General Form of Assignment as Collateral for Note

Description Life Insurance Collateral Assignment Form

How to fill out Assignment Collateral Statement?

Employ the most extensive legal library of forms. US Legal Forms is the perfect place for finding up-to-date General Form of Assignment as Collateral for Note templates. Our service offers thousands of legal forms drafted by certified lawyers and grouped by state.

To obtain a template from US Legal Forms, users only need to sign up for an account first. If you are already registered on our platform, log in and choose the document you are looking for and buy it. Right after purchasing forms, users can see them in the My Forms section.

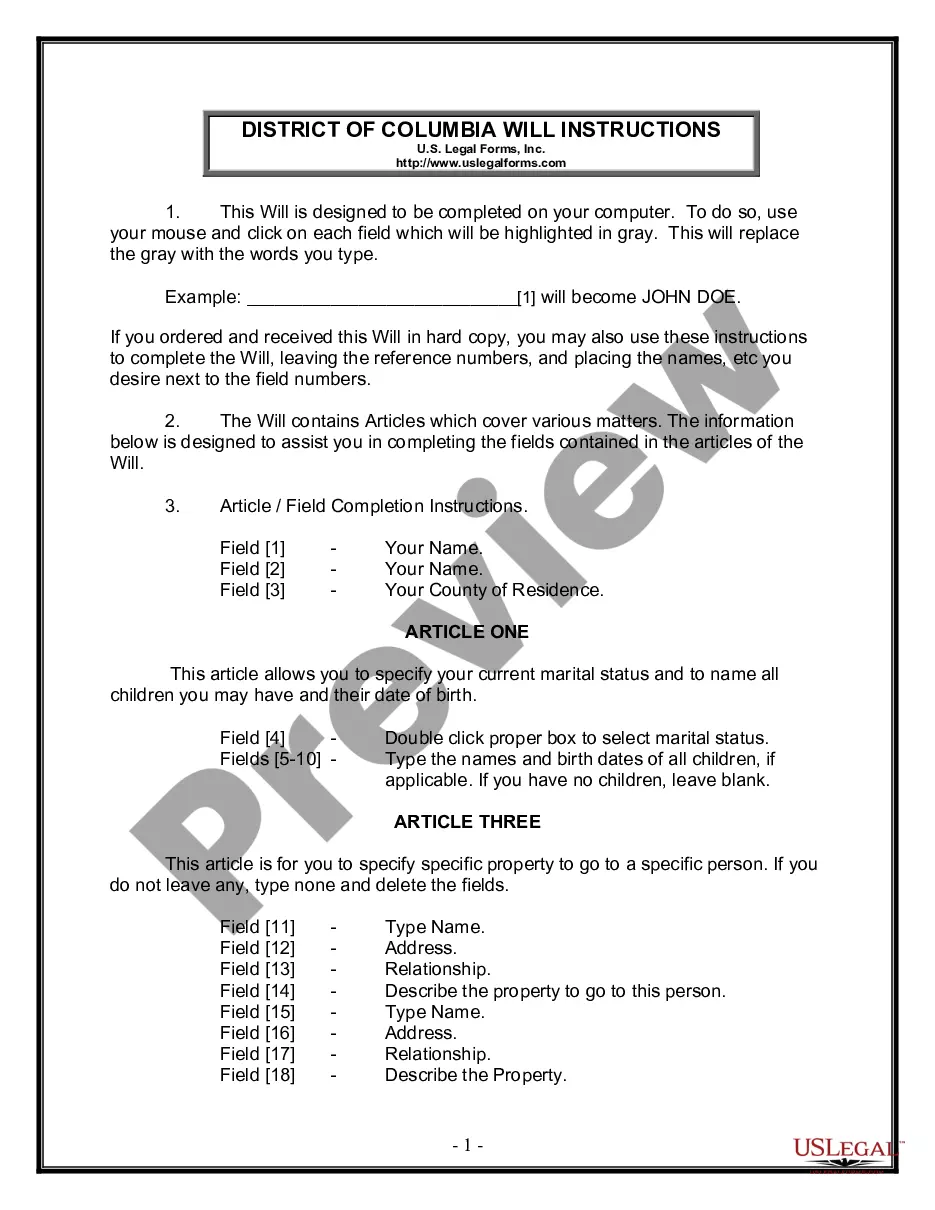

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you have found is state-specific and suits your requirements.

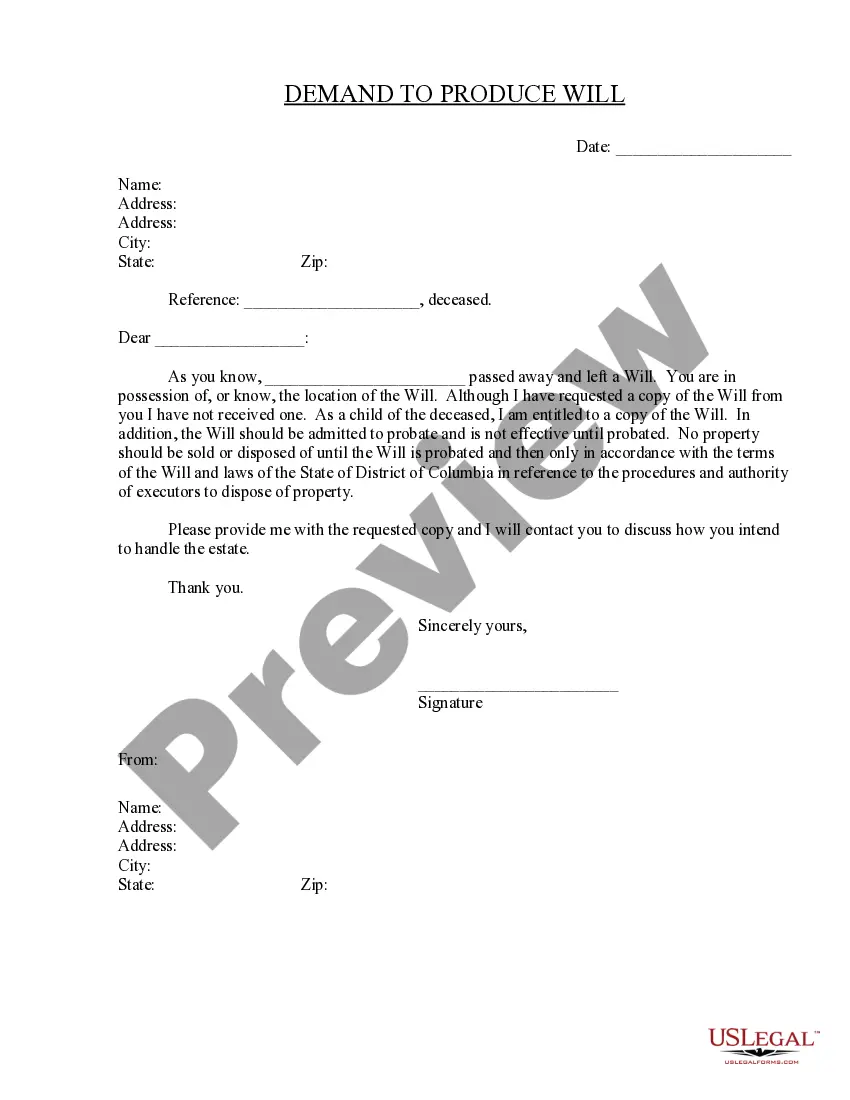

- In case the template features a Preview option, utilize it to check the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your requirements.

- Choose a pricing plan.

- Create your account.

- Pay via PayPal or with the debit/bank card.

- Select a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time with our service to find, download, and complete the Form name. Join a large number of delighted customers who’re already using US Legal Forms!

Form Note Assignment Form popularity

Form Collateral Note Other Form Names

Assignment Collateral FAQ

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

If the policy is transferred under an absolute assignment, the transfer is irrevocable and the assignee receives full control of the policy.If the policy is transferred as a means of establishing security on a debt, it is considered a collateral assignment.

When buying life insurance for the purpose of collateral assignment, you name your beneficiaries as you would for a personal policy. The lender is not your beneficiary; they are the assignee on the collateral assignment paperwork after your policy is active. On the form, you are the assignor .

A collateral assignment is temporary. For example, you take out a loan from the bank who asks you to provide life insurance to pay off the loan if you should die. Since you already have life insurance, you direct your insurer to pay off the loan out of the proceeds of your life policy.

A collateral assignment refers to the transfer of ownership rights of an asset. When you borrow money, or when someone spends money on your behalf, often they will require you to pledge collateral in the form of an asset in order to protect them from loss.