Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

Description

How to fill out Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

Use US Legal Forms to get a printable Sample Letter regarding Articles of Incorporation - Election of Sub-S Status. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library on the web and provides cost-effective and accurate templates for customers and lawyers, and SMBs. The documents are grouped into state-based categories and many of them might be previewed prior to being downloaded.

To download templates, users need to have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

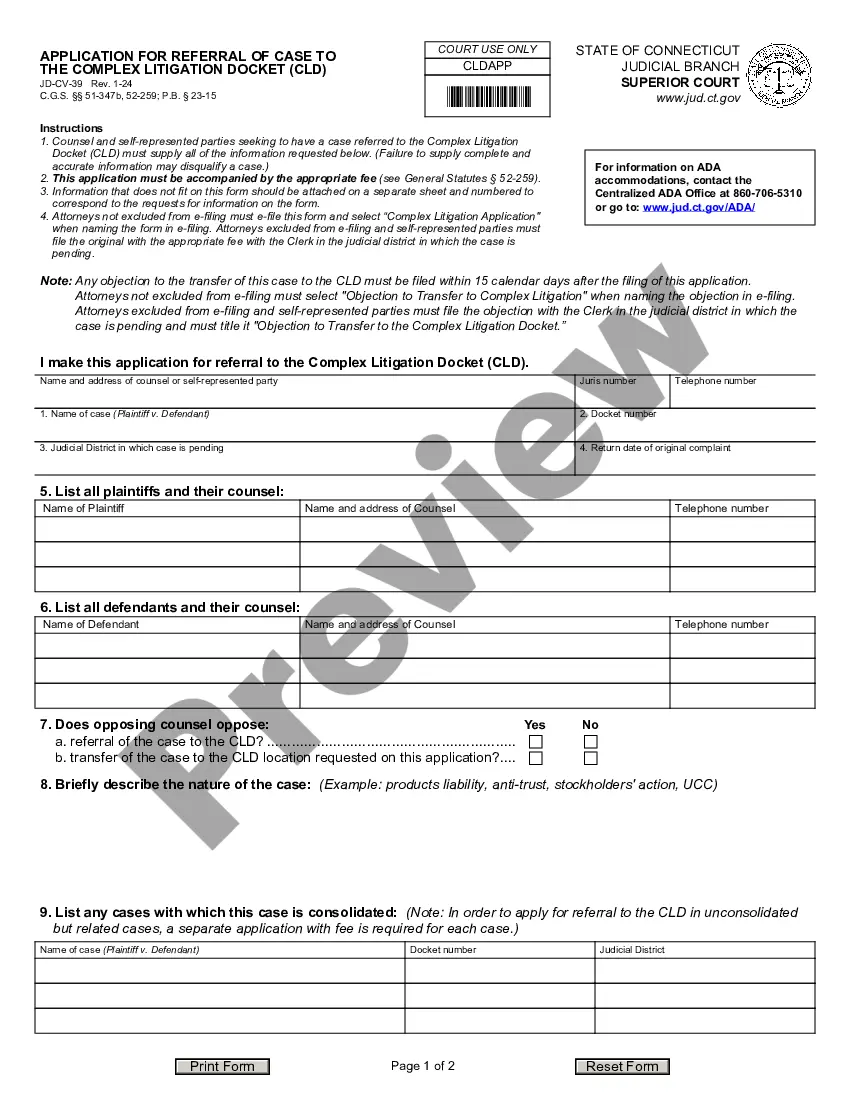

For those who do not have a subscription, follow the tips below to easily find and download Sample Letter regarding Articles of Incorporation - Election of Sub-S Status:

- Check to make sure you get the right form with regards to the state it is needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Sample Letter regarding Articles of Incorporation - Election of Sub-S Status. Above three million users have already utilized our service successfully. Choose your subscription plan and get high-quality documents in a few clicks.

Form popularity

FAQ

A. Employer identification number (EIN): Put your company's EIN here. B. Date incorporated: Write the date your business was incorporated or registered. C. State of incorporation: Enter the state where you formed your business. D. Check if:

Filing options for IRS Form 2553 include mail and fax filing. You cannot file this form online.

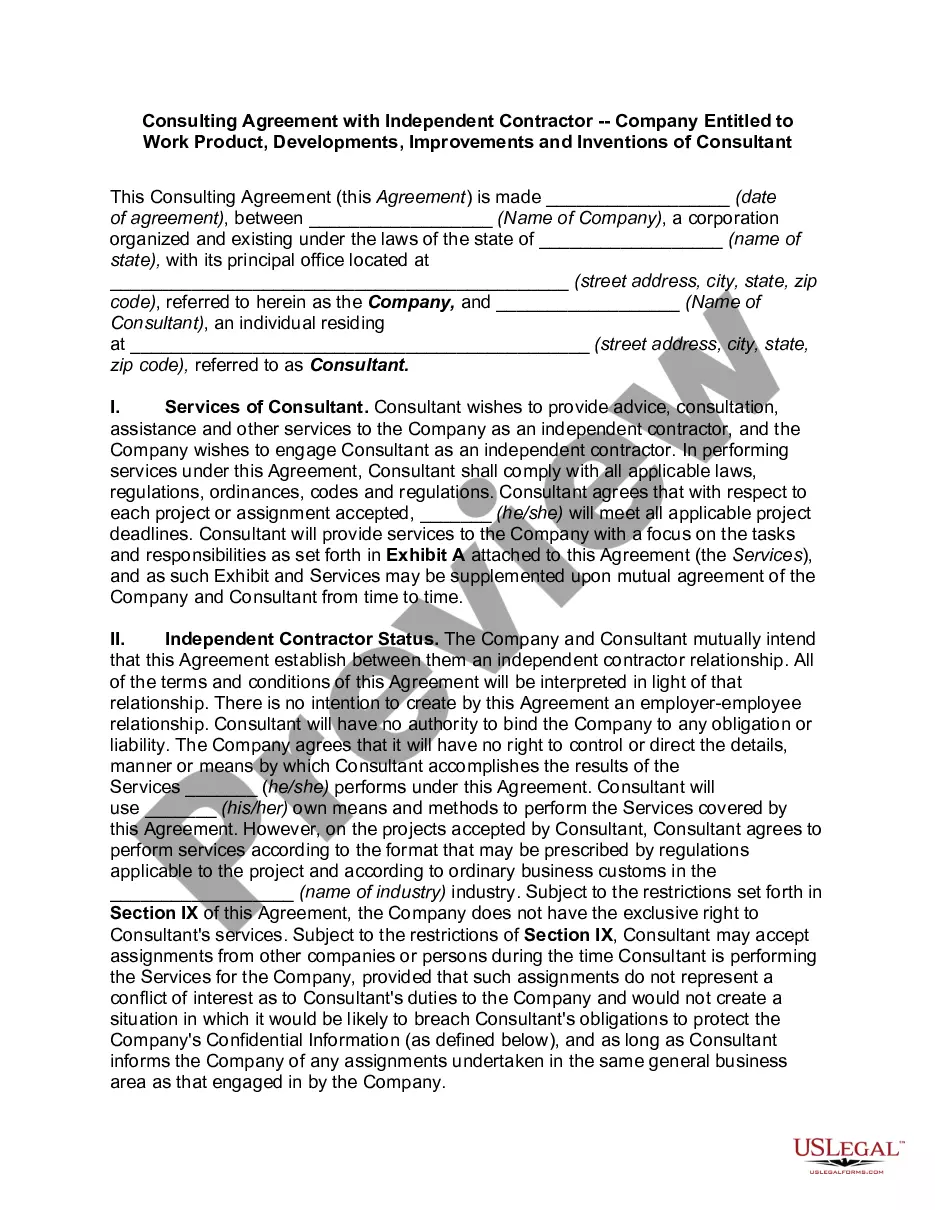

If you're an LLC or partnership, use Form 8832 if you want to be taxed as a C-corp, partnership, or a sole proprietor. Meanwhile, Form 2553 is for LLCs or corporations that want to be taxed as S-corps. Keep this in mind: If you're filing Form 2553, you don't need to file Form 8832.

Although being taxed like an S corporation is probably chosen the least often by small business owners, it is an option. For some LLCs and their owners, this can actually provide a tax saving2248particularly if the LLC operates an active trade or business and the payroll taxes on the owner or owners is high.

You can check your S corp status relatively easily by contacting the IRS. If you have properly submitted your S corporation form to the IRS and have not heard back, you can call the IRS at (800) 829-4933 and they will inform you of your application status.

1the name of your corporation.2your corporation's principal place of business.3the name and address of your corporation's registered agent.4a statement of the corporation's purpose.5the corporation's duration.6information about the number of shares and classes of stock the corporation is authorized to issue.What Are Articles of Incorporation? Nolo\nwww.nolo.com > legal-encyclopedia > articles-incorporation