Sample Letter for Tax Exemption - Review of Applications

Description Tax Exemption Applications

How to fill out Exemption Applications Blank?

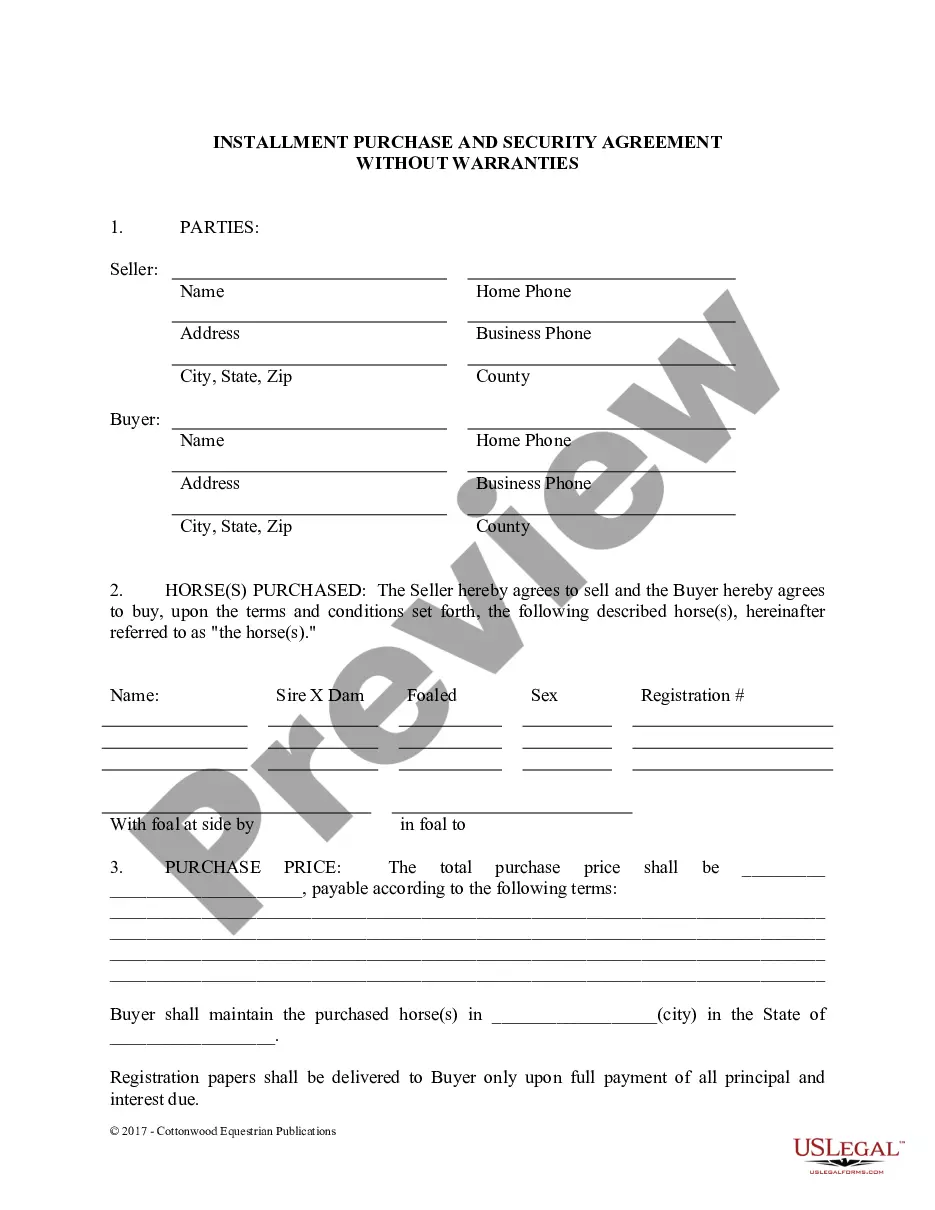

Use US Legal Forms to obtain a printable Sample Letter for Tax Exemption - Review of Applications. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue online and offers affordable and accurate templates for consumers and attorneys, and SMBs. The documents are categorized into state-based categories and a number of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to quickly find and download Sample Letter for Tax Exemption - Review of Applications:

- Check out to make sure you get the proper form in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it is the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Tax Exemption - Review of Applications. More than three million users have already utilized our service successfully. Choose your subscription plan and obtain high-quality documents in a few clicks.

Tax Exemption Request Letter Sample Form popularity

How To Write A Request Letter For Tax Exemption Other Form Names

Sample Letter Tax FAQ

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

A tax exempt letter needs to include the name and contact information of the organization. Then establish the reason for the tax exempt status such as listing what the organization does that will profit the public.

The letter should include basic identifying information, an explanation of the legal obligation and reason for exemption, and clearly state that the writer is claiming the exemption. The Boy Scouts of America and other non-profit organizations can file exemption letters to be excluded from paying taxes.

Incorporate. Apply for an EIN. Provide a detailed business purpose. File Form 1023 with the IRS. Pay the necessary filing fees. When to file. Complete the state-level application (if applicable).

NYSC: Difference Between Exclusion Letter and Exemption Certificate.An exemption certificate is issued to someone who by law could not participate in the NYSC scheme despite the fact that such person attended a regular program in a University or Polytechnic program and graduated.

Name and address of the purchaser. description of the item to be purchased. the reason the purchase is exempt. signature of purchaser and date; and. name and address of the seller.

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

Exemption letter is an official document, which can be issued only by accredited certification body, for products, which do not fall under obligatory certification according to TR CU.Practically this document informs that obligatory certificate is not needed for exact type of product.

A statement declaring the nonprofit's tax-exempt status as a 501c3. The name of the donor that they used to make their gift. The date the the gift was received by your nonprofit. A description of the donation.