Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description Irrevocable Trusts For Dummies

A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

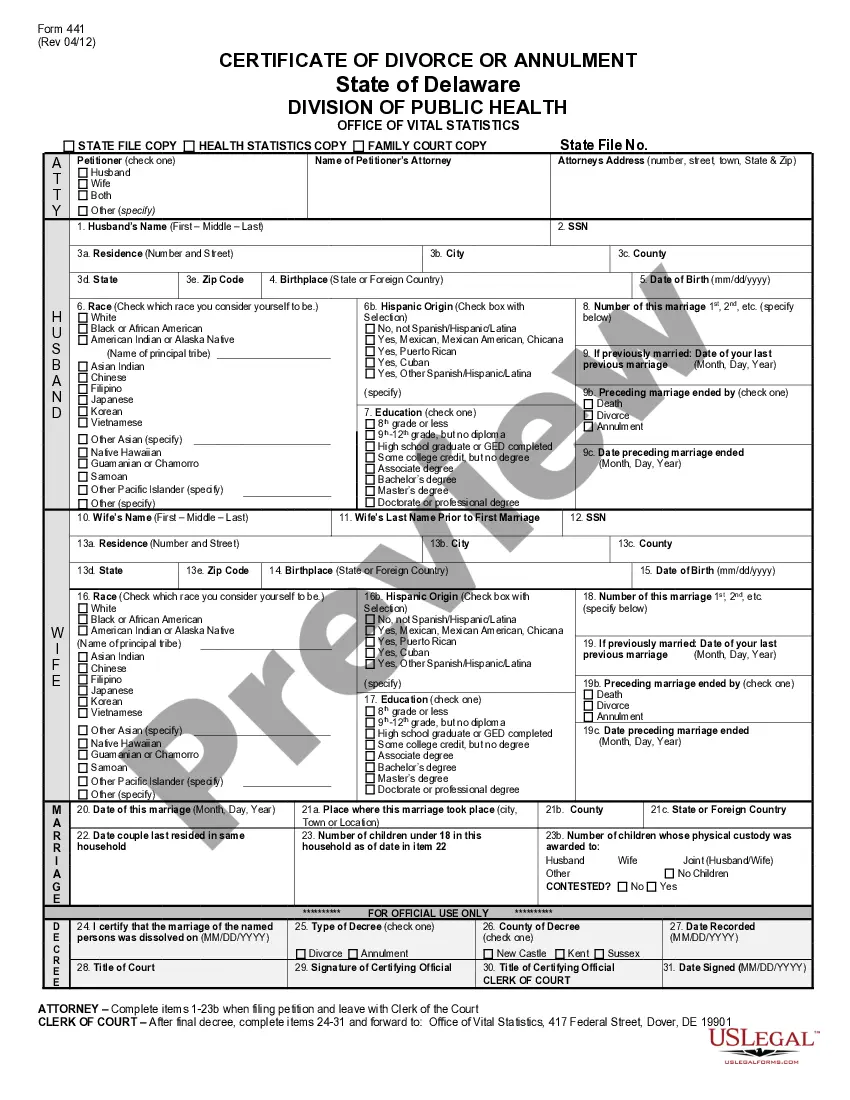

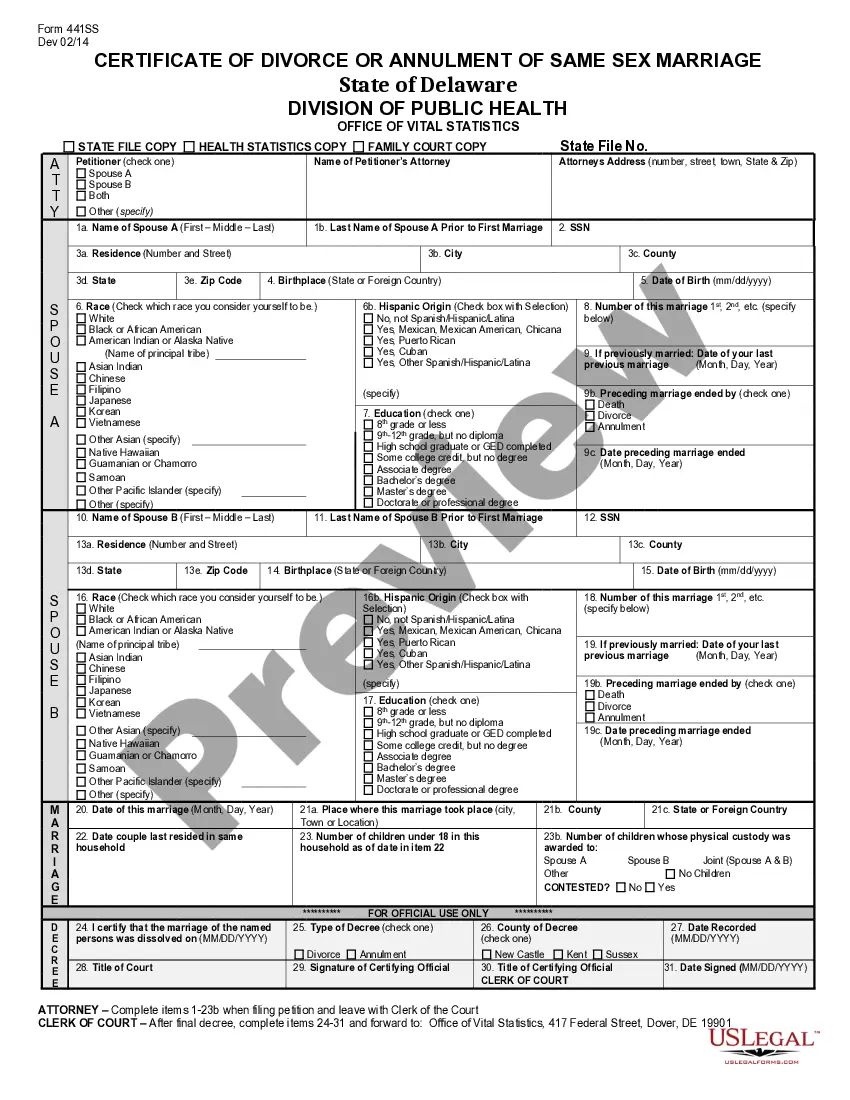

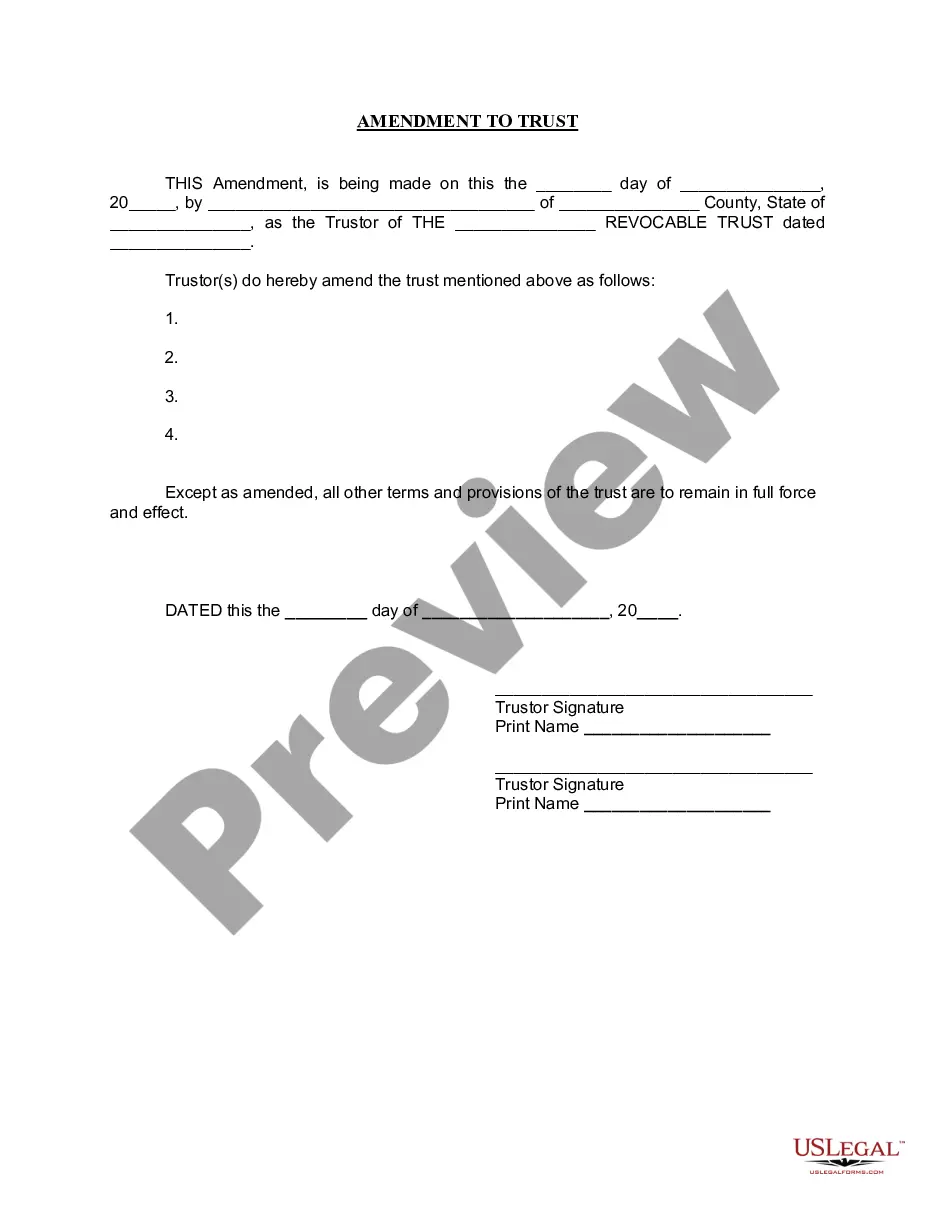

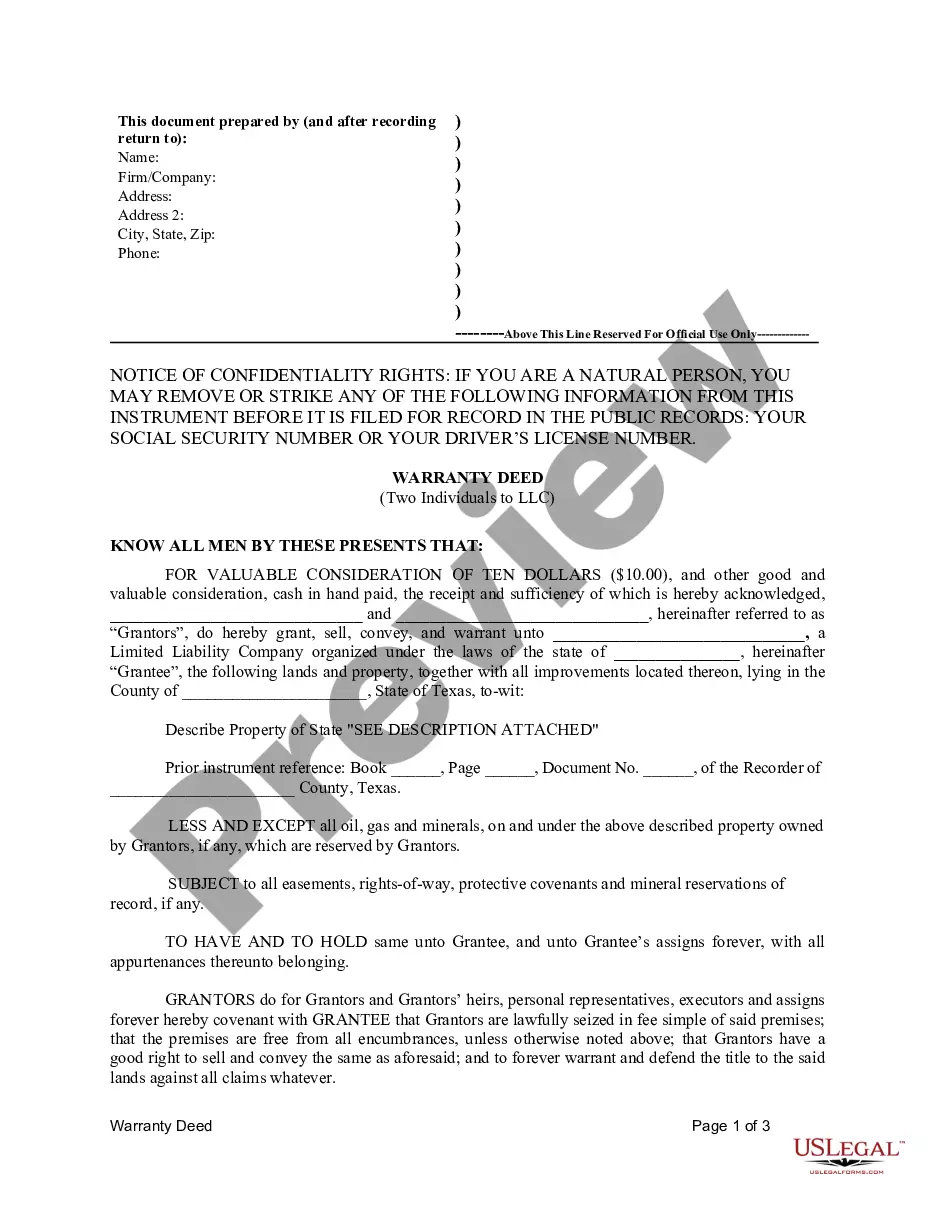

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Irrevocable Trust Online?

Utilize the most complete legal catalogue of forms. US Legal Forms is the perfect platform for getting updated Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren templates. Our platform provides a huge number of legal forms drafted by licensed lawyers and sorted by state.

To obtain a template from US Legal Forms, users just need to sign up for an account first. If you’re already registered on our platform, log in and select the template you need and purchase it. Right after buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your needs.

- If the template features a Preview function, utilize it to check the sample.

- In case the sample doesn’t suit you, use the search bar to find a better one.

- Hit Buy Now if the sample meets your expections.

- Choose a pricing plan.

- Create a free account.

- Pay via PayPal or with yourr debit/bank card.

- Choose a document format and download the sample.

- Once it’s downloaded, print it and fill it out.

Save your effort and time with our platform to find, download, and fill out the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Irrevocable Trusts Law Form popularity

Taxes And Irrevocable Trusts Other Form Names

Trustor Trustee Trust FAQ

Set guidelines on how you'd like the money to be used. Release funds at key milestoneslike graduating college, getting married, or turning 35over your grandchild's lifetime, rather than all at once. Help protect the inheritance from potential depletion due to lack of financial literacy or other financial challenges.

What assets can I transfer to an irrevocable trust? Frankly, just about any asset can be transferred to an irrevocable trust, assuming the grantor is willing to give it away. This includes cash, stock portfolios, real estate, life insurance policies, and business interests.

When you transfer your assets into an irrevocable trust, you relinquish control of them. The trust is now the owner of the assets, which you'll retitle or register in the trust's name. The assets are no longer yours, and have no bearing on your wealth, the value of your estate, or your tax liability .

Irrevocable trust: The purpose of the trust is outlined by an attorney in the trust document. Once established, an irrevocable trust usually cannot be changed. As soon as assets are transferred in, the trust becomes the asset owner. Grantor: This individual transfers ownership of property to the trust.

The main downside to an irrevocable trust is simple: It's not revocable or changeable. You no longer own the assets you've placed into the trust. In other words, if you place a million dollars in an irrevocable trust for your child and want to change your mind a few years later, you're out of luck.