Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

Among numerous paid and free samples that you get online, you can't be certain about their accuracy. For example, who made them or if they’re skilled enough to take care of what you need those to. Keep relaxed and use US Legal Forms! Find Sample Letter for Notice of Charge Account Credit Limit Raise samples made by professional lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and after that paying them to draft a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your previously saved templates in the My Forms menu.

If you’re making use of our service the very first time, follow the guidelines listed below to get your Sample Letter for Notice of Charge Account Credit Limit Raise quickly:

- Make sure that the document you see is valid in the state where you live.

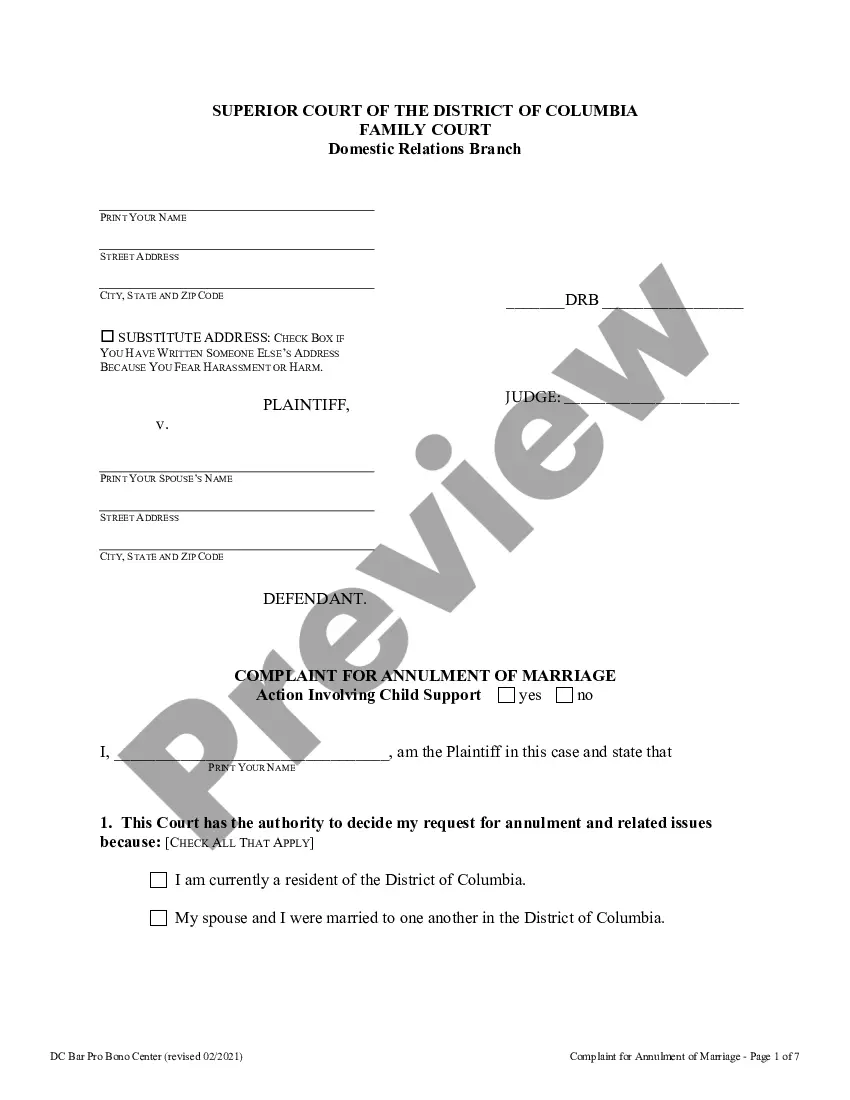

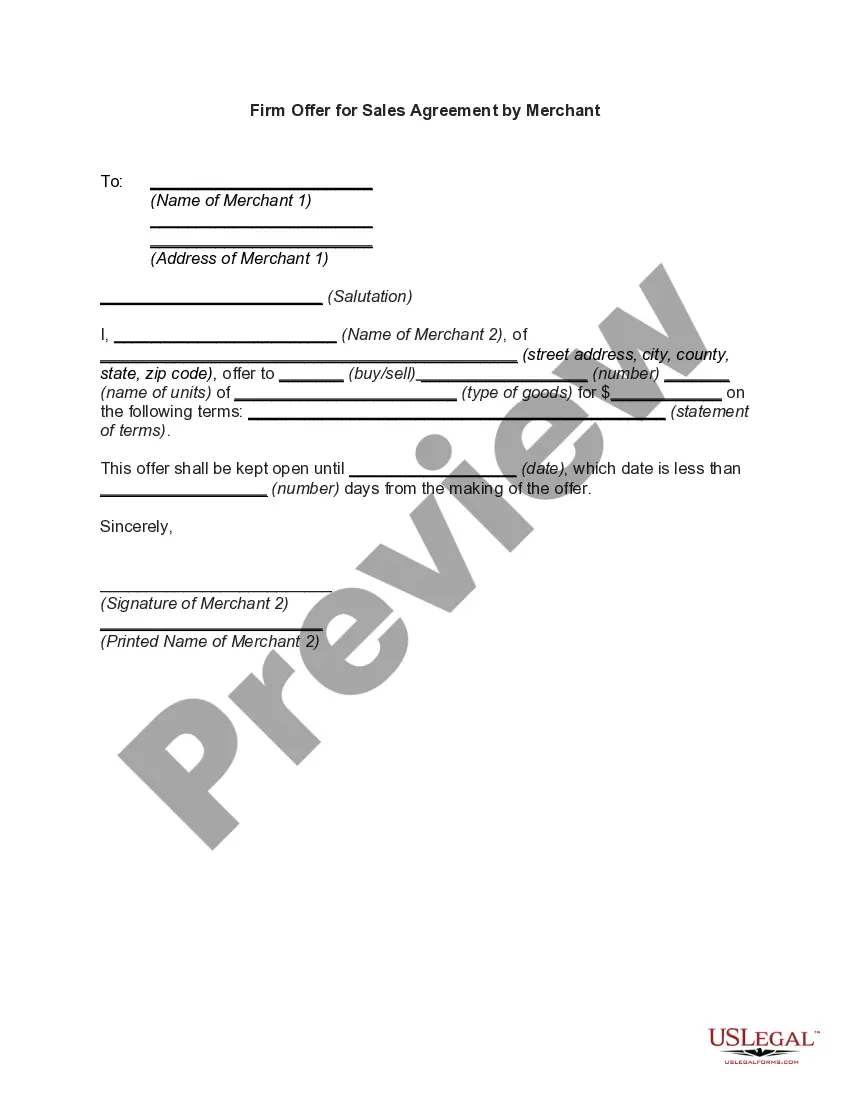

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and bought your subscription, you may use your Sample Letter for Notice of Charge Account Credit Limit Raise as often as you need or for as long as it continues to be active where you live. Revise it in your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

Your credit card company may decide to automatically increase your credit limit. This decision could depend on factors like how long your account has been open and whether you've used your credit responsibly. You could also request an increase yourself.

Your credit card company may decide to automatically increase your credit limit. This decision could depend on factors like how long your account has been open and whether you've used your credit responsibly. You could also request an increase yourself.

Generally, this may include using your card regularly, making on-time payments greater than the required minimum, using your card wisely by staying under the credit limit, and linking your bank account. When you become eligible for a credit limit increase, we will notify you by email with your new limit.

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.Best Cash Back Credit Cards.

If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.If you decide it's the right time to up your limit, either call customer service or request a credit limit increase online.

Apply for a New Card with a Higher Credit Limit. Pick an Existing Card to Request an Increase On. Plead Your Case, But Don't be Desperate. Don't Be Greedy When Requesting an Increase. Entice Them with a Balance Transfer. Wait For an Increase to Occur Naturally.

Mention your reason for needing more credit. Tell the creditor how good your previous record has been. The tone of your letter should be formal, and the language should be unambiguous and objective. Get directly to the point and request the creditor an increase in your credit limit.

Pay your bills on time. Ask the card company to raise your credit limit. Apply for a new card with a higher limit. Balance transfer. Roll two cards into one. Increase your income. Wait for an Automatic Credit Limit Increase. Increase your Security Deposit.