Sample Letter for Promotional Letter - Insurance

Description

How to fill out Sample Letter For Promotional Letter - Insurance?

Use US Legal Forms to get a printable Sample Letter for Promotional Letter - Insurance. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms library on the web and provides reasonably priced and accurate templates for consumers and legal professionals, and SMBs. The templates are grouped into state-based categories and some of them can be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download Sample Letter for Promotional Letter - Insurance:

- Check out to ensure that you get the right form in relation to the state it is needed in.

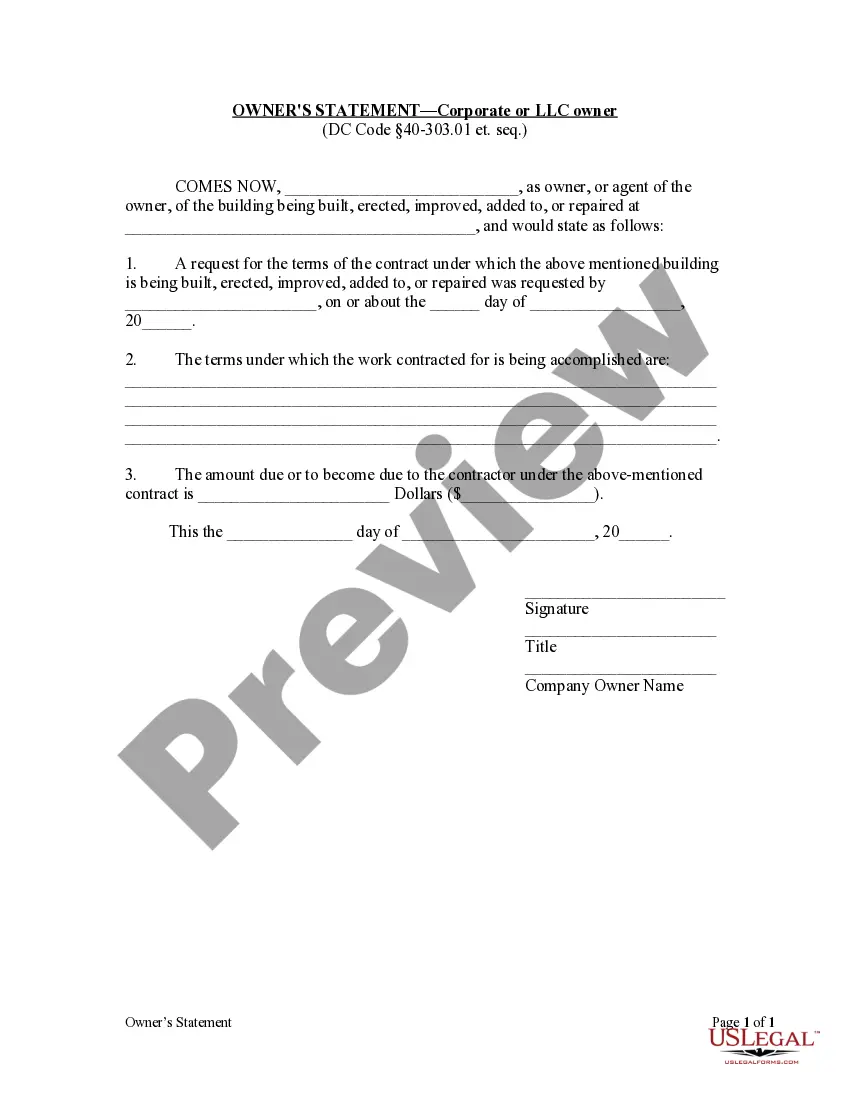

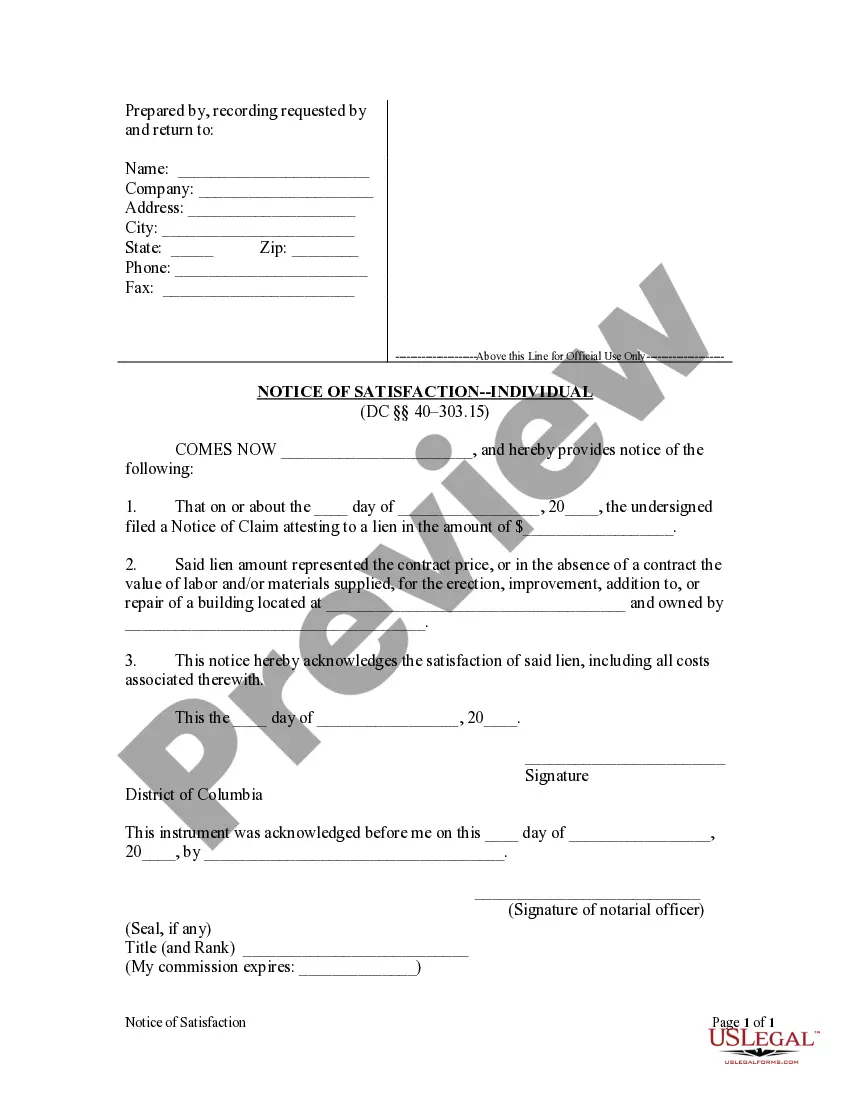

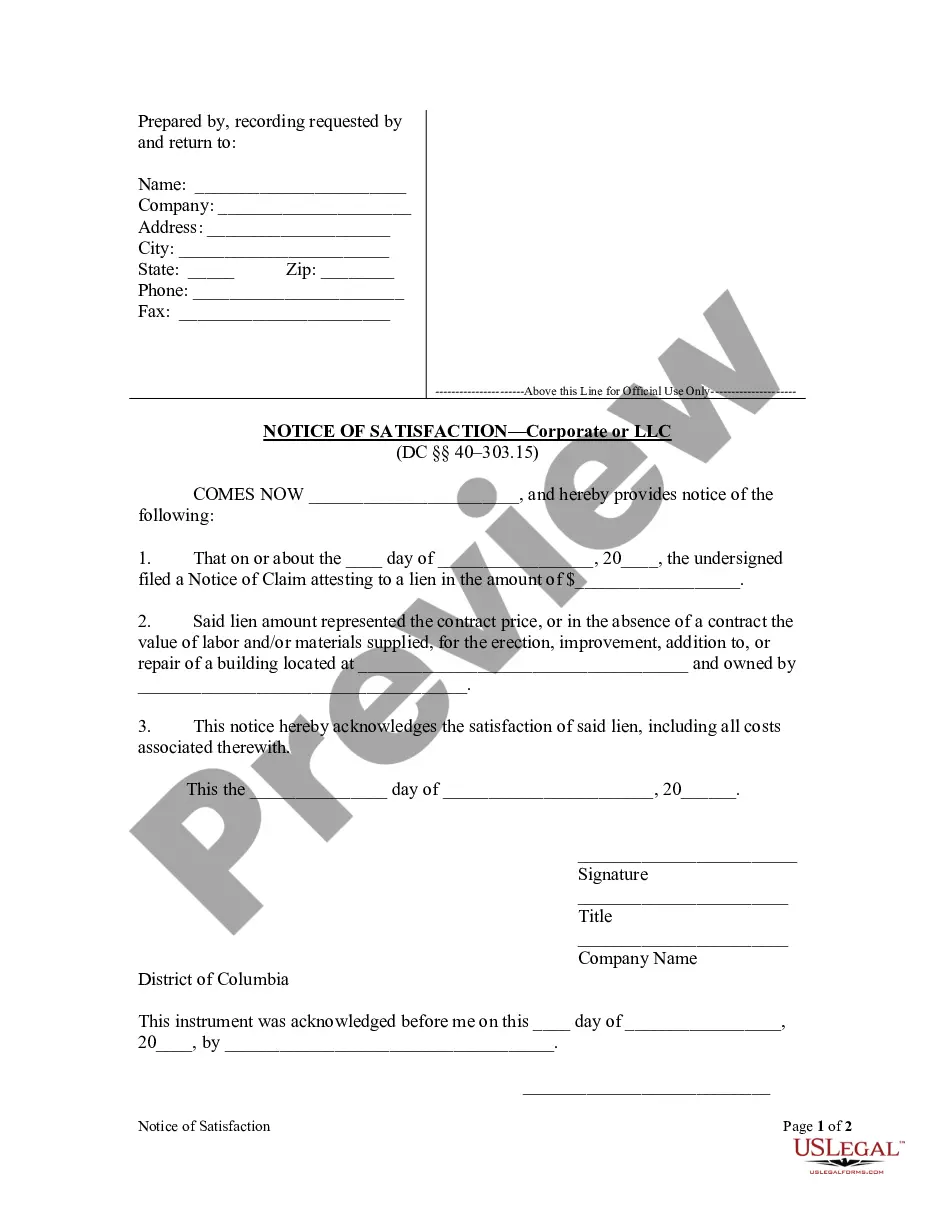

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it’s the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search field if you need to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Promotional Letter - Insurance. More than three million users have used our platform successfully. Select your subscription plan and have high-quality forms within a few clicks.

Form popularity

FAQ

Patient name, policy number, and policy holder name. Accurate contact information for patient and policy holder. Date of denial letter, specifics on what was denied, and cited reason for denial. Doctor or medical provider's name and contact information.

Sir, I am writing this letter to claim my health insurance as I am suffering from heart disease (Actual cause). Doctors at (Hospital name) have informed me about the surgery that I have to undergo next week which costs approximately (amount of money) including medicine charges.

Use People's Names. Address the recipient by name, so that your message appears personal. Explain Why You're Writing. State why you're writing the letter, using persuasive language that pulls the reader in. Explain What You Offer. Be Concise. Include a Call-to-Action. Use an Appealing Subject Line. Follow Up.

Be the customer as you write. This is the most important aspect of a good sales letter, but it's often overlooked. Organize your letter. Make it easy to read. Capture your reader's attention. Get your readers interested. Make your readers want your product or service. Ask your readers to take action.

The claimant should write the letter as early as possible after the occurrence of the incidence. Mention the intend of writing your claim letter. State the incident clearly with the date of occurrence. Most importantly mention your Policy number and Your Identity.

Letter date. Your full name and contact information. Injury date and location. Brief description of the incident, such as car accident or slip and fall The at-fault party's name and contact information. The at-fault party's insurance policy number, if available.

In the subject line, list your policy's reference number. You should open your letter by stating the purpose of your claim in your first body paragraph. List what injuries, property damage, or loss you have sustained and give a brief description of the event that has prompted your claim.

Letter date. Your full name and contact information. Injury date and location. Brief description of the incident, such as car accident or slip and fall The at-fault party's name and contact information. The at-fault party's insurance policy number, if available.

(name of doctor). The operation is expected to be done on 6th September. I, therefore, request you to intimate my insurance company so that my claim may be settled in due time. I am attaching the photocopies of the medical advice letter, health insurance policy details, and his health card.