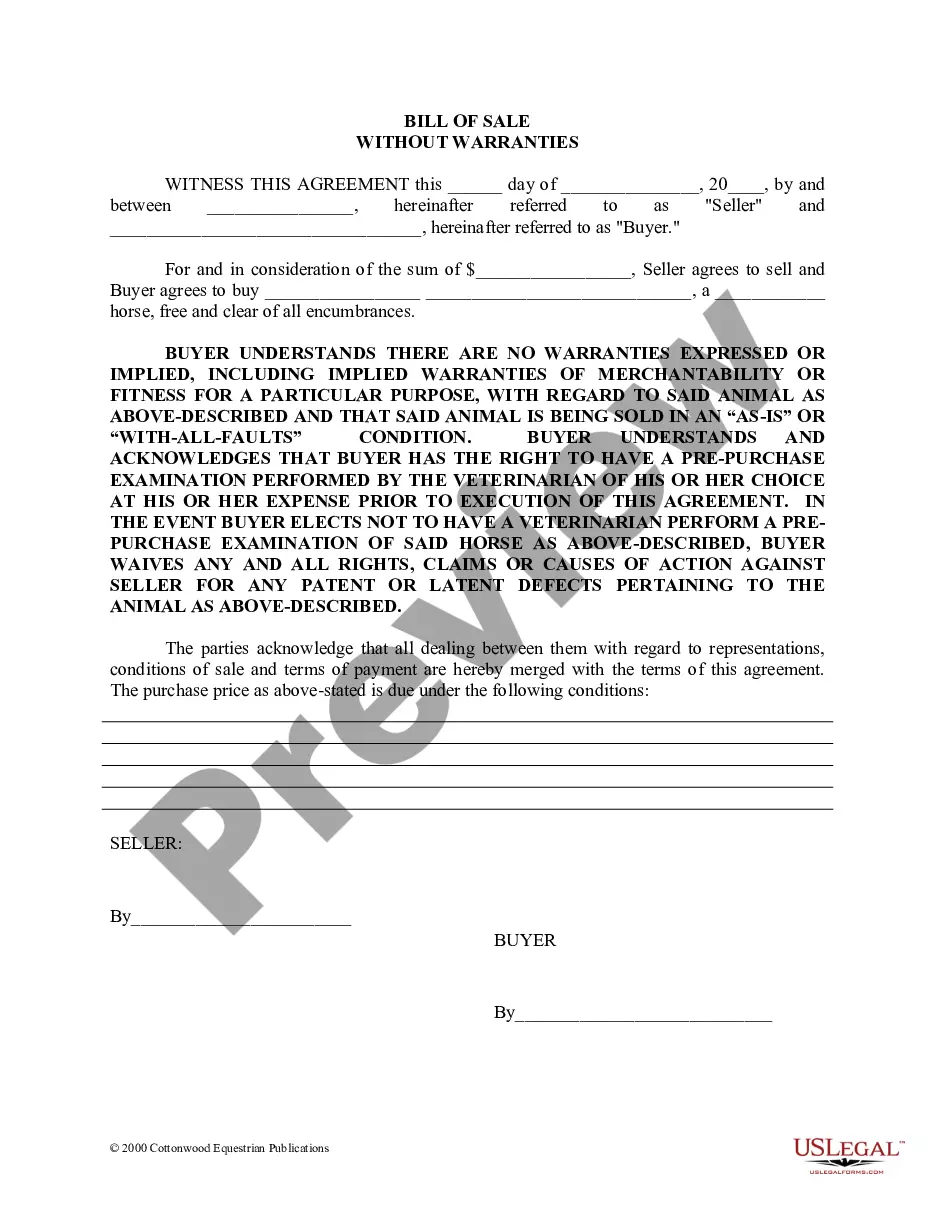

A Request for Credit Application is a form used by a business to request information from a customer before granting them credit. This form is typically used when a business wants to offer a customer credit, but needs more information about the customer's financial situation before approving the credit. This form is also sometimes referred to as a Credit Inquiry Form. There are two types of Request for Credit Application: an informal request and a formal request. An informal request is typically used when a customer is already familiar with the business and is requesting credit for a purchase. This type of request typically does not require a credit report or financial documentation from the customer. A formal request is typically used when a customer is new to the business and is requesting credit for a larger purchase. This type of request typically requires a credit report and other financial documentation from the customer.

Request for Credit Application

Description Credit Application Template

How to fill out Credit Application Blank?

If you’re searching for a way to properly prepare the Request for Credit Application without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of documentation you find on our online service is designed in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these straightforward guidelines on how to obtain the ready-to-use Request for Credit Application:

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the list to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Request for Credit Application and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Credit Application Form Form popularity

Credit Application Doc Other Form Names

Credit Application Docx FAQ

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name.Customer's Address and Telephone Number.Customer's Employer Identification Number (EIN)Customer's Bank Information and Credit References.Guarantor's Name, Address, Telephone, Social Security Number, Etc.Signature Line.

A credit application helps prevent delinquent payments, bad debt and financial loss. An accurate and up-to-date credit application is one of the best ways to minimize risk. The application also allows the company to better implement their credit policy.

Pursuant to the request of our customer, we, (Bank) hereby establish and give to you an irrevocable Letter of Credit in your favour in the total amount of $ which may be drawn on by you at any

I am (name) writing this letter to you in support of (name of the bank). You are at this moment informed that our bank had issued a credit letter in your name for INR. This letter is being issued to you upon the given request. The letter has validity till .

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

State the reasons for your request. State why you are a good credit risk. If possible, give credit references. Ask for an immediate response.

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.