A New Business Announcement for Use with Credit Application is a written notification that a new business has been established. This document is typically used to apply for a line of credit with a lender or creditor. It provides information such as the business name, address, contact information, and the type of business. It also includes the names and contact information of the business owners, as well as any other pertinent information. Types of New Business Announcement for Use with Credit Application include: * Startup Business Application: Used when applying for a line of credit for a new business. * Expansion Business Application: Used when applying for a line of credit to expand an existing business. * Change of Ownership Business Application: Used when applying for a line of credit for a business that has changed ownership.

New Business Announcement for Use with Credit Application

Description

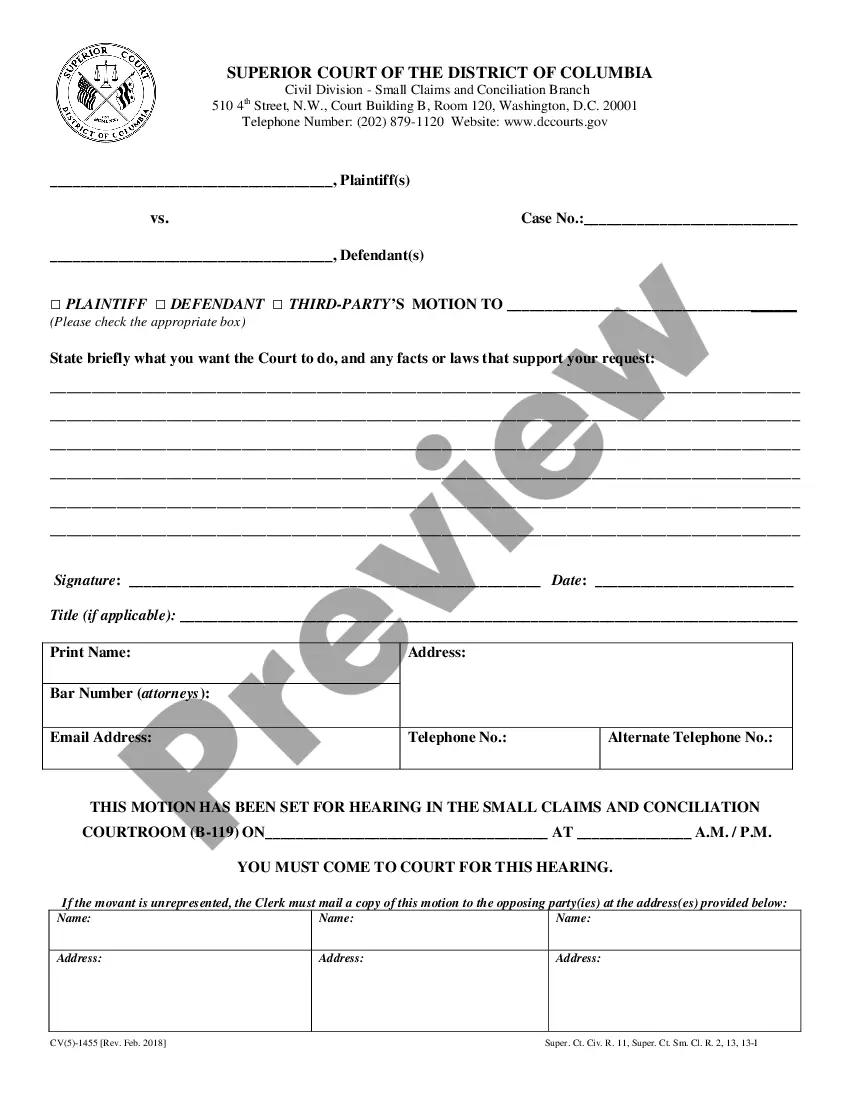

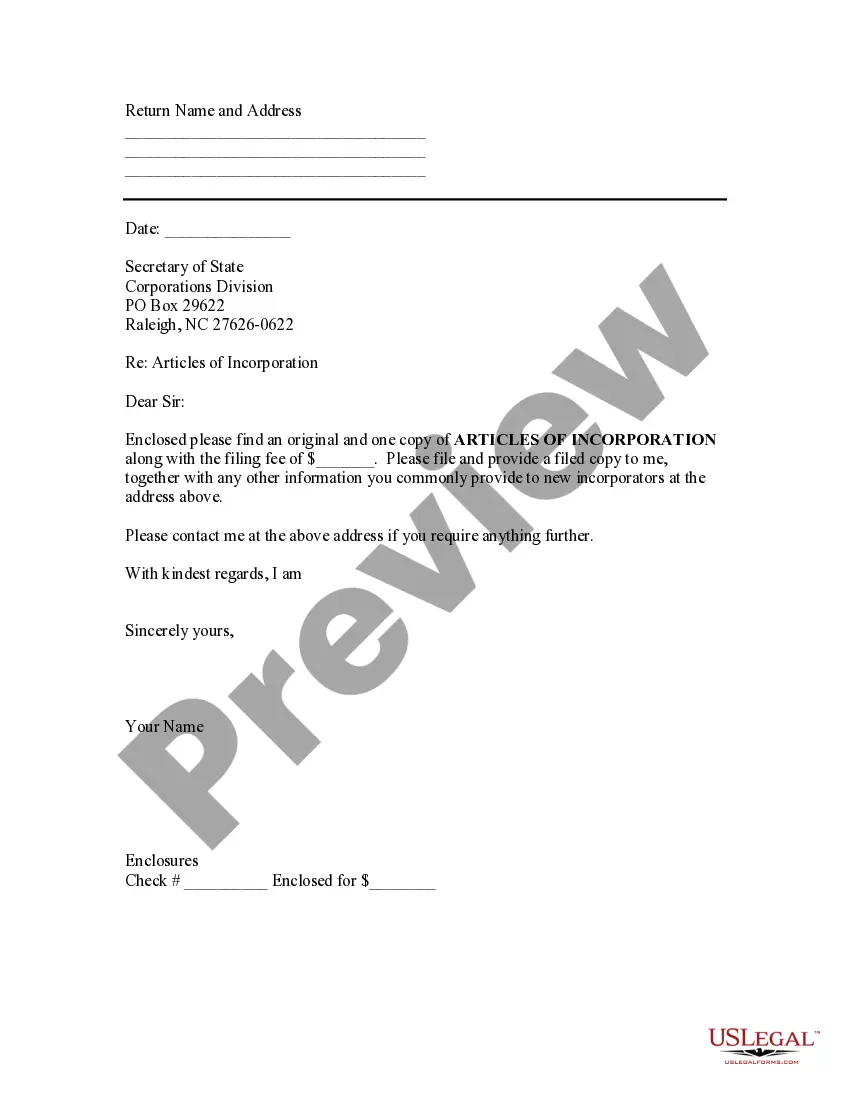

How to fill out New Business Announcement For Use With Credit Application?

Coping with legal paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New Business Announcement for Use with Credit Application template from our service, you can be sure it meets federal and state regulations.

Working with our service is easy and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your New Business Announcement for Use with Credit Application within minutes:

- Make sure to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New Business Announcement for Use with Credit Application in the format you need. If it’s your first time with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the New Business Announcement for Use with Credit Application you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

defined credit application provides the basis for gathering information and implementing the company's policies. The credit application is the primary document which allows the credit professional to ?Know Your Customer (KYC).? It may also serve as a contract.

The purpose of a business credit application is to assess the creditworthiness of the business seeking credit and to determine the level of risk involved in extending credit to that business.

The credit application (Application) is the. initial document used by Vendors to collect. information and establish contractual terms. with the Applicant.

A credit application helps prevent delinquent payments and financial loss. An accurate and up-to-date credit application is one of the best ways to minimize risk. The application also allows the company to better implement their credit policy.

A business credit application form is used by businesses to request funding or lines of credit with a bank through the business's website.

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.