The right of election of a surviving spouse may be waived, wholly or partially, by a written agreement, or by a waiver signed by the surviving spouse. A valid waiver by a surviving spouse of a right of election against a will must meet three requirements:

1. It must be in the form of a written contract or agreement;

2. It must be signed by the party waiving the right; and

3. There must have been fair disclosure.

Certification of Waiver by Attorney for Surviving Spouse

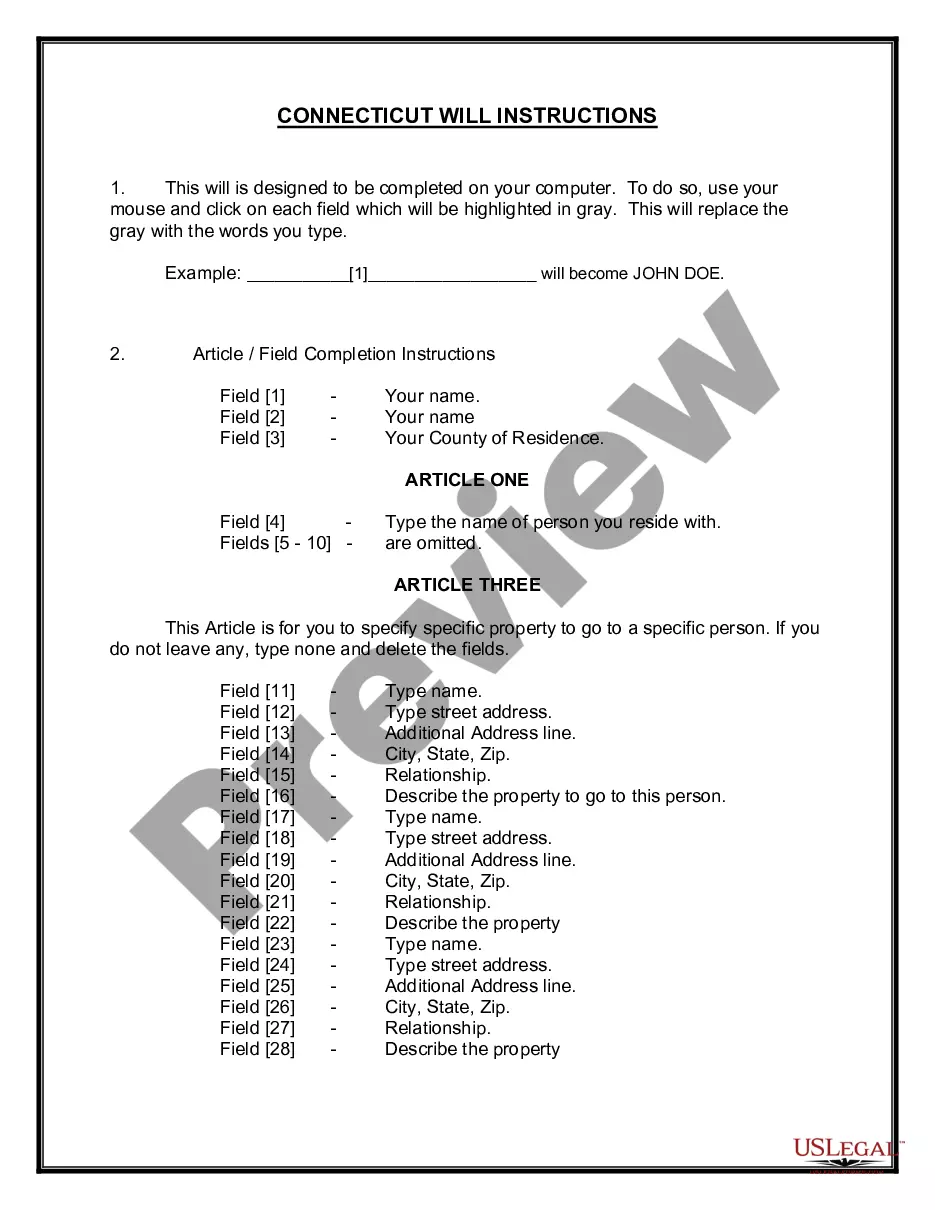

Description

How to fill out Certification Of Waiver By Attorney For Surviving Spouse?

Employ the most comprehensive legal library of forms. US Legal Forms is the perfect platform for getting updated Certification of Waiver by Attorney for Surviving Spouse templates. Our service offers 1000s of legal documents drafted by certified lawyers and categorized by state.

To get a template from US Legal Forms, users just need to sign up for a free account first. If you’re already registered on our platform, log in and select the document you need and buy it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your needs.

- When the form has a Preview function, use it to check the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your requirements.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Choose a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a large number of happy customers who’re already using US Legal Forms!

Form popularity

FAQ

If you die without a valid will, Ohio intestacy laws will decide how your property will be distributed and who will receive your property. The descent and distribution section of the intestate statute favors family members and heirs that are closely related to you.

If your spouse passed away in California without a Trust, you may think you'll need to go through probate. However, in many cases, the surviving spouse does not need to probate the estate of their loved one to gain access to his or her assets. Instead, you may only need to file a Spousal Property Petition.

The laws in Texas surrounding intestate wills for married individuals without children are much simpler. The surviving spouse automatically receives all community property.If there are no surviving parents, siblings or descendants of siblings, the spouse gets the remainder of the estate's separate real property.

However, to change the title to some property, the will must be admitted to probate.For example, if a married person dies, and the couple's property is owned with right of survivorship, the property automatically goes to the surviving spouse.

In Texas, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If you fail to probate a will within the 4 year time period, then the decedent's estate will be treated as though they died intestate without a will. There are specific laws in Texas that govern which heirs are entitled to the estate's assets when a person dies intestate.

If your spouse passed away in California without a Trust, you may think you'll need to go through probate. However, in many cases, the surviving spouse does not need to probate the estate of their loved one to gain access to his or her assets. Instead, you may only need to file a Spousal Property Petition.

If you die without a will or the person named in the will can't serve as executor, the probate court will choose an executor. State law dictates who has priority to serve. The surviving spouse usually has first priority, followed by children. If there is no spouse or children, then other family members may be chosen.

If your spouse passed away in California without a Trust, you may think you'll need to go through probate. However, in many cases, the surviving spouse does not need to probate the estate of their loved one to gain access to his or her assets. Instead, you may only need to file a Spousal Property Petition.