Sample Letter for Traffic Accident - Refusal to Pay Requested Damages

Description Minor Car Accident Settlement Letter

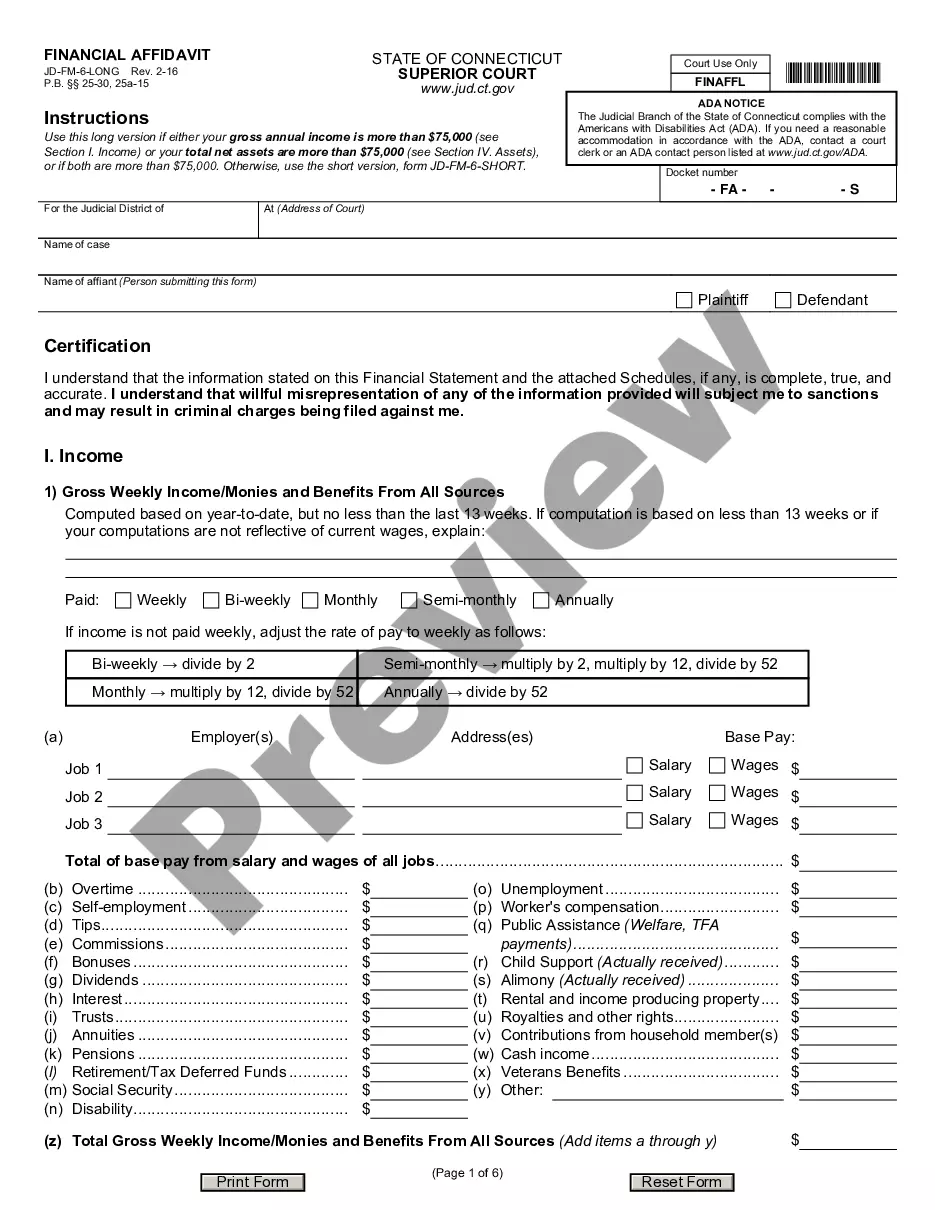

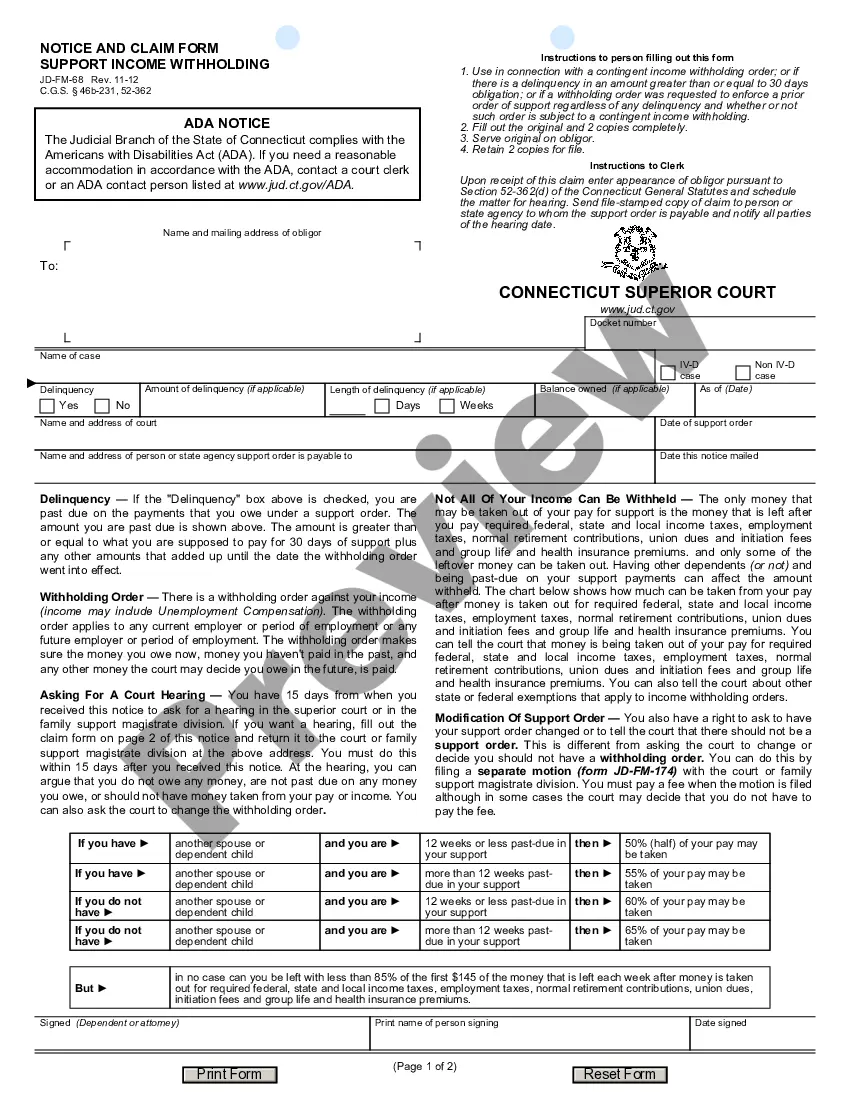

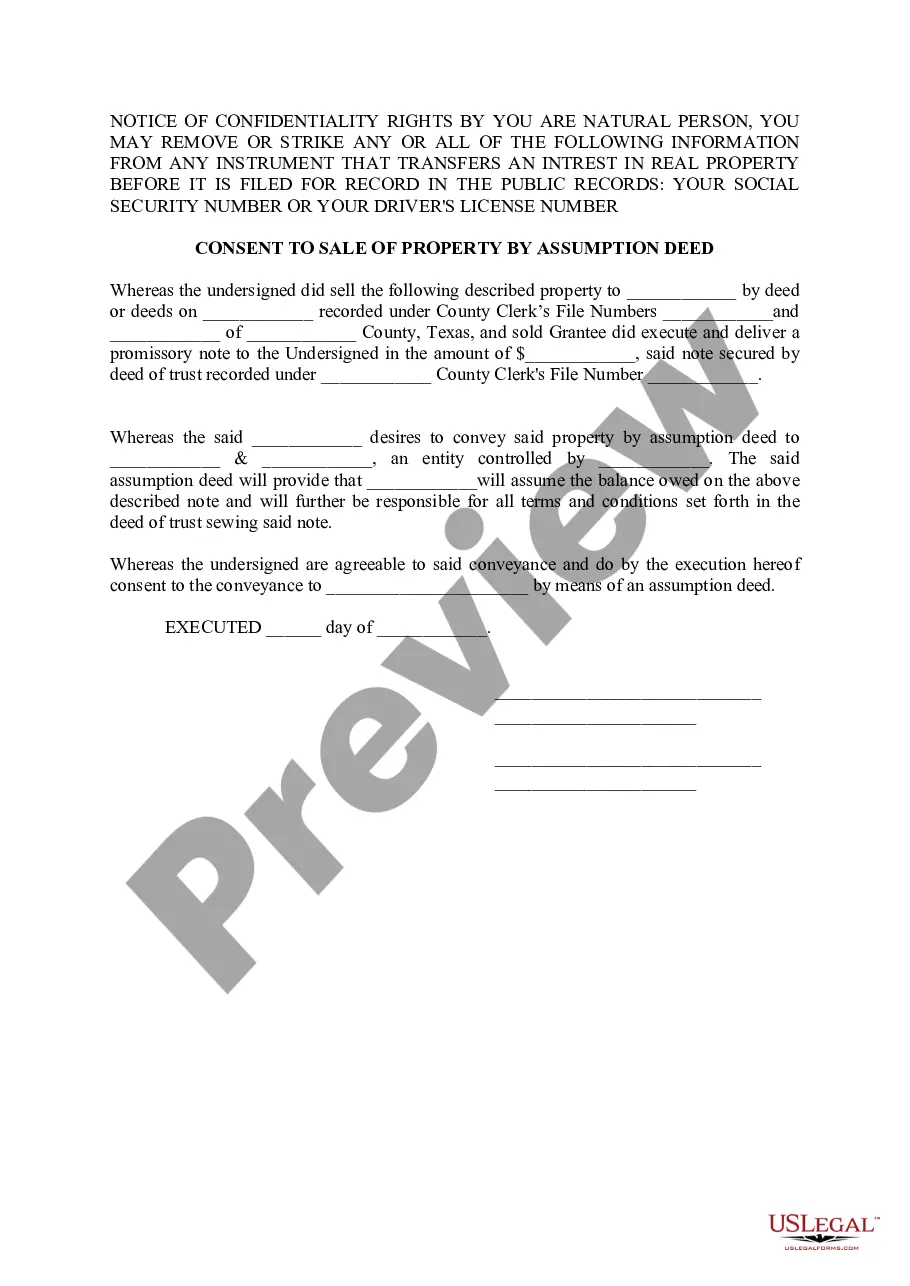

How to fill out Traffic Accident Buy?

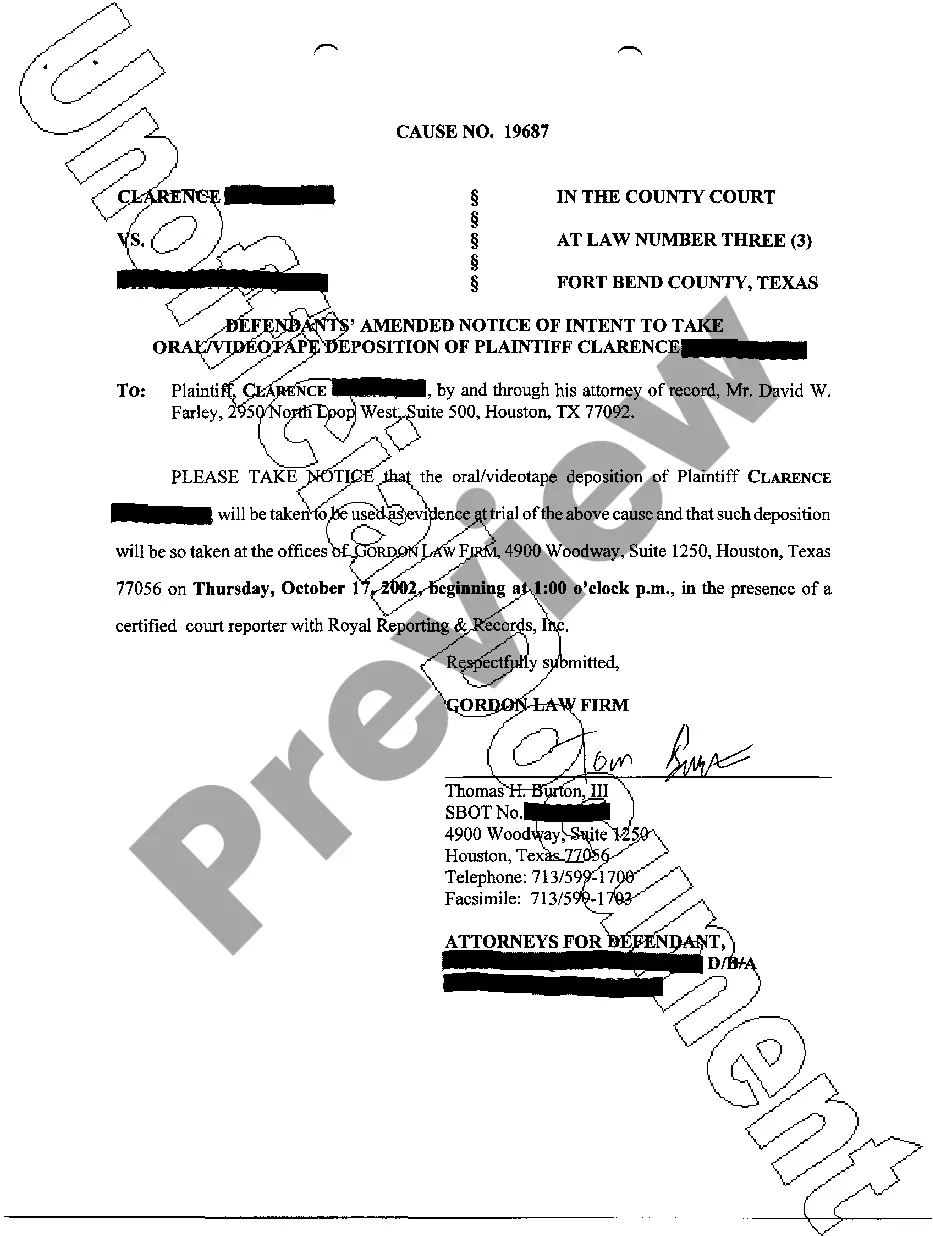

Use US Legal Forms to obtain a printable Sample Letter for Traffic Accident - Refusal to Pay Requested Damages. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and provides reasonably priced and accurate templates for customers and lawyers, and SMBs. The documents are grouped into state-based categories and a few of them can be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Sample Letter for Traffic Accident - Refusal to Pay Requested Damages:

- Check to make sure you get the proper form with regards to the state it is needed in.

- Review the document by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Sample Letter for Traffic Accident - Refusal to Pay Requested Damages. Above three million users have utilized our service successfully. Select your subscription plan and obtain high-quality forms in a few clicks.

Car Accident Settlement Letter Without Insurance Sample Form popularity

Sample Demand Letter For Negligence Other Form Names

Accident Format Letter FAQ

Though insurers may try to refuse payment using the tactics discussed above, if their policyholder is responsible for the accident that caused your injuries, they must pay. If the at fault person does not have insurance, you should be able to rely on your own insurance company to cover your expenses.

What to Do After the Other Party's Insurance Denies Your Claim. If your claim is denied, regardless of how valid you believe it is, you'll most likely need to hire an attorney if you choose to fight the denial. After all, insurers make a profit by taking in more money in premiums than they pay out in claims.

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

Request Your Medical Records. One of the first things you will need to do is request copies of your medical records. Document Your injury. Establish the Extent of Property Damage. Document Your Expenses. Be Organized. Do Not Exaggerate and Do Not Be Greedy. Calculating Pain and Suffering Seek Professional Legal Advice.

Ask For an Explanation. Several car insurance companies are quick to support their own policyholder. Threaten Their Profits. Most insurance companies will do anything to increase their profits. Use Your Policy. Small Claims Court & Mediation. File a Lawsuit.

Unfortunately, insurance companies can and do deny policyholders' claims on occasion, often for legitimate reasons but sometimes not. Whether it's an accident or a stolen car insurance claim that is denied, it is important to understand the major reasons your claim might be denied and what you can do if it happens.

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

You can sue your insurance company if they violate or fail the terms of the insurance policy. Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims.