Notice of the Findings of the Lost Property to Apparent Owner of Property

Description

How to fill out Notice Of The Findings Of The Lost Property To Apparent Owner Of Property?

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the best platform for getting up-to-date Notice of the Findings of the Lost Property to Apparent Owner of Property templates. Our platform offers a large number of legal documents drafted by licensed attorneys and categorized by state.

To get a template from US Legal Forms, users only need to sign up for an account first. If you’re already registered on our platform, log in and choose the document you are looking for and buy it. After buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you have found is state-specific and suits your requirements.

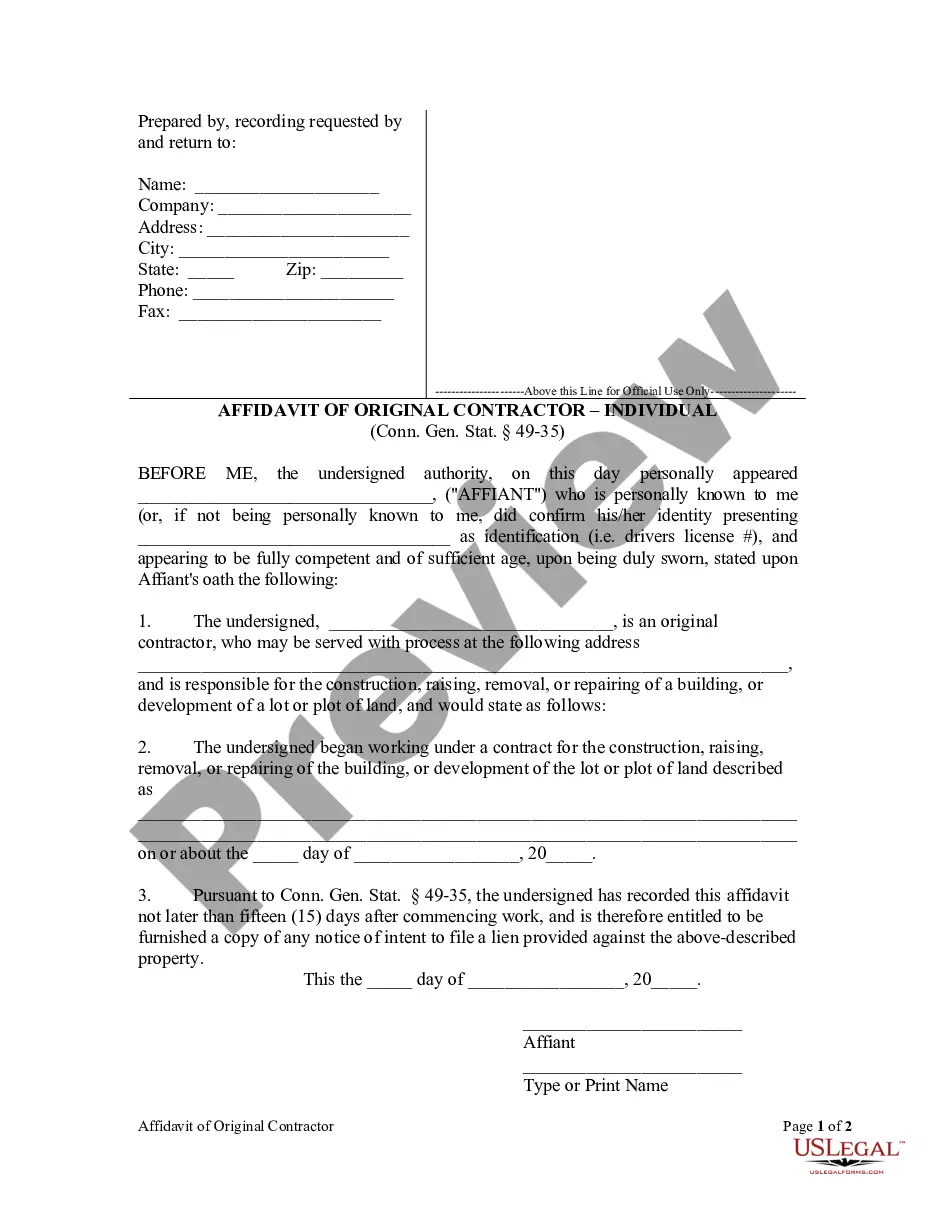

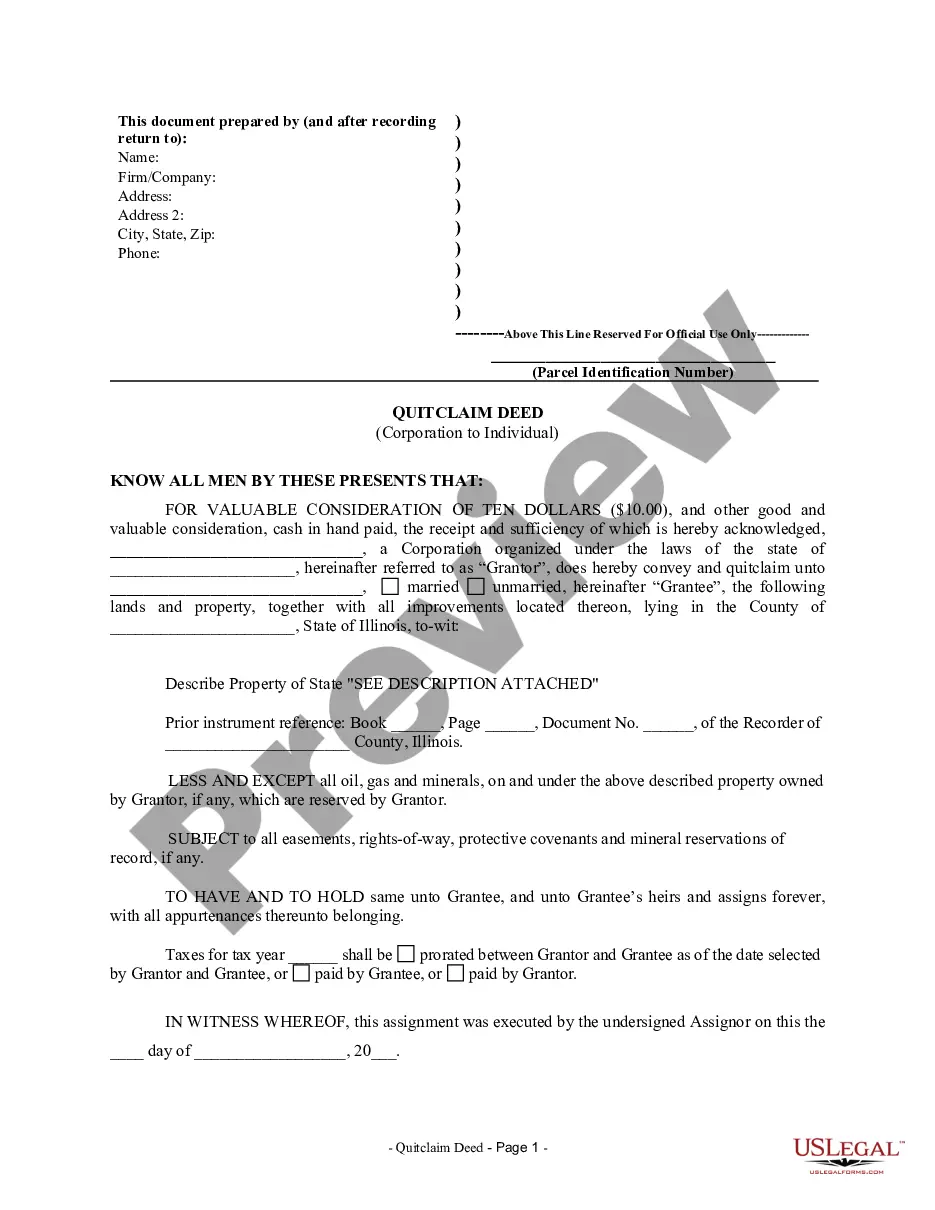

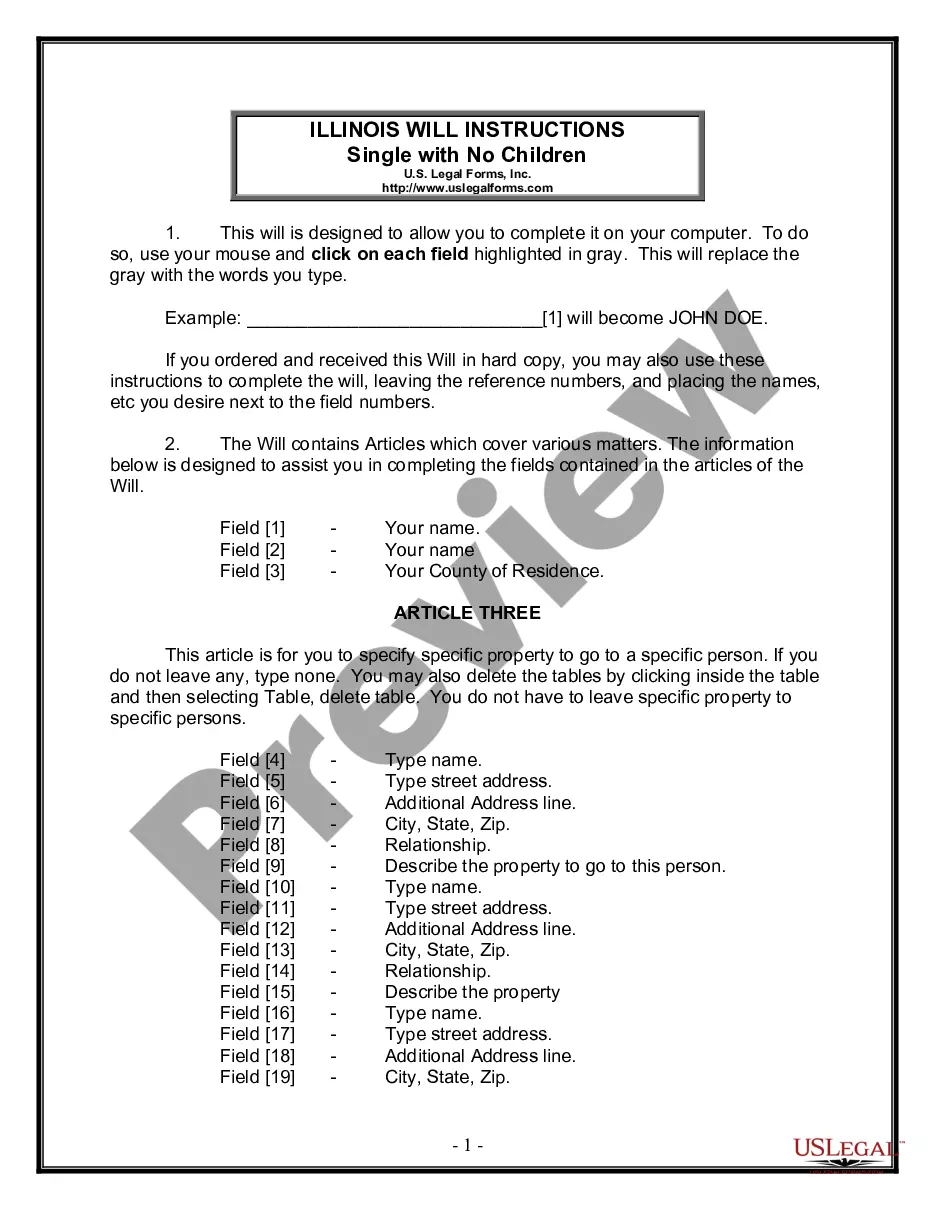

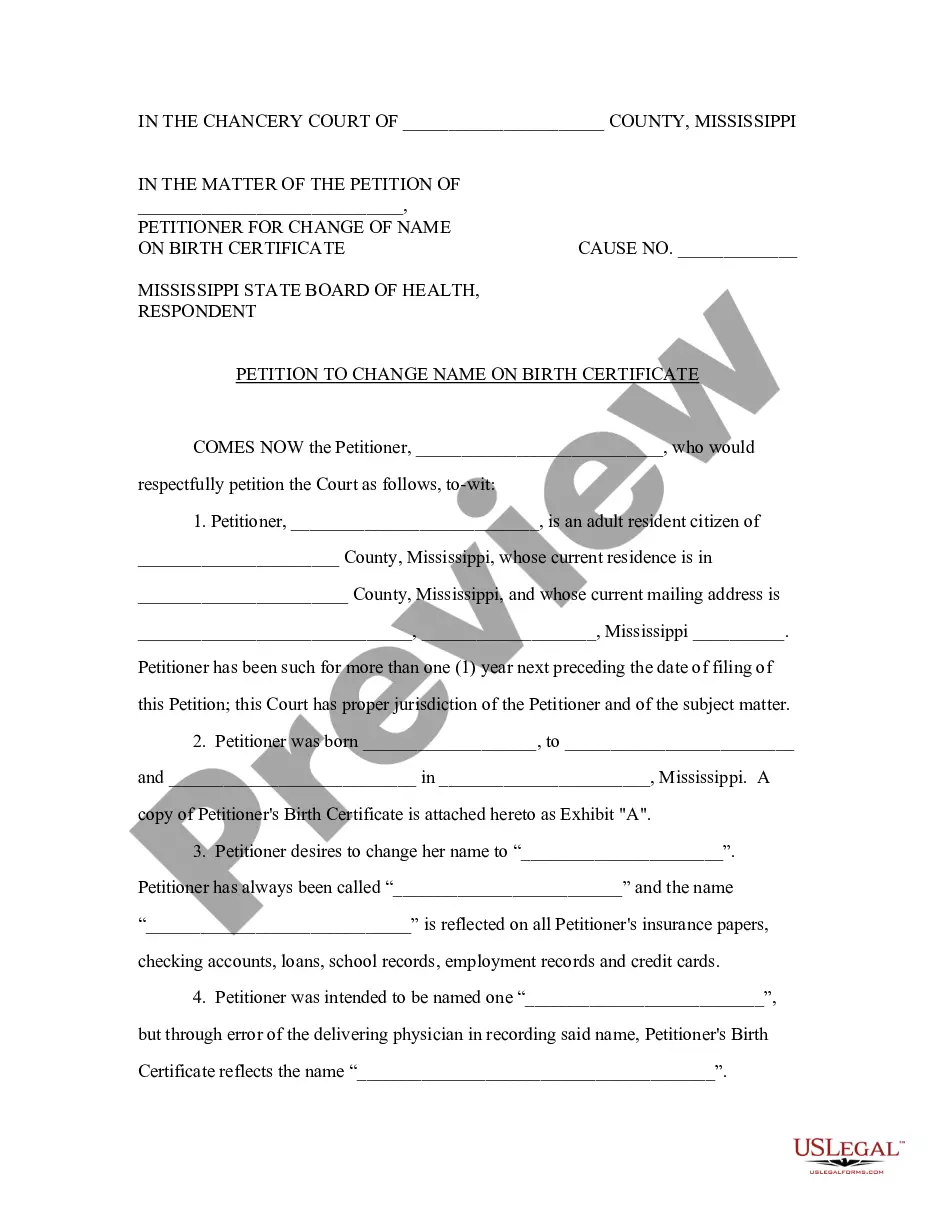

- If the template features a Preview option, utilize it to check the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the debit/visa or mastercard.

- Select a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your effort and time using our service to find, download, and fill out the Form name. Join a huge number of happy clients who’re already using US Legal Forms!

Form popularity

FAQ

There are several ways to produce such proof: If your parents named you, on the form provided by the bank, as the "payable-on-death" (POD) beneficiary of the account, it's simple. You can claim the money by presenting the bank with your parents' death certificates and proof of your identity.

The executor or administrator must complete the claim. If there's more than one executor or administrator, all must be part of the claim. Search online for the unclaimed money. Lodge a claim online for the unclaimed money.

For most states, the dormancy period is five years. When property is officially designated by the state as abandoned or unclaimed, it undergoes a process known as escheatment, where the state assumes ownership of that property until the rightful owner files a claim.

To access the unclaimed property database by telephone, contact the State Controller's Customer Service Unit. California residents can call toll-free, at 800-992-4647 between the hours of AM and PM, Monday through Friday (except holidays). Those outside California may call (916) 323-2827.

In California, property is generally presumed abandoned if it has remained unclaimed by the owner for more than three years after it became payable or distributable.Once abandoned property is turned over to the state by a business, an individual then generally has five years to reclaim.

UNCLAIMED PROPERTY HOLDERS MUST exhaust all options to locate the property's rightful owner before determining to which state they should report the assets. Companies should have policies and procedures in place to track potential unclaimed property and comply with the applicable state reporting requirements.

The best place to begin your search is www.Unclaimed.org, the website of the National Association of Unclaimed Property Administrators (NAUPA). This free website contains information about unclaimed property held by each state. You can search every state where your loved one lived or worked to see if anything shows up.

Claiming Unclaimed Property in California. In California, property is generally presumed abandoned if it has remained unclaimed by the owner for more than three years after it became payable or distributable. However, this time limit varies depending on the type of property involved.

Relatives are entitled to unclaimed money belonging to a deceased family member. Billions of dollars in unclaimed property collects dust each year in the unclaimed property divisions that are maintained by state governments across the country.Unclaimed money can legally be claimed by relatives of a deceased person.