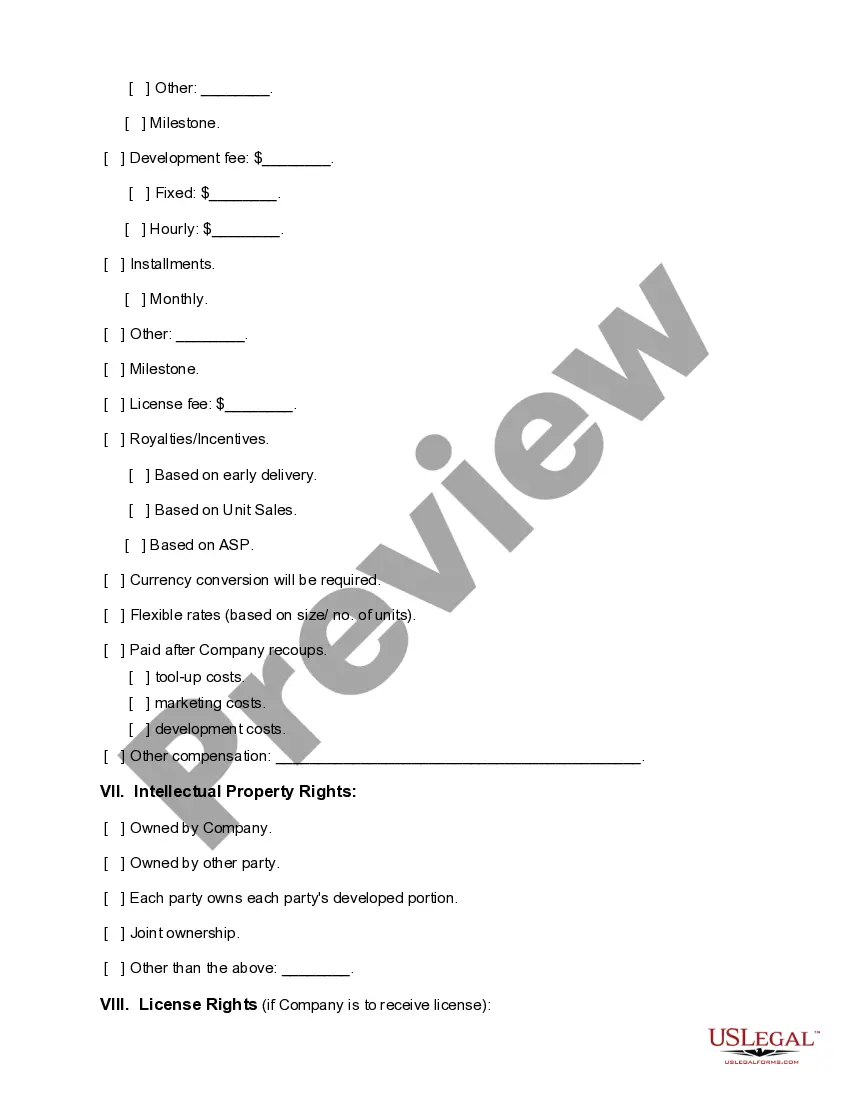

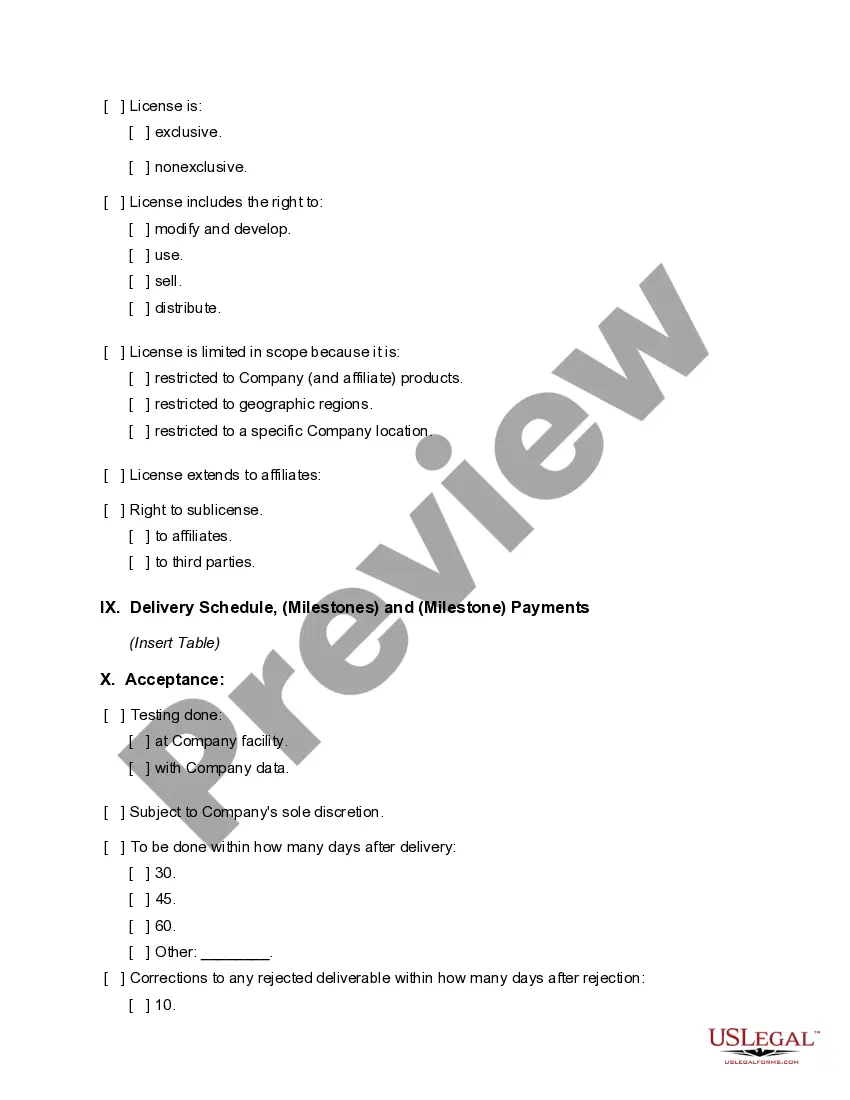

Sample Checklist for Contract Term Sheet

Description Term Sheet Template

This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

How to fill out Checklist Sheet Blank?

Utilize the most extensive legal library of forms. US Legal Forms is the best platform for getting updated Sample Checklist for Contract Term Sheet templates. Our platform provides a huge number of legal documents drafted by certified legal professionals and categorized by state.

To obtain a template from US Legal Forms, users simply need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and buy it. After purchasing templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the template features a Preview function, utilize it to check the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your expections.

- Select a pricing plan.

- Create an account.

- Pay via PayPal or with yourr debit/bank card.

- Choose a document format and download the template.

- Once it is downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Checklist Contract Form popularity

Company Information Name Other Form Names

Term Sheet Online FAQ

How much money is expected from the VC, or venture capitalist, to the founder of the startup, A detailed overview of the financial side of the investment, and. The power and controls given to the VCs.

What is a term sheet? A term sheet is a mostly non-binding document signed by the target and the prospective buyer that describes the major terms of the proposed acquisition. While most term sheets are non-binding, they often contain binding provisions regarding non-soliciation, exculsivity and confidentiality.

Although term sheets are not generally legally binding, other than in respect of confidentiality, exclusivity (if applicable), costs and jurisdiction, they evidence the intent of the parties to them. Therefore, once something is agreed in a term sheet, it may be difficult for either side to renegotiate.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment.Once the parties involved reach an agreement on the details laid out in the term sheet, a binding agreement or contract that conforms to the term sheet details is drawn up.

The approach to the final and binding agreement includes negotiating and signing the terms sheet, conducting due diligence, having legal counsel draft the final documents, and having a closing where all parties sign.

A term sheet usually has some provisions that are called out as being binding even though the rest of the term sheet is typically not binding. These binding provisions give the non-breaching party a right to sue for breach of those "binding" provisions.

Take the Time to Woo Multiple Investors. Do Your Due Diligence When Finding Investors. Negotiate A Term Sheet Better by Understanding the Terminology. Hire a Good Lawyer to Assist You. Prioritize the Non-Negotiables of Your Term Sheet. Be Prepared to Negotiate with Your Investor. Watch for Red Flags.

Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.