Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description S Corp Corporation

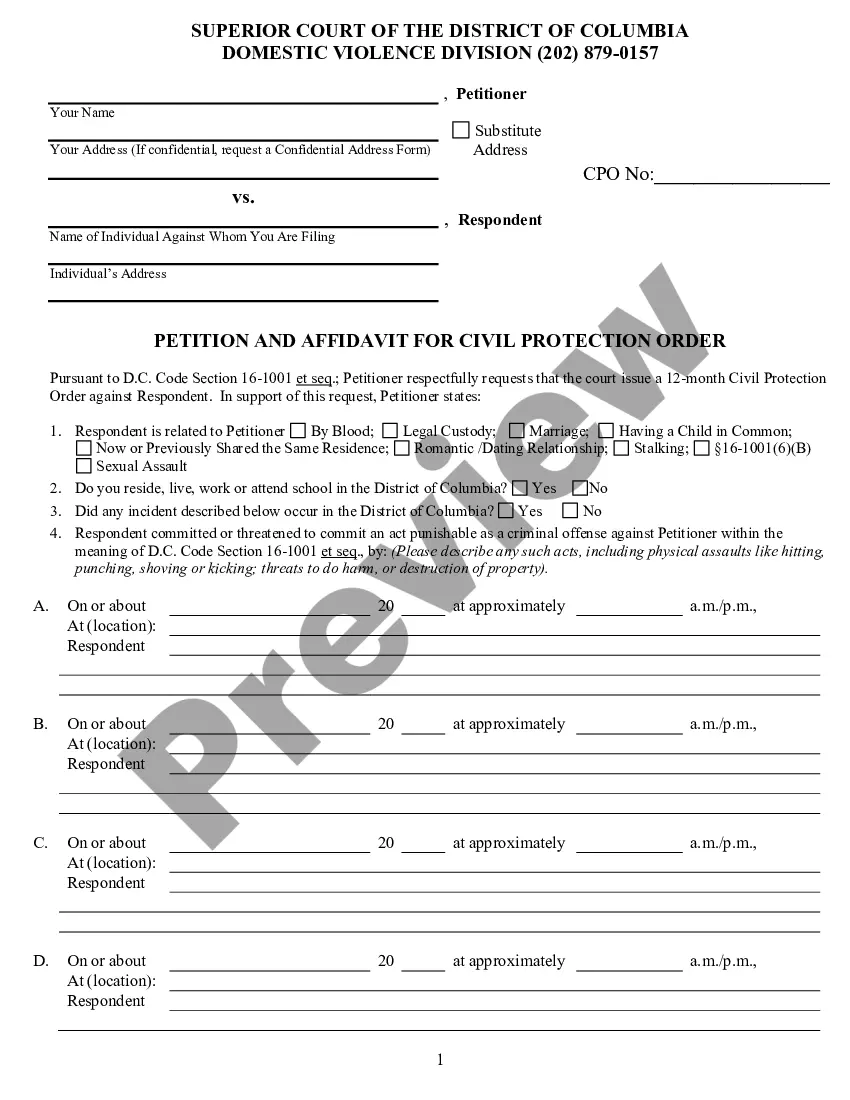

How to fill out Small Business Section 1244?

Employ the most extensive legal catalogue of forms. US Legal Forms is the best platform for getting updated Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock templates. Our service provides thousands of legal forms drafted by certified attorneys and grouped by state.

To obtain a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the document you are looking for and buy it. After buying templates, users can find them in the My Forms section.

To get a US Legal Forms subscription on-line, follow the guidelines below:

- Find out if the Form name you have found is state-specific and suits your needs.

- If the template features a Preview function, utilize it to check the sample.

- In case the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the sample.

- As soon as it is downloaded, print it and fill it out.

Save your effort and time with the platform to find, download, and fill in the Form name. Join a large number of delighted clients who’re already using US Legal Forms!

S Corp Form Form popularity

S Corp Pdf Other Form Names

Small Business 1244 FAQ

HW: How are gains from the sale of § 1244 stock treated?The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

The stock must be issued by U.S. corporations and can be either a common or preferred stock. The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.

To qualify as IRC Sec. 1244 stock, the stock must be issued by a domestic corporation, and it must be either voting or non- voting common stock. Preferred stock may not qualify as IRC Sec.

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec.If the stock is subsequently sold at a loss or becomes worthless, such losses may be treated as ordinary losses rather than capital losses.

Any excess over $3,000 must be carried over to the next year. A loss on Section 1244 stock, on the othe hand, is deductible as an ordinary loss up to $50,000 ($100,000 on a joint return, even if only one spouse has a Section 1244 loss). A big difference! Note that ordinary losses are noramally 100% deductible.

Gains from the sale of Section 1244 stock are treated as regular long-term capital gains, but losses are treated as ordinary losses (maximum characterized as ordinary is $100,000 for married filing jointly and $50,000 for others).