Request for Credit and Pickup of Merchandise Delivered Late

Description

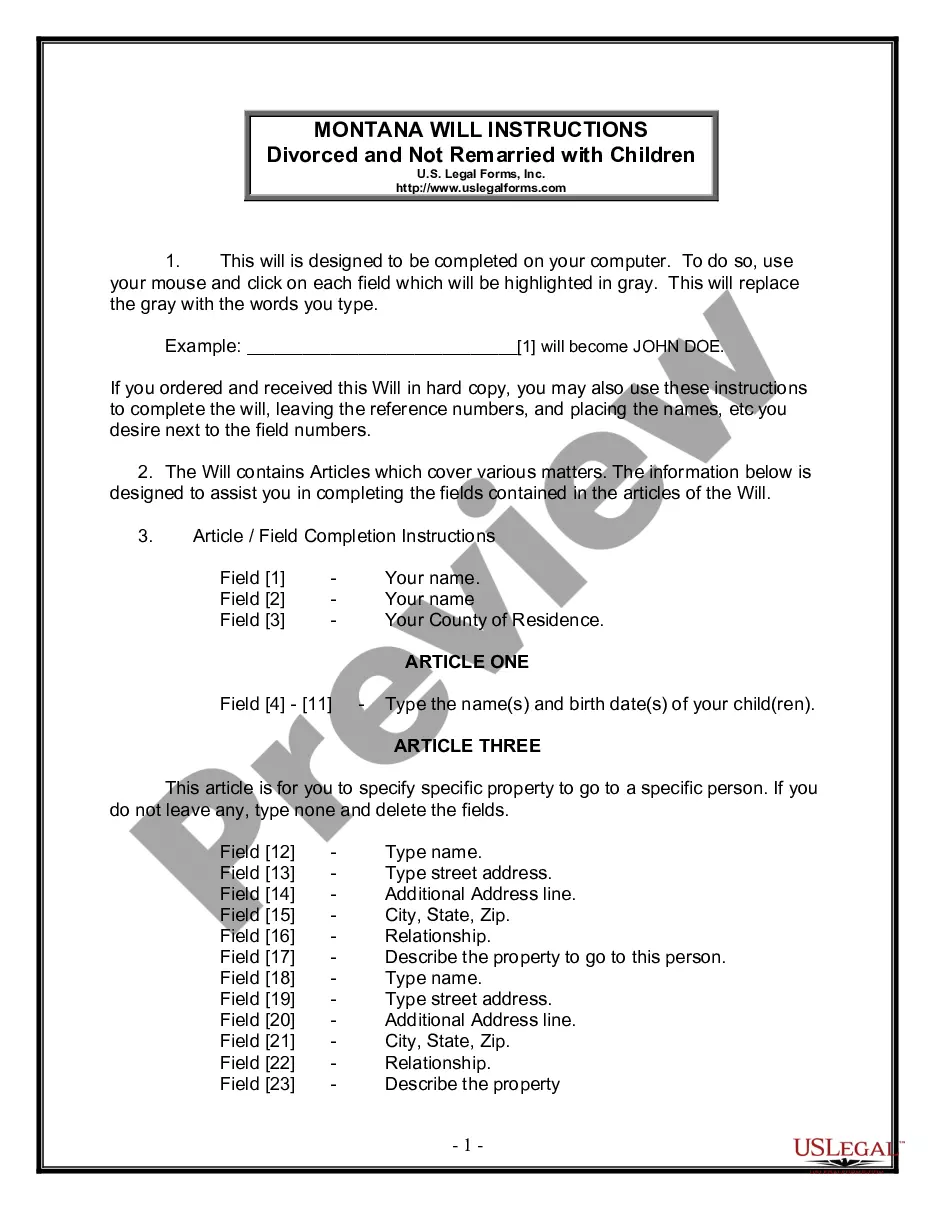

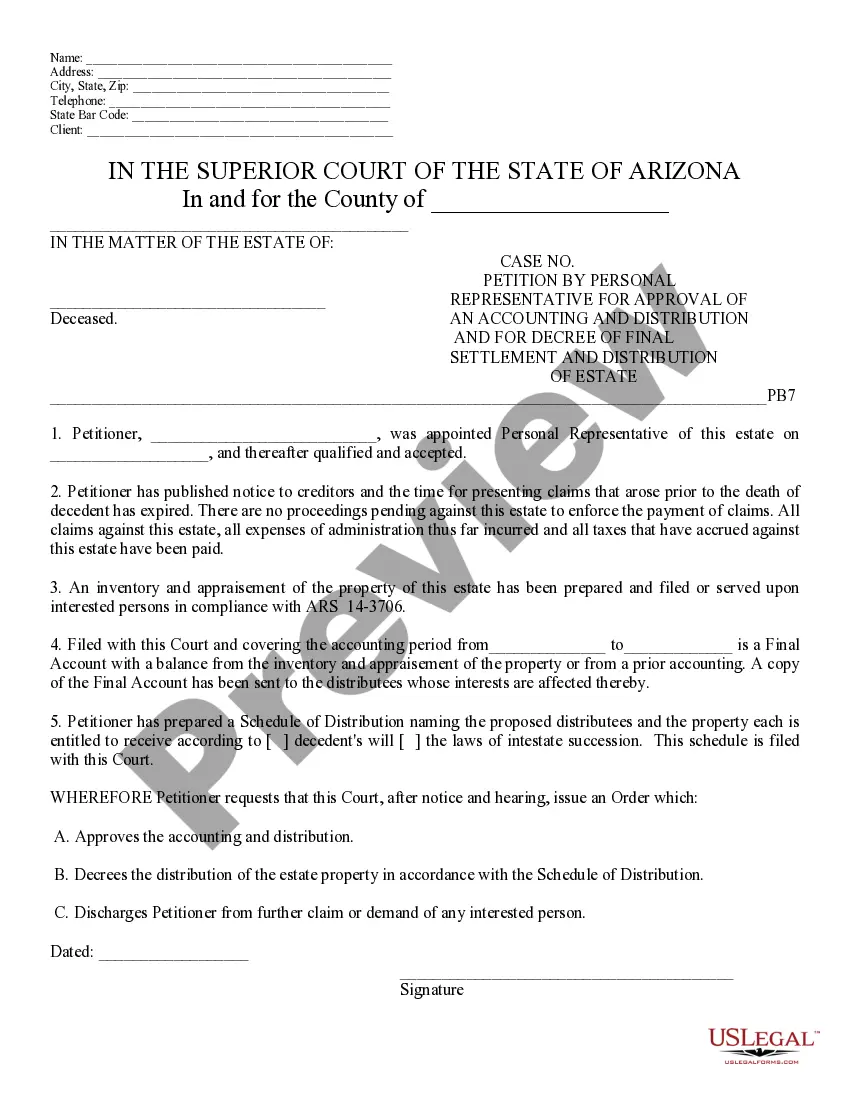

How to fill out Request For Credit And Pickup Of Merchandise Delivered Late?

If you’re looking for a way to appropriately prepare the Request for Credit and Pickup of Merchandise Delivered Late without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business situation. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Request for Credit and Pickup of Merchandise Delivered Late:

- Make sure the document you see on the page meets your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Request for Credit and Pickup of Merchandise Delivered Late and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Information in the next section. Provide your shipping and billing contact. Information.MoreInformation in the next section. Provide your shipping and billing contact. Information.

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.

A credit application helps prevent delinquent payments, bad debt and financial loss. An accurate and up-to-date credit application is one of the best ways to minimize risk. The application also allows the company to better implement their credit policy.

A business credit application form is used by businesses to request funding or lines of credit with a bank through the business's website.

A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts.

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.

An application for credit form is a form containing questions asking for information about the applicant's finances and income. A credit application is used by banks and other credit-granting agencies to assess the creditworthiness of potential borrowers.

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name.Customer's Address and Telephone Number.Customer's Employer Identification Number (EIN)Customer's Bank Information and Credit References.Guarantor's Name, Address, Telephone, Social Security Number, Etc.Signature Line.