Mortgage Deed

Description

How to fill out Mortgage Deed?

Employ the most comprehensive legal library of forms. US Legal Forms is the perfect platform for finding updated Mortgage Deed templates. Our platform provides a large number of legal forms drafted by certified attorneys and grouped by state.

To obtain a template from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and choose the template you need and purchase it. Right after buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

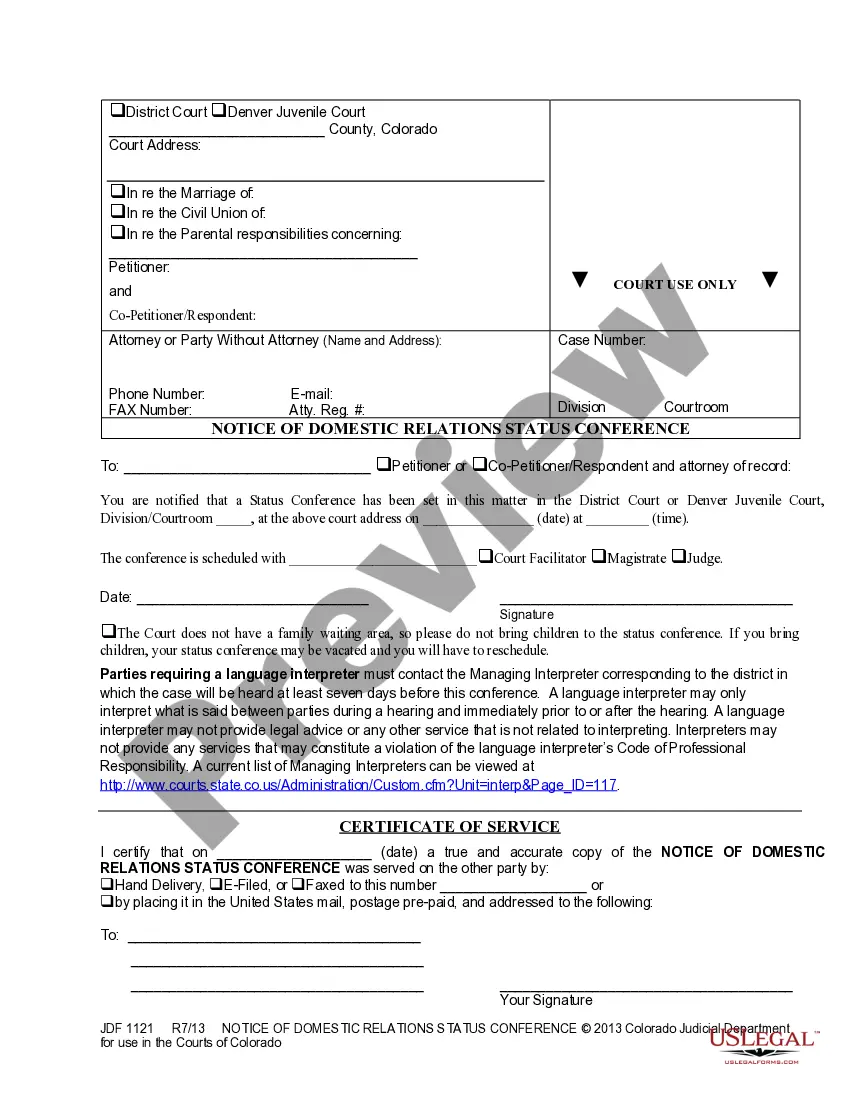

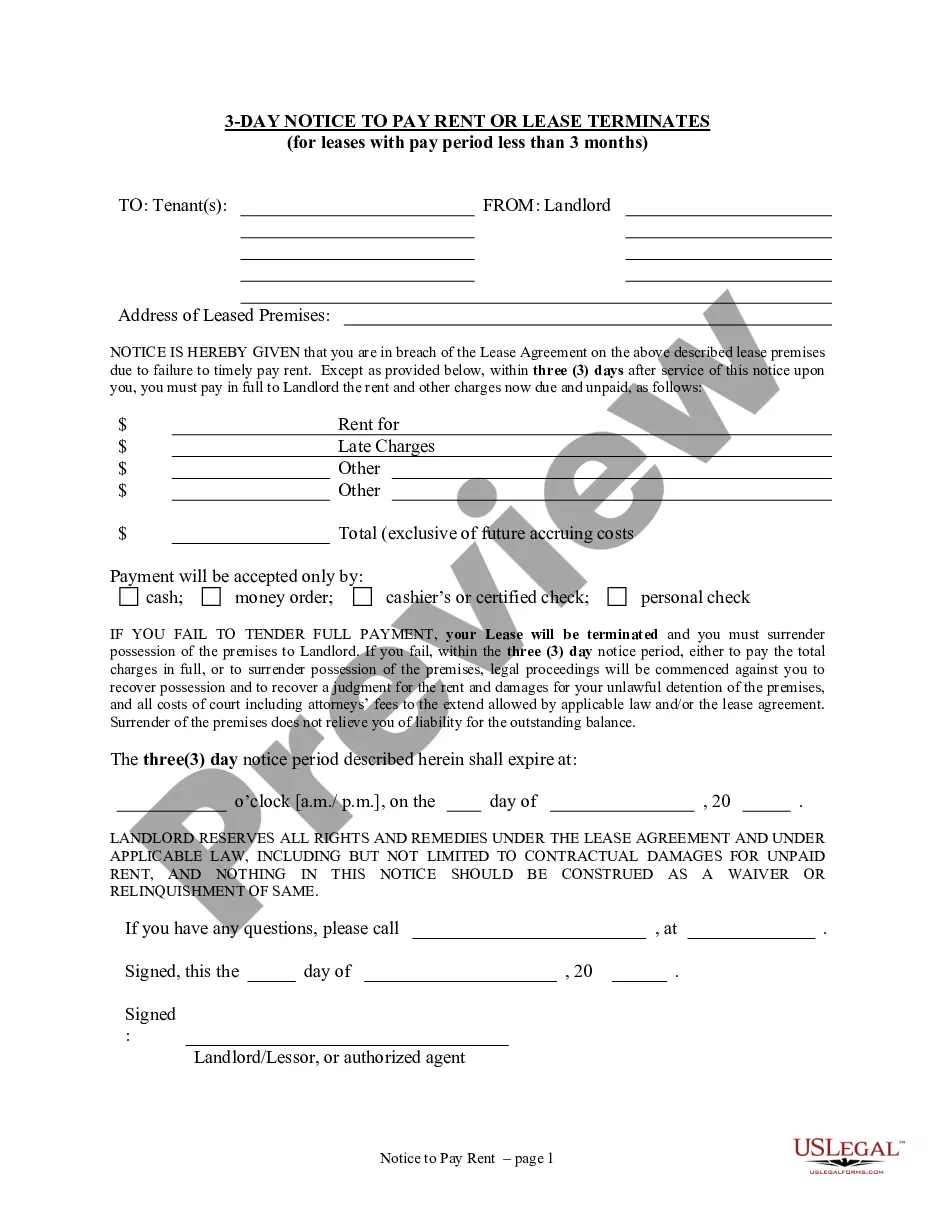

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the template features a Preview option, utilize it to review the sample.

- If the template does not suit you, use the search bar to find a better one.

- Hit Buy Now if the template corresponds to your requirements.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/credit card.

- Select a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your time and effort with the platform to find, download, and fill in the Form name. Join a huge number of pleased subscribers who’re already using US Legal Forms!

Form popularity

FAQ

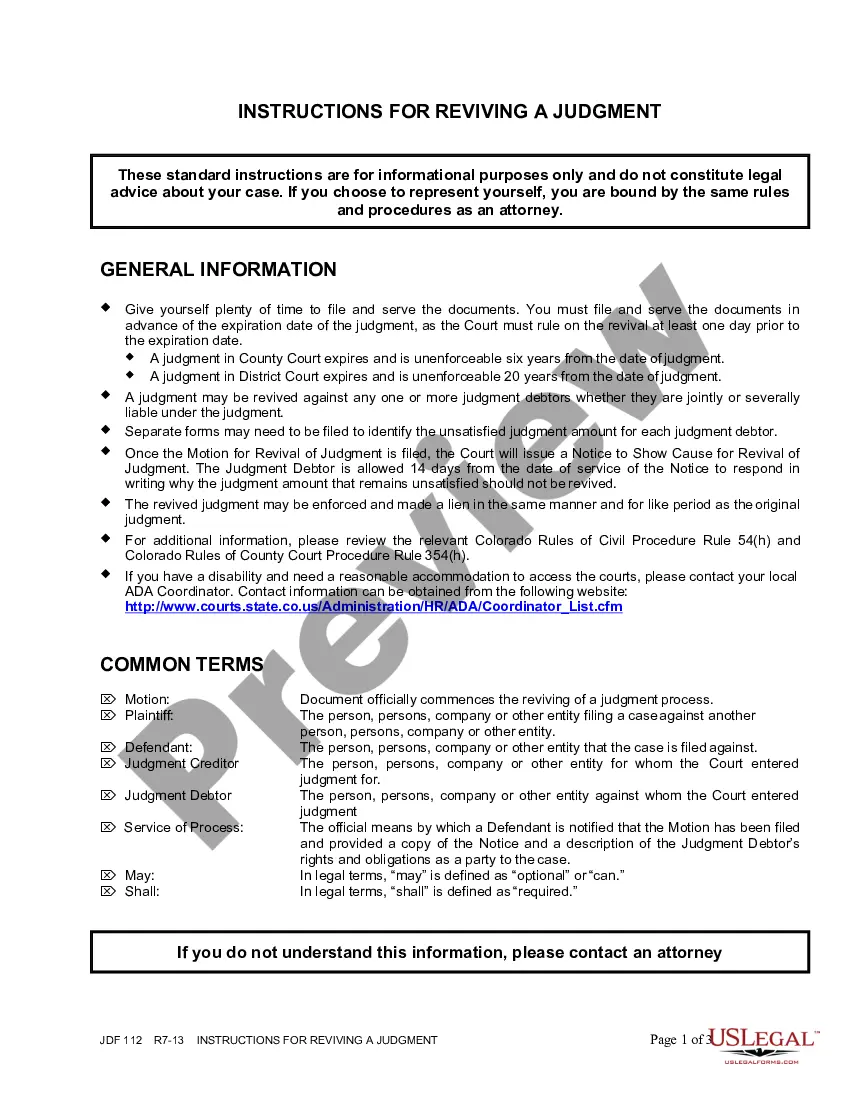

Who can be a witness to the signatory of a deed?A witness should not be the signatory's spouse or partner or a family member, and should not have a personal interest in the provisions of the document. Case law has confirmed that a party to the document cannot act as a witness to another party's signature.

If you own a computer and have a sheet of paper, you can create your own mortgage to finance the purchase of real estate. No one checks your credit, and you don't need a cash down payment.There is a huge market of investors who buy privately created mortgages and trust deeds (often referred to as paper).

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.

What is the Mortgage Deed? This can sometimes be known as the legal charge form. Your mortgage deed is usually a 1 or 2 page document that, once signed, provides confirmation that you're happy to proceed based on the terms of your mortgage offer. Upon completion, the signed mortgage deed is a legally binding document.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

Definition. Simple mortgage is executed where without any property being delivered to the mortgagee; the mortgagor makes himself liable to repay the debt9.The fundamental characteristic of simple mortgage is that the mortgagee has no right to liquidate the property without the permission of the court.

While you have a mortgage, the lender has rights to the property title until the loan is paid. If you buy a home without a mortgage, the real estate attorney or title company records the deed and issues a copy to you.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.