Equipment Lease Checklist

Description Equipment Checklist Template

How to fill out Lease Checklist Contract?

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the perfect platform for getting updated Equipment Lease Checklist templates. Our service provides 1000s of legal documents drafted by certified legal professionals and sorted by state.

To get a template from US Legal Forms, users simply need to sign up for a free account first. If you’re already registered on our platform, log in and choose the document you need and buy it. After purchasing templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

- In case the template has a Preview function, use it to review the sample.

- If the sample does not suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template meets your expections.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr debit/credit card.

- Select a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join thousands of satisfied subscribers who’re already using US Legal Forms!

Equipment Checklist Form Form popularity

Equipment Checklist Sample Other Form Names

Equipment Checklist Print FAQ

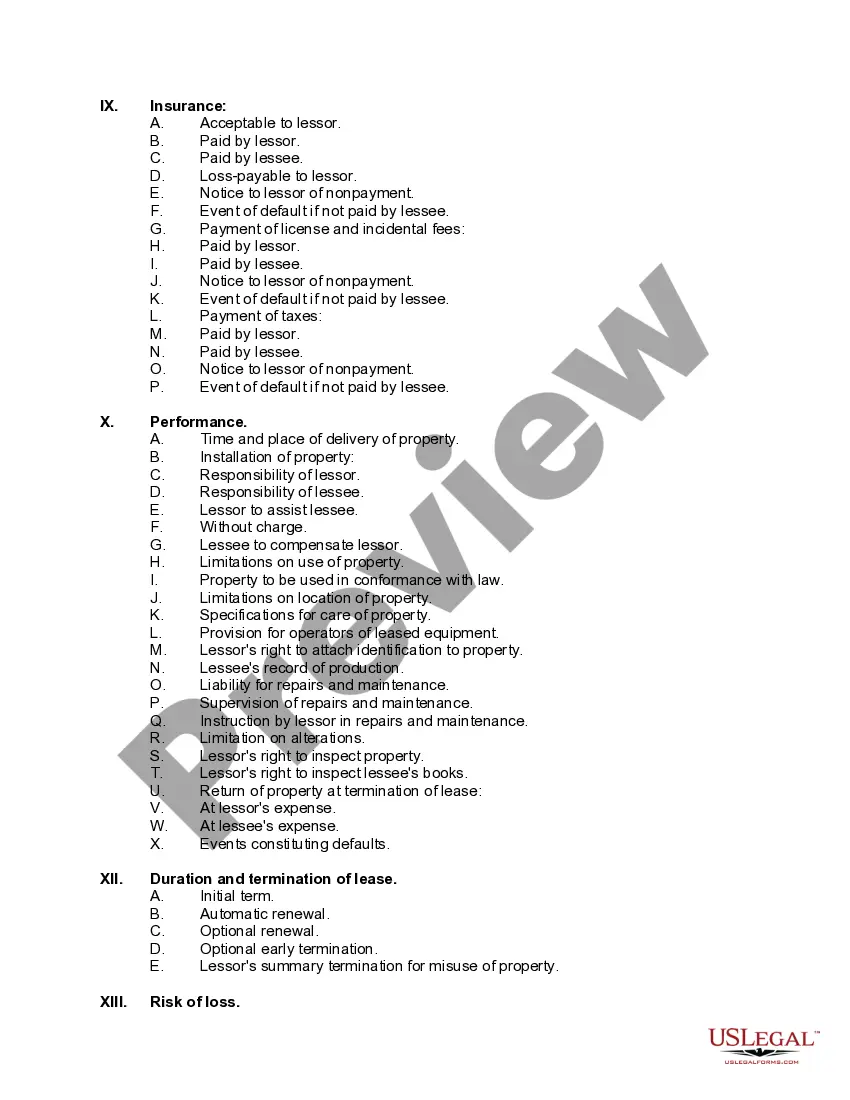

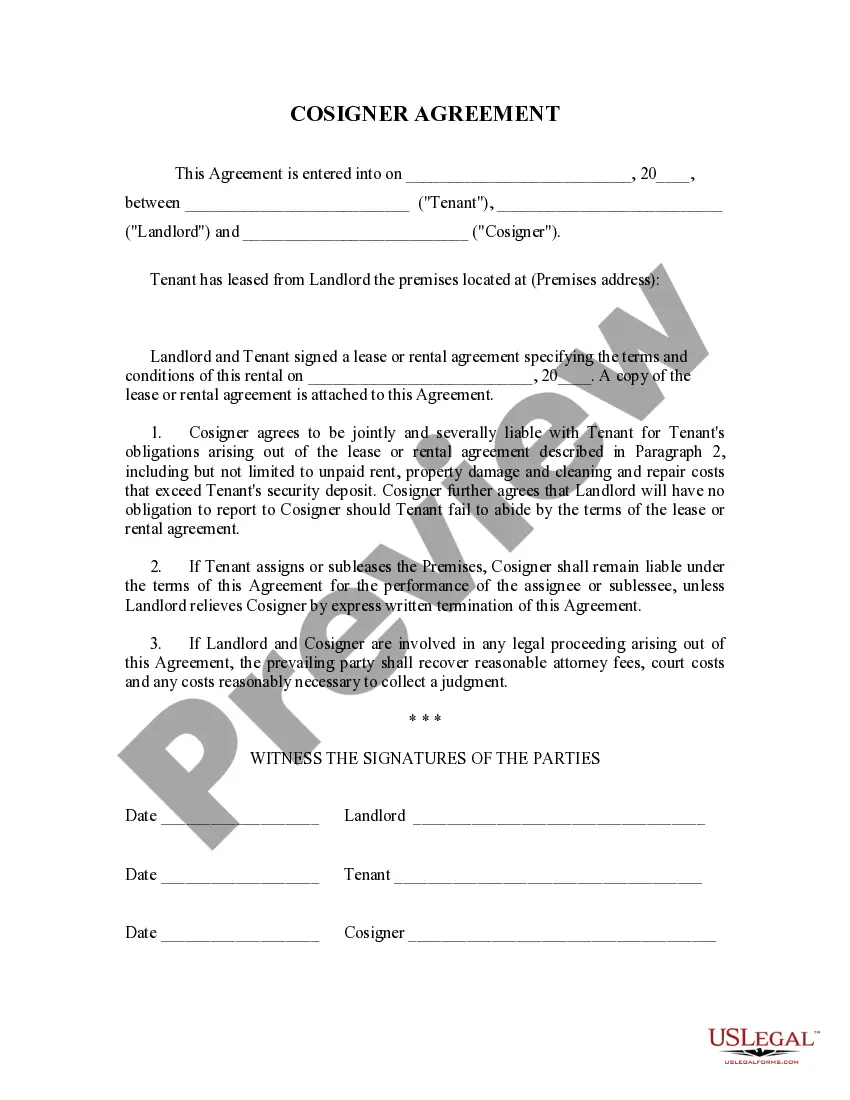

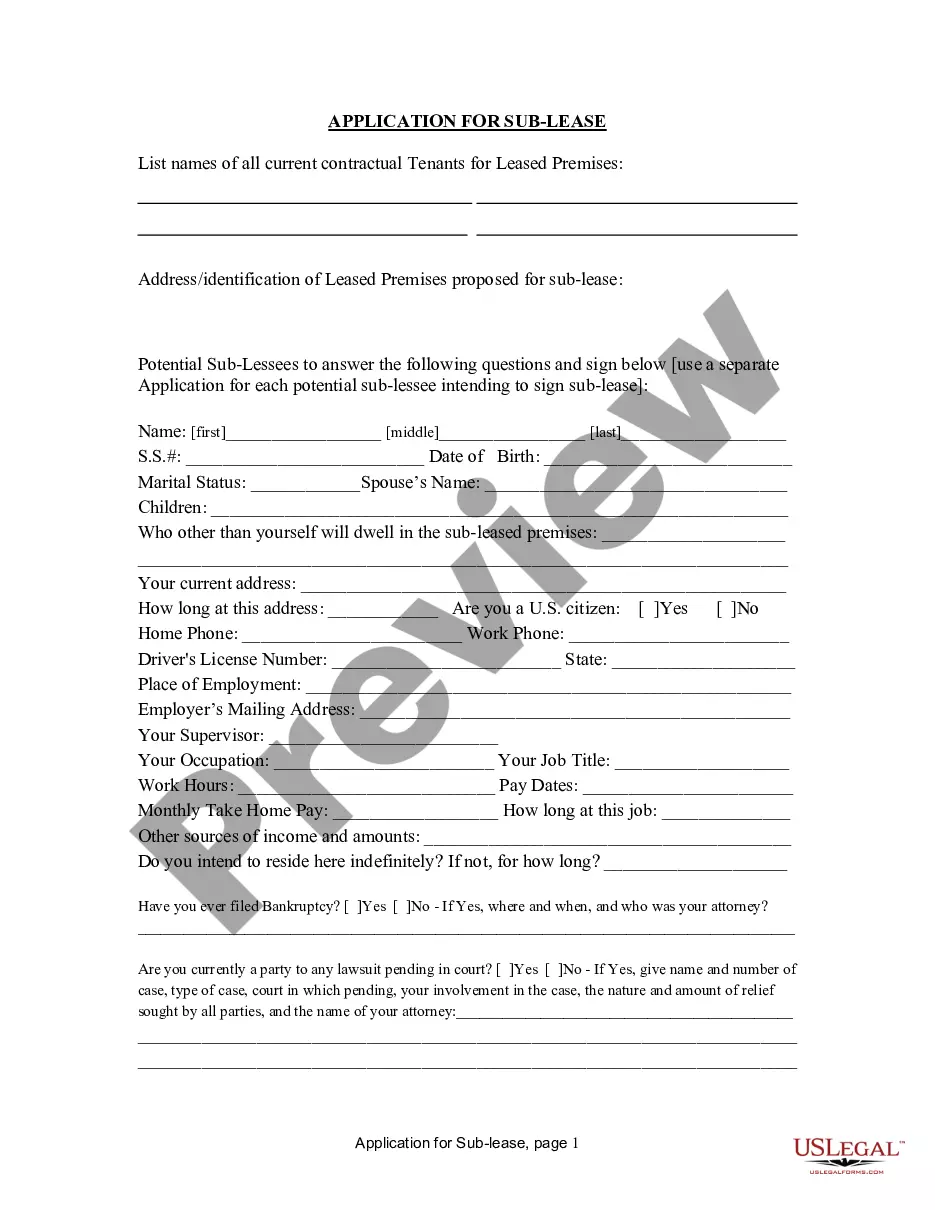

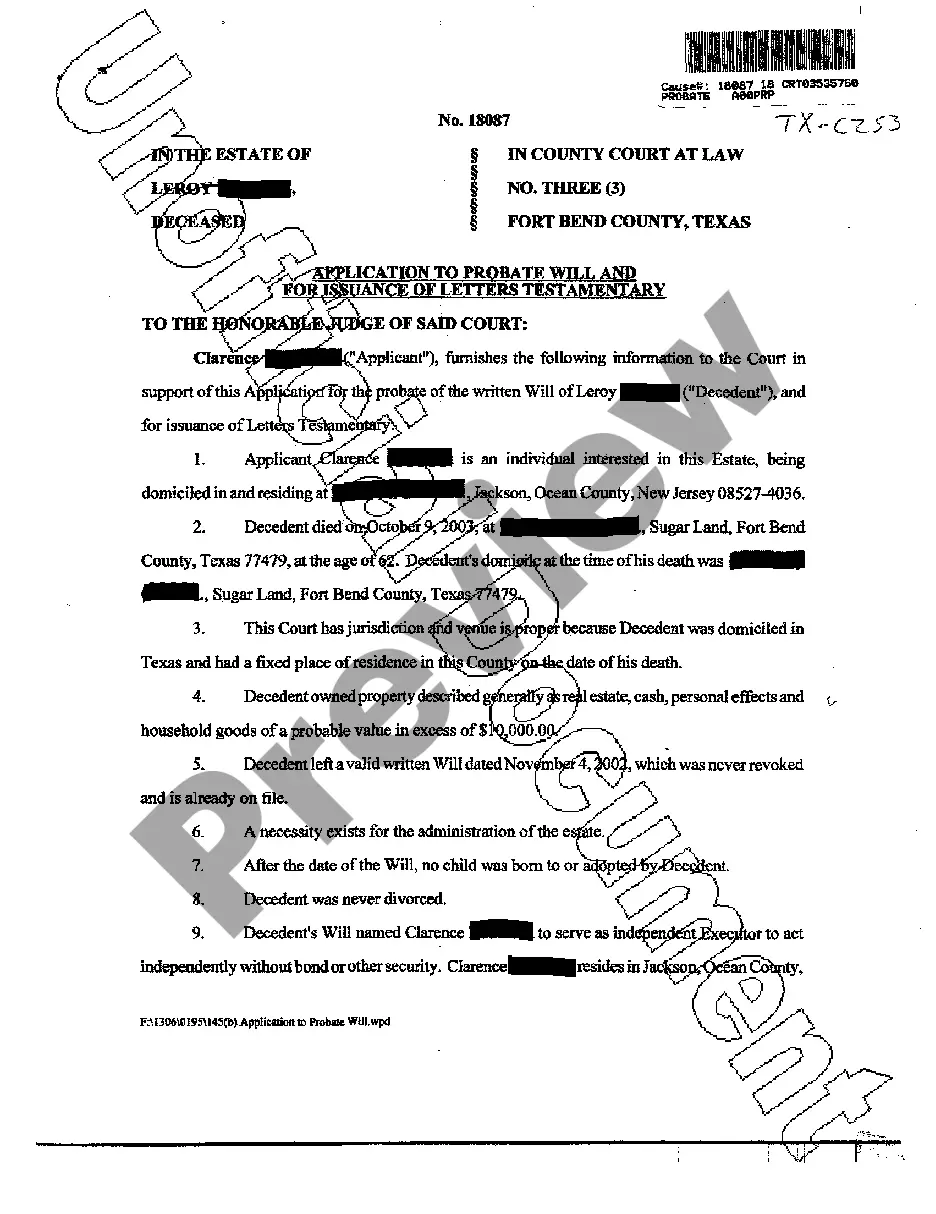

ESSENTIAL ELEMENTS OF A VALID LEASE AGREEMENT. Competent Parties. Legal Purpose. Statute of Frauds. Reversionary Right. Property Description. Mutual Assent (Offer and Acceptance) Consideration.

Create Other Current Liability account for the loan/lease payable. Create Fixed Asset account for Computer Equipment. You must use a General Journal Entry, as taxes cannot be entered from the register. On the first line, enter the Computer Equipment asset account and enter the total loan amount as a Debit.

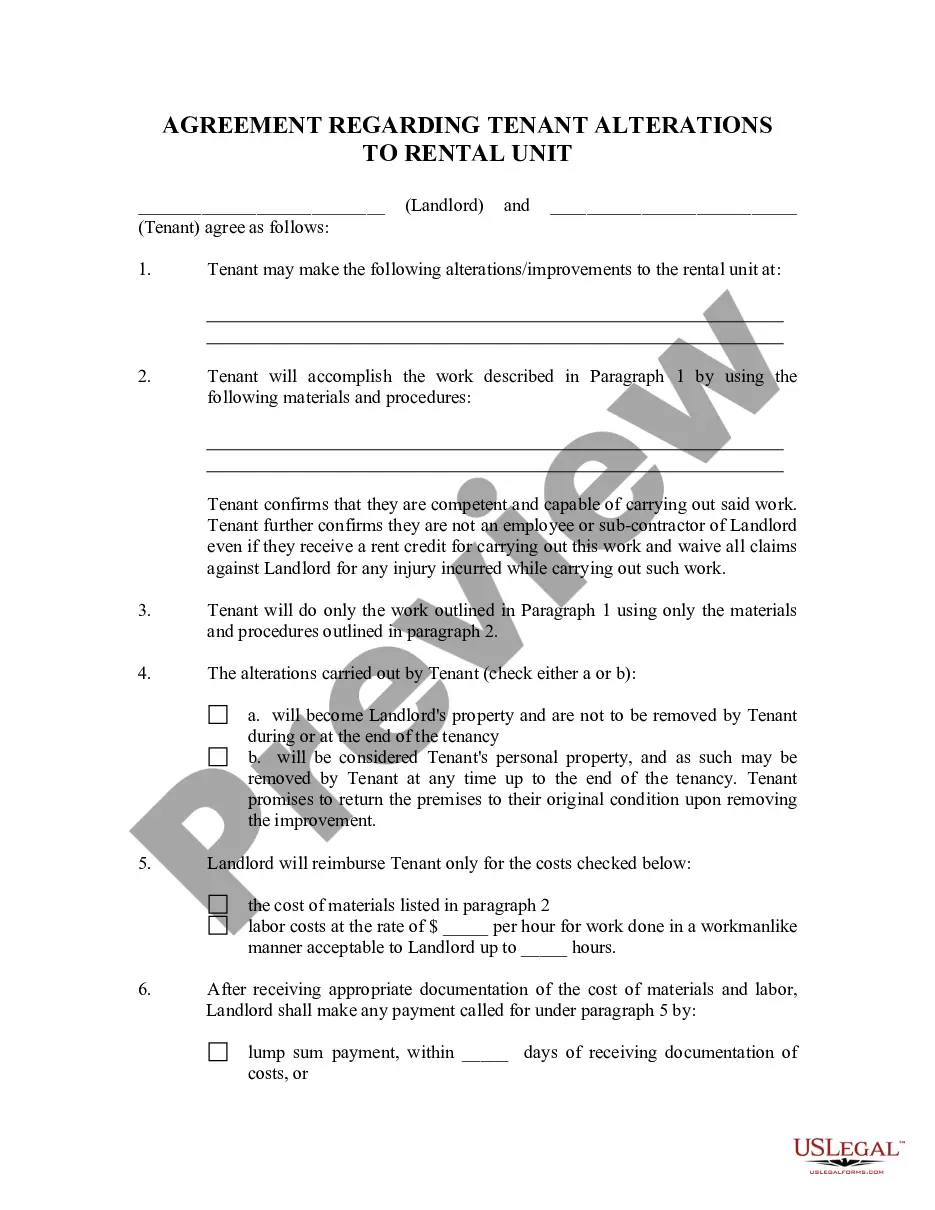

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

Names of all tenants. Limits on occupancy. Term of the tenancy. Rent. Deposits and fees. Repairs and maintenance. Entry to rental property. Restrictions on tenant illegal activity.

Inspect the Property and Record Any Current Damages. Know What's Included in the Rent. Can You Make Adjustments and Customizations? Clearly Understand the Terms Within the Agreement and Anticipate Problems. Communicate with Your Landlord About Your Expectations.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment. PP&E is impacted by Capex,.

For example, if a lease payment were for a total of $1,000 and $120 of that amount were for interest expense, then the entry would be a debit of $880 to the capital lease liability account, a debit of $120 to the interest expense account, and a credit of $1,000 to the accounts payable account.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

Accounting Treatment Of Leased Asset The lease payments also include interest, and the lessee needs to record it separately. For instance, if in a lease payment of $1000, $200 is for the interest expense, then $800 would be a debit to the capital lease liability account and $200 to the interest account.