Collection Report

Description Collection Report Form

How to fill out Collection Report?

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the perfect place for finding up-to-date Collection Report templates. Our platform offers a large number of legal documents drafted by licensed legal professionals and categorized by state.

To get a template from US Legal Forms, users only need to sign up for an account first. If you are already registered on our service, log in and choose the document you need and purchase it. Right after buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps listed below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

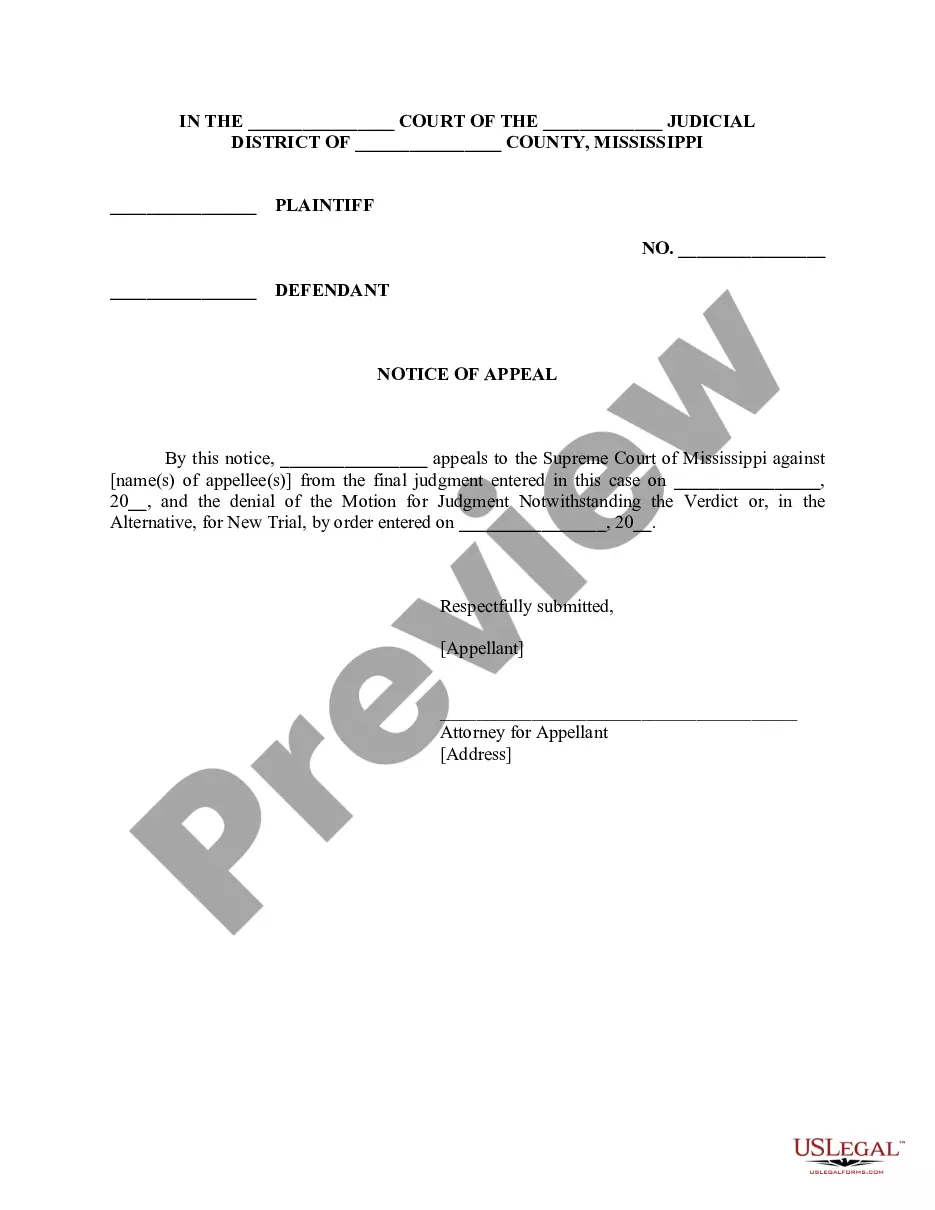

- If the template has a Preview function, utilize it to review the sample.

- In case the template doesn’t suit you, use the search bar to find a better one.

- PressClick Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the template.

- When it’s downloaded, print it and fill it out.

Save your time and effort with the platform to find, download, and complete the Form name. Join thousands of delighted subscribers who’re already using US Legal Forms!

Report Form Document Form popularity

Report Form Pdf Other Form Names

FAQ

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.

Once an account is sold to a collection agency, the collection account can then be reported as a separate account on your credit report. Collection accounts have a significant negative impact on your credit scores. Collections can appear from unsecured accounts, such as credit cards and personal loans.

It's always a good idea to pay collection debts you legitimately owe. Paying or settling collections will end the harassing phone calls and collection letters, and it will prevent the debt collector from suing you.

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely.Generally, an account in collection will remain on your credit reports for seven years.

If you've neglected to pay off a medical or credit card bill, a collection account may appear on your credit reports. This typically happens when the original company owed writes off your debt as a loss and sells it to a debt collection agency.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

Debt collectors report accounts to the credit bureaus, a move that can impact your credit score for several months, if not years.The late payments and subsequent charge-off that typically precede a collection account already will have damaged your credit score by the time the collection happens.