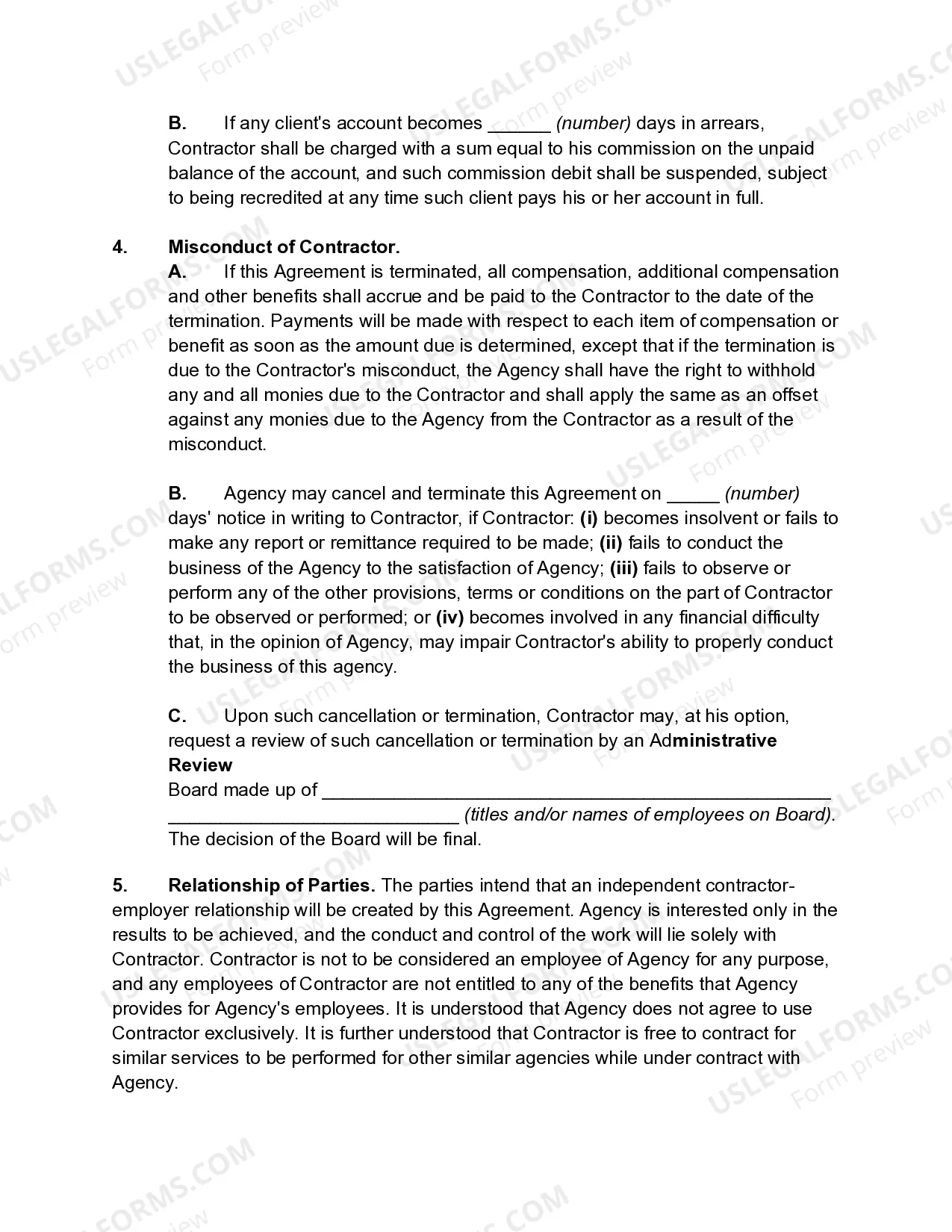

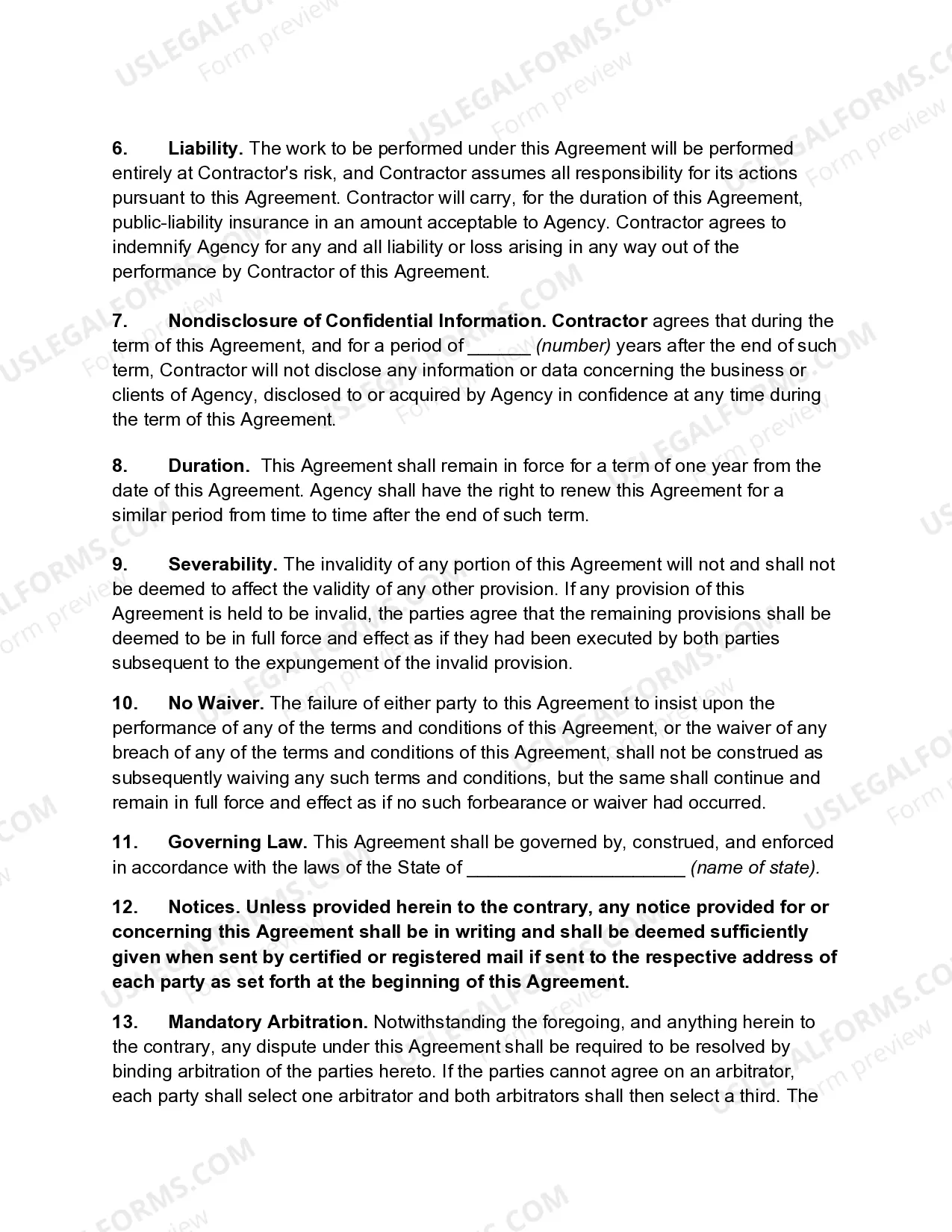

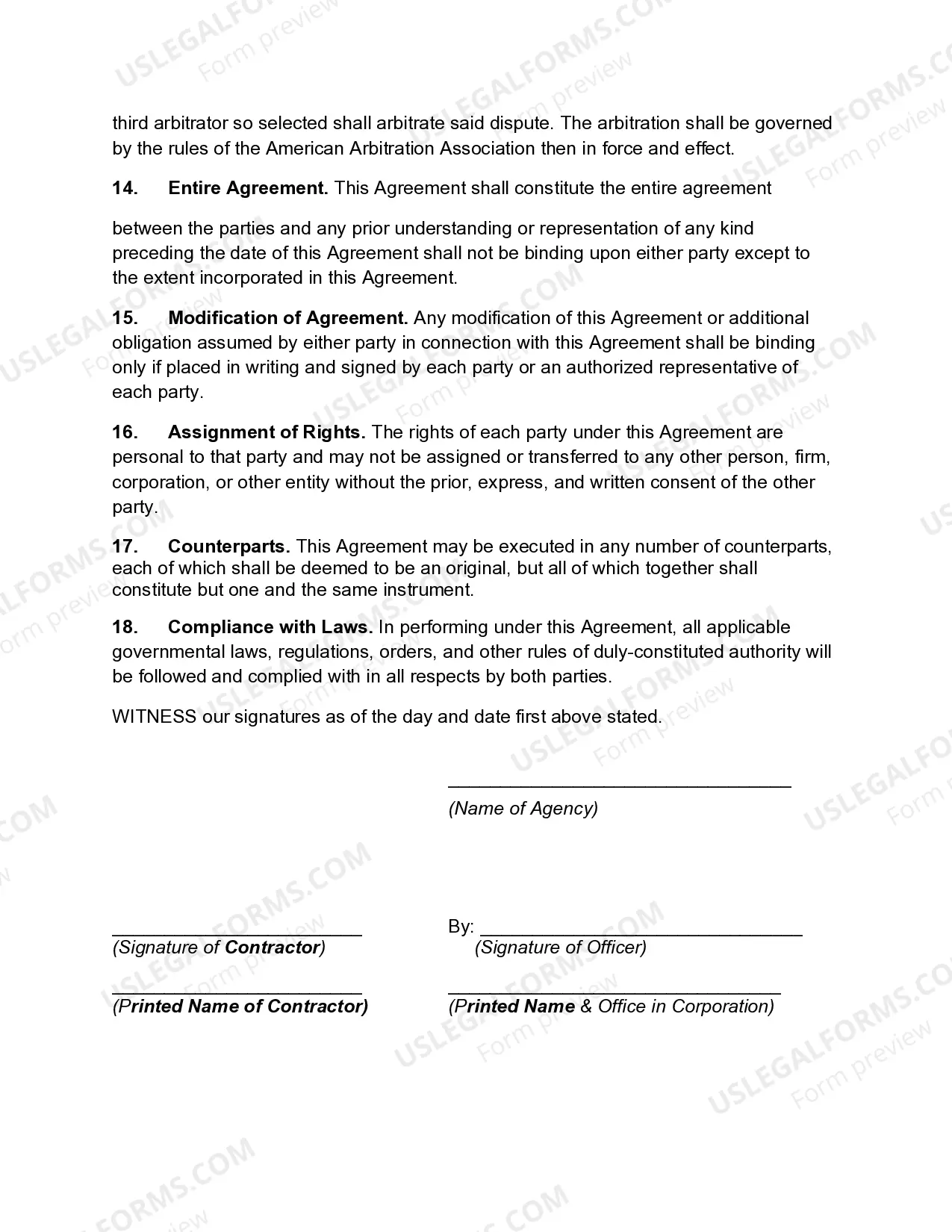

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees. Whether or not such control was exercised is not the determining factor, it is the right to control which is key.

A confidentiality agreement is an agreement between at least two persons that outlines confidential material, knowledge, or information that the parties wish to share with one another for certain purposes. However, when access to the information is to be restricted from a third party a confidentiality clause is added in the contract. It is a contract through which the parties agree not to disclose information covered by the agreement. Generally, such clauses are added in contracts between companies. However, this clause can be added in employment contracts also.