Accredited Investor Questionnaire (AIQ) is a set of questions used to determine whether an individual or organization is eligible to invest in certain types of securities. AIDS are required by the U.S. Securities and Exchange Commission (SEC) and are used to verify that investors meet certain financial qualifications and have the experience and knowledge necessary to understand the risks associated with investing in alternative investments. AIDS typically ask questions related to net worth, income, and investment experience and knowledge. There are two main types of AIDS: the Form D AIQ and the Form U-4 AIQ. The Form D AIQ is a questionnaire used when registering a security offering with the SEC. This AIQ is typically used by hedge funds, angel investors, and venture capitalists. The Form U-4 AIQ is a questionnaire used by brokers, broker-dealers, and investment advisers. This AIQ is used to verify that individuals meet the financial requirements to become registered representatives.

Accredited Investor Questionnaire

Description

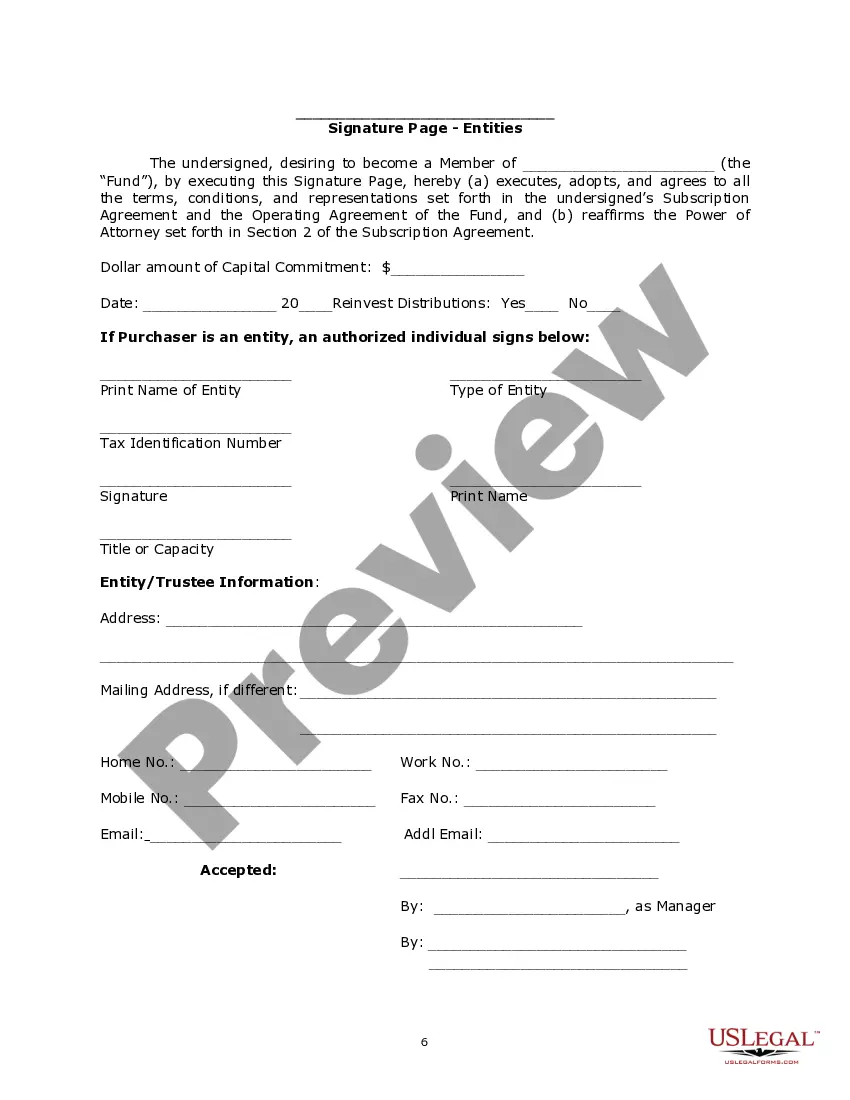

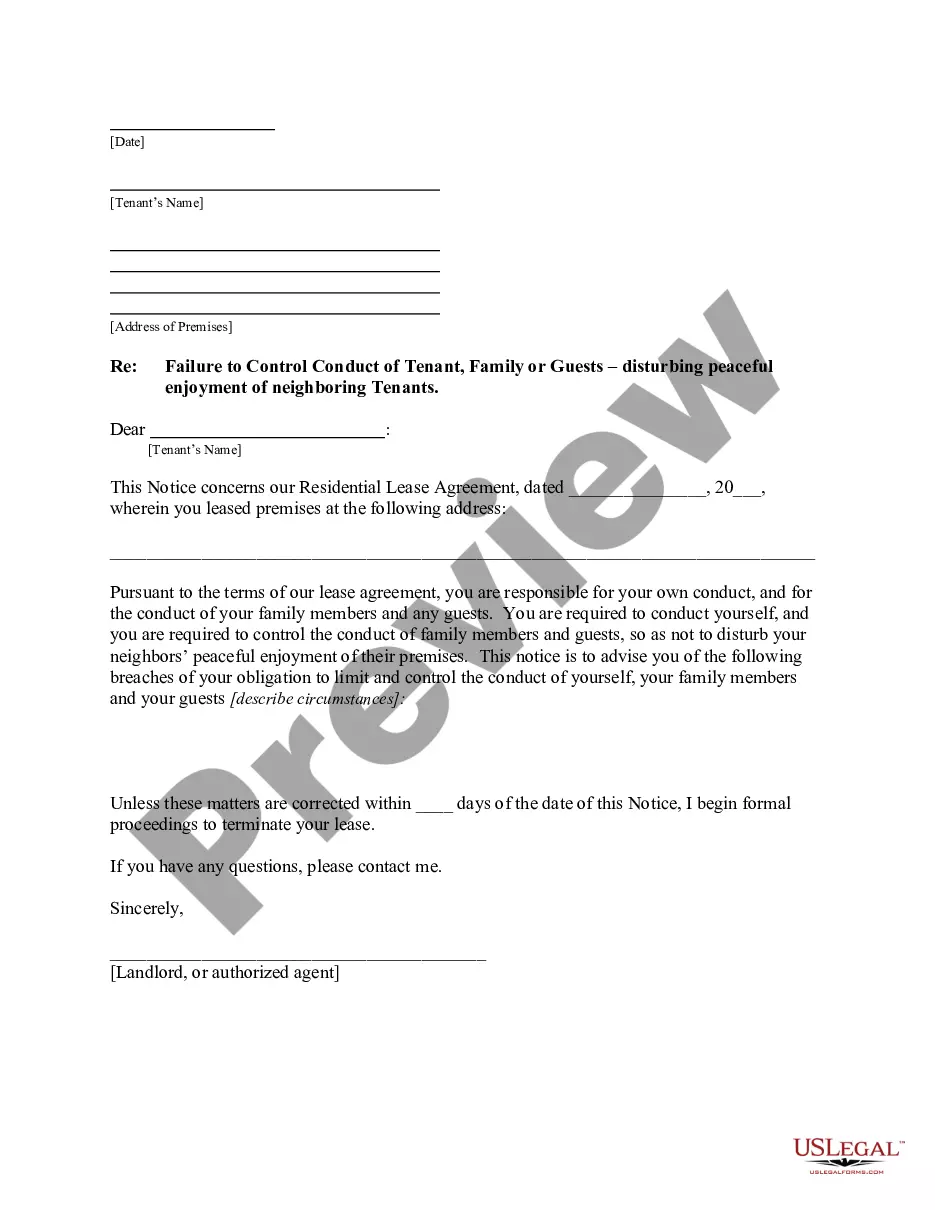

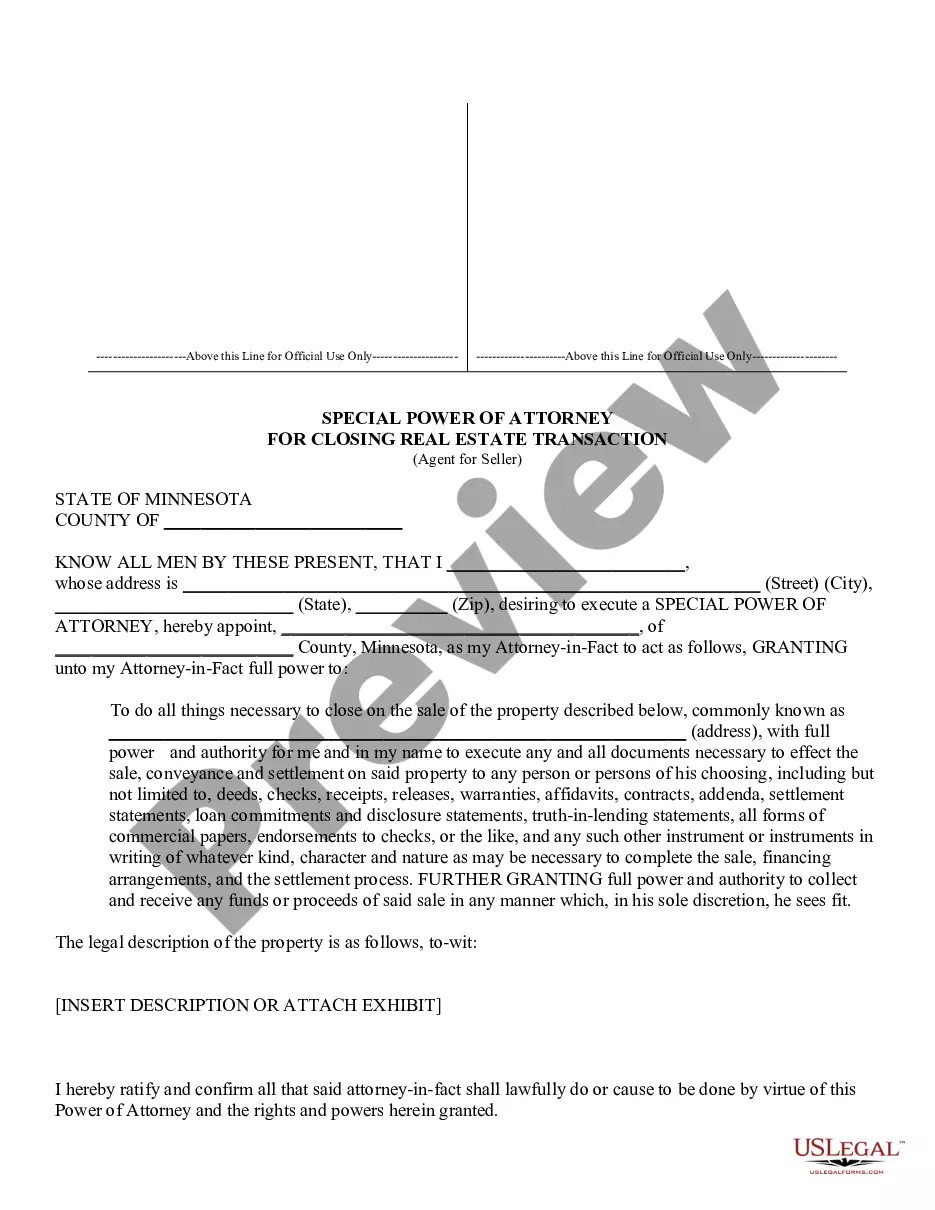

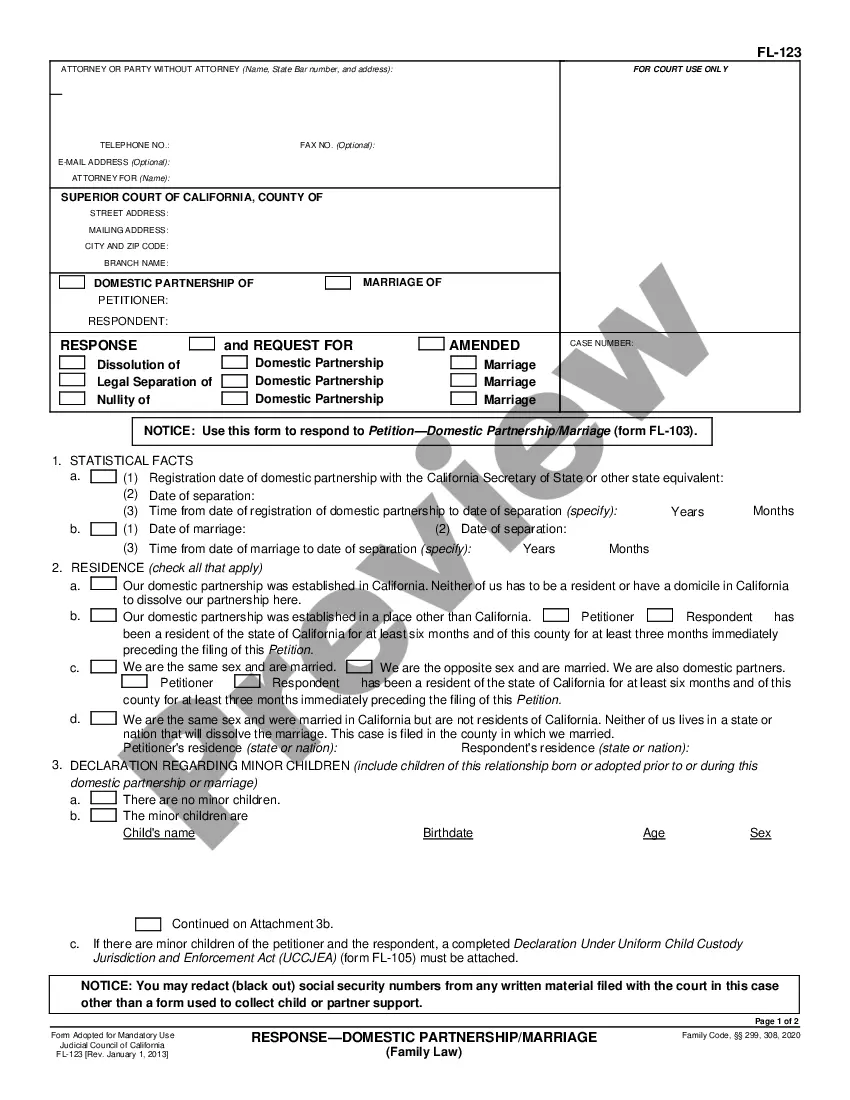

How to fill out Accredited Investor Questionnaire?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are examined by our experts. So if you need to complete Accredited Investor Questionnaire, our service is the best place to download it.

Obtaining your Accredited Investor Questionnaire from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the correct template. Afterwards, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few moments. Here’s a quick guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Accredited Investor Questionnaire and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

The Investor Questionnaire is designed to help you decide how to allocate your assets among different asset classes (stocks, bonds, and short-term reserves).

Income method Some documents that can prove an investor's accredited status include: Tax filings or pay stubs; A letter from an accountant or employer confirming their actual and expected annual income; or. IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

Professional credentials: Individuals who hold certain professional designations may also qualify as accredited investors. These qualifications include certain licenses from the Financial Industry Regulatory Authority (FINRA), including the Series 7, Series 65 and Series 82.

Ing to the SEC, an individual accredited investor is anyone who: Earned income of more than $200,000 (or $300,000 together with a spouse) in each of the last two years and reasonably expects to earn the same for the current year.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse.

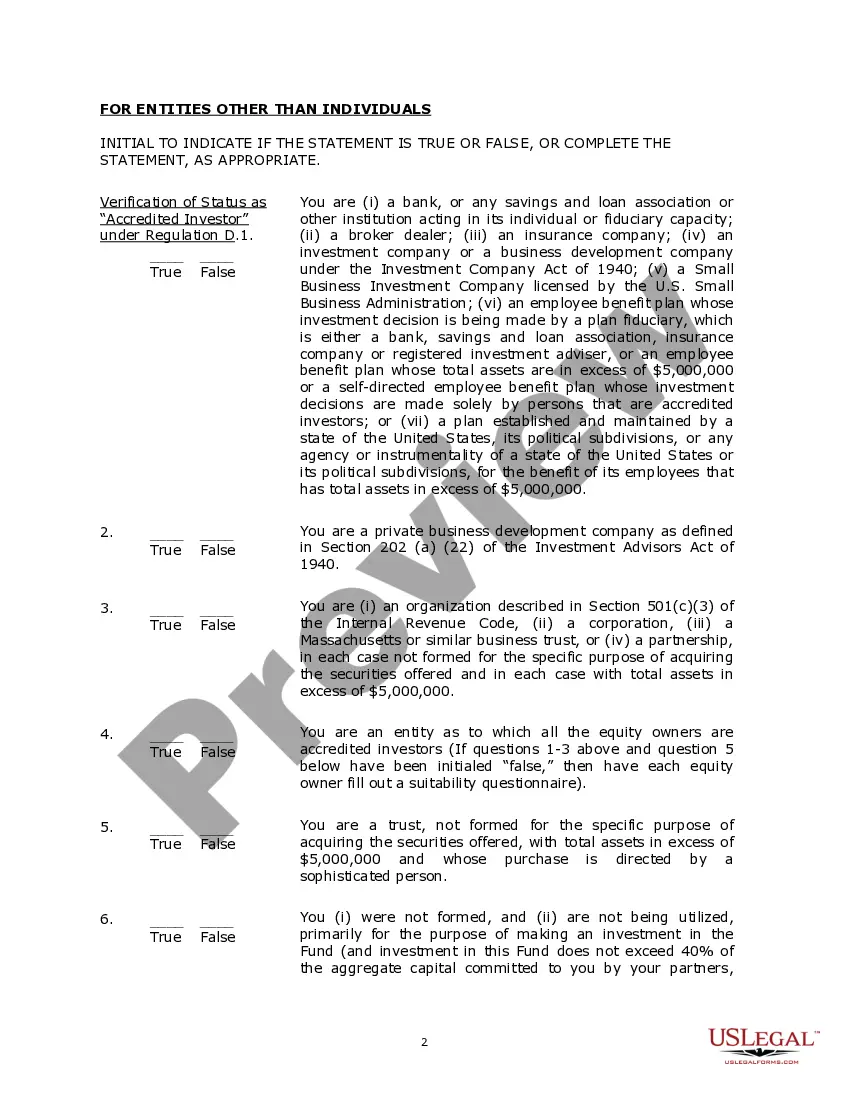

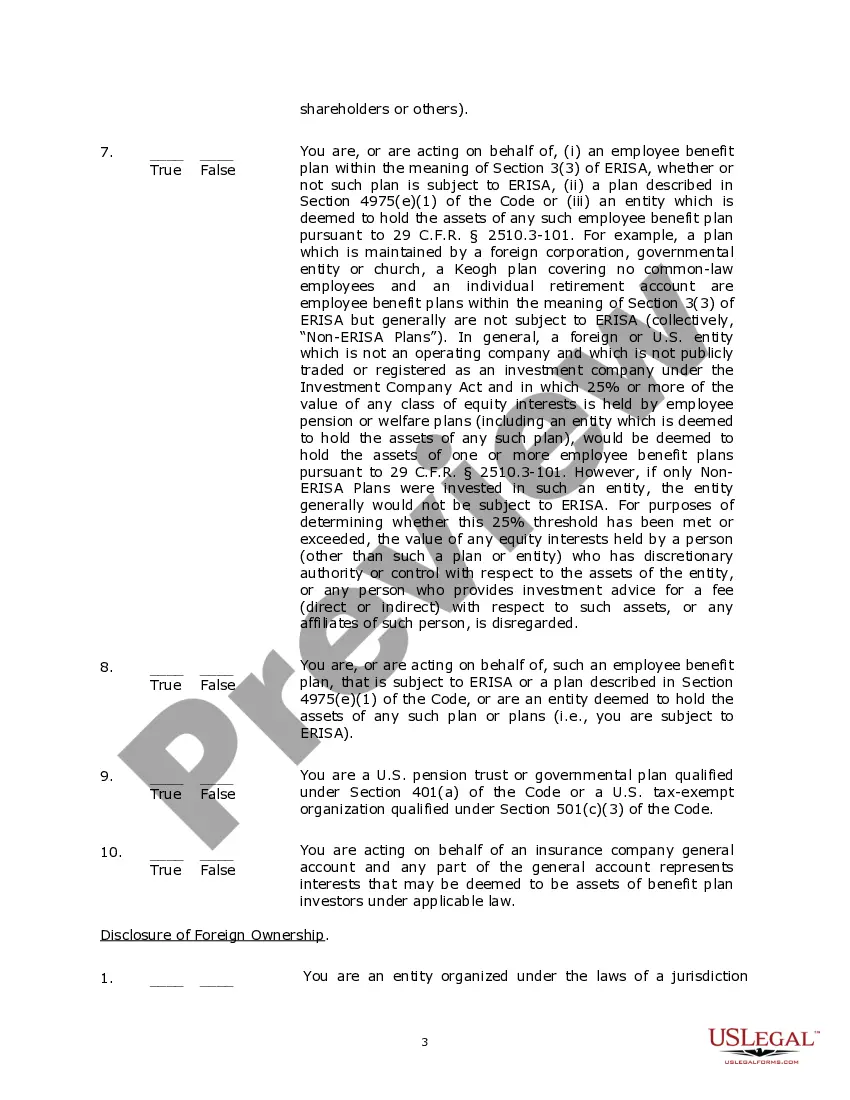

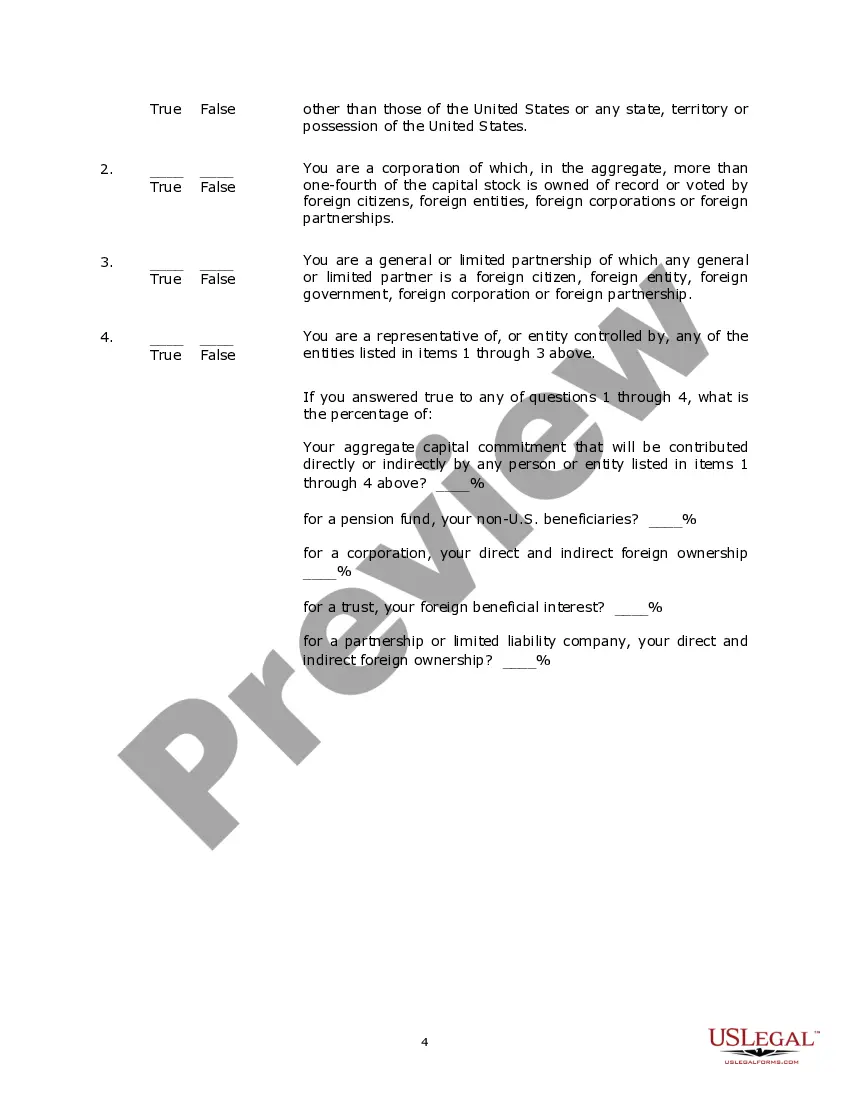

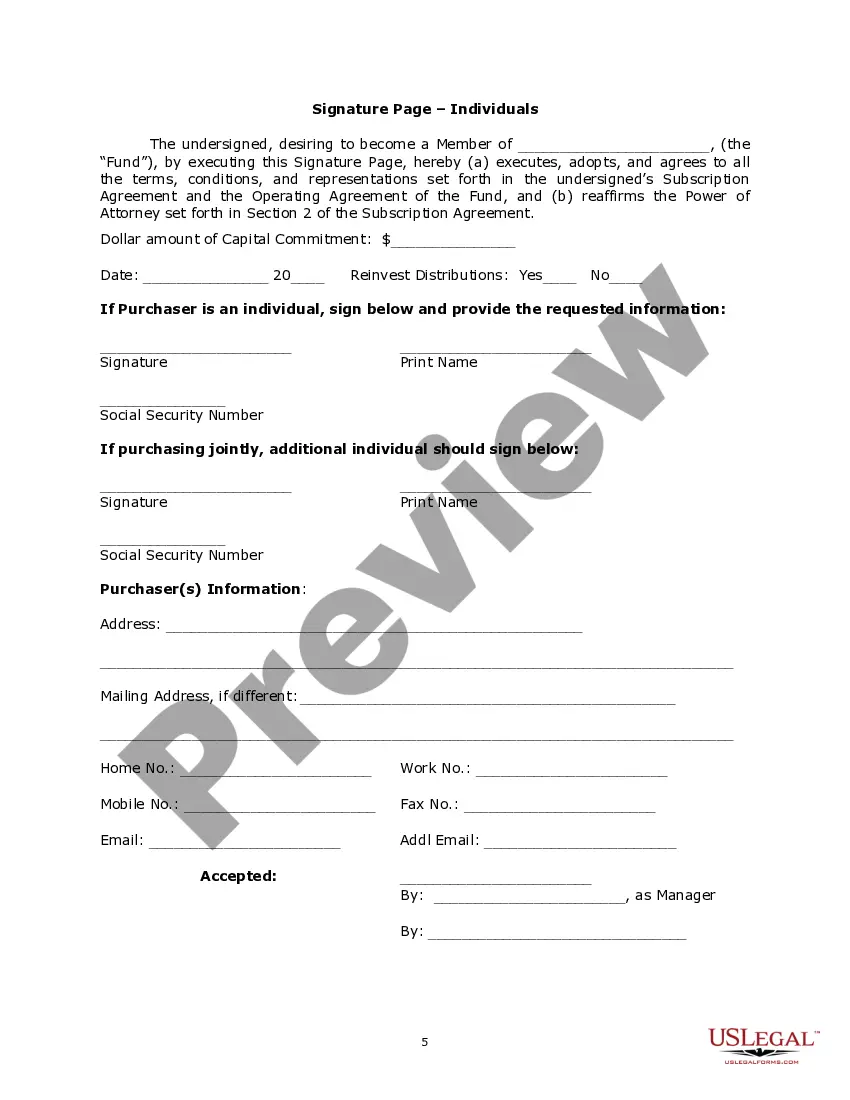

An Accredited Investor Questionnaire is a document used to verify an individual's eligibility as an accredited investor. In the United States, the SEC defines accredited investors as individuals who meet certain income or net worth thresholds.

The SEC defines an accredited investor as either: an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.