Mortgage Note

Description Mortgage Form Online

Understanding Mortgage Notes

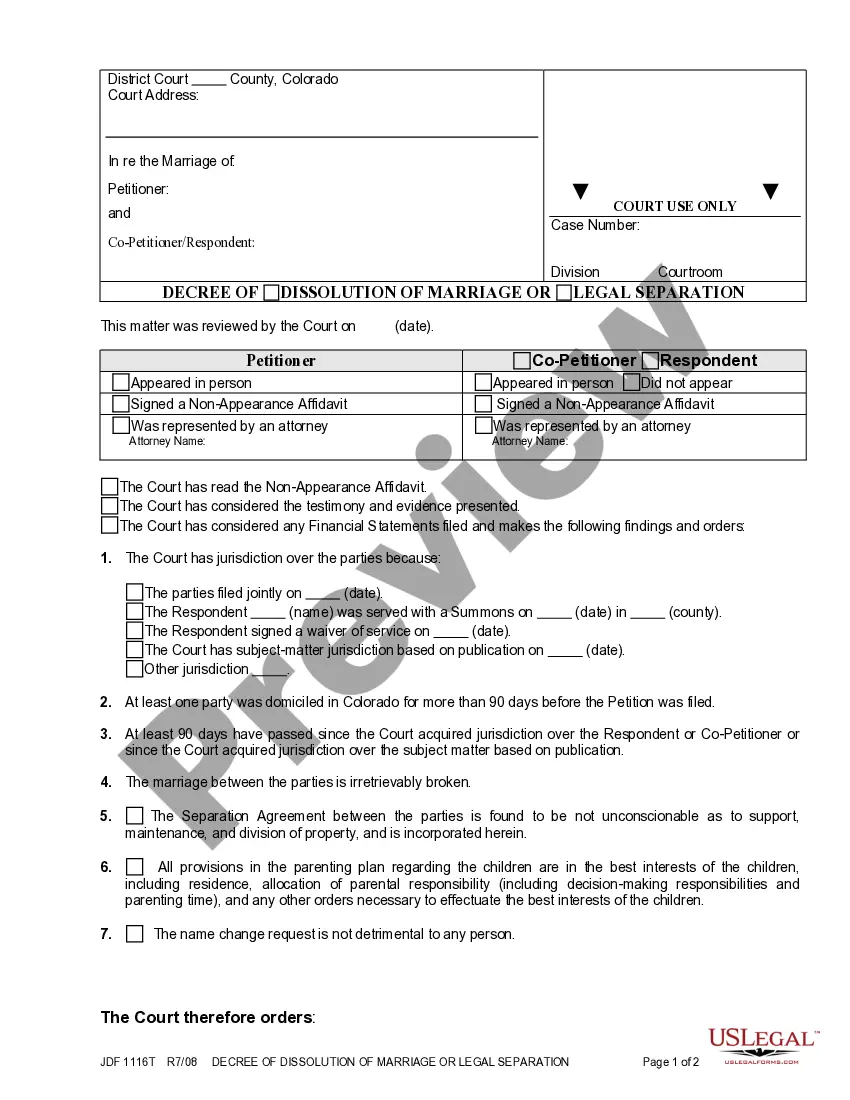

A mortgage note is a legal document that outlines the terms of a mortgage between a borrower and a lender. Also known as a promissory note, it details the loan amount, interest rate, repayment schedule, and the obligations of the borrower.

Key Elements of a Mortgage Note

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The cost of borrowing the principal loan amount, usually expressed as a percentage.

- Repayment Schedule: The timeline for when the loan will be paid back, including frequency of payments and duration.

- Home Equity: The portion of property that the owner truly owns, free of the lien of the mortgage.

Mortgage Note Investing Explained

Investing in mortgage notes is a form of real estate investment that involves purchasing the debt that the mortgage creates. Unlike traditional real estate investments, investors in mortgage notes become the creditor in the property’s financial arrangement, potentially receiving monthly payments from the borrower.

Comparing Lenders for Mortgage Notes

| Lender | Interest Rate | Loan Terms | Reputation |

|---|---|---|---|

| Lender A | 4.5% | 30 years | Excellent |

| Lender B | 3.9% | 15 years | Good |

| Lender C | 5.0% | 30 years | Average |

It's crucial to compare lenders on factors such as interest rates, loan terms, and their reputation to find the best mortgage note deal.

Risks in Mortgage Note Investing

- Default Risk: Risk that the borrower may fail to make payments as agreed.

- Prepayment Risk: The borrower may pay off the note early, affecting expected interest earnings.

- Market Risk: Changes in the real estate market could affect the value of the mortgage note.

Debt Solutions Through Mortgage Notes

Mortgage notes can offer a tailored debt solution for homeowners looking to secure financing tied to their property. Through this mechanism, homeowners leverage their home equity to manage and finance their debt needs, sometimes refinancing to take advantage of lower interest rates.

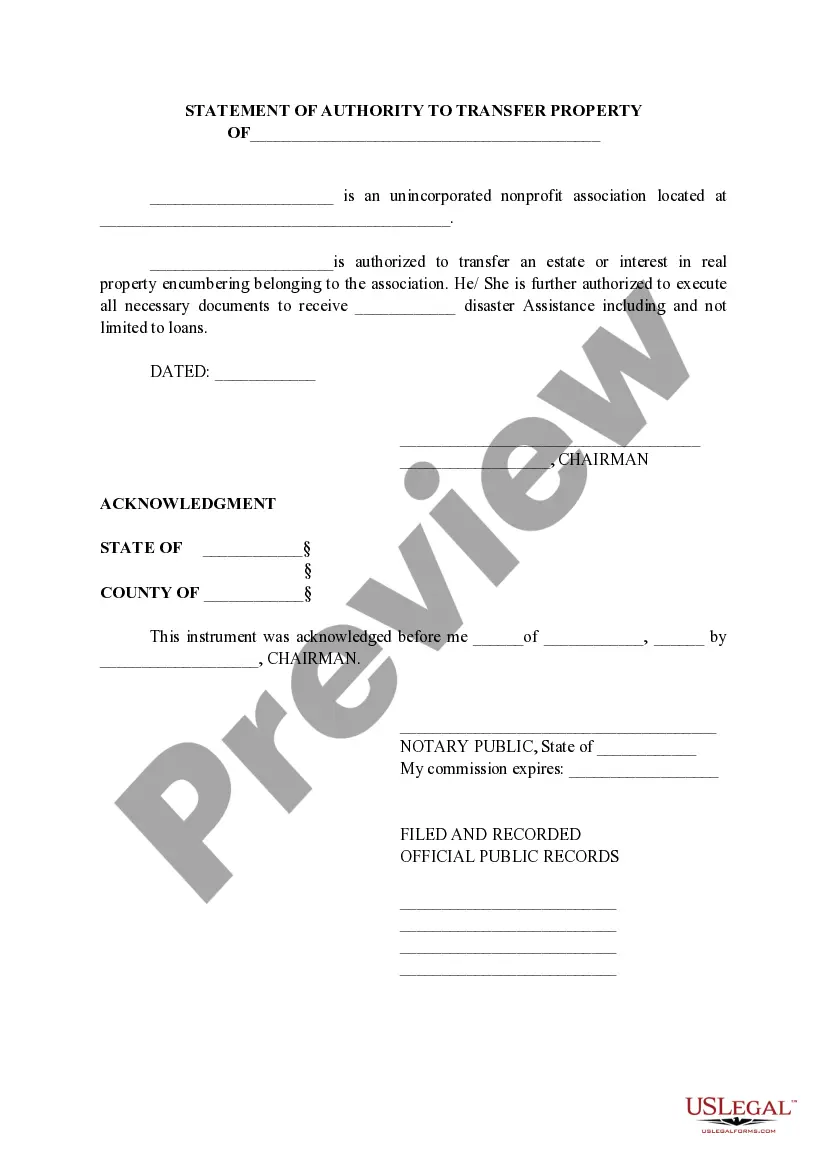

How to fill out Mortgage Form Pdf?

Use the most extensive legal library of forms. US Legal Forms is the perfect platform for finding updated Mortgage Note templates. Our platform offers thousands of legal documents drafted by certified legal professionals and categorized by state.

To get a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our platform, log in and choose the template you need and buy it. Right after purchasing templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

- When the form has a Preview function, use it to check the sample.

- If the sample does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your requirements.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with the debit/credit card.

- Choose a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join thousands of happy customers who’re already using US Legal Forms!

Example Of Mortgage Note Form popularity

Mortgage Note Other Form Names

What Is A Mortgage Note Sample FAQ

It's only four pages long (five if you count the blank one at the end). You'll supply information about your identification, the property, and your income, assets and credit use.

Type of Mortgage and Terms of Loan. Property Information and Purpose of Loan. Personal Information. Employment Information. Monthly Income and Combined Housing Expenses. Assets and Liabilities. Details of Transaction. Declarations.

Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower. The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

A promissory note is often referred to as a mortgage note and is the document generated and signed at closing. A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

A mortgage is a loan that the borrower uses to purchase or maintain a home or other form of real estate and agrees to pay back over time, typically in a series of regular payments. The property serves as collateral to secure the loan.

Mortgage notes are a type of promissory note that details repayment of a loan used to purchase real estate. This legal document describes the amount of the loan and terms of repayment, including duration and interest rate. In a private mortgage, the borrower makes payments to a private person or entity directly.

The mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The amount of the mortgage loan.

The Note will provide you with details regarding your loan, including the amount you owe, the interest rate of the mortgage loan, the dates when the payments are to be made, the length of time for repayment, and the place where the payments are to be sent.

The main difference between a promissory note and a mortgage is that a promissory note is the written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property.A mortgage, or mortgage loan, is a loan that allows a borrower to finance a home.