Petition for Partial and Early Distribution of Estate

What is this form?

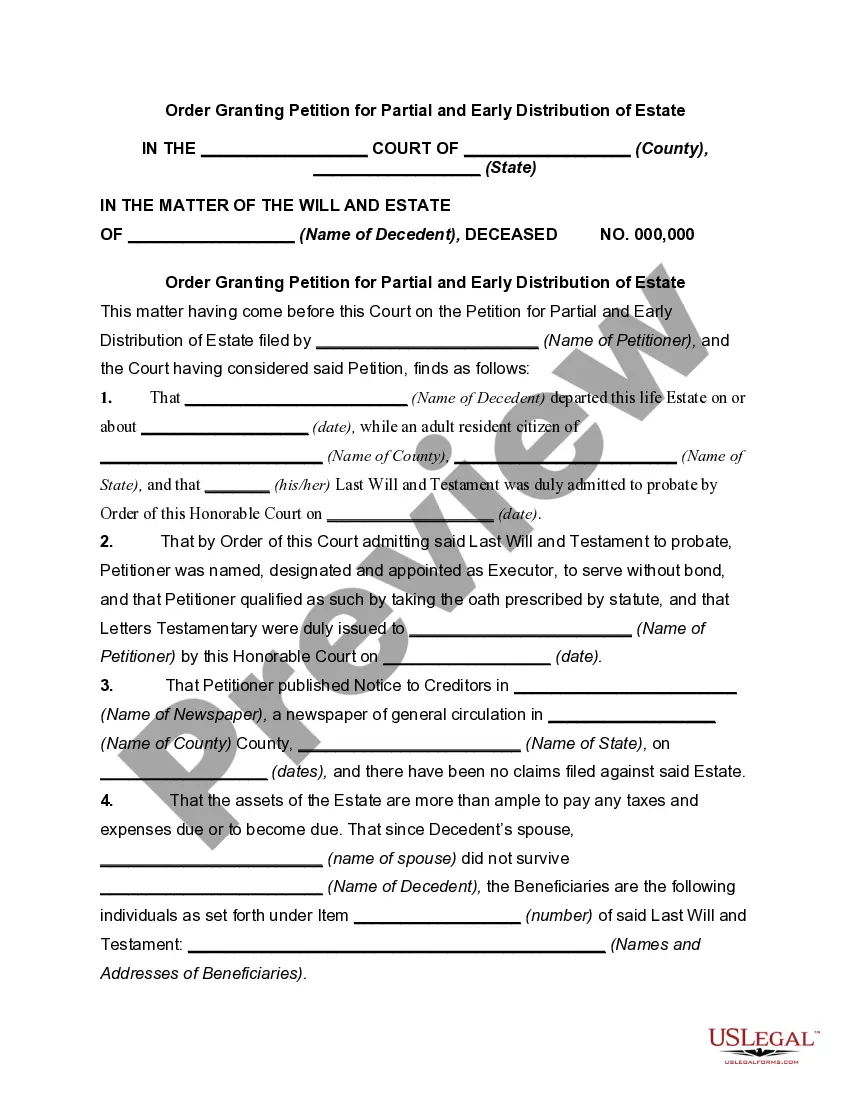

The Petition for Partial and Early Distribution of Estate is a legal document used by an executor to request the court's permission to distribute part of an estate to beneficiaries before the estate is fully closed. This form is particularly useful when beneficiaries may face delays in receiving their inheritance due to the estate administration process. It allows for early financial relief while ensuring that all debts and taxes are settled before distribution.

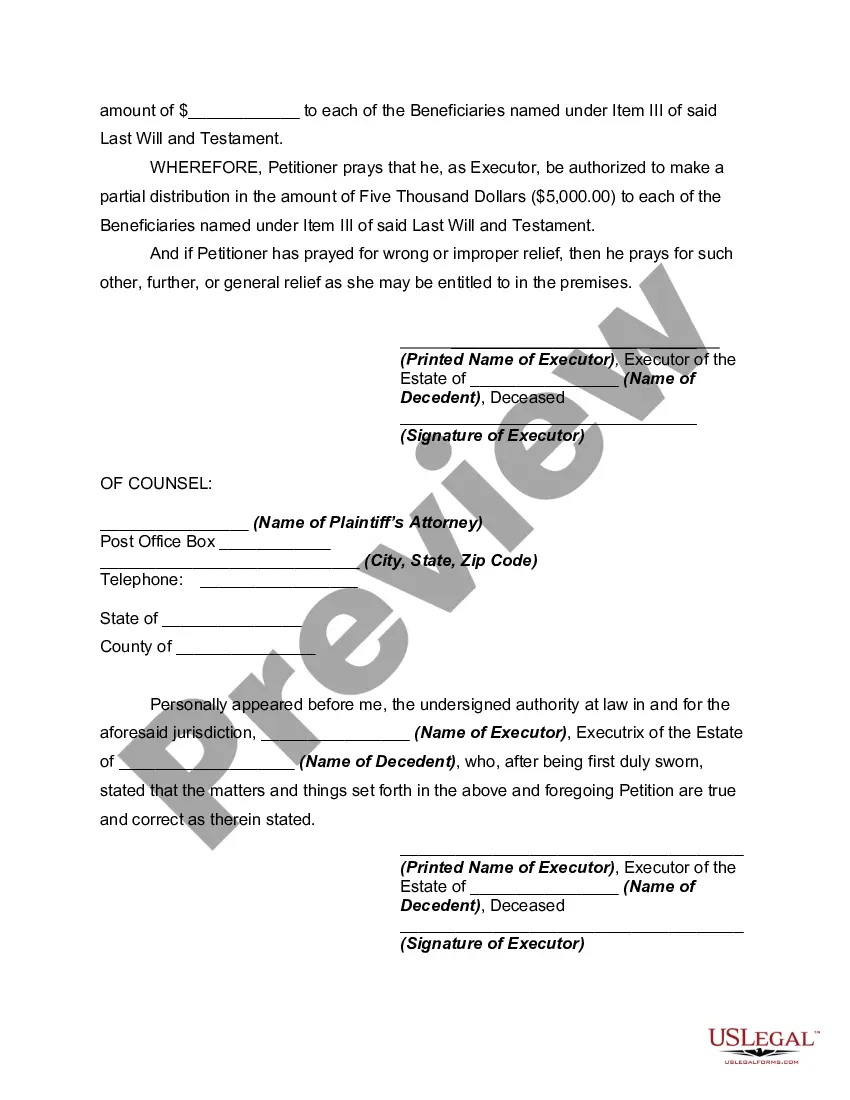

Main sections of this form

- Information about the decedent, including name and date of death.

- Details identifying the executor and their appointment by the court.

- A declaration stating that no claims against the estate were filed.

- List of beneficiaries and their respective entitlements.

- The specific amount proposed for distribution to each beneficiary.

- Signature lines for the executor and attorney, along with notary acknowledgment.

Common use cases

This form is applicable in situations where an executor of an estate wishes to make an early partial distribution to beneficiaries. It is particularly relevant when all debts and claims have been addressed, and the executor is ready to proceed but awaiting closure of the estate, which may take an extended time due to IRS or tax agency responses. If beneficiaries are in need of funds before the estate is fully settled, this form facilitates that process.

Who this form is for

- Executors appointed to manage the estate of a deceased individual.

- Beneficiaries who need early access to their inheritance.

- Legal representatives assisting executors in estate administration.

How to complete this form

- Identify the decedent's name and date of death.

- Provide details about the executor, including their name and appointment date.

- State that there are no creditor claims filed against the estate.

- List the beneficiaries and the specific amounts to be distributed to each.

- Obtain signatures from the executor and any legal counsel involved, and arrange for notarization if required.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to verify that all debts and claims have been resolved before making distributions.

- Not including all necessary information about the decedent and beneficiaries.

- Overestimating the amount available for early distribution without holding back sufficient funds for taxes or expenses.

Advantages of online completion

- Convenient access to expertly drafted legal forms tailored for state requirements.

- Editability to customize the form easily for specific circumstances.

- Immediate downloading, eliminating the need for in-person visits to legal offices.

Form popularity

FAQ

A. Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

If the estate is small and has a reasonable amount of debt, six to eight months is a fair expectation. With a larger estate, it will likely be more than a year before everything settles.

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

Final Distribution and Closing the Estate: 1-3 Months During the probate process, you may distribute some assets, like tangible personal property. However, in most states you are required to wait to distribute financial assetssuch as proceeds from the property saleuntil the final probate hearing.