Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

Utilize the most complete legal catalogue of forms. US Legal Forms is the best place for getting up-to-date Reorganization of Partnership by Modification of Partnership Agreement templates. Our platform offers 1000s of legal forms drafted by licensed lawyers and categorized by state.

To download a template from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the template you need and purchase it. After buying templates, users can see them in the My Forms section.

To get a US Legal Forms subscription online, follow the guidelines below:

- Check if the Form name you’ve found is state-specific and suits your requirements.

- If the form has a Preview function, use it to check the sample.

- In case the template doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template meets your requirements.

- Select a pricing plan.

- Create your account.

- Pay via PayPal or with yourr credit/credit card.

- Select a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort with our platform to find, download, and fill out the Form name. Join a large number of delighted subscribers who’re already using US Legal Forms!

Form popularity

FAQ

An amended return is a return filed after the due date of the original return filed (including extensions). Unlike BBA partnerships, non-BBA partnerships can revise a previous partnership return by filing an amended Form 1065 and Schedules K-1, rather than an AAR.

Having a partnership change in ownership can mean adding or withdrawing partners. Partners can agree to add new partners in two different ways. The partner who's new could buy out part or all of the interest of the current partner or partners.

Contributions. Money, money, money, and where is it coming from? Management. Decision-making. Authority of each partner. Division of profits. Admission of new partners. What if a partner wants to leave the business, or dies? Role of a spouse?

A partnership agreement is a contract that defines each partner's role, liability, and profit distribution.Because it is a legally binding document, you should consult a lawyer before drafting your partnership contract. You are not required to create a partnership agreement.

Correct items on a previously filed Form 1065, Form 1065-B, or Form 1066. Make an Administrative Adjustment Request (AAR) for a previously filed Form 1065, Form 1065-B, or Form 1066.

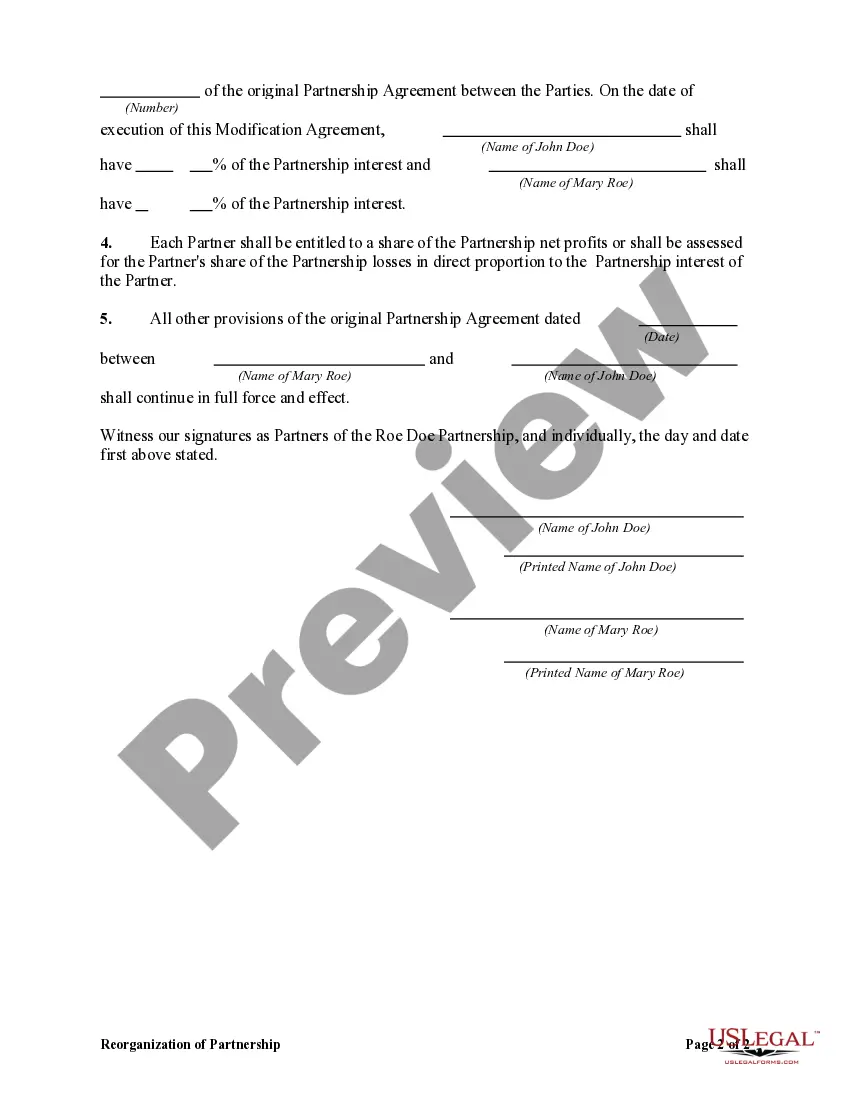

A Partnership Agreement may be amended in accordance with the terms of that agreement.

An amended return is a return filed after the due date of the original return filed (including extensions). Unlike BBA partnerships, non-BBA partnerships can revise a previous partnership return by filing an amended Form 1065 and Schedules K-1, rather than an AAR.

Step 1: Take the mutual consent of partners. Step 2: Prepare for making a supplementary partnership deed. Step 3: Executing supplementary partnership deed. Step 4: Do the filing with Registrar of Firm (RoF).

Most typically, the partnership agreement will be altered to amend the profit and loss sharing ratios for the prior year.Such a change can also have other ancillary effects, such as changing the way nonrecourse liabilities may be shared among the partners under Sec.