Sample Letter for Freeport Warehouse Exemptions

Description

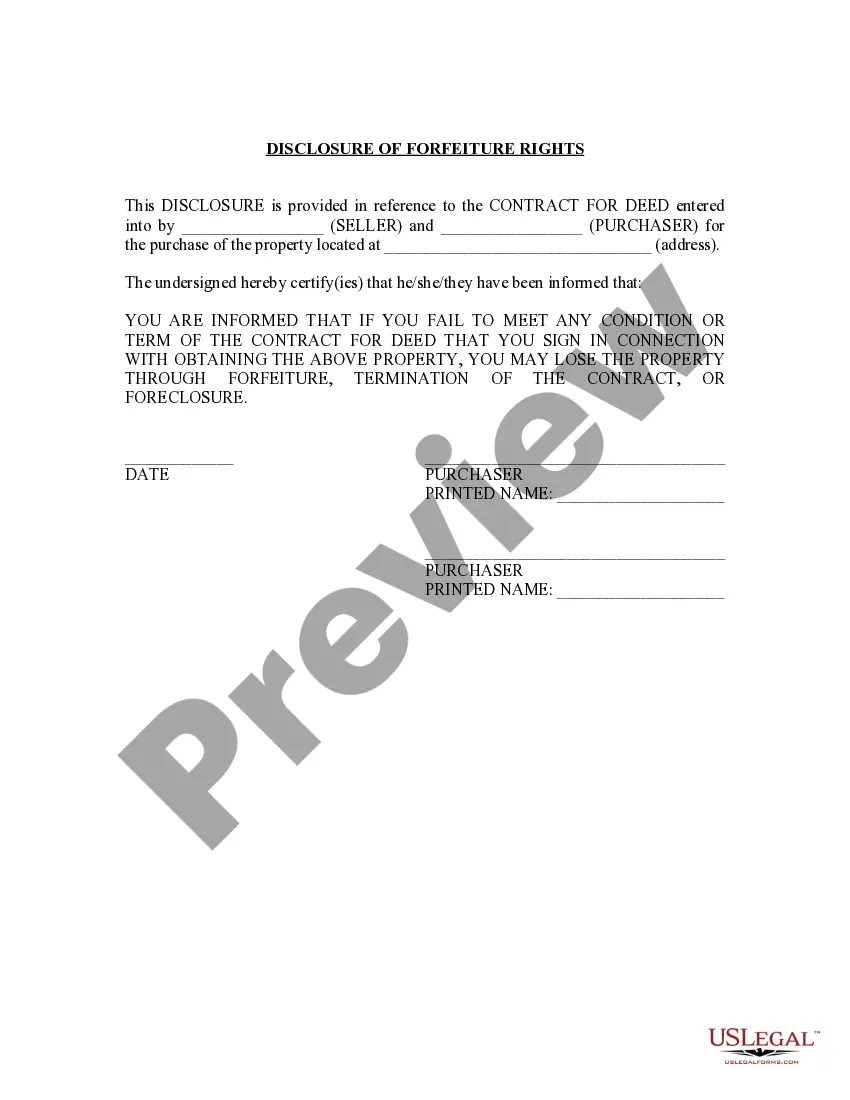

How to fill out Sample Letter For Freeport Warehouse Exemptions?

Use US Legal Forms to get a printable Sample Letter for Freeport Warehouse Exemptions. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue on the web and provides affordable and accurate samples for customers and lawyers, and SMBs. The templates are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the tips below to quickly find and download Sample Letter for Freeport Warehouse Exemptions:

- Check out to ensure that you have the right template with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Freeport Warehouse Exemptions. Above three million users have already used our service successfully. Select your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

A tax exemption is the right to exclude all or some income from taxation by federal or states governments. Most taxpayers are entitled to various exemptions to reduce their taxable income, and certain individuals and organizations are completely exempt from paying taxes.

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

When you file exempt with your employer for federal tax withholding, you do not make any tax payments during the year. Without paying tax, you do not qualify for a tax refund unless you qualify to claim a refundable tax credit, like the Earned Income Tax Credit.

The letter should include basic identifying information, an explanation of the legal obligation and reason for exemption, and clearly state that the writer is claiming the exemption. The Boy Scouts of America and other non-profit organizations can file exemption letters to be excluded from paying taxes.

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

A tax exemption is the right to exclude all or some income from taxation by federal or states governments. Most taxpayers are entitled to various exemptions to reduce their taxable income, and certain individuals and organizations are completely exempt from paying taxes.

1 : the act of exempting or state of being exempt : immunity. 2 : one that exempts or is exempted especially : a source or amount of income exempted from taxation.

Personal exemptions This is a fixed amount that generally increases each year. The exemption reduces your taxable income just like a deduction does, but has fewer restrictions to claiming it. If you are married and file a joint tax return, both you and your spouse each get an exemption.

1 : the act of exempting or state of being exempt : immunity. 2 : one that exempts or is exempted especially : a source or amount of income exempted from taxation. Synonyms Example Sentences Learn More about exemption.