Financial Record Storage Chart

Description

How to fill out Financial Record Storage Chart?

Utilize the most extensive legal library of forms. US Legal Forms is the perfect platform for finding up-to-date Financial Record Storage Chart templates. Our platform offers a large number of legal documents drafted by licensed attorneys and grouped by state.

To get a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the template you need and purchase it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your requirements.

- If the template has a Preview function, utilize it to check the sample.

- If the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template meets your requirements.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the credit/visa or mastercard.

- Choose a document format and download the sample.

- As soon as it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a huge number of pleased clients who’re already using US Legal Forms!

Form popularity

FAQ

The eight small business record keeping rulesAlways keep receipts, bank statements, invoices, payroll records, and any other documentary evidence that supports an item of income, deduction, or credit shown on your tax return. Most supporting documents need to be kept for at least three years.

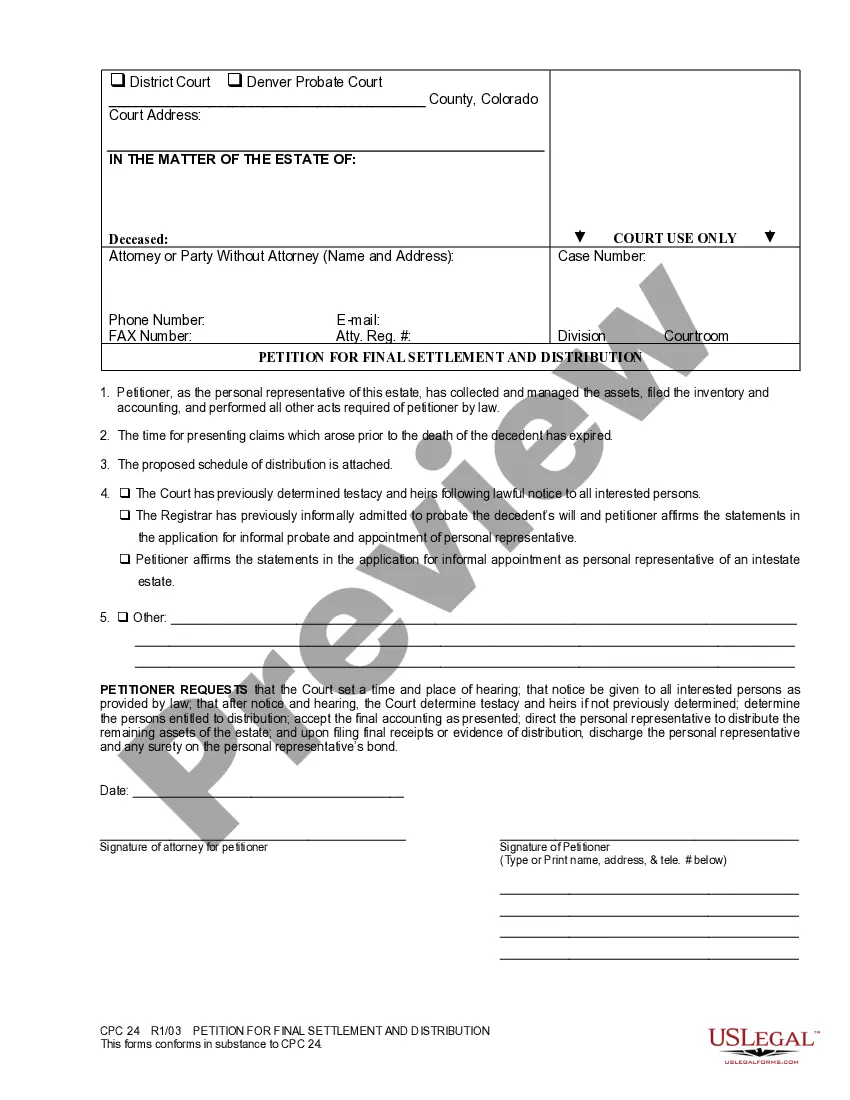

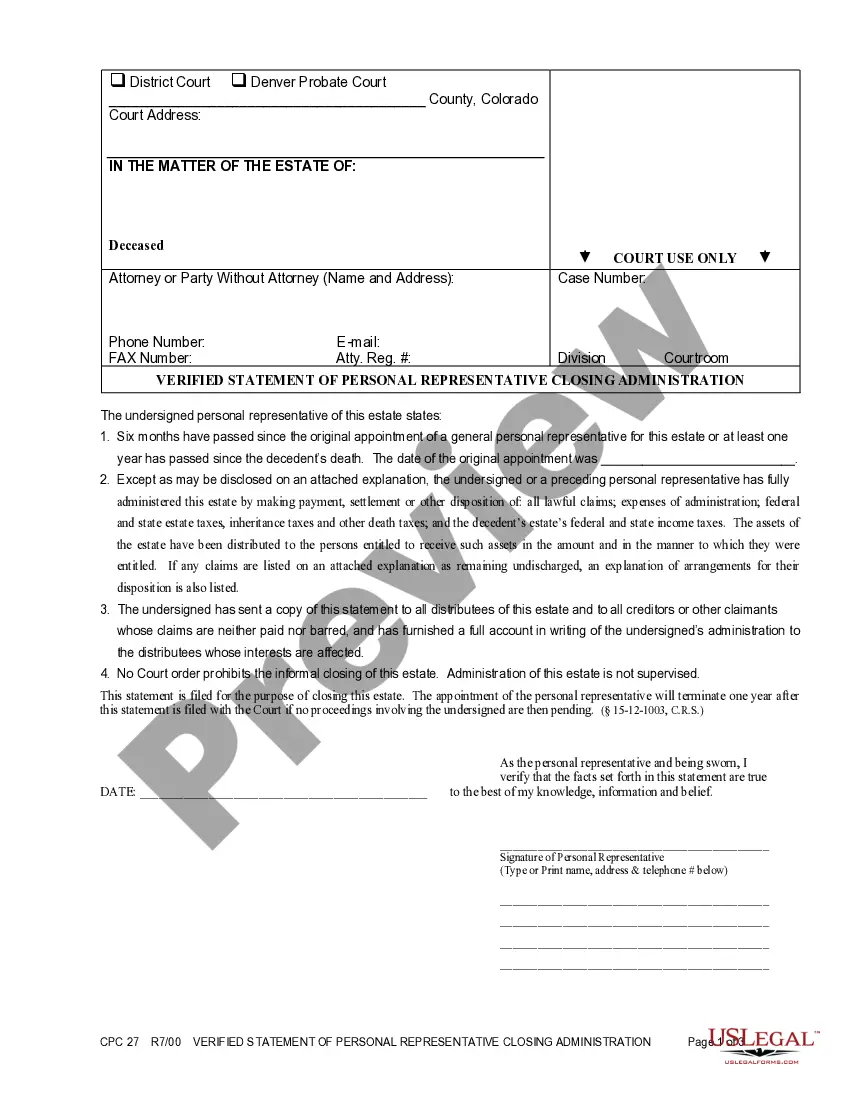

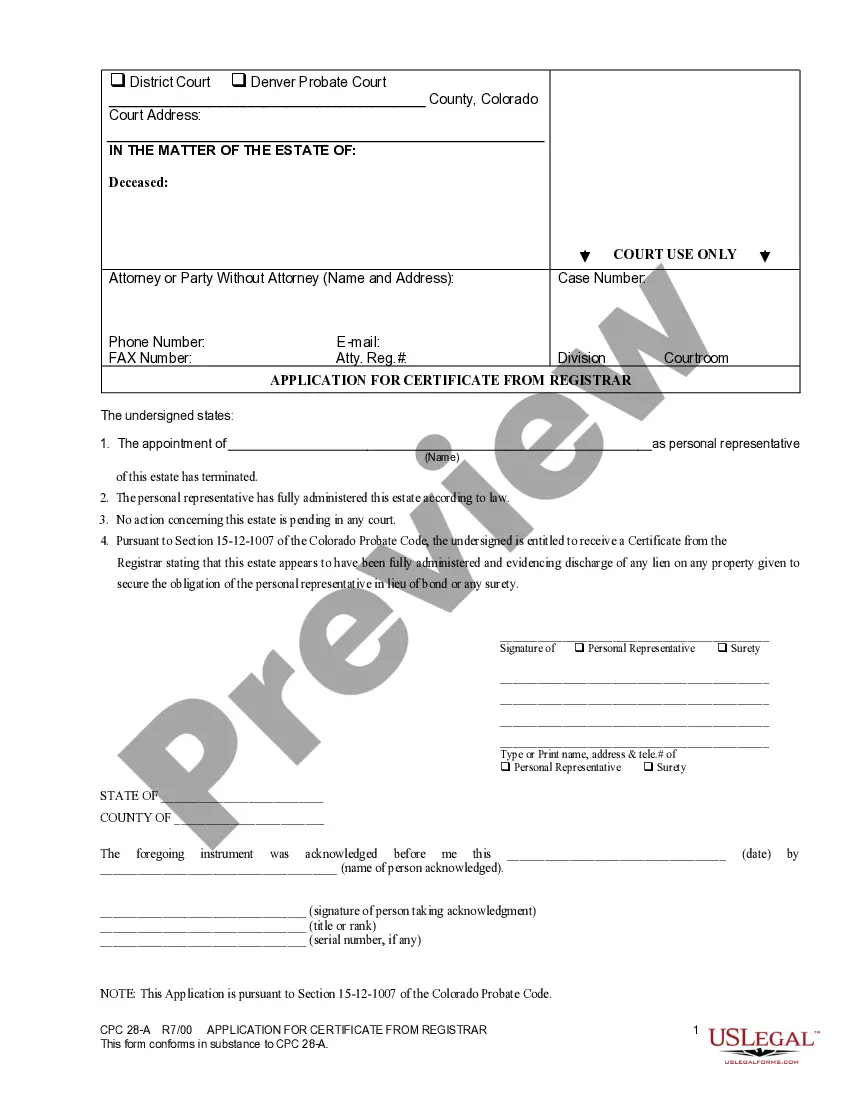

Apply for and claim benefits. Get through the probate process. Close bank accounts. Pay any final estate or income taxes.

General account books including general journal and general and subsidiary ledgers. Cash book records including receipts and payments. Banking records including bank and credit card statements, deposit books, cheque butts and bank reconciliations.

See What You Have. Set Up Your Filing System. Reconcile And File Receipts. Protect Your Investment Papers. Properly Store Your Bank Documents. Take Care Of Any Credit Card Issues.

Establish Business Bank Accounts. Avoid Using Cash. Schedule a Specific Time Each Week. Purchase the Right Accounting Software. Tax Obligations. Keep a Complete Record of Accounting Documents.

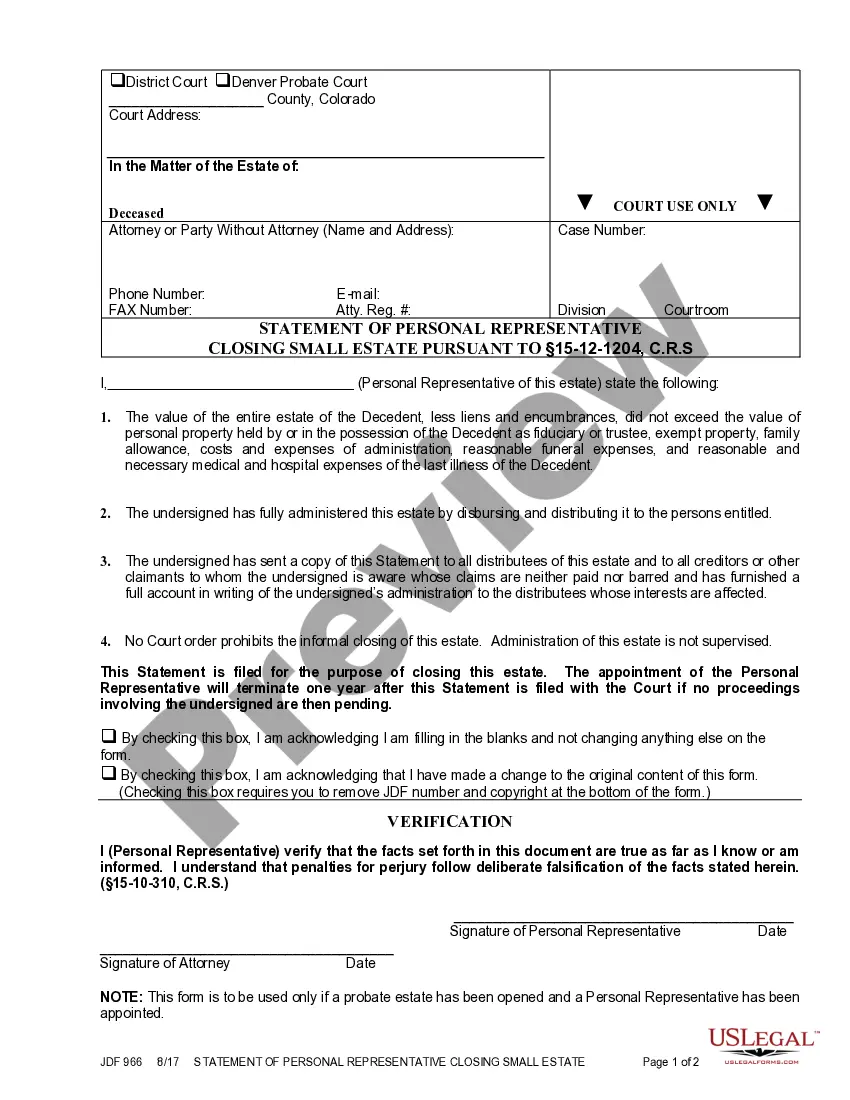

Financial Documents The following documents should be kept in either a safe deposit box or locked filing cabinet at home: Tax returns and supporting documents: Keep forever, in case one day you are audited. Credit card statements: Store for one month, unless needed for tax season; then keep for one year.

Keep Your Business and Personal Expenses Separate. Get Sufficient Documentation for All Business Expenses. Get a Separate Bank Account for Your Business. Have and Use a Separate Credit Card for Business Expenses. Keep a Mileage Log of Your Business Travel.

Step 1: Set Up a Filing System For Your Personal Finance. Step 2: Create a Budget with the Help of a Budget Calculator, and Stick to It. Step 3: Set Up Money Reminders or Automate Bill Payments. Step 4: Balance Your Payments with Your Paydays. Step 5: Evaluate and Pay Off Your Debt. Step 6: Start Saving Money.

Establish Business Bank Accounts. Avoid Using Cash. Schedule a Specific Time Each Week. Purchase the Right Accounting Software. Tax Obligations. Keep a Complete Record of Accounting Documents. Invest in an Experienced Bookkeeper.