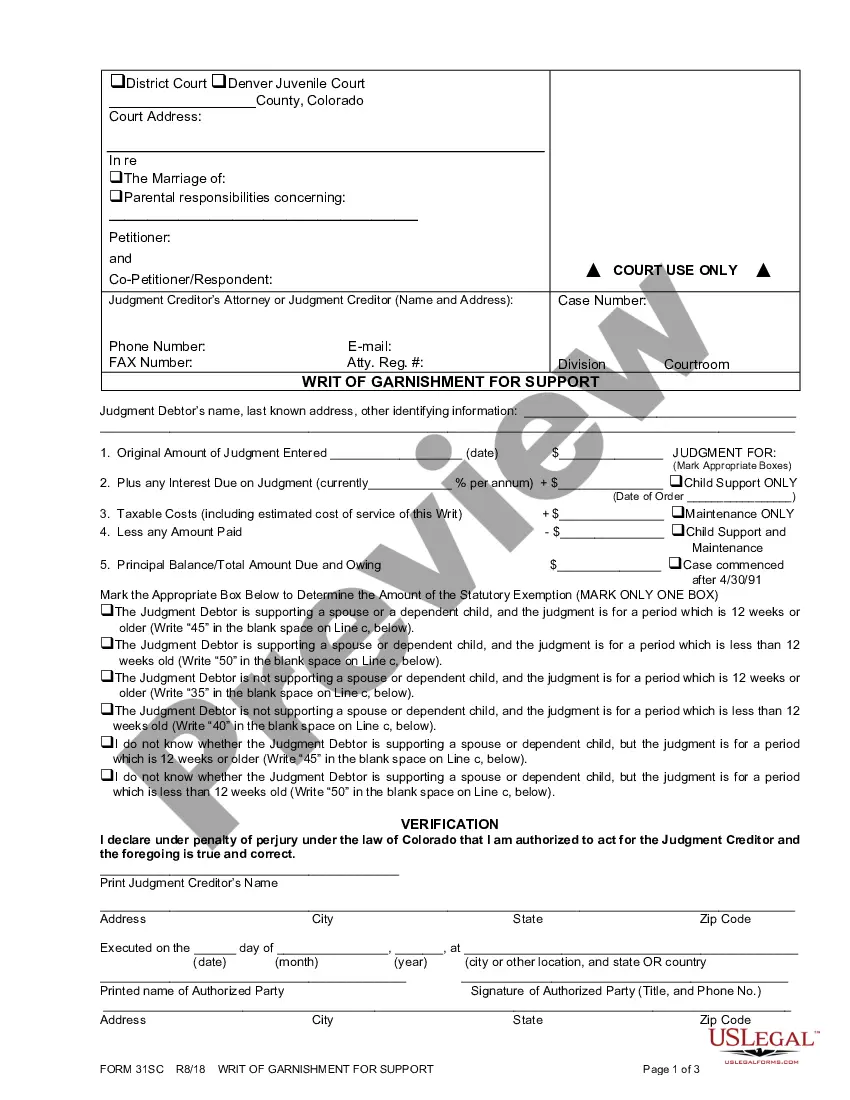

Compensable Work Chart with Explanation

Description Compensable Application

How to fill out Compensable Work Chart With Explanation?

Make use of the most extensive legal catalogue of forms. US Legal Forms is the best place for finding up-to-date Compensable Work Chart with Explanation templates. Our service offers thousands of legal forms drafted by certified attorneys and grouped by state.

To obtain a sample from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our service, log in and choose the document you are looking for and purchase it. Right after purchasing forms, users can see them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your needs.

- In case the form features a Preview option, utilize it to check the sample.

- In case the sample does not suit you, utilize the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with the debit/credit card.

- Select a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join thousands of happy customers who’re already using US Legal Forms!

Compensable Sample Form popularity

Compensable Purchase Other Form Names

Compensable Hours Chart FAQ

Company management must exercise control over employees to ensure that work is not performed off the clock.For example, a supervisor can now text or email an employee 24/7. If the employee is expected to answer, they must be paid for their time in reviewing and responding to the message.

While there is no bright-line rule as to how much time is or is not de minimis, many courts have held that less than ten minutes of working time is de minimis.

Work that is off the clock is any work done for an employer which isn't compensated and not counted towards a worker's weekly hours for overtime purposes.Suffered work means the employee engages in work that isn't requested, but allowed, such as working extra, unpaid hours in order to help colleagues.

If such control is unreasonable, the on-call time is compensable.Under the FLSA, periods during which an employee is completely relieved from duty and that are long enough to enable him to use the time effectively for his own purposes are not hours worked.

So, in order to calculate the amount of money a non-exempt employee should receive, an employer must determine the number of hours of work or "compensable time." Compensable time or working time is defined as any time the employer permits or allows an employee to perform the activity.

FLSA Overtime: Covered nonexempt employees must receive overtime pay for hours worked over 40 per workweek (any fixed and regularly recurring period of 168 hours seven consecutive 24-hour periods) at a rate not less than one and one-half times the regular rate of pay.

What hours are supposed to be paid? So called Compensable Hours include all time during which an a) employee is required to be on duty, to be at employer's premises or prescribed place or b) all time during which an employee is suffered or permitted to work.

In general, "hours worked" includes all time an employee must be on duty, or on the employer's premises or at any other prescribed place of work. Also included is any additional time the employee is allowed (i.e., suffered or permitted) to work.

The court noted that compensable time in California includes the time during which an employee is subject to the control of an employer, and includes all the time the employee is suffered or permitted to work, whether or not required to do so. Time is compensable when an employee is working or under the control of