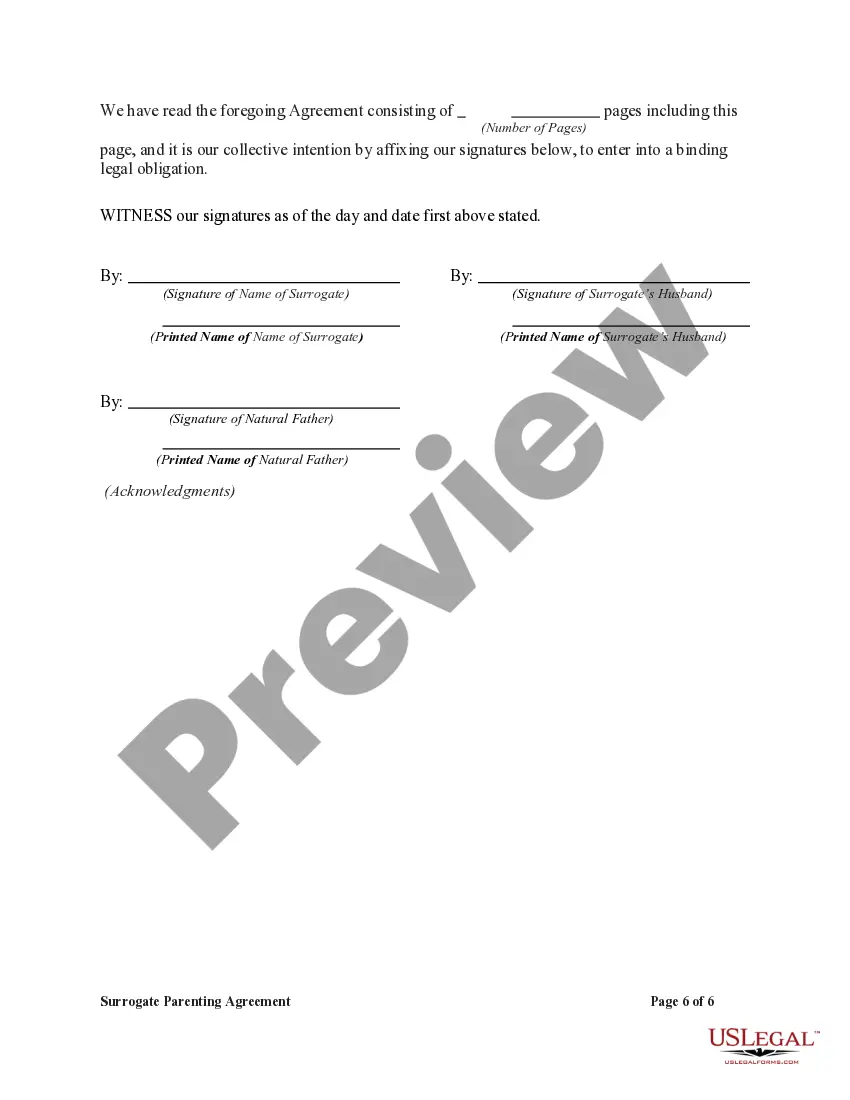

Surrogate Parenting Agreement

Description Parenting Agreement Sample

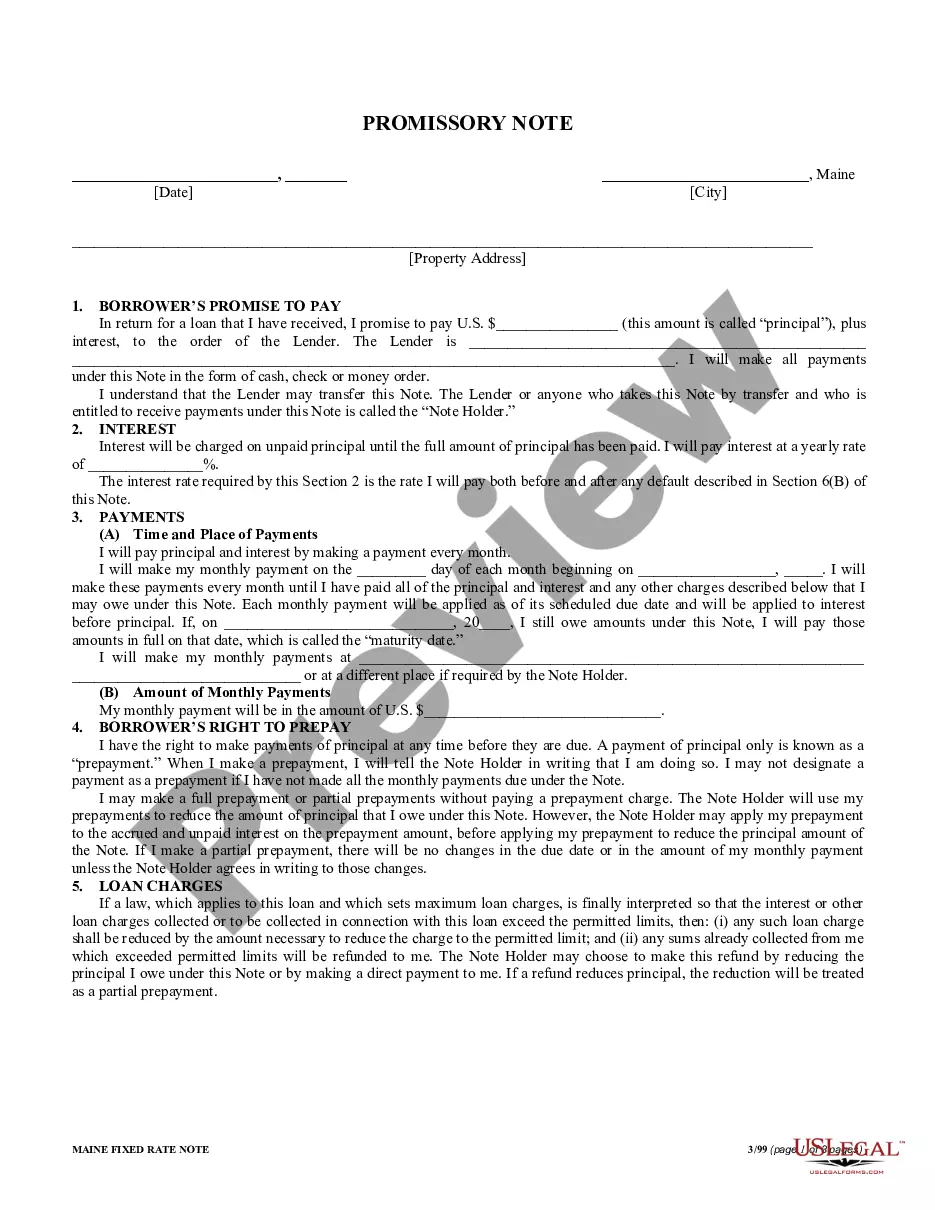

How to fill out Surrogate Contract Agreement?

Make use of the most extensive legal library of forms. US Legal Forms is the perfect platform for finding updated Surrogate Parenting Agreement templates. Our platform provides 1000s of legal forms drafted by certified lawyers and sorted by state.

To get a sample from US Legal Forms, users just need to sign up for a free account first. If you are already registered on our service, log in and choose the template you are looking for and purchase it. After buying templates, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

- Check if the Form name you have found is state-specific and suits your needs.

- If the form features a Preview option, use it to check the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample meets your needs.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr credit/credit card.

- Select a document format and download the template.

- Once it’s downloaded, print it and fill it out.

Save your time and effort with our service to find, download, and fill out the Form name. Join a huge number of satisfied clients who’re already using US Legal Forms!

Is Surrogate Legal In Us Form popularity

Parenting Agreement Template Other Form Names

Surrogacy Agreement Format FAQ

Can a surrogate mother decide to keep the baby? No.Once legal parenthood is established, the surrogate has no legal rights to the child and she cannot claim to be the legal mother. In the same vein, the contract protects the surrogate from any kind of legal or medical responsibility for the child.

Typically, a surrogate's base compensation is between $30,000 and $40,000 and can vary based on a number of factors, including her location, experience with surrogacy, and more. This surrogacy cost will be determined prior to the embryo transfer and will be included in your surrogacy contract.

The commissioning parents must be unable to give birth to a child and the condition must be permanent and irreversible, and the surrogates must have had at least one healthy (still living) child prior to the surrogacy agreement being concluded.

The increase in price is due to the application of an IVF, in addition to legal preparations and agency requirements. According to West Coast Surrogacy, intended parents can expect to pay anywhere from $90,000 to $130,000 for their gestational surrogacy.

California has held that surrogate mother contracts are specifically enforceable, at least where both the egg and sperm are donated by individuals other than the surrogate who bears the child.

Any required surrogate mother income tax would have to be identified by a local tax lawyer. If there is a situation in which a professional or intended parents issue a 1099-MISC to their surrogate, she must claim her compensation as income.

Technically, none! There are no ACA medical plans that are specifically designed to cover a woman for surrogacy. She will need to have a medical insurance plan that does not have an exclusion for her using the maternity benefit of the policy while acting as a surrogate.

Traditional surrogacy is banned in many states. A traditional surrogate is the biological mother of her child, meaning she has parental rights and the power to change her mind and keep the baby.

Generally, the intended parents will work with their attorney to draft the initial contract, which will then be sent to the surrogate and her attorney for review.The contracts can then be signed, and the intended parents and surrogate will move forward with medical procedures.