Sample Letter for Notice to Debtor of Assignment of Debt

Description Notice Debtor

How to fill out Notice Debtor Assignment?

Among countless free and paid samples that you’re able to get on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they’re skilled enough to take care of the thing you need them to. Always keep calm and use US Legal Forms! Find Sample Letter for Notice to Debtor of Assignment of Debt templates created by professional lawyers and get away from the high-priced and time-consuming process of looking for an lawyer or attorney and after that paying them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access your earlier saved documents in the My Forms menu.

If you are utilizing our service the first time, follow the tips listed below to get your Sample Letter for Notice to Debtor of Assignment of Debt with ease:

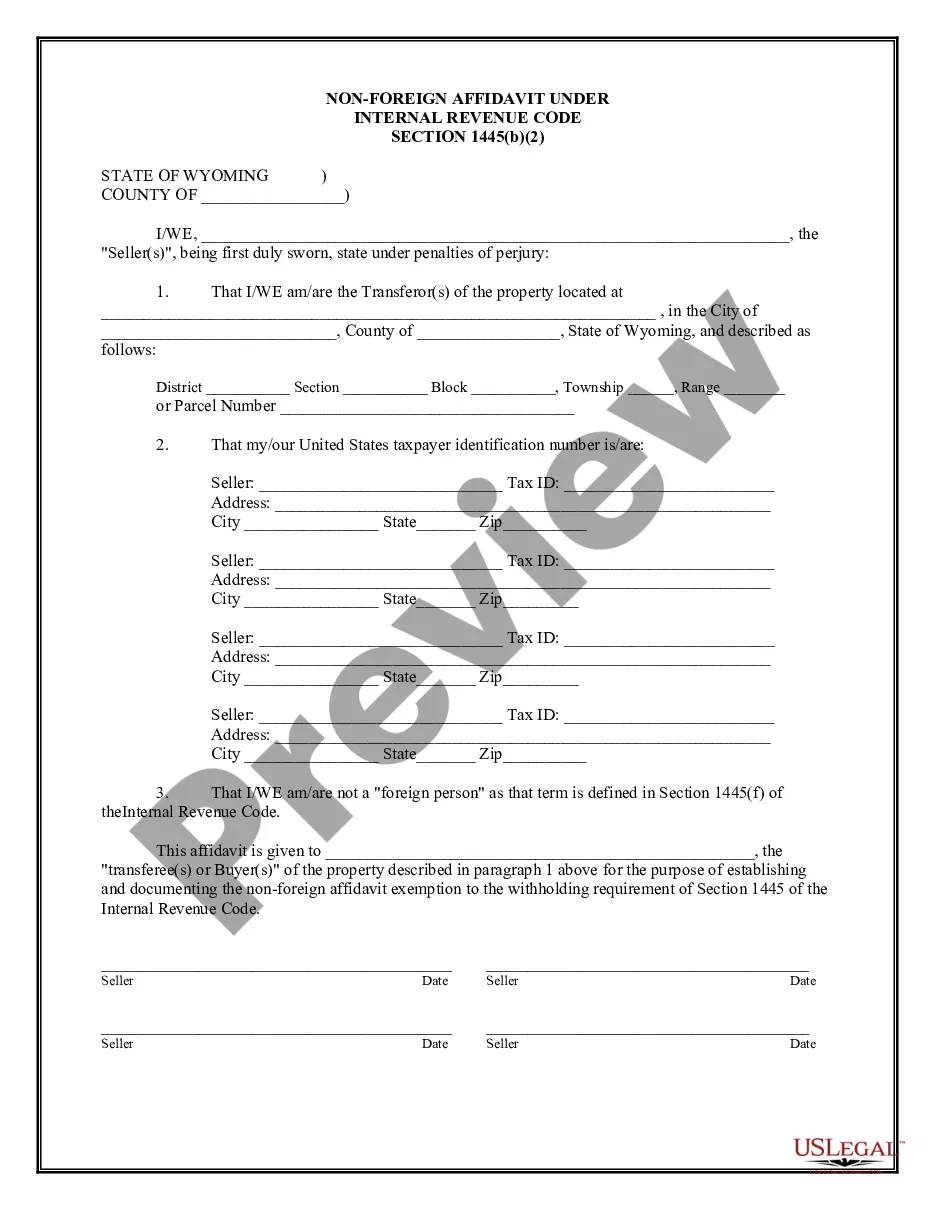

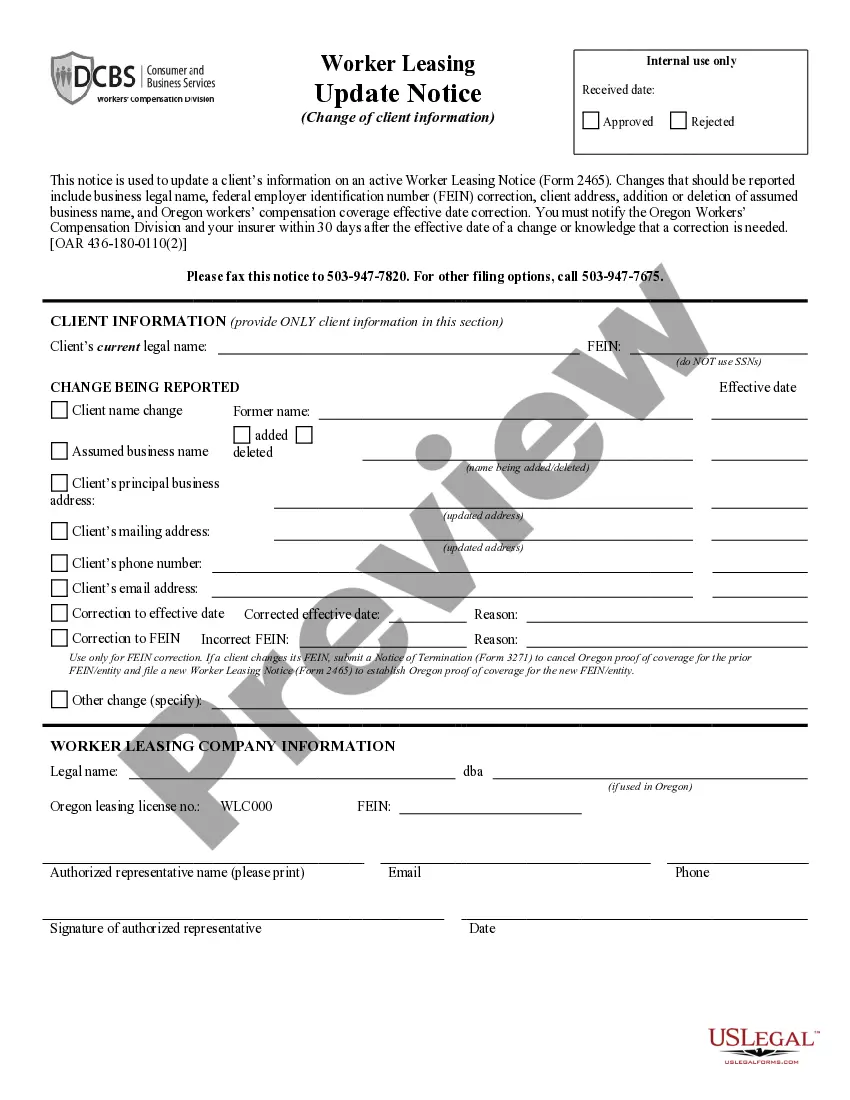

- Ensure that the file you discover applies in your state.

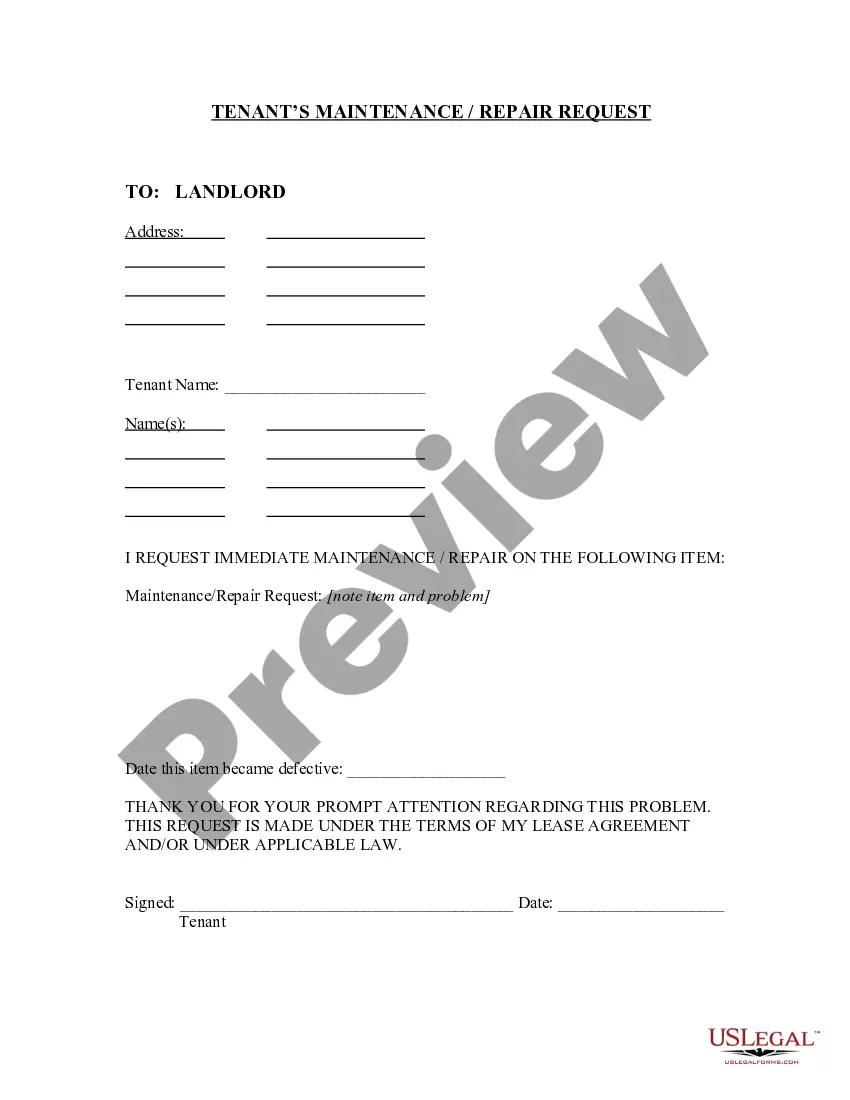

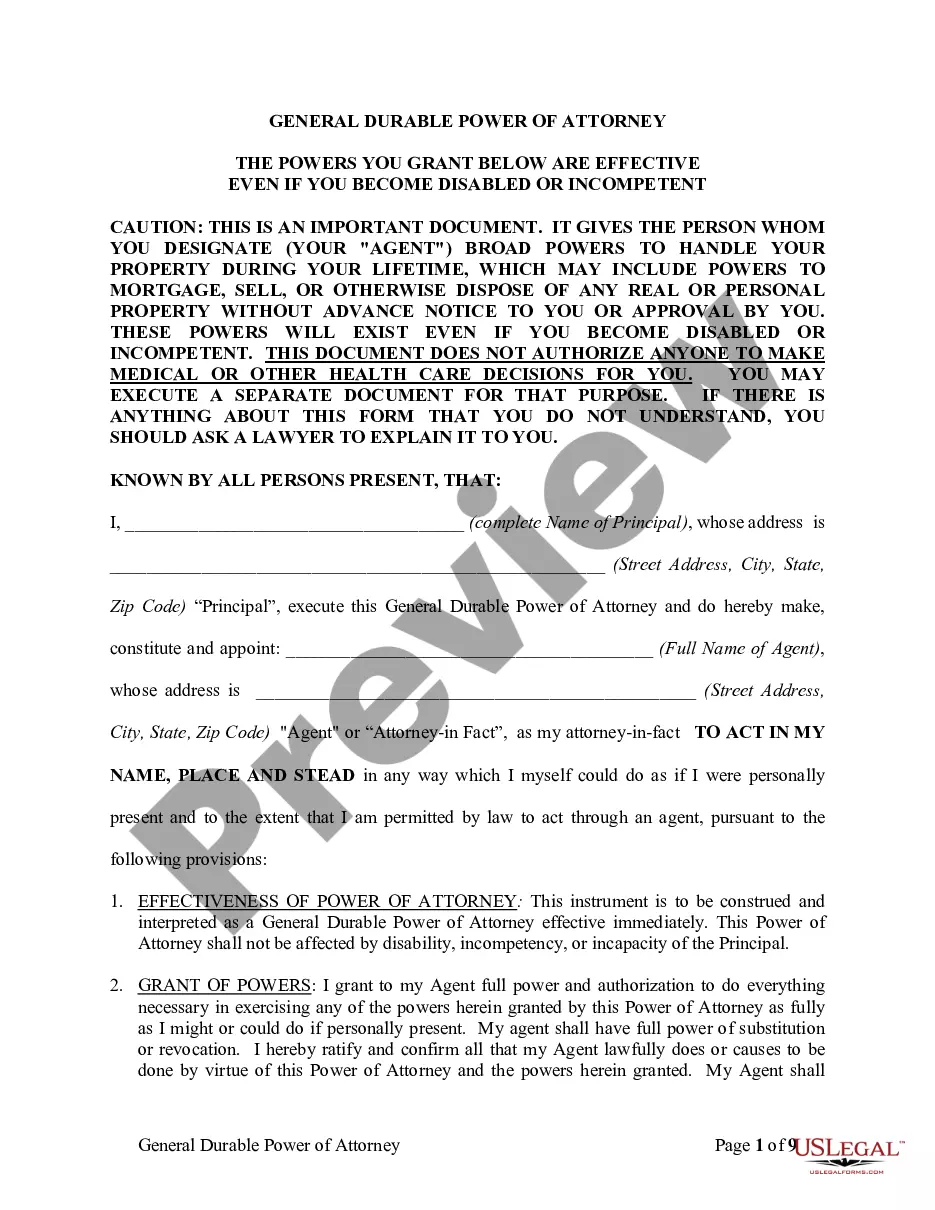

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another template using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you’ve signed up and bought your subscription, you may use your Sample Letter for Notice to Debtor of Assignment of Debt as often as you need or for as long as it remains active where you live. Change it with your preferred editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Letter Debt Sample Form popularity

Debt Form Pdf Other Form Names

Sample Debtor FAQ

The creditor and/or debt collectors name. The date the letter was drafted. Your name. Your account number.

When writing the letter, it is crucial to use a simple and professional language. Do not be harsh or threat the debtor in your letter as it can turn the tables against you. The letter should be addressed to the debtor's home address or any other address that the debtor has provided before.

Use a letterhead. Outline the facts/story leading up to the demand letter in a chronological manner. State the legal basis for your claim. State how you will pursue legal action if your demand is not met, and include a timeline within which the demand is to be met.

When writing letters to debtors, especially those asking for payment, you need to be professional. Start with a friendly letter and if the failure to pay continues, get progressively more serious. Provide important details about the debt - state how much is owed and when the payment should be made.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

The answer is that is it is actually perfectly legal for them to sell your debt to another company. When you sign a credit agreement there will have been a clause within the fine print. This will have stated that they are able to assign their rights to a third party.

Know What to Include A demand letter should include the name of the creditor, the amount owed, action required, debt reference, deadline, and the consequences. Ensure you include all these details so your letter is not only compliant with the FDCPA, but also practical.

Debts may be assigned by the creditor to another party, the assignee, who may then proceed with further legal action to recover the debt.