Sample Letter for Request for Payment - Credit Line Exceeded

Description Sample Credit Line Buy

How to fill out Sample Credit Line Contract?

Among numerous free and paid templates which you find online, you can't be certain about their accuracy. For example, who created them or if they are skilled enough to take care of what you require these people to. Keep relaxed and utilize US Legal Forms! Discover Sample Letter for Request for Payment - Credit Line Exceeded samples developed by skilled lawyers and avoid the expensive and time-consuming process of looking for an lawyer or attorney and then paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access all your earlier saved documents in the My Forms menu.

If you’re making use of our website the very first time, follow the tips listed below to get your Sample Letter for Request for Payment - Credit Line Exceeded quickly:

- Make certain that the file you discover applies where you live.

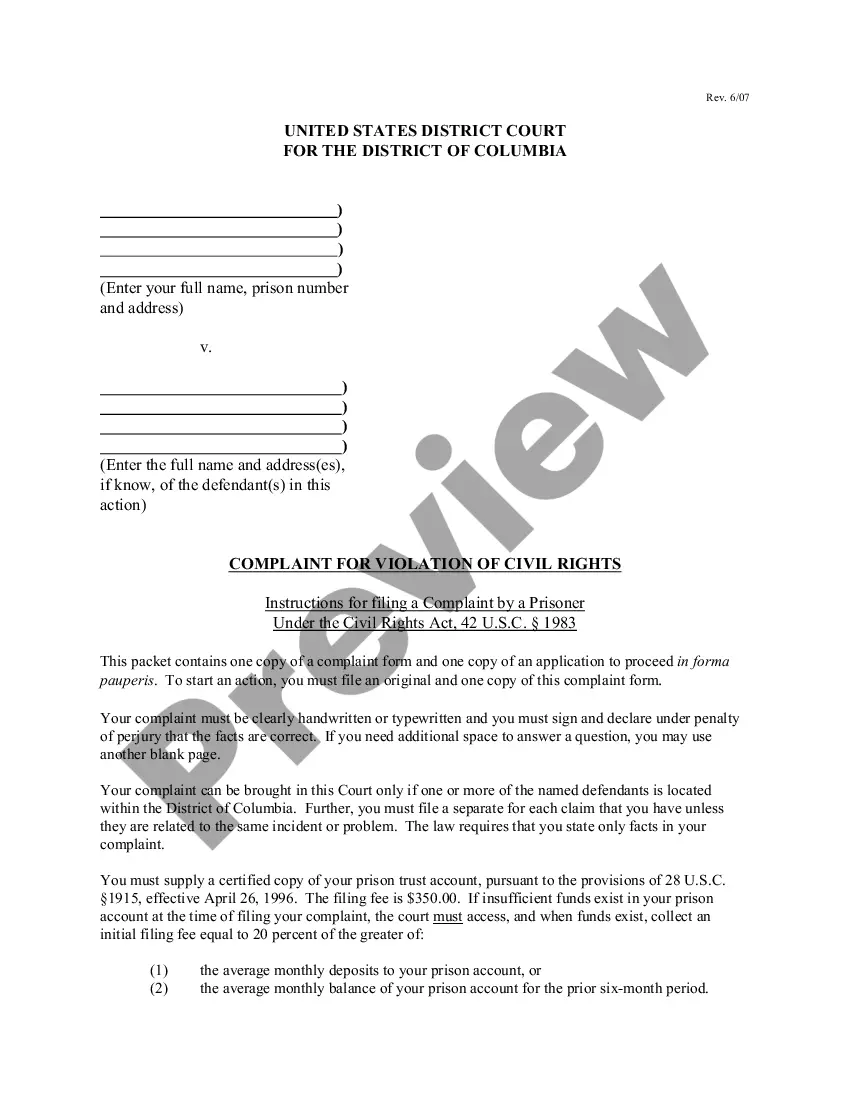

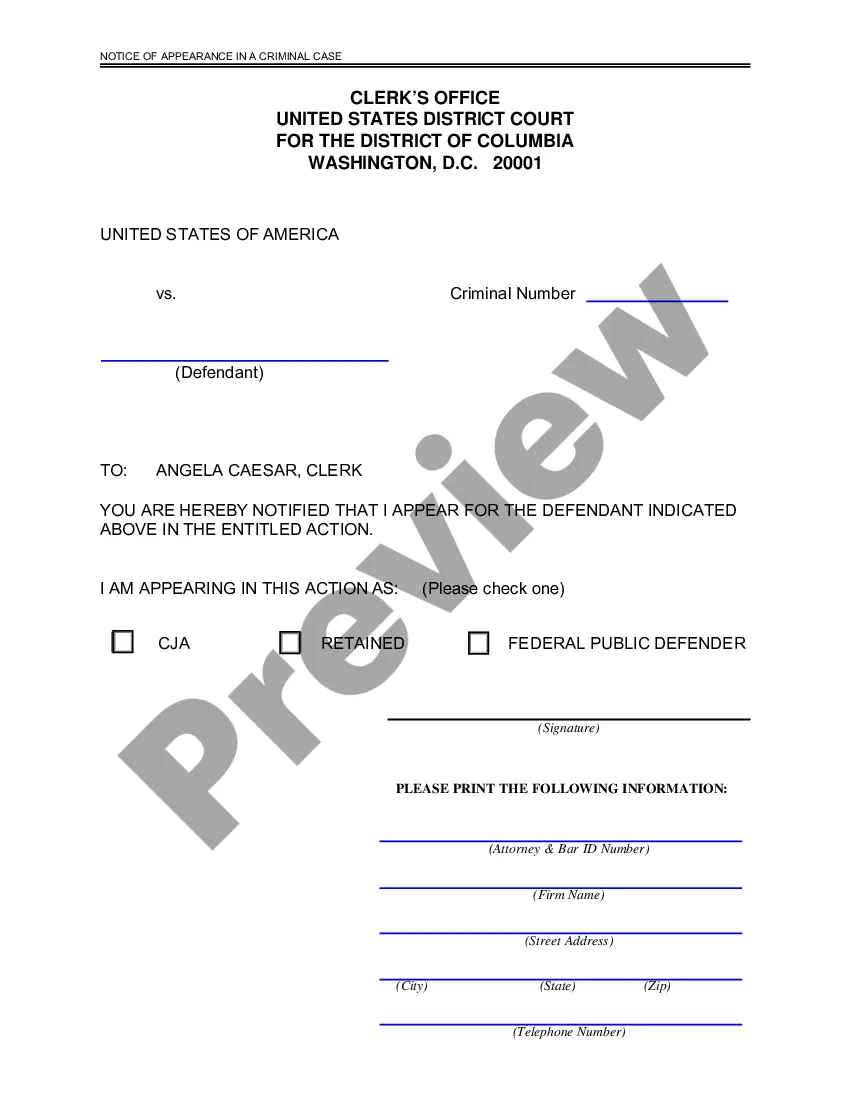

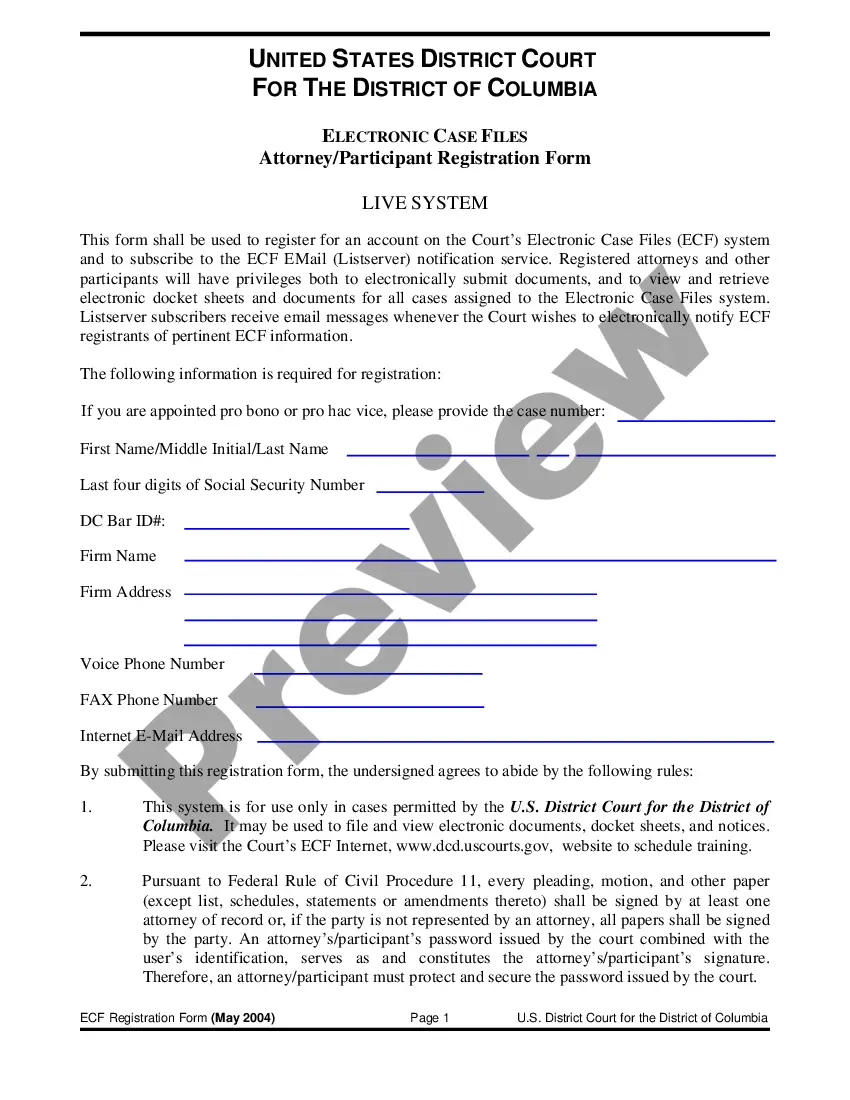

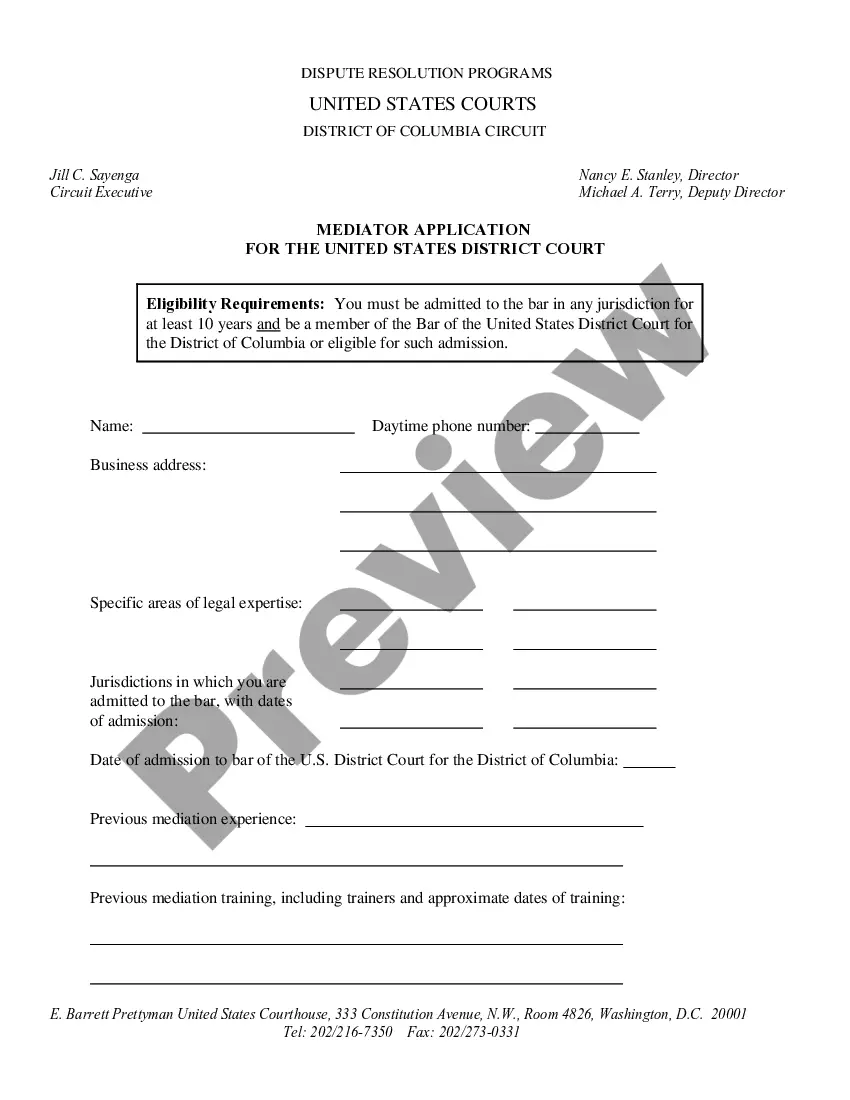

- Review the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another example using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and paid for your subscription, you can use your Sample Letter for Request for Payment - Credit Line Exceeded as often as you need or for as long as it continues to be valid where you live. Edit it in your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Credit Line Form Pdf Form popularity

Credit Line Form Draft Other Form Names

Sample Credit Line File FAQ

Mention your reason for needing more credit. Tell the creditor how good your previous record has been. The tone of your letter should be formal, and the language should be unambiguous and objective. Get directly to the point and request the creditor an increase in your credit limit.

Generally, this may include using your card regularly, making on-time payments greater than the required minimum, using your card wisely by staying under the credit limit, and linking your bank account. When you become eligible for a credit limit increase, we will notify you by email with your new limit.

Call your card issuer. Call the number on the back of your card and ask a customer service representative whether you're eligible for a higher credit limit. The rep may ask the reason for your request, as well as whether your income has gone up recently. Look for automatic increases.

Although a credit limit increase is generally good for your credit, requesting one could temporarily ding your score. That's because credit card issuers will sometimes perform a hard pull on your credit to verify you meet their standards for the higher limit.Best Cash Back Credit Cards.

At the same time, you don't want to ask for too much or seem too confident. For example, don't insist the rep double your credit limit. Instead, ask for 10 to 25% more up to $250 for every $1,000 in credit you already have. If you have excellent or even good credit, you may be able to ask for more.

Apply for a New Card with a Higher Credit Limit. Pick an Existing Card to Request an Increase On. Plead Your Case, But Don't be Desperate. Don't Be Greedy When Requesting an Increase. Entice Them with a Balance Transfer. Wait For an Increase to Occur Naturally.

If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.If you decide it's the right time to up your limit, either call customer service or request a credit limit increase online.

Requesting a credit limit increase can hurt your score, but only in the short term. If you ask for a higher credit limit, most issuers will do a hard pull, or hard inquiry, of your credit history.Hard inquiries will lower your credit score by a few points, but can only affect your score for one year.

So if you think your current BDO credit limit is no longer enough for your needs, you may contact the customer service hotline at (02) 8631-8000 to apply for a higher credit card limit.